Tariffs will take effect immediately but precise details are yet to be unveiled

Reuters - Daniel Keane

Countries across the world were bracing for economic pain on Tuesday night as the White House confirmed that President Donald Trump would unveil sweeping tariffs on trade.

Mr Trump’s press secretary Karoline Leavitt said that the tariffs, which are expected to affect a raft of imports from rival economies, would take effect immediately amid fears of a shock to the global economy.

The White House is expected to unveil full details of the tariffs at 9pm BST on Wednesday, which Mr Trump has hailed as “liberation day”. It is unclear whether the levies will be universal or affect specific countries.

“American workers and businesses will be put first under President Trump,” Ms Leavitt said.

“The president’s historic action tomorrow will improve American competitiveness in every area of industry, reduce our massive trade deficits and ultimately protect our economic and national security.”

Foreign Secretary David Lammy said the UK is preparing "for the worst" but "all options remain on the table".

Mr Trump has already imposed tariffs on UK aluminium and steel, and carmakers exporting to the US, in a bid to boost American production and protect home-grown manufacturers.

The tariffs could have a major impact on the country’s car industry because it could make it harder for UK businesses to sell to the US.

Global stocks bounced back after tariff uncertainty sparked widespread turbulence in the financial markets on Monday.

London’s FTSE 100 moved higher on Tuesday, gaining 51.99 points, or 0.61%, to close at 8,634.8.

Europe’s top indexes also staged a rebound after starting the week with sharp losses.

On Wall Street, the S&P 500 was up 0.4%, while Dow Jones was edging 0.1% despite starting the day lower.

The Bank of England said that the effect of Trump’s tariffs would depend on how other countries respond.

Economists say the uncertainty over retaliatory tariffs – meaning how other countries will respond with their own policies – makes it harder to assess how things will change for everyday goods that consumers buy.

Most experts do not expect overall prices to spike as a result, but many are anticipating economic activity to slow to some degree.

Economist Swati Dhingra, a member of the Bank’s Monetary Policy Committee (MPC), suggested that the inflation impact could be “less than feared”.

This is because the main goods that the US imports from the UK, including refined oil, were unlikely to see cost increases on account of tariffs.

Fellow economist and MPC member, Megan Greene, said tariffs could end up being “disinflationary”, meaning they help bring down the rate of overall price rises in the UK.

This is because businesses in countries targeted by duties may divert trade by seeking new international buyers.

https://www.standard.co.uk/news/world/trump-us-tariffs-economy-trade-b1220170.html

Well that was fun.

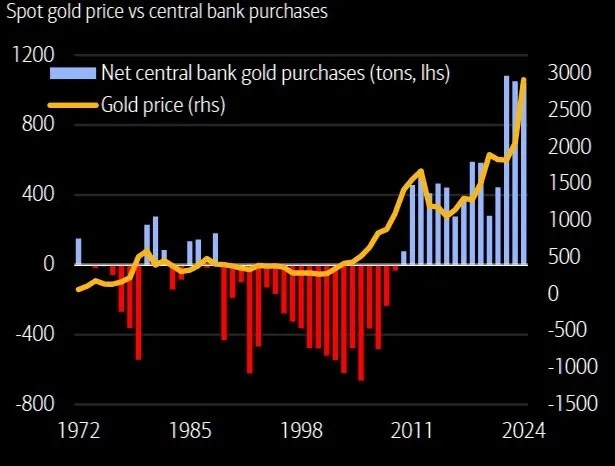

Gold extended its bull market into uncharted territory in March, surpassing $3,000/oz.

What’s driving it? Rising global chaos, obviously. But also central bank buying, which seems to be price-insensitive:

Copper had a nice run to levels that are profitable for well-run miners. All but one of our Portfolio’s copper miners are up (see below).

Silver did about as well as gold in percentage terms and generated some buzz as a “squeeze candidate.”

Silver squeeze graphics like the following have become common:

https://substack.com/home/post/p-158486981?utm_campaign=post&utm_medium=web

As Bloomberg news agency has learned, state-owned Indian oil refining companies Bharat Petroleum Corp. and Hindustan Petroleum Corp have begun hastily looking for alternative oil suppliers to the aggressor country Russia.

