DAVID JENSEN MAY 24, 2025

"Limited hangout" is intelligence jargon for a form of propaganda in which a selected portion of a scandal, criminal act, sensitive or classified information, etc. is revealed or leaked, without telling the whole story. The intention may be to establish credibility as a critic of something or somebody by engaging in criticism of them while in fact covering up for them by omitting many details; to distance oneself publicly from something using innocuous or vague criticism even when one's own sympathies are privately with them; or to divert public attention away from a more heinous act by leaking information about something less heinous.

This is a common tactic used by political extremist groups on both ends of the political spectrum, as well as by government intelligence agencies caught in scandals.

Rational Wiki

The focus of this Substack is and has been 1) to warn of the specific danger to worldwide societal and market stability presented by the Bank of England’s creation of the leveraged gold and silver market in the City of London where claims for non-existent gold and silver have been sold to unwitting cash purchasers and 2) to call for the institution of stable sound money to avert the coming disruptions.

The suppression of gold and silver’s monetary policy inflation warning signals, coordinated through Bank for International Settlements (BIS), has compounded global currency and debt market disorder created by central bankers over decades.

This week, BIS member the European Central Bank (ECB) revealed that it appears to have gotten the memo in terms of the imminent danger posed by the leveraged claims in the world’s gold (and silver) markets.

However, the challenge for the ECB and other central banks is how do you now offload blame by warning of the imminent disintegration of this decades-old metals Ponzi scheme without implicating your own institution?

The Limited Hangout

In its May 21, 2025 Financial Stability Review, the ECB gingerly begins the entire discussion on page 39 in a 5 page section titled “What does the record price of gold tell us about risk perceptions in financial markets?” by Maurizio Michael Habib, Oscar Schwartz Blicke, Emilio Siciliano and Jonas Wendelborn.

In what appears to be the ECB’s ‘limited hangout’, the ECB discusses gold and how physical gold delivery in the US against derivatives in the COMEX market highlight the risk of gold delivery default destabilizing the Euro area where a notional value of $1 trillion (T) of gold derivatives are held.

On pg. 42, the ECB report notes: “While gold prices are driven by many factors, investors showed high demand for gold as a safe-haven asset and, at the beginning of 2025, a notable preference for gold futures contracts to be settled physically. These dynamics hint at investors’ expectations that geopolitical risks and policy uncertainty could remain elevated or even intensify in the foreseeable future. Should extreme events materialise, there could be adverse effects on financial stability arising from gold markets. This could occur even though the aggregate exposure of the euro area financial sector appears limited compared with other asset classes, given that commodity markets exhibit a number of vulnerabilities.34 Such vulnerabilities have arisen because commodity markets tend to be concentrated among a few large firms, often involve leverage and have a high degree of opacity deriving from the use of OTC derivatives. Margin calls and the unwinding of leveraged positions could lead to liquidity stress among market participants, potentially propagating the shock through the wider financial system. Additionally, disruptions in the physical gold market could increase the risk of a squeeze. In this case, market participants could be subject to significant margin calls and/or have trouble sourcing and transporting appropriate physical gold for delivery in derivatives contracts, leaving themselves exposed to potentially large losses.”

We see in the quote above the ECB use key words “gold”, “vulnerability”, “concentrated”, “leverage”, “opacity” and, most importantly, “OTC derivatives” where OTC is Over-the-Counter (or private party-to-party) derivative contracts.

However, the report only obliquely mentions the London Gold Market despite the fact that London is the world’s largest gold and silver market, trades exclusively in OTC contracts, and is ‘ground zero’ for the global leveraged silver and gold price fixing scheme created by the Bank of England.

The London Bullion Market Association (LBMA) itself tells us that trading of derivatives is less than 10% of daily trading volume while the remainder is in the form of trading of unallocated (leveraged) cash/spot claims for immediate delivery of gold.

Standing claims for cash/spot gold in London are leveraged hundreds of times against physical gold available for immediate delivery with the Bank of England having to lease gold into the market to cover the nature of the leveraged market when physical delivery was demanded earlier this year.

With an estimated 400M to 600M oz. of cash/spot gold claims and 5B to 8B oz. of cash/spot silver claims standing in London, the real risk to global stability is the leveraged CASH/SPOT market for immediate delivery physical gold and silver in London and not derivative gold claims in an unnamed OTC market.

The ECB does not mention this however, as that would highlight the problem that has been created by these central planners.

