Saudi Arabia’s King Salman replaced the country’s energy minister with one of his own sons Sunday, naming Prince Abdulaziz bin Salman to one of the most important positions in the country as oil prices remain stubbornly below what is needed to keep up with government spending.

The new energy minister is an older half-brother to 34-year-old Crown Prince Mohammed bin Salman and an experienced oil industry figure in Saudi Arabia. He has been minister of state for energy affairs since 2017, but the brothers are not known to be close.

His appointment marks the first time a Saudi prince from the ruling Al Saud heads the important energy ministry.

The move comes as Brent crude oil trades under US$60 a barrel, well below the US$80-US$85 range that analysts say is needed to balance the Saudi budget.

Prince Abdulaziz replaces Khalid al-Falih, who had been removed just days ago as board chairman of the state-owned oil giant Aramco, a company that he once ran as CEO.

Al-Falih had also seen his cabinet portfolio diminished recently when mining and industry were removed from his purview and spun off into a new ministry.

Jin Canrong, an international relations professor at Renmin University of China in Beijing, says China had agreed to 80 per cent of a deal as far back as May

‘Between 60 and 70 per cent’ chance of Chinese President Xi Jinping and American counterpart Donald Trump agreeing a deal in November if US can lower demands

US trade representative Robert Lighthizer (left), US Treasury Secretary Steven Mnuchin and Chinese Vice-Premier Liu He are expected to continue face-to-face talks in Washington in October.

Chinese President Xi Jinping and US counterpart Donald Trump could reach a deal to end the ongoing trade war by their next scheduled meeting in November, but only if Washington is able to drop the final 20 per cent of American demands currently on the table which are impossible for Being to agree to, according to a leading Chinese expert.

China has already agreed to 80 per cent of demands for a trade deal, but the final portion of Washington’s demands are seen by Beijing as an infringement on its sovereignty, said Jin Canrong, an international relations professor at Renmin University of China in Beijing, on his social media account.

Canrong believes the odds are “between 60 and 70 per cent” that China and the US can reach a trade deal by the time Xi and Trump are likely to meet at the Asia-Pacific Economic Cooperation summit in Chile, but only if the US can lower or even drop certain demands.

“It’s not a 100 per cent thing, and it’s possible that the negotiations will collapse,” Jin warned. “The major reason is that China has already offered to make huge concessions.”

The Politburo would never agree to these terms. It would be forfeiting sovereignty and humiliating the nationJin Canrong

China had already agreed to about 80 per cent of US demands before the bilateral talks came to a halt in May, including “buying US goods, opening markets to US investors and making policy improvements in certain areas”, Jin said.

According to Jin, who did not reveal the source of his information but is known to be well-connected in Beijing, the final 20 per cent includes completely abandoning the “Made in China 2025” industrial policy programme, a plan to cut the share of the state in the overall economy from 38 per cent to 20 per cent, as well as an implementing an enforcement check mechanism that would allow the US to dig into the books of different levels of the Chinese government.

“The Politburo would never agree to these terms,” Jin said, referring to China’s supreme decision-making body. “It would be forfeiting sovereignty and humiliating the nation.”

“For the US, the choice is zero or 80 per cent [of what it wants],” Jin said. “The option of getting 100 per cent doesn’t exist … my conclusion is that the US has to give up the final 20 per cent [of its demands].”

China’s top trade envoys, led by Vice-Premier Liu He, are expected to fly to Washington early next month to start a new round of face-to-face trade talks with their US counterparts led by trade representative Robert Lighthizer and Treasury Secretary Steven Mnuchin.

The US and China have already imposed significant tariff increases, which came into affect at the start of September, with further increases threatened for October and December. In particular, China’s Ministry of Commerce has publicly urged the Trump administration to reverse the tariff increase on US$250 billion of Chinese imports scheduled for October 1 – the 70th anniversary of the founding of the People’s Republic of China – to facilitate the talks.

Politico reported on Friday that China made a peace proposal in the most recent phone call with top US trade officials last week to buy a modest amount of US agricultural goods if Washington eased export restrictions on Chinese telecommunications equipment maker Huawei and postponed the tariff increase set for the beginning of next month.

If agreed by both sides, this could produce a “mini-deal” before the end of the year, both US and China experts speculated in a conference in Beijing on Friday, according to Caixin magazine.

Beijing and Washington have both kept the details of any negotiations shrouded in secrecy, but last week China’s Ministry of Commerce said that communications between lower-level trade officials would intensify this month to lay the groundwork for “substantive progress” in the October talks. The Office of the United States Trade Representative also said that deputy-level meetings will take place in mid-September to pave the way for “meaningful progress”.

On Friday, Larry Kudlow, the director of the White House National Economic Council, said that the trade war with China may take a long time to resolve.

“The stakes are so high. We have to get it right. And if that takes a decade, so be it,” he said.

White House trade adviser Peter Navarro, meanwhile, was quoted by Yahoo Finance as saying on Friday that the US would stick to its original demands.

“We had a deal. We had a 150 page plus agreement that was in these seven verticals that dealt with each of these issues plus enforcement. It was negotiated over 11 negotiating sessions and including commas and paragraphs. And that’s the basis for moving forward,” Navarro was quoted as saying, referring to the tentative trade deal text from early May. “But the Chinese walked away from that. And in many ways, this deal will be determined by what the Chinese want to do.”

The 12th round of face-to-face talks between China and the US took place in Shanghai at the end of July.

