All the rooms in the three-storey Songinokhairkhan hospital in western Ulaanbaatar, Mongolia's capital city, are full. They are mostly occupied by small children being treated for respiratory problems, according to the busy nurses here.

The cause is heavy pollution, mainly from the country's decades-long over-reliance on coal.

Children's hospitals in the area are overburdened and paediatricians can only treat the symptoms of health problems caused by air pollution, they are unable to remove the cause.

A young mother, Ganchimeg, waits for the fever to let up in her one-year-old daughter's trembling body. They have been here all day. "She's been coughing a lot," says the tired mother. "When we came here they told me it's probably pneumonia." Her daughter smiles, and then coughs.

UNICEF declared Mongolia's air pollution problem a "child health crisis" in a 2018 report which stated: "In the last 10 years, incidences of respiratory diseases in Ulaanbaatar alarmingly increased including a 2.7-fold increase in respiratory infections per 10,000 population.

"Pneumonia is now the second leading cause for under-five child mortality in the country. Children living in a highly polluted district of central Ulaanbaatar were found to have 40 percent lower lung function than children living in a rural area."

Ganchimeg and her daughter, who has a high fever and will not stop trembling, at Songinokhairkhan hospital, western Ulaanbaatar [Fredrik Lerneryd/Al Jazeera]

Ariunsanaa and Oyun (Mongolians tend only to use one name), are a young couple living in Ulaanbaatar's western ger district. Gers are traditional Mongolian yurts - small wooden structures in which whole families live.

Both their children - a four-year-old son and a one-year-old daughter - have been hospitalised this winter with fever, coughing and, eventually, pneumonia. "Same old story every winter," says Ariunsanaa, preparing suutei tsai and biscuits inside their ger while the TV shows flickering images of a conflict far away.

"It's the same strain of the flu that returns every winter, and every year it takes its toll on the kids a lot worse than the previous winter.

"Medicines and antibiotics aren't free, you know," he adds.

Behind a curtain hangs Ariunsanaa's shaman coat. Interest in Mongolian Shamanism has risen among the young, after being banned during Communist rule. Local people seek Ariunsanaa's counsel on matters from relationships to health.

Inside the overcrowded Songinokhairkhan hospital in Ulaanbaatar. All rooms of the three-storey hospital are occupied, mostly by small children with respiratory problems [Fredrik Lerneryd/Al Jazeera]

The price of success

This is not all that has changed here since the fall of Communism.