While the ECB’s May 2025 Financial Stability Review has very little value in identifying the central issue in the gold and silver markets that we face today, it does serve as an excellent example of a ‘limited hangout’.

RIYADH: Egypt’s manufacturing and extractive industries index — excluding crude oil and petroleum products—rose by 3.9 percent in March, reaching 120.47 points, up from 115.93 in February, according to the Central Agency for Public Mobilization and Statistics.

The increase was largely driven by seasonal demand for food and a significant boost in steel rebar production, CAPMAS reported.

The monthly index, which uses the fiscal year 2012-13 as its base and reflects producer prices from January 2020 onward, is part of Egypt’s ongoing efforts to enhance industrial measurement standards.

The rise in manufacturing activity also coincides with Egypt’s strengthening economic ties with Arab markets. Total trade volume with Arab countries reached $30.5 billion in 2024—a 16 percent increase from $26.3 billion in 2023.

Egyptian exports to Arab nations rose by 18 percent to $16.2 billion, while imports grew by 14 percent to $14.3 billion. Saudi Arabia remained Egypt’s top Arab trading partner, with bilateral trade surpassing $11.3 billion. Egyptian exports to the Kingdom totaled $3.4 billion, followed by the UAE at $3.3 billion and Libya at $2 billion. On the import side, Egypt received $7.9 billion in goods from Saudi Arabia, $2.7 billion from the UAE, and $947 million from Kuwait.

Sector-wise, the food manufacturing index jumped 10.18 percent in March, rising to 160.02 from 145.24 in February—driven by Ramadan-related consumption. The base metals sector saw even sharper growth, climbing 22.89 percent to 65.92 from 53.64, largely due to heightened steel rebar production amid robust construction and infrastructure activity.

However, not all sectors fared equally. The tobacco products index plummeted by 27.44 percent to 118.84, down from 163.78 in February, reflecting a drop in cigarette consumption. Similarly, the printing and reproduction of recorded media sector fell 14.43 percent to 115.18, attributed to the seasonal completion of textbook printing contracts.

CAPMAS emphasized that the new figures reflect both seasonal trends and long-term structural shifts in Egypt’s industrial landscape.

Exxon Mobil (XOM) and Chevron (CVX) stock will be closely watched by investors this week as the two oil giants get set for a battle over lucrative oil discoveries in South America.

At a private arbitration hearing in London the two companies will square off over the right to buy a 30% stake in Guyana’s Stabroek oilfield, owned by U.S. energy firm Hess (HES).

Four Way Tussle

Chevron proposed to buy Hess for $53 billion in September, 2023 thereby taking control of the oilfield which is understood to have reserves of up to $1 trillion. However, Exxon, which owns 45% of Stabroek claims it holds a contractual right of first refusal over any sale of the Guyana asset.

That is under the terms of a joint operating agreement with Hess and another oil firm, China’s Cnooc which has a 25% stake in the field.

Stabroek has an estimated 11 billion barrels of oil reserves and has helped boost the ExxonMobil share price in recent times and its valuation which now sits at $444 billion.

In the Balance

Losing the field would therefore be a huge blow and could swing the balance of fossil fuel power towards Chevron. Investors have been concerned over its long term pipeline so securing Hess would go a long way to silence the doubters. The Chevron share price is down 16% over the last 6 months.

Both companies are confident they will prevail in the hearing this week. The ruling is expected to be made by August or September this year.

If it is in favour of Exxon then Chevron could walk away from the deal but there is also the option to renegotiate the terms to benefit both parties.

Chevron could also, say analysts, look at another M&A opportunity such as Occidental Petroleum (OXY).

[SINGAPORE] Oil prices gained in early Asian trade on Monday after US President Donald Trump extended a deadline for trade talks with the European Union, easing concerns about US tariffs on the bloc that could hurt the global economy and fuel demand.

Brent crude futures rose 37 cents, or 0.6 per cent, to US$65.15 a barrel by 0001 GMT while US West Texas Intermediate crude was up 34 cents, or 0.6 per cent, at US$61.87 a barrel.

“A nice push higher in crude oil and US equity futures this morning after US President Trump extended the deadline,” IG market analyst Tony Sycamore said.

Trump said he agreed to extend a deadline for trade talks with the European Union until July 9 after Ursula von der Leyen, president of the European Commission, said the bloc needed more time to strike a deal.