“A good international treaty should be like this: there will be complaints from both sides but both sides will feel it is acceptable,” Jin said. “If one side is extremely happy with a deal and is eager to share it with the press while the other side is depressed, this kind of deal would just be a piece of scrap paper because the unhappy side would renegade on it for sure.”

The chaos of Britain’s recycling system is exposed today with hundreds of thousands of tons of waste being redirected to landfill or incinerators.

Despite residents sorting their household waste into separate bins, up to half of “recyclable” material is not being recycled in some areas of England, government data shows.

Today, The Telegraph launches a Zero Waste campaign calling on the Government, local councils and private companies to do more to boost the country’s lacklustre recycling rates.

https://www.telegraph.co.uk/news/2019/06/26/revealed-really-goes-recycling-rubbish-behind-scenes/

Brexit:

https://www.thetimes.co.uk › article › french-foreign-minister-threatens-to-v...

14 hours ago - Political chaos in Westminster and Boris Johnson’s failure to hold meaningful negotiations means that France will veto another delay to Brexit, the country’s foreign minister said. Frustration is growing across Europe at the deepening political deadlock and brinkmanship in Britain ...

Express.co.uk-5 Sep 2019

Brussels refuse to guarantee Brexit extension as France and Germany could BLOCK delay ... are widely regarded as a general election or second referendum. ... The Labour Party leader said he would not allow the electoral ...

Trade Wars:

According to a Chinese official who asked not to be identified commenting on policy, Trump’s attempts to lobby European leaders such as Merkel appear to have worked in the short term. Trump has provided a model for world leaders to be globalist in their words and protectionist in their actions, the person said.

There are signs that German industry is in lockstep with the government’s aims. In January, Germany’s industry lobby BDI announced a turnaround in its China strategy, labeling China a "systemic competitor” and arguing that "German industry must prepare itself for this new reality,” while the system of open markets in Europe "must be made more resilient.”

Hong Kong:

Protesters clash with police in shopping districts after rally to petition US to ‘resist Beijing’

demonstrators rallied at the US consulate calling on Donald Trump to “liberate” the territory.

Police had clashed with protesters in the Centraldistrict as the demonstrations in Hong Kong entered their 14th week.

Under the deal, Deutsche Bahn will buy the power produced from a 25MW portion of the 48-turbine project at a fixed price.

The supply and trading unit of Innogy’s parent company RWE will act as the contracts and retail partner.

Nordsee Ost consists of 48 of Senvion’s 6.2M126 turbines and was commissioned in 2015.

State-owned railway operator Deutsche Bahn plans to source 100% of its electricity from clean sources, up from 57% today.

Its CEO Torsten Schein said Deutsche Bahn plans to replace expiring fossil fuel-based contracts with power deals for renewable energy "over the next few years", and intends to launch a Europe-wide tender for clean energy contracts by the end of the month.

Corporate PPAs remain rare in Germany — even for onshore wind — but more deals are anticipated beyond 2021 as support schemes expire.

Innogy is due to be carved up under a complex asset swap deal between its owner RWE and utility E.on.

RWE will acquire the renewable assets — including Nordsee Ost — and gas storage businesses of its subsidiary Innogy, as well as those of E.on.

Meanwhile, E.on will buy 86.2% of Innogy and its grid and retail business, and RWE will receive a 16.67% "effective participation" in E.on in return.

Drilling Down: Denver saltwater disposal well operator makes Permian Basin push

Denver oilfield water company Felix Water is seeking permission to drill 13 injection wells on its Pbar SWD lease in Loving County. Denver oilfield water company Felix Water is seeking permission to drill 13 injection wells on its Pbar SWD lease in Loving County. Photo: Courtesy Photo / Felix Water LLC Photo: Courtesy Photo / Felix Water LLC Image 1 of / 5 Caption Close Drilling Down: Denver saltwater disposal well operator makes Permian Basin push 1 / 5 Back to Gallery

Water remains a big issue in the arid Permian Basin of West Texas where for every barrel of oil produced, another four to 10 barrels of saltwater — the remnants of an ancient inland sea — come out of the ground.

Over the past week, six companies filed 20 drilling permits to develop saltwater disposal, or injection, wells in the West Texas shale play.

Denver oilfield water company Felix Water led the pack by seeking permission to drill 13 injection wells on its Pbar SWD lease in Loving County. Occidental Petroleum-owned APC Water Holdings is seeking to develop another three saltwater disposal wells in Reeves County.

The remaining four injection well permits were filed by Midland-based APR Operating, Houston-based Crimson Exploration and Midland-based Double Drop SWD.

Permian Basin

Chinese-owned Surge Energy is preparing for nine horizontal drilling projects in West Texas. Spread out on three leases near the towns of Vealmoore and Knott, the wells target the Spraberry field down to a total depth of 9,000 feet.

Eagle Ford Shale

Houston exploration and production company Recoil Resources is preparing obtained a drilling permit for a new oil well on its Boeing Unit lease in Wilson County, southeast of San Antonio. The horizontal drilling project targets the Marcelina Creek field of the Austin Chalk geological layer down to a total depth of 8,100 feet.

Haynesville Shale

No horizontal drilling permits were filed in the East Texas shale play over the past week, but San Angelo exploration and production company KJ Energy is preparing to drill a vertical gas well. The company obtained a permit to drill a vertical well on its Hughes Gas Unit lease about 7 miles north of Long Branch in Rusk County, targeting the natural gas-rich Brachfield SE field at a depth of 10,365 feet.