Trump managed to scare India

According to journalists, India is hastily looking for alternative sources of oil in the Middle East, North Sea, and Mediterranean regions.

The country's authorities made this decision after loud threats from American leader Donald Trump towards the aggressor country Russia.

As is known, the head of the White House recently officially confirmed that he is ready to impose powerful secondary sanctions against countries that buy Russian oil if Moscow does not agree to a ceasefire in Ukraine.

After the US president's words, oil futures rose, in particular, the American West Texas Intermediate grade rose by 3.1%.

What is important to understand is that India almost never bought Russian oil until 2022, but after the war began, it became the second largest importer after China.

Last year, Russian supplies provided almost 40% of its imports, mostly Urals oil from western ports.

Cheap Russian resources have allowed India to reduce purchases from the Middle East and Africa.

https://news.online.ua/en/india-ready-to-abandon-russian-oil-after-trumps-threats-892163/

Kazakhstan's oil and condensate output reached a record high in March, with higher output from the giant Tengiz oilfield and stable exports via the Caspian pipeline, further exceeding OPEC+ production quotas, two industry sources said and Reuters calculations showed on Tuesday.

The country has repeatedly exceeded its OPEC+ quotas in recent months and has promised to reduce output under pressure from OPEC+ leaders Saudi Arabia and Russia.

Oil and gas condensate production in Kazakhstan reached 8.95 million metric tons in March, or 2.17 million barrels per day (bpd), the sources said. That compared with 2.15 million bpd on average in February, according to the state's Energy Ministry.

Kazakhstan's OPEC+ quota does not limit condensate production, but crude oil output is meant to be set at 1.468 million bpd.

Excluding gas condensate, a type of light oil, crude oil production increased last month to 1.88 million bpd from 1.83 million bpd in February, according to the source familiar with the official statistics, and Reuters calculations, which take into account Kazakhstan's tons per barrel ratio of 7.5.

Kazakhstan's March oil exports remained high, with flows via its Caspian Pipeline Consortium (CPC) export route continuing unabated last month, despite expectations after drone attacks on its infrastructure in February and March.

Exports via the CPC pipeline have been initially set at 1.7 million bpd for both March and April.

However the CPC operator, which exports around 1% of global oil supply via the Russian terminal, said late on Monday that the two single mooring points (SPM) were halted following snap inspections by Russia's transport watchdog. That means April CPC Blend oil loadings might decline.

The former head of trader Mercuria's Beijing operation is joining China's largest private oil refining and chemical group Rongsheng Holdings in a senior position, according to sources and an internal memo seen by Reuters.

Li Xinhua, 54, will be assistant to Xiang Jiongjiong, the president of Rongsheng Holdings. Li will oversee Rongsheng's coal and petrochemical businesses and co-lead its Singapore-based oil trading, said the sources, who declined to be named as the move has not been officially announced.

Rongsheng did not immediately comment.

Li is a 17-year veteran of Geneva-based Mercuria, a global top-four commodities and energy merchant.

In his new role, Li is expected to help grow and manage Rongsheng's expanding business in what two of the sources described as a time of challenges, including overcapacity in China's refining industry, a lacklustre global petrochemicals market and geopolitical uncertainty.

Rongsheng's Singapore trading desk is populated by former senior Chinese state oil traders, and the firm recently hired an ex-PetroChina trader to lead its Canadian crude oil trading.

After joining Mercuria in 2008 from Chinese state-run Sinochem, Li was instrumental in growing its China oil business, especially in dealing with the country's independent refiners.

"During his tenure, Xinhua has been a key player in the company's growth and transitions. He proactively developed the independent refiners' market in Shandong, setting a solid foundation for the company's oil trading business," Mercuria's internal memo said.

Li's new boss, Xiang, is the son-in-law of Rongsheng's founder and chairman, Li Shuirong, who built the business from a small textile factory in the late 1980s.

Rongsheng controls China's largest private refiner, Zhejiang Petrochemical Corp, and was the first Chinese private refiner with a substantial investment from Saudi Aramco.