Trade and tariff headlines, along with ongoing fiscal concerns are going to be the main wild card for risk sentiment and crude oil this week, Sycamore said.

Brent and WTI extended gains after settling 0.5 per cent higher on Friday as limited progress in US-Iran nuclear talks alleviated concerns of more Iranian oil returning to global markets and as US buyers covered positions ahead of the three-day Memorial Day weekend.

Prices were also buoyed by data from energy services firm Baker Hughes that showed US firms, under pressure from lower oil prices, cut the number of operating oil rigs by 8 to 465 last week, the lowest since November 2021.

The gains were capped by expectations that the Organization of the Petroleum Exporting Countries and their allies, a group known as Opec+, could decide to increase output by another 411,000 barrels per day (bpd) for July at next week’s meeting.

Reuters reported this month that the group could unwind the rest of its 2.2 million bpd voluntary production cut by the end of October, having already raised output targets by about 1 million bpd for April, May and June. REUTERS

In response to the recent outbreak of Foot-and-Mouth Disease (FMD) across central Afghanistan and several provinces, the Ministry of Agriculture, Irrigation, and Livestock convened a high-level coordination meeting with national and international partners, government agencies, and members of the agriculture sector.

The meeting aimed to establish joint strategies to contain the spread of the highly contagious animal disease and mitigate its impact on the livestock sector.

Deputy Minister Sadr Azam Osmani warned of the serious economic consequences if the outbreak is not brought under control.

“FMD is one of the greatest threats to Afghanistan’s livestock industry,” he said.

“Uncontrolled, it could inflict severe damage on the national economy. Close cooperation from international and local partners is vital.”

Mokhtar Mohseni, Head of Animal Health at the Ministry, emphasized that the disease, while previously present at lower levels, has now spread significantly.

“This is not just the government’s responsibility—it requires coordinated action from all partners,” he said, noting that both short- and long-term response plans have been developed and are underway with the support of key stakeholders.

FMD is a viral disease that affects cloven-hoofed animals such as cattle, sheep, goats, and pigs.

It causes fever, painful lesions, and excessive salivation, particularly in cattle and pigs. If left unchecked, the disease can lead to severe losses in the livestock sector, which plays a critical role in Afghanistan’s rural economy.

Residents of Khutsong South are raising urgent concerns after a sinkhole that began forming last year has now expanded dangerously, posing a serious threat to pedestrians, motorists, and nearby property.

Located just metres from the main road between Khutsong and Welverdiend, the sinkhole is situated at the end of the last street in Khutsong South. The affected road is frequently used by both local residents and through traffic, raising fears of a potential tragedy if the situation is not addressed quickly.

Community Voices Concerns

Mzwandile Maila, a local community leader, expressed alarm over the lack of action:

“It poses a significant safety risk, particularly if it is not properly fenced or secured. It can cause injuries or accidents if not addressed. The sinkhole can lead to property damage, including damage to nearby structures or infrastructure. It can also lead to environmental concerns, such as water pollution or soil erosion.”

Once a small cavity, the sinkhole has now engulfed a large section of the street, extending dangerously close to a palisade fence at the edge of the community and undermining the sidewalk used daily by pedestrians.

A bystander added, “People or animals can step into it, and even drivers unfamiliar with the area could easily drive into it.”

Call for Municipal Intervention

Despite repeated warnings and a formal media inquiry sent to the Merafong City Local Municipality earlier this week, no official response was received by the time of publication.

The lack of fencing, warning signage, or repair efforts has left residents frustrated and fearful, as infrastructure deterioration and geological risks become increasingly visible across the region.

Urgent Action Needed

The Khutsong community is urging local authorities to inspect, secure, and repair the affected area before further damage or injury occurs. Immediate action could prevent both human tragedy and long-term structural harm.

As the sinkhole continues to grow, residents say the silence from officials is becoming as dangerous as the hole itself.

Silvercorp Metals Inc. (TSE:SVM) fell 7.2% during trading on Friday . The stock traded as low as C$4.92 and last traded at C$5.02. 327,141 shares were traded during trading, a decline of 37% from the average session volume of 521,108 shares. The stock had previously closed at C$5.41.

Silvercorp Metals Stock Down 5.7%

The firm’s fifty day simple moving average is C$5.24 and its 200 day simple moving average is C$4.99. The company has a current ratio of 3.04, a quick ratio of 4.43 and a debt-to-equity ratio of 0.18. The company has a market cap of C$780.34 million, a price-to-earnings ratio of 13.11, a PEG ratio of 0.03 and a beta of 1.15.