Barnett Shale

No horizontal drilling permits weree filed in North Texas shale play over the past week, but Plano oil company Veteran Exploration and Production is drilling a vertical well on its N. Elrod USMC lease in Archer County. The well targets the Mississippian and other geological formations down to a depth of 6,100 feet.

More Information Top 10 Texas Drillers (Wednesday, August 28th through Tuesday, September 3rd) Felix Water 13 Diamondback Energy 10 Pioneer Natural Resources 9 Surge Energy 9 Magnolia Oil & Gas 8 EOG Resources 6 BPX Operating Company 5 Encana 4 APC Water Holdings 3 Production Resources 3 Source: Railroad Commission of Texas

Conventionals

Castroville oil company Production Resources Inc. is planning to drill three vertical wells in deep South Texas to target he Piedre Lumbre field on its Duval County Ranch Company East lease about 7 miles southeast of Freer.

Source: Xinhua| 2019-09-10 19:58:40|Editor: huaxia

Video Player Close

UN high commissioner for human rights Michelle Bachelet delivers a speech at the opening of the 40th regular session of the UN Human Rights Council (UNHRC) in Geneva, Switzerland, Feb. 25, 2019. (Xinhua/Xu Jinquan)

Some migration policies are "putting migrants at heightened risk of human rights violations and abuses, and may violate the rights of vulnerable people," warned the United Nations (UN) High Commissioner for Human Rights Michelle Bachelet.

GENEVA, Sept. 10 (Xinhua) -- The United Nations (UN) High Commissioner for Human Rights Michelle Bachelet on Monday expressed concern about the migration policies of the United State and the European Union (EU).

In a speech at the 42nd session of the Human Rights Council, Bachelet said some migration policies are "putting migrants at heightened risk of human rights violations and abuses, and may violate the rights of vulnerable people."

Referring to the U.S. recent measures to block migrants, Bachelet said at least 35,000 asylum seekers have been pushed back to Mexican border areas.

Migrants walk in front of the border wall between Mexico and the United States, near the Santa Fe International Bridge, in Ciudad Juarez, state of Chihuahua, Mexico, on May 11, 2019. (Xinhua/Christian Torres)

According to the human rights chief, in these areas, the UN human rights office has documented increases in detentions and deportations, cases of family separation in the context of arbitrary deprivation of liberty, lack of individual assessment, denial of access to services and humanitarian assistance, and excessive use of force against migrants.

"I remain deeply disturbed ... in particular, the continued separation of migrant children from their parents, and the prospect of a new rule which would enable children to be indefinitely detained, merely on the basis of their administrative status," she added.

Asylum seekers' bedding is seen outside the migrant reception center in Brussels, Belgium, on Sept. 3, 2015. (Xinhua/Zhou Lei)

Speaking of the migration policies in Europe, Bachelet said actions by some European countries to "criminalize, impede or halt the work of humanitarian rescue vessels and search planes" and the sharp decrease in the number of search and rescue vessels have had "deadly consequences for adults and children seeking safety."

"I am concerned by this lethal disregard for desperate people," Bachelet said, while calling for more determined and effective actions by the EU and its member states to deploy search and rescue operations.

According to the UN High Commissioner for Refugees, by July, the death by drowning of over 900 migrants in the Mediterranean has been reported, and many more deaths may have gone unrecorded.

JPMorgan Chase (JPM) reported second-quarter results that came in ahead of Wall Street’s expectations, with its chief executive offering upbeat comments about US consumers even as geopolitical uncertainty hindered the markets segment and the bank lowered its view for full-year net interest income. Earnings increased to $2.82 a share from $2.65 in the same period of 2018, ahead of the […]

Natural gas prices were trading lower early on Friday despite a heat-wave in high demand regions as production continues to outstrip demand, with the U.S. Energy Information Administration a day earlier reporting another big build in stored supplies. Gas for August delivery was last seen down US$0.01 to US$2.28 per million British thermal units in Nymex electronic trade, the lowest […]

United Parcel Services (UPS) reported second-quarter results that came in better than Wall Street expected as gains in the domestic segment offset a weaker performance in the international division amid demand for next-day delivery that was driven by online shopping. Adjusted earnings rose to $1.96 a share from $1.94 a share in the same period of 2018, while the consensus […]

Procter & Gamble’s (PG) fiscal fourth-quarter results came in ahead of analysts’ expectations as the consumer-products maker said its organic sales growth got a benefit from higher prices and positive mix. Net sales rose 4% to $17.1 billion, ahead of the consensus on Capital IQ for $16.9 billion. Excluding the impact of foreign exchange, acquisitions and divestitures, organic sales rose […]

Market News UPS Beats Expectations in Second Quarter United Parcel Services (UPS) reported second-quarter results that came in better than Wall Street expected as gains in the domestic segment offset a weaker performance in the international division amid demand for next-day delivery that was driven by online shopping. Adjusted earnings rose to $1.96 a share from $1.94 a share in the same period of 2018, while the consensus […]

Stock Watch Procter & Gamble’s Fiscal Fourth-Quarter Results Beat Expectations Procter & Gamble’s (PG) fiscal fourth-quarter results came in ahead of analysts’ expectations as the consumer-products maker said its organic sales growth got a benefit from higher prices and positive mix. Net sales rose 4% to $17.1 billion, ahead of the consensus on Capital IQ for $16.9 billion. Excluding the impact of foreign exchange, acquisitions and divestitures, organic sales rose […]

Finance Wynn Resorts Says Proxy Firms Back Plans for Board Nominees, Executive Pay Wynn Resorts (WYNN) said proxy advisory firms Glass Lewis & Co. and Institutional Shareholder Services Inc. have recommended that shareholders vote for the casino and resort company’s planned executive compensation proposal and endorse all three directors who are up for re-election. “”Given the very high level of refreshment of the Company’s management and board, as well as the remedial actions […]

Markets regulator Sebi is likely to give approval to Deutsche Bank by next month to operate as a custodian in the commodities space, a move which will enable participation from institutional investors, including mutual funds and portfolio management service providers, in such segment.