Li will be replaced by Wang Tiezheng, a senior iron ore trader, as head of Mercuria's Beijing office, Mercuria's memo said.

Mercuria did not immediately respond to emails seeking comment.

By Tsvetana Paraskova - Apr 01, 2025, 7:00 PM CDT

As Saudi Arabia pushes ahead with its ambitious Vision 2030 plan to build huge futuristic cities and resorts, the world’s top crude oil exporter will need to borrow more money on the debt markets as oil prices continue to linger at levels of about $20 per barrel lower than the Saudi fiscal breakeven oil price.

The Kingdom, the leader and main architect of the OPEC+ production cuts, is starting to ease a small part of these cuts on April 1, per the group’s latest plan to add 138,000 barrels per day (bpd) to supply this month.

Rising OPEC+ output this year could weigh down on oil prices, which have been hovering in the low $70s per barrel in recent weeks. That’s well below the $91 per barrel that the International Monetary Fund (IMF) thinks is the oil price needed to balance Saudi Arabia’s budget.

With many uncertainties about global trade and economic and oil demand growth, the Kingdom may have to endure a prolonged period of lower-than-breakeven prices and raise its public debt. Borrowing will have to increase to cover planned expenditures, or spending on some mega projects and Vision 2030 programs could be delayed or reduced, analysts say.

Moreover, Saudi Arabia’s main cash cow, oil giant Aramco, has just slashed its dividend, which further dents income for the Kingdom, the company’s main shareholder.

Another Deficit

In its 2025 Budget Statement, Saudi Arabia expects total expenditures of $342 billion (1.285 trillion Saudi riyals) as it continues to invest in projects to diversify the economy away from oil revenues, which account for about 61% of total Saudi government revenue.

Revenues are projected to be lower than expenditures, at $316 billion (1.184 trillion riyals). These estimates indicate a deficit of $27 billion (101 billion riyals), which represents about 2.3% of Gross Domestic Product (GDP).

“The Government will continue funding and supporting the implementation of programs, initiatives, and economic transformation projects in line with Saudi Vision 2030, while maintaining spending efficiency and fiscal sustainability over the medium- and long-term,” the Ministry of Finance said in November.

To fill in the deficit gap, Saudi Arabia will issue more debt this year, aiming “to take advantage of available market opportunities to implement alternative government fiscal operations that enhance economic growth, such as spending that is directed towards strategies, mega projects, and Saudi Vision 2030 programs.”

Public debt is expected to rise to 29.9% of GDP by the end of 2025, up from 29.3% of GDP in 2024.

Saudi Arabia will continue to borrow on the debt markets and explore other financing options this year as it has estimated its funding needs for 2025 are $37 billion (139 billion riyals) to cover the deficit and repay maturing debts.

Lower Dividends from Aramco

The funding needs are likely to be higher than these estimates from January, considering that Saudi Aramco said in early March that its dividend would be 30% lower this year.

Aramco said that it expects total dividends of $85.4 billion to be declared in 2025. This is nearly 30% lower compared to last year’s $124 billion in dividends, which included about $43.1 billion in performance-linked dividends.

The lower dividends for 2025 will cut revenues for the Kingdom of Saudi Arabia, which is the biggest shareholder of Aramco via a direct stake of almost 81.5% and an indirect interest via the sovereign wealth fund, the Public Investment Fund (PIF), which has 16% of Aramco.

As the deficit widens with the slashed Aramco dividend, Saudi authorities have the flexibility to recalibrate investments, Fitch Ratings said last month.

Fitch expects the Saudi government to cut capex and associated current spending this year.

“Regular project recalibration has recently resulted in a scaling back and resequencing of certain projects, for example,” the credit rating agency noted.

“This flexibility could ease the effect on Saudi Arabia’s public finances if oil prices are lower than we expect, though in Fitch’s view, lower investment spending could also have an impact on efforts to diversify the economy away from oil.”

Ironically, the Saudi efforts to diversify the oil-reliant economy need a sustained period of healthy oil demand and relatively high oil prices.