About Silvercorp Metals

Silvercorp Metals Inc is a mineral mining company. It acquires, explores, develops, and mines precious and base metal mineral properties at its producing mines and exploration and development projects in China. The group produces silver, gold, lead, and zinc.

US congressmen have linked the development of a goldmine in Co Tyrone to wider investor confidence in doing business in Northern Ireland in a warning letter to the executive office.

Four congressmen, including two influential members of the Friends of Ireland caucus in Congress expressed their concerns over the long delayed development of the Dalradian mine at Curraghinalt.

Separately, the UK ambassador to the US, Peter Mandelson, wrote to the head of the NI Civil Service, Jayne Brady, with details of the frustration in Washington over the project, the subject of a currently suspended planning inquiry.

The congressmen, including Representatives Richard Neal and Mike Kelly, the chair of the Friends of Ireland group, urged the government to “reach a reasonably timely final decision”, according to the Financial Times.

They added: “We believe that a fair and timely adjudication of the merits of this project would send the message to investors worldwide that NI is truly a place they should feel confident doing business.” The politicians also expressed concern that “yet again” reviews of the project had been extended, the FT wrote.

A spokesperson for the executive office said: “The matter is currently subject to a public inquiry and on receipt of the Planning Appeals Commission’s report, the Department for Infrastructure will work to reach a decision on the issue as soon as possible.”

The letter was sent in November after the Planning Appeals Commission inquiry into the proposed gold mine opened and first adjourned two months previously.

Public inquiry opened at Strule Arts Centre in Omagh, but suspended after three days (Liam McBurney/PA)

Public hearings began at the Strule Arts Centre in Omagh in January but were suspended after three days over failures to properly consult with the Irish Government or Donegal County Council over cross border issues, particularly in relation to the impact on rivers.

Dalradian, owned by Orion Resources, has been working to develop the Curraghinalt site near Greencastle for 15 years, and claims that it could create 1,000 jobs and add £4bn to the local economy.

However, campaigners opposing the plan have cited the health and environmental impacts in an Area of Outstanding Natural Beauty.

Protesters against gold mining The Europa hotel during a recent environmental conference PICTURE COLM LENAGHAN

Approximately 50,000 letters of objection were received during the long drawn out planning process. However, locals supporting the project have argued the majority of the objections were submitted before Dalradian reversed plans to use cyanide in the mining process.

It is not clear when the planning inquiry will resume, but was previously described by the Department of Justice as “unprecedented in the history of the Planning Appeals Commission in terms of its complexity and scale”.

(Bloomberg) -- Emerging market currencies gained as President Donald Trump’s move to extend a deadline for aggressive tariffs on the European Union bolstered risk appetite, while trading volumes remained thin due to holidays in the US and the UK.

MSCI’s gauge of EM currency returns climbed as much as 0.4% to an all-time high as the dollar hovered around its lowest level in almost two years. Risk-on sentiment was also evident in some equity markets, though MSCI’s broad gauge for stocks fell. With a rise of 2%, South Korea’s benchmark was the standout, while India’s flagship Nifty 50 gauge climbed 0.6%.

“We’re starting to really see the stars align now,” Amy Oldenburg, head of emerging market equity for Morgan Stanley Investment Management. “We’ve seen the dollar weakening quite considerably — that’s really given a tailwind to some of our markets.”

The move came as Trump extended the tariff deadline on the European Union until July. The EU agreed to accelerate negotiations with the US to avoid a transatlantic trade war, following a phone call between Commission President Ursula von der Leyen and Trump — just days after the US president criticized the bloc.

Enthusiasm for the greenback has faded this year due to Washington’s unpredictable trade policy and concerns about the fiscal deficit, with developing-nation currencies some of the major beneficiaries. The Polish zloty was the top gainer in emerging markets on Monday. Brazil’s real, meanwhile, underperformed peers amid jitters over fiscal policy and new tax measures.

“Trump’s unpredictable trade and fiscal policies mean investors must hedge US exposure more carefully and reallocate away from US assets,” said Henrik Gullberg, macro strategist at Coex Partners Ltd.

Tariff Impacts

While Trump’s decision to extend the tariff deadline for the EU helps EM currencies, “gains have been relatively modest so far,” said Piotr Matys, a senior analyst at inTouch Capital Markets. That can “be attributed to concerns that Trump’s tariffs may have stagflationary consequences for the US economy, which for many EM countries is the most important trading partner.”