To help broaden the commodity derivatives market, Sebi’s board in March this year approved a proposal to allow mutual funds and portfolio managers to trade in this segment. Moreover, the regulator made necessary amendments in the custodian regulations so as to provide for requisite custodial services.

The regulator in May came out with guidelines allowing mutual funds and portfolio managers to invest in commodity derivatives.

However, institutional investors have been staying away from the segment and experts believe lack of custodial services has been a key deterrent to institutional participation in the commodity derivatives markets.

Many custodians have been sceptical about managing the physical delivery of commodities as they lack domain expertise with regard to agricultural commodities and warehousing.

Now, sources privy to the development expect some participation from institutional investors in the commodities derivatives market from this year which will deepen the market.

“Deutsche Bank is expected to get a green signal from Sebi by October to provide custodial services and once the custodian thing will happen, we will see some participation from institutional investors in the commodities derivatives market this year,” a source close to the development said.

Besides, HDFC Bank and Stock Holding Corporation of India among others have approached the capital markets regulator to provide custodial services, he added.

Under the Securities and Exchange Board of India (Sebi) guidelines, mutual funds need to appoint a registered custodian for underlying goods, in view of the physical settlement of contracts.

The issue of lack of participation from mutual funds in the commodity derivatives segment was discussed in the Sebi’s commodity derivatives advisory committee late August, sources said.

Apart from this, issues including Options offered by stock exchanges and gold spot exchange were also discussed, they added.

A committee, under the leadership of NITI Aayog member Ramesh Chand, had pointed out the importance of regulation in the spot market after ₹5,600-crore National Spot Exchange Ltd (NSEL) fraud was revealed 2013.

The committee appointed by the Finance Ministry submitted its report in February 2018 suggesting that Sebi should regulate the new gold spot exchange.

Earlier Sebi was believed to have told the government that it did not have the skill set to regulate a spot market. Instead, it had suggested that regulation of commodity spot exchanges should be vested in a separate sectoral regulator.

A senior White House adviser tamped down expectations on Tuesday for the next rounds of U.S.-China trade talks, urging investors, businesses and the public to be patient about resolving the two-year trade dispute between the world’s two largest economies.

“If we’re going to get a great result, we really have to let the process take its course,” Peter Navarro said on CNBC.

U.S. President Donald Trump’s administration is seeking sweeping changes to China’s policies and practices on intellectual property protection, the forced transfer of U.S. technology to Chinese firms, American companies’ access to China’s markets and industrial subsidies.

Trump has imposed stiff tariffs on Chinese imports that have roiled global markets. China has retaliated with its own duties.

See more stories

Chinese trade deputies are expected to meet with their U.S. counterparts in mid-September in Washington before minister-level meetings in early October in the U.S. capital, involving Chinese Vice Premier Liu He, U.S. Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin.

U.S. tariffs of 15% on about $125 billion worth of goods took effect on Sept. 1, and tariffs on virtually all remaining Chinese imports, including cellphones and laptop computers, are scheduled to take effect on Dec. 15. Tariffs on $250 billion worth of goods are due to rise by 5 percentage points to 30% on Oct. 1.

Navarro said the tariffs were “working beautifully.”

“People need to understand this: the tariffs on China are our best defense against China’s economic aggression and best insurance policy - this is important - the best insurance policy that China will continue to negotiate in good faith,” he said.

The South China Morning Post reported bit.ly/2manJ5q, citing an unidentified source, that China was expected to buy more agricultural products in hopes of a better trade deal with the United States.

American and Chinese trade officials would discuss a deal based on a draft text that was negotiated in April before the talks broke down in May, the Hong Kong-based newspaper said.

The U.S. Chamber of Commerce called for a high-standard comprehensive agreement to lift the uncertainty.

“The time is now to strike a deal that addresses the U.S.’s legitimate concerns about market access, forced technology transfer, subsidies, and digital trade, while concurrently removing punitive and retaliatory tariffs,” U.S. Chamber international affairs director Myron Brilliant said in remarks to an audience in Beijing.

“Without a truly effective agreement, we don’t see an alternative path to reestablishing bilateral economic stability,” Brilliant added.

The U.S. Commerce Department on Tuesday levied preliminary anti-subsidy duties of 104% to 222% on Chinese-made ceramic tiles, a popular item in U.S. home improvement stores.

The Commerce finding that the tile exports were unfairly subsidized affects about $483 million worth of Chinese imports, which have already been hit with 25% tariffs.

A B.C. company plans to open a plant in Texas where giant fans will suck carbon dioxide from the air so it can be permanently stored underground.

The plant, set for completion in 2023, will likely be able to capture 1-megatonne of CO2 annually.

“That’s the work of 40 million trees,” said Carbon Engineering CEO Steve Oldham.