This year, the uncertainties about oil markets and oil prices are even higher than usual, with a new U.S. Administration seeking American dominance with tariffs on the biggest trade partners and upending foreign diplomacy. Tariffs could weigh on economies, including the U.S. and Chinese economies. If these slow down, demand for oil will slow, too, and oil prices will decline. So will Saudi Arabia’s oil revenues.

The OPEC+ group’s production increase and expectations of weaker demand growth due to the U.S. tariff policies and the potential economic slowdown will cap oil price rises this year, the monthly Reuters poll showed on Monday.

At around $70 oil, the short-term remedies for Saudi Arabia are to raise borrowing to finance the mega projects or delay some of these investments.

https://oilprice.com/Energy/Oil-Prices/Saudi-Arabia-Faces-Oil-Price-Dilemma.html

By Julianne Geiger - Apr 01, 2025, 11:30 AM CDT

OPEC+ is expected to agree on a plan that would see production for the group increase in May, OPEC+ sources told Reuters on Tuesday.

The OPEC+ group, comprised of the 12 OPEC members—Saudi Arabia, Iraq, Iran, Kuwait, Venezuela, Gabon, Algeria, Equatorial Guinea, Libya, UAE, Congo, and Nigeria—and non-OPEC member organizations Russia, Brazil, Mexico, Kazakhstan, Oman, Azerbaijan, Bahrain, Malaysia, South Sudan, Brunei, and Sudan—produce more than 45 million barrels of crude oil per day—or 59% of global oil production. The combined clout of the members is considerable and has proven sufficient for moving oil prices.

Eight of the OPEC+ members are scheduled to lift production by another 135,000 barrels per day in May, OPEC+ sources told Reuters—although the planned increase on paper could result in improved compliance rather than an actual production hike.

Kazakhstan, for example, has been exceeding its oil production quota for years, reaching an all-time high in March, despite its pledges to do better. Russia, one of the larger members of the broader group, has claimed that it was in full compliance with its oil production quotas in January and February, but analysts and secondary sources routinely fault Russia for its chronic overproduction.

Iraq is another chronic overproducer, although it has agreed to compensatory cuts over the next year.

At the OPEC+ ministerial in December, the alliance delayed the start of the easing of its 2.2 million bpd cuts to April 2025. The group also extended the period in which it would unwind all these cuts to until September 2026.

The OPEC+ group is scheduled to meet virtually on Thursday and is expected to approve production hikes for May.

The news comes as the Brent crude oil benchmark is trading at $74.67—$16 under where it was this time last year.

Hungarian Foreign Minister Peter Szijjarto © Vladislav Nogai/TASS

Hungary and Slovakia have fully activated the pipeline between the two countries to supply Russian gas, following the halt of gas transit through Ukraine, announced Hungarian Foreign Minister Peter Szijjarto.

"We managed to solve the problem of natural gas supplies to Slovakia and Hungary, despite the fact that Ukraine created very serious difficulties for us. To ensure reliable gas supplies to Slovakia via Hungary even with the cessation of its transit through Ukraine, we had to increase the capacity of the connecting gas pipeline between our countries," he said at a press conference after a meeting with Acting Speaker of the Slovak Parliament Peter Ziga in the border town of Komarom. His speech was broadcast by the M1 TV channel, News.Az reports citing TASS.

"Today, the gas pipeline between Hungary and Slovakia is operating at increased capacity. We have now increased the capacity of this pipeline by 900 million cubic meters per year. Until now, 2.6 billion cubic meters were transported between the two countries per year. Starting today, this volume will increase to 3.5 billion cubic meters," Szijjarto noted.

Szijjarto added that "compared to last year's record volume, the volume of natural gas transported through Hungary to Slovakia has increased by 50% in the first three months of this year."

Szijjarto stressed that by stopping the transit of Russian gas on January 1, Ukraine had created serious problems for Central Europe, but Hungary and Slovakia found a way out of this situation. And they did this all on their own, without assistance from the EU, he noted.

"I cannot say anything about assistance from the European Union, because there was none," Szijjarto stressed. Budapest and Bratislava demand that Kiev resume Russian gas transit to Central Europe and would like to get Brussels’ support on this as well, but the issue is as yet unresolved.