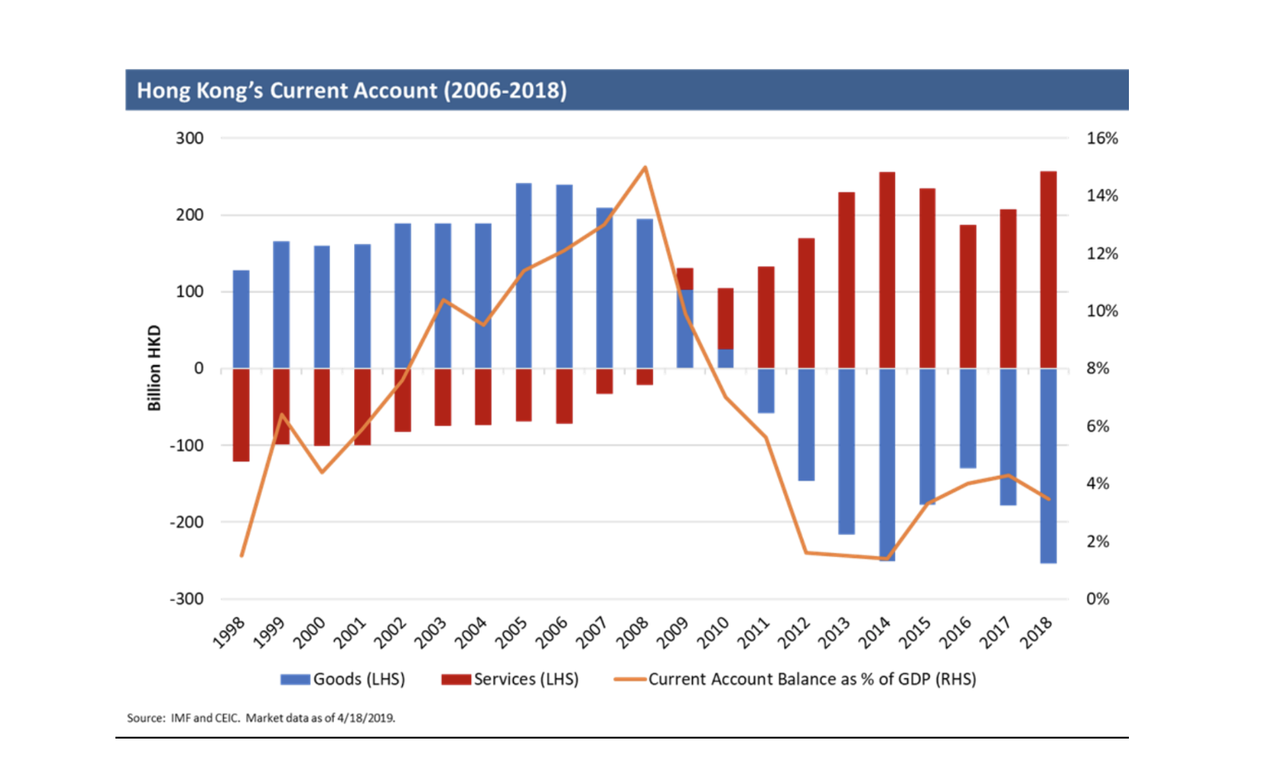

Democracy's arrival in Mongolia in 1990, alongside an economic boom from the country's rich coal resources, gave birth to a market-economy class system defined by stunning income inequality.

"Despite strong overall growth, job creation and poverty alleviation remains a significant challenge," is how the International Monetary Fund summarised the situation in its 2019 member-country report.

I don't want to be pregnant again, I'm too afraid. When pregnant, both times during winters, I was constantly afraid that air pollution would lead to birth defects Oyun

So, while doctors recommend that people - especially those with small children - leave Ulaanbaatar for fresh air, this is a luxury that few can afford.

"I don't want to be pregnant again, I'm too afraid," says Oyun. "When pregnant, both times during winters, I was constantly afraid that air pollution would lead to birth defects."

Ariunsanaa and Oyun's home in a working-class neighbourhood of western Ulaanbaatar [Fredrik Lerneryd/Al Jazeera]

In the mid-2010s, Mongolia, riding the wave of its mining boom, was hailed as "the world's fastest-growing economy" by the World Bank. But the global financial crisis and subsequent boom and bust in commodity prices dealt a severe blow to Mongolia, fuelling poverty, unemployment and despair.

A $5.5bn bailout from the International Monetary Fund helped pull Mongolia's economy off its knees.

In 2018 the country produced 34.4 million tonnes of oil equivalent (TOE) of coal - a record. Overall, the National Statistical Office (NSO) of Mongolia says, the mining industry represents nearly 22 percent of the nation's revenue for 2019.

Despite this, coal is not the magic bullet for Mongolia that many believed it to be; it is also a poisoned chalice. It is proving to be a "resource curse", whereby a country's over-reliance on one or a limited number of natural resources - in Mongolia's case, coal and copper - can lead to a failure to invest in other sectors as well as a higher risk of corruption.

In its 2019 report, Freedom House, the US government-funded NGO, highlights increasing corruption levels within the mining sector in Mongolia, despite - or perhaps because of - "vaguely written and infrequently enforced" anticorruption laws.

But most of all, coal is dirty and its over-use has triggered a health and environmental crisis in Ulaanbaatar as well as further afield.

The view from Ariunsanaa and Oyun's home in one of Ulaanbaatar's ger districts [Fredrik Lerneryd/Al Jazeera]

'There were a lot of people sick'

On the Mongolian steppe, seemingly far removed from the centre stage of the coal industry, the effects of this over-reliance on coal are already hitting the country's nomadic population hard.