B.C. company Carbon Engineering developed massive fans to suck carbon dioxide from the air so it can be reused as fuel will open a plant in Texas in 2023. (Carbon Engineering)

The Squamish-based company’s massive turbine technology works like a giant global warming vacuum to suck carbon straight from the atmosphere. Its fans pull air through a structure filled with corrugated sheets soaked in a solution that absorbs C02. The absorbed carbon-rich solution is then turned it into tiny white pellets, which in turn can be treated at high temperatures to release the carbon dioxide as a gas. It can then be stored permanently underground, or turned into synthetic liquid fuel.

“We’re using a material we’ve treated as waste for years as something that we can reuse,” said engineer Jenny McCahill.

Though direct air capture of carbon has been discussed for years, it recently gained more momentum when the United Nations in 2018 labeled it a necessity to end global warming. Concepts like Carbon Engineering’s fans are all about damage control now, said Simon Fraser University professor Mark Jaccard.

“We are still in a struggle to move forward with policies that reduce the burning of fossil fuels, so now we’re moving to technologies that have to reverse the damages,” he said.

For Oldham and his carbon capture team in Squamish, the goal is as much to have a commercially-viable product as it is to make progress in the fight against global warming.

“If you believe there is a cost to climate change, there is a value in eliminating carbon now,” he said.

New York (CNN Business)One investing firm is trying to capitalize on the success of the plant-based food craze with a new meatless ETF.

The US Vegan Climate ETF is set to begin trading Tuesday under the ticker symbol "VEGN." As you might expect, Beyond Meat (BYND), up nearly 500% from its initial public offering price, is one of its holdings.

But investors looking at the ETF should be warned. It's not a fund that focuses on plant-based food.

The ETF is based on the Beyond Investing US Vegan Climate Index — an index with 275 companies. That index, itself, is based on the Solactive US Large Cap Index, which tracks America's biggest publicly traded firms.

Beyond Investing, which runs the VEGN ETF, says its index "excludes companies engaged in animal exploitation, defense, human rights abuses, fossil fuels extraction and energy production, and other environmentally damaging activities" according to the fund's prospectus. Beyond Investing's team decides which stocks to exclude and which new ones to add.

That doesn't mean environmentally friendly companies are necessarily the top holdings. It just means the ETF won't own oil stocks, big food firms or retailers that sell meat-based products — be that beef and poultry or leather and fur.

According to the fund's website, the US Vegan Climate ETF's biggest stakes are in megacaps Microsoft (MSFT), Apple (AAPL), Facebook (FB), JPMorgan Chase (JPM) and Cisco (CSCO). They make up nearly 15% of the fund's total assets.

Still, Apple is often targeted by workers rights group China Labor Watch due to its business relationship with Chinese manufacturer Foxconn, which makes many Apple products. Few big companies actually hit all the marks when it comes to being socially responsible.

Since the fund is only kicking out companies with questionable stances toward animals and the planet, what's left are many stocks you'd find in your average S&P 500 index fund.

Claire Smith, CEO of Beyond Investing, said in an interview with CNN Business that by removing these companies — what she dubbed "the nasties" — from a broader index fund, Beyond Investing is eliminating about 43% of the market value in the S&P 500.

Could fake meat burgers make cows obsolete?

That means that energy giants (and Dow Jones Industrial Average components) Exxon Mobil (XOM) and Chevron (CVX) are not in the fund.

There's also no Amazon (AMZN) (which owns Whole Foods), Walmart (WMT), McDonald's (MCD) or Warren Buffett's Berkshire Hathaway (BRKB), which is the top investor in Kraft Heinz (KHC). That's because these companies sell or make meat-based products and Smith said her firm draws a hard line in the sand when it comes to investing in stocks that profit from the sale of any meat.

"The consumer sector is riddled with animal exploitation and we would prefer that's not the case," Smith said.

What else does the US Vegan Climate ETF own specifically because it is good for the planet?

Smith said Tesla (TSLA), which now has leather-free interiors for its Model 3 and plans to do the same for its upcoming Model Y, is also a holding because the electric car company is both environmentally and animal friendly.

Other top picks include Energizer (ENR), which makes lithium ion batteries in addition to regular ones and Idacorp (IDA), a Boise-based utility that primarily uses hyrdopower to generate electricity.

But Smith conceded that it's a bit of a challenge finding companies that are pure play vegan or green stocks. Beyond Meat rival Impossible Foods is not yet public.

"We're struggling to find plant-based food stocks and we would love to see more," she said.

Nonetheless, the vegan strategy has been a success in its short history. The Beyond Investing index is up about 23% so far in 2019, compared to a 19% jump for the S&P 500.

Still, there are other ways for investors to profit from the push toward plant-based foods and other socially responsible themes.

Jason Escamilla, CEO of investment firm ImpactAdvisor, has a new portfolio simulation website called Vegemizethat helps people pick individual stocks and even bonds from companies that match specific social metrics for things like gender equality and CO₂ emissions.

"We're looking more at what to include and not necessarily exclude," Escamilla said about Vegemize, which launched Monday. "We want to build a portfolio from scratch so investors can have their cake and eat it too."

Presumably, that cake will be flourless and dairy free.

https://edition.cnn.com/2019/09/10/investing/vegan-climate-etf-beyond-investing/index.html

Tanzanian President John Pombe Magufuli has told Ugandan President Yoweri Kaguta Museveni to forego short-term gains in terms of taxing oil companies and focus on the longer-term benefits. Magufuli, who was hosting Museveni at the just concluded Tanzania-Uganda Business Forum in Dar es Salaam on Friday, said tax issues were delaying the oil pipeline project. “We are late. We are still sleepy,” said Magufuli. He made it clear that Uganda should sacrifice some of the short-term gains for the long-term and the Uganda Revenue Authority officials should not delay the project for the benefit of a large population.