Hungary continues to receive the bulk of its gas in accordance with long-term contracts with Gazprom via the TurkStream pipeline and its extensions through Bulgaria and Serbia. According to Hungarian data, in 2023 this volume totaled 5.6 billion cubic meters, and in 2024 it reached a record high of 7.6 billion cubic meters. In turn, Hungary itself supplies fuel to neighboring Slovakia.

https://news.az/news/hungary-slovakia-boost-russian-gas-supplies-bypass-ukraine-says-fm

The DRC is seeking to attract Western investment to counterbalance Chinese dominance in its mining industry. Credit: BJP7images/Shutterstock.

Rio Tinto Group has held discussions with the Democratic Republic of Congo (DRC) to develop one of the world’s largest hard rock lithium deposits, reported Bloomberg.

The negotiations, which have taken place in recent weeks, revolve around the possibility of Rio Tinto transforming the Roche Dure deposit into a lithium mine, said sources familiar with the matter.

The outcome of these talks remains uncertain as the discussions are in the early stages.

The DRC is seeking to attract Western investment to counterbalance Chinese dominance in its mining industry.

The country is also exploring a minerals-for-security deal with the US to support its fight against regional insurgencies in its eastern provinces.

The Roche Dure lithium deposit, initially identified by Australian company AVZ Minerals, has attracted interest from multiple parties.

The deposit is estimated to hold mineral resources of 400 million tonnes at 1.65% lithium oxide, 715 parts per million (ppm) of tin and 34ppm of tantalum, as of May 2019.

Located near the Manono lithium project in south-eastern Congo, the licence is currently subject to arbitration proceedings initiated by AVZ Minerals after the DRC Government cancelled its rights and redistributed them, with the northern section going to Zijin Mining Group.

In March, AVZ Minerals announced that an International Chamber of Commerce tribunal had issued a partial award, ordering DRC’s state-owned Cominière to pay €39.1m ($42.4m) plus interest for non-compliance with emergency orders over the Manono lithium project.

Rio Tinto’s talks with the DRC on the development of the Roche Dure deposit highlight the company’s growing interest in battery metals essential for the electric vehicle industry.

The company is aiming to establish itself as a significant player in the lithium supply chain, contrasting with other mining giants such as BHP and Glencore, which have been more cautious about entering the lithium market.

Rio Tinto’s expansion strategy includes the acquisition of Arcadium Lithium for $6.7bn (£5.19bn) last year, as well as developing assets in Serbia and Argentina.

KoBold Metals, supported by investors such as Bill Gates and Jeff Bezos, has also expressed its intention to develop the deposit once legal disputes are resolved.

There is speculation that KoBold and Rio Tinto may collaborate on the mine, although both companies are also considering independent involvement, the report added.

https://www.mining-technology.com/news/rio-tinto-congo-lithium/

Gold price today: Gold Futures on the Multi Commodity Exchange hit a new all-time high level at ₹91,400 per 10 grams on Tuesday, amid tariff concerns ahead of US President Trump's announcement on April 2.

Anubhav Mukherjee

Published1 Apr 2025, 06:00 PM IST

Gold Futures for the June contract on the MCX index hit a new high of ₹91,400 on Tuesday, April 1. (Pexels)

Gold price today: Prices of the precious yellow metal Gold hit a new lifetime high on the Multi Commodity Exchange (MCX) on Tuesday, April 1, amid fears of US President Donald Trump's upcoming tariffs on Wednesday, April 2.

Gold futures for the June 5, 2025, contract hit their lifetime high of ₹91,400 per 10 grams on the MCX index on April 1.

Just off the day's high at 5:50 p.m. (IST), the gold futures for the June contract were trading at ₹91,120 per 10 grams, compared to ₹90,717 per 10 grams at the previous market close.

The all-time low level for the gold futures was at ₹77,078 per 10 grams, according to data collected from the MCX.

On the other hand, Silver futures on the MCX index were trading 0.24 per cent lower at ₹99,829 per kilo at 7:35 p.m. (IST), compared to the previous close at ₹1,00,065 per kilo, as per the market data.