The Batbold family's ger, camouflaged by snow, sits surrounded by valleys outside Karakorum, the ancient Mongol capital founded by Genghis Kahn.

There are other gers within walking distance, dotted between enclosures for the animals and giant piles of wood to heat these rudimentary homes. Other than that, these families live alone - as Mongolian nomads have done for centuries.

It is a way of life. But Mongolia's nomads, reliant on livestock and mostly contributing to the cashmere industry, now stare the consequences of climate change right in the eye, embodied by a man-made catastrophe they call the "dzud", a term for the severe winters marked by starvation, cold and financial hardship that they now endure every year.

Chantsaldulam and Banzragch Batbold prepare supper for their seven children inside the family ger on the Steppes of Mongolia. Life is becoming difficult for the family in the face of increasingly harsh winters [Fredrik Lerneryd/Al Jazeera]

Millions of livestock have died due to the dry summers followed by the extreme winters over the past decade in Mongolia, according to a 2018 report by the research journal, Nature.

It states: "Alleviating the impacts of climate change on herder communities, through strengthening adaptive capacities, risk reduction strategies, including reducing herder vulnerability to future hazards, and resilience in degraded environments, will be a crucial challenge."

This extreme weather phenomenon is the scourge of every nomad's daily life. "Here, winter starts in the summer," says Chantsaldulam Batbold.

Here, winter starts in the summer Chantsaldulam Batbold

She is paying "tribute" to the sky, mountains and soil outside the family ger by throwing spoons of fresh cow's milk into the air, in a kind of offering. "We thought the summer would be good; it wasn't. There is no grass for the animals and the winter is getting harder."

Every day, the family takes the livestock - 100 cows, goats, horses and sheep - out in search of suitable pastures. "We can't get enough hay to them due to higher prices, and even if we had, it's not nutritious enough," says Banzragch Batbold as he saddles his horse. Chantsaldulam hands him a thermos with warm suutei tsai, a traditional Mongolian beverage consisting of milk, salt, tea leaves and water.

The nearby river is ice-covered and melted snow serves as drinking water. All seven Batbold children, who range in age from nine months to 10 years, see their father off and play outside until their mother hauls them back inside. Three of them, who attend boarding school in Ulaanbaatar, returned from school with the flu just before Christmas - another effect of the pollution, Chantsaldulam suspects.

"There were a lot of people sick at the school, as is usually the case this time of the year," she says.

Mongolia's nomadic communities must battle the harsh winter to find pasture for their livestock [Fredrik Lerneryd/Al Jazeera]

As inside any typical Mongolian ger, life is divided into sections: the kitchen area; beds; a couch for visitors; a shrine for valuables, family portraits, clothing and a TV set. The heart of the ger is the stove, which provides heat during the harsh winter season.

The temperature can reach 30°C inside the ger while outside it gets as cold as minus 20°C.

Climate change has been particularly extreme in Mongolia, where the average temperature has increased by 2.2°C since 1940 - compared to 0.85°C for the planet in general - causing havoc with weather patterns.

According to a 2019 report from the European Institute for Asian Studies, Mongolia's mining sector is to blame for this and, therefore, for the resulting compromised biodiversity and worsening public health. The report states: "Mining activities and mining-related infrastructure projects have, indeed, contributed to the rapid increase of CO2 emissions in the country, the vast erosion of pasture land and deforestation."

The choice for those living on the ground? Put up with it or get out.

"On the steppe, you're on your own," laments Chantsaldulam. Many have opted for the latter, heading to Ulaanbaatar's ger districts, where thousands of former nomads-turned-city-dwellers reside in a socioeconomic parallel society.

In 2001, Ulaanbaatar's total population was 630,000; in 2014 it had reached over one million. It is now 1.6 million. One in four inhabitants of Ulaanbaatar lives in what the International Monetary Fund describes as "shanty towns" - the ger districts - and 28.4 percent of the population are living below the poverty line, according to Mongolia's National Statistical Office.

Chantsaldulam and Banzragch know both worlds but fancy neither; climate change has altered everything, everywhere.