Plans to sign the much-awaited Final Investment Decision (FID), which is needed to unlock nearly $10 billion for the development of Uganda's Tilenga and Kingfisher oil projects, and the East African Crude Oil Pipeline came to an abrupt halt after Tullow Oil's failed to sell 21.5 per cent of its stake for $900 million to its partners - France’s Total E&P and China’s Cnooc – collapsed late last week.

At the heart of the dispute was the definition of the amount of money that Tullow Oil was to get from the transaction. Tullow Oil announced that out of the $900 million it would get from the sale of 21.5 per cent of its stake, $700 million would be reinvested in the development stage of Uganda’s oil industry as part of its share of the contribution.

Government, on the other hand, looked at the $700 million as an earning and, therefore, imposed a capital gains tax on it. This difference in opinion would stall the negotiations for a while.

China’s crude oil imports gained about 3% in August from a month earlier, customs data showed on Sunday, buoyed by a recovery in refining margins desite a persistent surplus of oil products and tepid demand.

Shipments of crude oil last month were recorded at 42.17 million tonnes, compared with 41.04 million tonnes in July, data from the General Administration of Customs showed on Sunday. Arrivals were 9.9% higher than 38.38 million tonnes in August last year.

That equates to 9.93 million barrels per day (bpd), from 9.66 million bpd in July, and the highest on a daily basis since April.

Over the first eight months of 2019, China’s crude imports reached 327.8 million tonnes, or 9.85 million bpd, up 9.6% from the same period last year, customs data showed.

Profit margins at refineries have recovered to 200-300 yuan a tonne after falling into negative territory in the first half of this year, but overall the industry remain under pressure due to oil products supplies from big refiners Hengli Petrochemical and Zhejiang Petrochemical.

“Private refineries in Shandong are also facing difficulties in obtaining bank credit, they may not be able to use up their annual crude oil imports quotas,” said Amanda Zhao at JLC Network Technology, a Chinese commodities consultancy, before the data was released.

Meanwhile, Chinese buyers are wary of taking crude oil from Venezuela and Iran due to escalating sanctions slapped by the United States on the two countries.

With growing trade tension with Washington, Beijing in late August imposed 5% tariffs on U.S. crude imports for the first time from September 1.

China’s oil product exports were at 4.08 million tonnes, slowing from 5.49 million tonnes in July, the customs data showed.

Oil product exports in January to August were 42.08 million tonnes, up from 40.22 million tonnes in the same period in 2018.

China’s total gas imports, including liquefied natural gas (LNG) and pipeline imports, hit 8.34 million tonnes in August, up 7.3% from the same month last year and compared to 7.89 million tonnes in July, the data showed. It was the highest seen since January.

The U.S. weekly offshore rig count remained unchanged for the second week in a row, according to a Friday report by Baker Hughes, a GE company.

Baker Hughes Rig Count: U.S. -6 to 898 rigs

U.S. Rig Count is down 6 rigs from last week to 898, with oil rigs down 4 to 738, gas rigs down 2 to 160, and miscellaneous rigs unchanged at 0.

U.S. Rig Count is down 150 rigs from last year’s count of 1,048, with oil rigs down 122, gas rigs down 26, and miscellaneous rigs down 2 to 0.

The U.S. Offshore Rig Count is unchanged at 28 and up 9 rigs year-over-year.

Baker Hughes Rig Count: Canada -3 rigs to 147 rigs

Canada Rig Count is down 3 rigs from last week to 147, with oil rigs down 3 to 102 and gas rigs unchanged at 45.

Canada Rig Count is down 57 rigs from last year’s count of 204, with oil rigs down 31 and gas rigs down 26.

Spotted a typo? Have something more to add to the story? Maybe a nice photo? Contact our editorial team via email.

Also, if you’re interested in showcasing your company, product or technology on Offshore Energy Today, please contact us via our advertising form where you can also see our media kit.

The ship was photographed off the coast of Syria on Friday and is believed to have been carrying 2.1 million barrels of Iranian crude oil. The UK’s Foreign Office has described the reports of the ship as “deeply troubling”. The UK also said if Iran were to backtrack on their assurances they would be in “violation of international norms and a morally bankrupt course of action”.

The US has said they would impose sanctions on any buyer of the oil. It is thought the ship turned off its transponder in the Mediterranean Sea before travelling to Syria. The tanker sent its last signal giving it location between Cyprus and Syria sailing north last Monday.