Global Gold

According to the news agency Reuters report, global investors are taking refuge in US government bonds and gold as they are dumping the equity shares, especially for the tech and IT sector.

The international gold prices hit $3,175 per ounce as per the morning session on Tuesday, according to an AP report. It also mentioned that the gold prices have reached their high compared to their $2,700 levels earlier this year.

Gold Price Outlook

Experts estimate that the week ahead will remain ‘highly volatile’ for the precious yellow metal after the gold futures hit their all-time high on Tuesday. Colin Shah, managing director at Kama Jewelry, attributed Gold's price hike to the uncertainty over the US tariff policy.

“Moving forward, spot gold prices are set to reach $3,250 by 2025, supported by key factors such as Trump's trade tariffs, a weak US Dollar, escalating geopolitical tensions between Russia and Ukraine, and rising tensions in the Middle East,” said Shah.

Jateen Trivedi, VP of Research, Commodities and Currency at LKP Securities, estimates that investors should take a ‘cautious approach’ ahead of Donald Trump's major US tariffs announcement on April 2.

“With gold already factoring in most of the tariff-related moves, any delay or lower-than-expected tariffs could trigger further profit booking,” said Trivedi.

“On MCX, gold registered a fresh all-time high of ₹91,400 in the June contract, marking an impressive 18% gain in 2025 so far. The week ahead remains highly volatile, with a trading range projected between ₹88,500 to ₹92,500. Additionally, key economic data, including Manufacturing and Services PMI, ADP unemployment, Nonfarm Payrolls, and US Unemployment data, will keep traders on edge, influencing gold’s movement further,” said Trivedi, analysing the outlook for gold in the upcoming sessions.

Prathamesh Mallya, DVP- Research, Non-Agri Commodities and Currencies at Angel One, said that the gold prices are anticipated to trade higher as investors remain anxious about the reciprocal tariffs fueling inflation in the economies around the world.

“Gold prices will likely trade higher as investors remain anxious that US President Donald Trump's reciprocal tariffs on all nations might fuel inflationary pressures and obstruct economic growth,” said Mallya.

Despite the losses of the last few days, the Copper price on the Comex is up a good 25 percent since the beginning of the year, almost on a par with tin. But on the LME, too, Copper is trading around 10 percent higher than at the beginning of the year, Commerzbank's commodity analyst Barbara Lambrecht notes.

Copper is still bullish despite the recent decline

"We see the latest price decline being caused, on the one hand, by the general increase in risk aversion in the markets and, on the other, as a ‘healthy’ correction after the almost overheated price rise of the previous weeks. However, there are also some supportive news for the Copper price: the improved sentiment indices in China's industry and construction sector, although it has to be admitted that the escalating tariff dispute could soon put a damper on this again."

"The disappointing Chilean Copper production, which fell back below 400 thousand tons in February, or 5.5% below the previous year, after reaching a record high of almost 570 thousand tons in December, a good 14% above the previous year; the low or negative treatment charges (TC/RCs) in China. During a conference of Chinese Copper smelters, no official indication was given for the second quarter, but it was said that the supply of concentrate remained very tight."

"Some smelters had therefore started maintenance work early and new political protests in front of a Copper mine in Peru. The mine affected is the country's seventh largest, Antapaccay. As a reminder, in 2023/2024, the expansion of the Las Bambas Copper mine was subject to significant delays in the approval process due to protests by indigenous groups."

Las Bambas is considered the world’s ninth-largest copper mine with an output of about 400,000 tonnes of the industrial metal per year. (Image courtesy of MMG.

Chinese-owned metals producer MMG Ltd. attempted to reassure investors about its prospects in Peru, saying a surge in “illegal” mining activity in the country isn’t affecting its copper production or development plans.

The company — a unit of state-owned China Minmetals Corp. — shared concerns with the Peruvian government about a “significant increase in illegal mining activity,” MMG said in a March 31 post on its website. The firm’s shares in Hong Kong fell as much as 6.1% on Monday, more than most peers.