"When you walk alongside your animals, day in and day out for many years, you realise what's at stake," says Banzragch. "The wheel of life is shifting on its axis."

Children at Preschool 68 in Ulaanbaatar. The school uses air purifiers and ventilators, and never opens the windows, in a bid to keep pupils safe from pollution [Fredrik Lerneryd/Al Jazeera]

Extreme measures

Ulaanbaatar was called Urga ("Palace") until 1924, when, as the capital of the new Mongolian People's Republic, it adopted its Soviet-style name, which means "Red Hero".

Mountain plateaus surround the city, which functioned as a Buddhist meeting point in the 1700s. Winds come from Siberia in the north, turning the winters into long, cold periods of existence under a veil of smog. At 1.6 million, the population of the city has trebled since 1989. Ulaanbaatar's undeveloped outskirts have swelled like balloons and these ger districts lack sustainable access to electricity and clean water, making coal - now, government-issued briquettes - the only option for cooking and heating.

As a result, the authorities blame Ulaanbaatar's ger districts for 80 percent of the recent years' hazardous air pollution levels which are taking their toll on residents. Small children, the elderly and pregnant women are particular prey for infections, viruses and diseases, which spread easily in poorly ventilated facilities.

A preschool named "63" in Gachuurt, eastern Ulaanbaatar, has taken extreme measures to protect its children.

"We've installed air purifiers, updated ventilators and keep all windows closed at all times to guarantee our 150 pupils access to fresh air and clean food," says principal Nyamsuren Enkhtsetseg.

The view through the window on the second floor, however, shows the preschool's neighbour is a heating plant. Raw coal emissions from it sweep over a part of Ulaanbaatar where the ban on raw coal has yet to be implemented, forcing all children to wear protective masks whenever they play outside. "We've begged the authorities to remove it; but nothing's happened," sighs Enkhtsetseg.

A woman without her briquette-coupon tries to purchase a bag at one of the distribution points in Ulaanbaatar. She will go away empty-handed and unable to heat her home [Fredrik Lerneryd/Al Jazeera]

In December 2018, the Mongolian government banned the use of unprocessed, raw coal for domestic cooking and heating, a directive which has been implemented in six of Ulaanbaatar's nine düüregs (districts) so far. The ban will take effect in the remainder in 2021.

Government-issued coal briquettes, which are "cleaner" than raw coal but are still rationed, provide a substitute and have helped to nearly halve the city's air pollution levels. The briquettes, made from coal powder and coking coal from the southern Gobi region, are produced at a newly built plant in Ulaanbaatar and sold at certified "briquette stations" throughout the capital.

Residents who need heating coal must show ration vouchers to buy them for $1 a bag - no voucher, no briquettes.

At one of the distribution sites, a woman without her briquette coupon is trying to purchase a bag, anyway. The briquette vendors shake their heads; there is nothing they can do. If they sell to unauthorised customers they risk a 30 percent salary deduction.

"How am I supposed to heat our home tonight?" the woman asks, then turns and leaves the station, her two children trying to keep up with her.

It is doubtful that rationing will be respected by everybody. People will always find a way around it - especially when the cold bites. "People are using briquettes just like the old raw coal and burning them the same way," Byambajargal Losol, a physicist at the Mongolian Science Academy, told AFP in November last year. "The briquettes are thick and compact so they require twice as much oxygen to burn, compared to raw coal."

Eight residents of Ulaanbaatar have suffocated to death in their sleep due to carbon monoxide poisoning after burning briquettes, and 1,000 people have been hospitalised with symptoms of nausea and breathing difficulties since October last year UNICEF

But the raw coal ban signals political responsibility, proclaims Gabymbyme Haldai, head of Ulaanbaatar’s Air Pollution Reduction Department. "The briquette transition has halved our air pollution levels in just one winter. Now, the production capacity at the briquette plant must increase and the ban implemented in wider areas."

Haldai sees no problems with Mongolia’s dependence on coal. "Coal makes Mongolia energy independent," he states.