The oil tanker was spotted off the coast of Syria

Donald Trump withdrew the US from the Iran deal

The US has been trying to seize the vessel as part of its sanctions targeting the Iranian energy industry. US Treasury official Sigal Mandelker said: “We will continue to put pressure on Iran and as President Trump said there will be no waivers of any kind for Iran’s oil.” Iran’s foreign ministry has said they they have sold oil without identifying to which country. The US has warned any country that if they assist the ship, they would see this as support for a terrorist organisation. READ MORE: Iran news: Europe warned time is running out

Tensions have heightened between Iran and the US

The ship, which was named Grace 1, was stopped by British Royal Marine commandos off Gibraltar on July 4 and in retaliation Iran seized a British-flagged tanker in the Strait of Hormuz two weeks later. The vessel was detained for six weeks and eventually released following objections from the United States when Gibraltar said it trusted it would not head for any countries under EU sanctions. In retaliation, Iran seized a British-flagged tanker in the Strait of Hormuz leading into the Gulf. Assistant to the U.S. President for National Security Affairs (NSA), John Bolton tweeted: “Anyone who said the Adrian Darya-1 wasn’t headed to Syria is in denial. DON'T MISS: World War Three: State with best terrain to ‘protect’ from US-Iran war

British warship fights off 115 ‘intimidating’ confrontations from Iran

Iran vs Israel: Tensions soar as Netanyahu gives a start warning

The Adrian Darya ship was spotted on satellite images

“Tehran thinks it’s more important to fund the murderous Assad regime than provide for its own people. “We can’t talk, but Iran’s not getting any sanctions relief until it stops lying and spreading terror.” Tensions between the US and Iran have been high since Donald Trump pulled out of the Iran nuclear deal.

Tensions have soared in the region after Trump withdrew from the Iran pact

Brazil’s state-run oil company, Petroleo Brasileiro SA, has launched the binding phase of the sale of 41 onshore oil concessions in the coastal states of Bahia and Espirito Santo, according to securities filings on Friday.

Petrobras, as the company is known, will sell 100% of 27 exploration and production concessions in the so-called Polo Cricare area in Espirito Santo, it said. The fields produced 2,800 barrels par day of oil and 11,000 cubic meters per day of natural gas on average in 2018.

In Bahia, the oil company will sell its 14 concessions in the Polo Reconcavo area, where it owns a 100% share in all but two of the blocs, Petrobras said. The concessions recorded average production of 2,800 barrels per day of oil and 588,000 cubic meters per day of natural gas in 2018.

Mexico will maintain a strategy of hedging its oil output against lower prices, the government said in its 2020 budget proposal unveiled on Sunday, adding that state oil company Pemex would also continue a similar but separate hedging program.

The Mexican Finance Ministry’s roughly $1 billion annual oil hedge is considered the world’s largest oil trade. Last week, Reuters reported that Mexico had made the first moves to launch the program by asking banks for quotes.

The budget document said the government had “fiscal shock absorbers” to protect against volatility that could affect public finances, including “a strategy of oil hedges contracted both by Pemex and the federal government to cover oil income against reductions compared to the price” estimated in the budget.

The Pemex hedge is much smaller than the one carried out by the Finance Ministry.

While it is not yet known what price the government and Wall Street banks have agreed on for Mexico’s 2020 hedge, the budget sets a target price of $49 per barrel for its crude export revenue estimates.

The budget blueprint estimates next year’s crude exports at 1.13 million bpd, or nearly 2 percent higher than 2019 levels.

The Finance Ministry based its 2019 hedge calculations on $55 per barrel for Mexican crude.

In a sign of the type of volatility that worries the government, Finance Minister Arturo Herrera said he had been planning until last month to use the same number, but lowered the estimate to reflect the U.S.-China trade war, slower global growth and new rules that limit the use of high sulphur fuel produced by Mexico.

Despite last month’s much-publicized start-up of two new crude oil pipelines from the Permian Basin to the Gulf Coast — Plains All American’s Cactus II and EPIC Crude Holding’s EPIC Pipeline — tangible evidence of how much crude is actually moving on those pipelines has been hard to come by. That’s because crude oil pipelines don’t post daily flow data, like some natural gas pipelines do, and shipper volumes are a closely held secret that often only becomes available long after the fact. However, Cactus II and EPIC both deliver into the Corpus Christi, TX, market area, where a number of export facilities have been waiting to move Permian barrels out into the global market. We’ve been keeping a close eye on Corpus-area docks and have noticed a significant increase in export volumes over the last few days — a clear indication that Permian crude on Cactus II and EPIC has broken through to the global market. Today, we detail a recent rise in Corpus Christi oil export volumes driven by new supply from the Permian Basin.

The Permian Basin has been front-and-center for us lately in this space, as activity there remains robust in both the upstream and midstream energy sectors. Just a few days ago, in Higher Ground, we blogged about how new crude oil and natural gas pipelines are lifting prices for both commodities. One of the major drivers of the price gains on the crude side has been the start of Plains’ Cactus II pipeline, which we profiled recently in Takeaway. In that blog, we also detailed how Cactus II is already interconnected with many of the existing export facilities in the Corpus Christi area. Now, recent data suggests that the volumes being brought in by Cactus II and EPIC — the other new pipeline to Corpus — are starting to show up as crude oil exports. According to data from our Crude Oil Voyager report, outbound shipments of crude from Corpus hit a record last week, suggesting that the expected surge in exports of Permian oil is finally occurring.