As for the US — tariffs have yet to materially boost official inflation readings — the impact is likely to become more apparent later this year. US economic growth is expected to cool, with many businesses becoming more guarded about the outlook as tariffs boost costs and weigh on consumer sentiment.

https://finance.yahoo.com/news/emerging-market-currencies-gain-stars-085705883.html

Greatland Gold (LON: GGP) has launched its long-anticipated initial public offering, targeting up to A$50 million ($33m) as part of a dual listing on the Australian Securities Exchange and the London Stock Exchange’s AIM market.

The Western Australian gold and copper miner, backed by Newmont Corporation (NYSE: NEM) and Andrew Forrest’s Wyloo Metals, aims to broaden its investor base and accelerate development in the Paterson province. Bank of America, Barrenjoey and Canaccord Genuity are managing the IPO.

While the capital raise is relatively modest, it forms part of a sweeping A$339 million restructuring announced in April, designed to reposition the company. This includes a A$14 million retail offer in the UK and the establishment of a new Australian parent entity, Greatland Resources, which is slated to list on the ASX on June 24.

Over 66.7 million shares will be offered, with proceeds earmarked for working capital across Greatland’s flagship assets, which include Telfer, Havieron and nearby tenements acquired from Newmont last year. These assets are central to the company’s strategy to establish a large-scale mining and processing hub in the mineral-rich region.

Since taking control of Telfer, Greatland has delivered its strongest production performance in years. The company expects to produce between 196,000 and 210,000 ounces of gold in FY25, with all-in sustaining costs forecast between $2,100 and $2,250 per ounce. A short-term production target has been set at 280,000 to 320,000 ounces annually for the first two years, creating a runway to first ore at Havieron.

Newmont, Greatland’s largest shareholder with a 20.4% stake, is reportedly considering a partial sell-down. It remains unclear whether it will use the IPO to divest, or whether Wyloo, which holds a 8.6% interest through a A$120 million investment in 2022, will exercise its first right of refusal or increase its position. Wyloo also holds the option to acquire half of Newmont’s stake.

Greatland Gold is currently valued at £1.8 billion ($2.4 billion) on the London Stock Exchange.

https://www.mining.com/greatland-gold-targets-33m-in-asx-dual-listing-push/

Primero Group, a leading engineering and construction company, has been awarded the tank design, fabrication, testing, and delivery package for South32’s Biological Oxalate Destruction (BOD) Project at the Worsley Alumina Refinery near Collie in Western Australia.

The BOD Project aims to implement a new process for managing sodium oxalate, a byproduct of alumina refining. This initiative utilises technology similar to that employed at Alcoa’s Pinjarra and Wagerup refineries, promising environmental benefits for ongoing operations at Worsley.

Primero will collaborate with its sister company, RCR, based in Bunbury, to execute the project, thereby supporting local employment in the South-West region. The partnership underscores a commitment to regional development and environmental responsibility.

The Worsley Alumina Refinery, operated by South32, is one of the largest integrated bauxite mining and alumina refining operations globally. The facility has recently received federal environmental approval for its mine development project, ensuring sustained production and employment in the region.

This contract marks a significant step in enhancing the refinery's environmental performance and demonstrates Primero's expertise in delivering complex engineering solutions within the resources sector.

Asian suppliers have entered the U.S. market, but their supply is unlikely to be sustainable in the future