The statement is a response to last week’s Bloomberg News article about the emergence of a large, informal mine run by thousands of local community members on the Sulfobamba area of MMG’s Las Bambas concession. That puts MMG and the community on a collision course given Sulfobamba will host the company’s planned third phase of mining in Peru.

To be sure, MMG isn’t the only mining company affected by informal operations, with both Southern Copper Corp. and First Quantum Minerals Ltd. suffering disruptions at their projects.

Mining at Sulfobamba isn’t due to start for another decade and the company is in talks with “all stakeholders” to ensure that the future pit “can be operated sustainably and in a way that benefits host communities,” MMG said.

MMG has only explored 10% to 15% of the concession, and is looking for for new deposits. Its mining operations continue to produce in line with 2025 guidance of between 360,000 metric tons and 400,000 tons, MMG said.

https://www.mining.com/web/mmg-seeks-to-reassure-investors-amid-peru-illegal-copper-boom/

The company raised the price by €20/t due to increased demand and an expected reduction in steel imports to Europe

ArcelorMittal, one of the leaders in the European steel market, has raised prices for hot rolled coil (HRC) in Northern Europe to €700 per tonne. The previous rate of the manufacturer was €680/ton. This was reported by ArgusMeda.

The company explains the price revision by the growth in demand and the number of bookings, which intensified after the revision of European measures to protect the steel market. This was most noticeable in the HRC segment in northern Europe, as well as in cold-rolled and galvanized steel across the region.

European steel mills are in no hurry to sell products as they face low capacity utilization and difficulties in fulfilling deliveries due to production delays. At the same time, steel imports to the EU are expected to decline in the coming months due to new anti-dumping duties on supplies from Egypt, Japan and Vietnam.

On the futures market today, the quarterly HRC contract was trading at €670/t, almost the same as the close on March 31. The physical market remains relatively calm as participants await trade results and possible changes in tariffs to be announced by US President Donald Trump.

Northern European producers’ margins hit an almost one-year high, with HRC profitability exceeding blast furnace production costs by €181/t as of March 31, the highest since April 5 last year.

As GMK Center reported earlier, 21.68 million tonnes of flat products from third countries were supplied to the EU market in 2024, up 7.5% compared to 2023. Hot-rolled flat products (HS 7208) traditionally account for the largest import volumes, amounting to 10.81 million tonnes, up 4.3% y/y.

Key suppliers of flat products to the EU in 2024 include: South Korea, India, Turkey, Taiwan, Vietnam, China and Ukraine. These countries accounted for 75% of the total imports of the relevant products last year.

Offers for the current week remained unchanged after 9 weeks of growth

US steelmaker Nucor has released its weekly spot price (WSP) for hot rolled coil (HRC), leaving offers unchanged from the previous week at $935 per short tonne for all production facilities except California Steel Industries (CSI), where the price is $995/tonne.

Offers for the current week remained unchanged after a 9-week increase (since January 21, 2025). In general, Nucor has raised prices for hot-rolled steel by $175/t since the beginning of the year.

Despite the slowdown in the HRC market, the company announced a $40 per short tonne price increase for plate in late March for May contracts. The Charlotte, North Carolina-based company noted in a letter to customers that the price increase was in line with increased customer demand.

Since the beginning of January, Nucor has raised prices for plate products four times. In total, the company increased prices by $320 per short ton in 2025.

The company resorted to price increases after SSAB Americas, another major US plate producer, raised prices by $60 per short ton last week. In total, SSAB has raised prices by $300 per short ton since the beginning of the year.

According to SMU, the average price for plate is now $1.19 thousand per short ton. Prices have remained stable over the past three weeks.

As GMK Center reported earlier, global hot-rolled coil prices faced weak demand in mid-March. US prices remained unchanged from March 14 to 28 at $975/t EXW. Since the beginning of the month, the product has risen in price by $125/t. A 25% safeguard duty on imports of all steel products to the US, effective from March 4, allowed local producers to raise prices without fear of competition from outside. But the growth potential has now been exhausted.

https://gmk.center/en/news/nucor-reaches-peak-price-growth-for-hot-rolled-coils/