Questions about sustainable energy investments seem to annoy him. "I don't know where you come from or what energy sources you use. Here, we experience extreme weather conditions," Haldai says.

The ban on raw coal, however, "will only take Mongolia so far", says Alex Heikens, UNICEF's Mongolia representative. "Its visible positive results might end up counterproductive. Only 90 percent decreased air pollution will make any real difference to climate and people's health."

Eight residents of Ulaanbaatar have suffocated to death in their sleep due to carbon monoxide poisoning after burning briquettes, and 1,000 people have been hospitalised with symptoms of nausea and breathing difficulties since October last year.

Miners haul raw coal from a semi-illegal mine in Nalaikh, Mongolia. The production and demand from the local mines in Nalaikh have dropped by 80 percent since the ban on raw coal [Fredrik Lerneryd/Al Jazeera]

'Times have never been so hard'

Government attempts to curb pollution - most notably by banning the use of raw coal in some areas - have brought new hardships to those reliant on the mining industry for a living.

Darkness falls over the industrial remnants of Nalaikh's now-closed and abandoned open-pit coal mine, 40km east of Mongolia's capital, Ulaanbaatar. The once state-owned mine shut down because of the fall in demand for raw coal, but the coal reserves are still there. They are now hauled out of narrow, small-scale shafts run in semi-illegal fashion, providing middlemen with raw coal to sell on the black market.

A dirt road ends at a 120m-deep shaft here. Five miners drink Coca-Cola and smoke cigarettes inside a ger, which has been raised next to the shaft. "I've been a miner since I was a kid," says Khurelshagai, smiling at clips of his daughters on his phone. "But times have never been as hard as today."

From the 1950s, Nalaikh Coal was a major local job provider and an important provider of energy to Ulaanbaatar. But it was also the primary contributor of carbon dioxide emissions and high levels of hazardous, atmospheric particles called PM2.5. These microscopic particles enter the lungs and the bloodstream, and are responsible for turning Mongolia's capital into one of the world's most polluted cities.

This used to be a place of pride. Now, it looks like a warzone Tserengund, coal miner

"There is really no affordable alternative [to coal] in terms of clean fuel," said Delgermaa Vanya, health and environment officer at the World Health Organization in a 2019 report. "As a result, in the winter months over 600,000 tonnes of raw coal are burned for heating in the city’s approximately 200,000 gers, accounting for about 80 percent of Ulaanbaatar’s winter pollution."

The ban on raw coal has helped Mongolia's ecological and financial climate - but it has also rewritten life in Nalaikh, where locals talk of shattered businesses and a lost future. Industrial-scale coal production is a thing of the past there, although small quantities of raw coal are still hacked and scavenged from semi-illegal, squatted shafts and sold, either to Ulaanbaatar's remaining raw-coal heating plants or on the black market.

Workers at a briquette station in Ulaanbaatar. Each bag costs $1 [Fredrik Lerneryd/ Al Jazeera]

Mongolian democracy is primarily embodied as the financial liberalisation of big industries, says Tserengund, one of the miners. He is having a smoke on the slope overlooking the 120m-deep narrow shaft. He has coughed, dug and stooped his way through narrow shafts for 20 years to provide for his wife and son. His only reward will be a broken body. "The boss can't pay me; I just get daily coal rations for heating and cooking. But I have no other choice, we don't want to freeze to death."

Night temperatures fall close to minus 30°C. Nalaikh's last coal miners catch their breath upon the slope; they have the air of guardians of a lost industrial kingdom. Tserengund looks around, seeing more than just the piles of gravel, debris and a silent industrial no-man's land.

"This used to be a place of pride," he laments. "Both my grandparents and parents worked here. In the summers, cows pastured in the surrounding hills. Back then, the place was green."

"Now," he sighs, "It looks like a war zone."

https://www.aljazeera.com/indepth/features/casualties-mongolia-doomed-love-affair-coal-200209085415566.html&ct=ga&cd=CAIyGjBlMDRkYTQxNmY2YWRlMjY6Y29tOmVuOkdC&usg=AFQjCNH2xwKUs4uppk3JbmWJbV-OipbWg