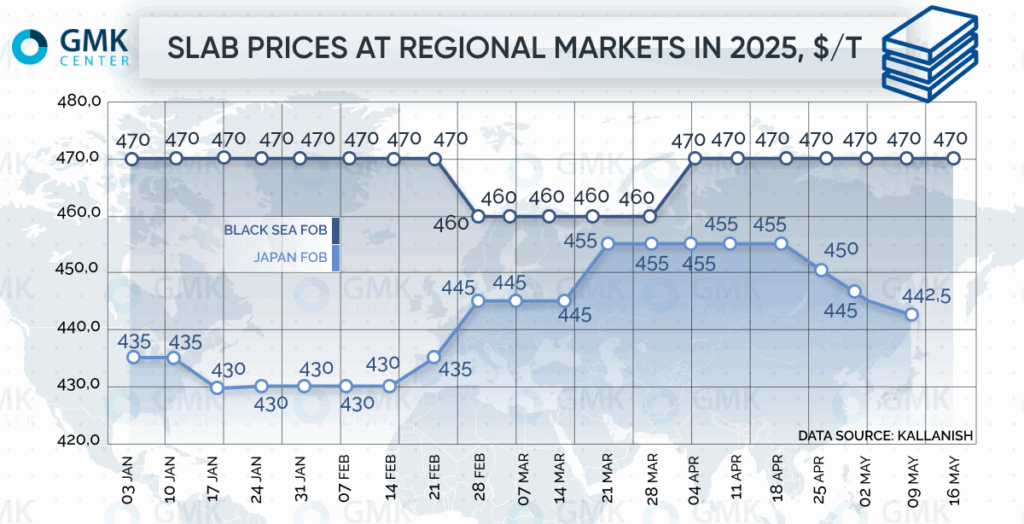

Regional markets are experiencing multidirectional dynamics of slab prices. Russian dumping, hot rolled coil (HRC) prices and US tariff policy remain the key influencing factors.

Slab prices FOB Black Sea have been in the range of $430-455/t since the beginning of the year. Within four weeks since mid-February they have increased by $15/t. The second stage of increase was observed from the middle of March, when prices rose by another $10/t. Such price dynamics fully coincides with FOB Turkey, i.e. growth of slab prices was supported by growth of prices for finished products.

According to Steelorbis, the latest offers for Chinese slabs in Europe are $510-515/t CFR, which is $10-15/t lower than in early May. Prices for slabs from Russia and Asian slabs for HRC production are $480-485/t CFR, down from $500/t CFR in early May.

Turkey remains the largest consumer of slabs from Russia. In January-March, imports of Russian slabs to Turkey increased 2.5 times y/y – up to 443.5 thousand tons. This significant growth is due to short logistic shoulder and lower prices compared to other suppliers. The price of slabs from the Russian plant, which is under trade sanctions in other regions, is $450-455/t CFR, while from a supplier not included in the sanctions lists – $470-475/t CFR Turkey. Therefore, Turkish HRC producers find such imports attractive in terms of reducing their own production costs.

According to Steelorbis, prices for slabs from Asia in May fluctuated in a narrow range with slight discounts due to weak demand from European buyers. August offers from Indonesia are $440/t FOB as of May 22, the same level as early May. Asian slabs have even appeared on the US market, but this is unlikely to be a trend due to existing tariffs.

According to Steelorbis, Brazilian slab prices have been at $510/t FOB for the past three weeks. At the same time, individual US buyers started buying Asian products to have more arguments in negotiations with suppliers from Brazil, which is in a priority position due to the exemption from the 25% tariff.

Slab prices in Japan are quoted at $460-470/t, having slipped to the lower end of the range during March. As of mid-May quotations were at $470/t FOB.

https://gmk.center/en/news/slab-prices-in-europe-fell-by-10-20-t-in-may/

Macro environment remains weak, HRC prices expected to stabilize or weaken next week

This week, the futures market fluctuated rangebound and remained in the doldrums. Spot market prices fell by 20-30 yuan/mt compared to last Friday. Overall market transactions during the week were moderate, with most concentrated in the latter half of the week. In terms of supply, there were new maintenance impacts at some steel mills in north and east China this week, leading to a further decline in HRC production, which is already at a low level compared to the same period in previous years. On the demand side, downstream end-use demand remains resilient, and trade shipments are moderate. Social inventory in large samples continued to decline, with the rate of decline expanding. By region, the reduction in east and north China markets was greater than that in south and central China, as well as north-east China. Meanwhile, in-plant inventory also declined slightly on a WoW basis. Currently, SMM's total HRC inventory stands at 4.187 million mt, down 222,300 mt WoW. On the cost side, pig iron has entered a cycle of peaking and pulling back, but it remains fluctuating at highs in the short term, with cost support remaining intact. Looking ahead at the supply and demand fundamentals, the impact from maintenance is expected to slightly decrease, but the recovery pace is slow, resulting in relatively small supply pressure in the short term. As the production pace of the manufacturing industry gradually slows down, demand is expected to gradually weaken. It is difficult to see significant upward driving forces from macro news in the short term. However, considering the certain restocking demand before the holiday, it is expected that HRC inventory will continue to decline, with the rate of decline narrowing. It is expected that HRC prices will be in the doldrums next week, with a price range of 3,150-3,230 yuan/mt.