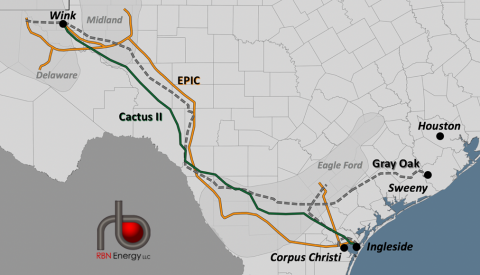

First, a quick recap on how Permian oil is getting to the Corpus Christi area. The map in Figure 1 shows the recently completed pipelines from the Permian to Corpus, as well as the under-construction Gray Oak Pipeline. Cactus II (green line) consists of 575 miles of new 26-inch pipeline and extends from the Permian to various delivery points in South Texas. Plains has stated that Cactus II is already complete to Ingleside — just across the bay from Corpus proper — and will be in full service to Corpus itself by the end of the first quarter of 2020. While we don’t know the capacity of Cactus II’s interim service, Plains has sold 585 Mb/d of capacity on the line, which is expandable to 670 Mb/d. The EPIC Pipeline (orange line) has also entered service and delivered its first volumes to Corpus, according to a statement from its operator, EPIC Crude Holdings. While EPIC will eventually be capable of moving 590 Mb/d out of the Permian when it’s in full service early next year, it is currently providing only 400 Mb/d of interim takeaway capacity. Finally, the Gray Oak Pipeline is expected to come online by the end of this year, adding another 900 Mb/d of capacity from the Permian to the Texas Gulf Coast. Gray Oak will make deliveries near Corpus but also extend northea to Sweeny, TX. All told, the two pipelines in operation have added about 1 MMb/d of new capacity; that will grow to over 2 MMb/d by early next year once Gray Oak is commissioned and EPIC reaches full capacity.

Figure 1. Permian Crude Oil Pipeline Projects. Source: RBN

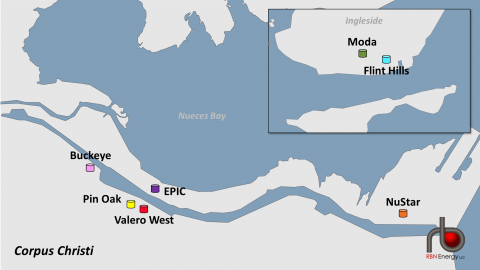

When Permian barrels arrive in South Texas, they have a plethora of export options at Corpus Christi (see Figure 2) and Ingleside (inset of Figure 2). While there are too many crude pipelines, interconnections and export docks in the Corpus area to review in today’s blog, we will hit the highlights as they relate to Cactus II and EPIC. As we mentioned earlier, Cactus II has already been completed to Ingleside, home to two important export facilities: one operated by Flint Hills Resources (light-blue tank icon in inset map) and the other by Moda Midstream (green icon). Moda is also in the midst of a major expansion of crude storage and loading capacity at its terminal, details of which we explained earlier this year in our Harder, Better, Faster, Stronger blog. Cactus II also has an interconnect with two NuStar pipelines in the area that supply NuStar’s export terminal (orange icon in main map) located along the Corpus Christi Ship Channel. In addition, Cactus II can access the Buckeye terminal at Corpus (pink icon) indirectly via an interconnection with Energy Transfer’s Rio Bravo pipeline. Finally, Valero’s terminal (red icon) at Corpus is currently supplied by the Eagle Ford JV Pipeline, which Cactus II will interconnect with sometime this month. The Eagle Ford JV Pipeline is owned in a 50/50 joint venture between Plains and Enterprise Products Partners. For more detail on Cactus II and how it meshes with the other Corpus pipes and docks, you may wish to refer to the aforementioned Takeaway blog.

However, Cactus II isn’t the only game in town, now that EPIC has entered commercial service. While EPIC’s interconnects haven’t quite reached the level of Cactus II’s, the pipeline is already connected with the Moda and Flint Hills terminals in Ingleside. EPIC has also entered the crude export terminal business and is constructing a facility along Corpus’s ship channel (purple tank icon in main map). By late this year, it is expected that EPIC’s new crude oil export terminal will have one dock operational, with a second complete in the second quarter of 2020. EPIC also plans to interconnect in the future with the Valero terminal, as well as a terminal being planned by Pin Oak (yellow icon).

Figure 2. Major Corpus Christi and Ingleside Export Terminals. Source: RBN Energy

Clearly, there’s a lot more to the Corpus Christi area’s crude-related infrastructure than what’s depicted here. If you’re itching for a lot more detail, the folks in our GIS department just created a new wall map showing every Corpus-area pipeline, terminal, and interconnect they could find. For more information on this product, click here.

Data on crude-oil volumes flowing through the new pipelines will be posted in a few weeks to the Texas Railroad Commission’s (RRC) T-1 database (which we track in our weekly Crude Oil Permian report), and we don’t know what those flows have been over the last few days. What we do know, however, is that crude exports out of the Corpus Christi area are starting to pick up in a big way. As shown in Figure 3 below, last week’s exports at Corpus and Ingleside combined (blue line) shot up to a record of over 1 MMb/d (part of the blue line within the dashed green circle). That compares to the year-to-date average of around 500 Mb/d (dashed black line) and a four-week moving average of about 750 Mb/d (dashed red line).

The data certainly suggests a significant increase has occurred, much more than the usual weekly chop in the export numbers. If we use the 750-Mb/d four-week moving average, simple math implies that exports are up about 250 Mb/d over the year-to-date average of 500 Mb/d. With no increase in local refinery demand and stable local production from the Eagle Ford over that period, the export increase in late August was very likely driven by new volumes on Cactus II and EPIC. The gain is even larger if we base our calculation on the last week of data, when exports grew to over 1 MMb/d — an increase of about 500 Mb/d over the average so far for 2019. We should note that these are rough calculations that just get us in the ballpark of what is likely flowing. The more precise answer to how much new crude is flowing into the Corpus area is obfuscated by the reality that those barrels likely spend some time in area storage tanks before being pumped into the hulls of awaiting tankers. That means we will have a better read on the level of increase after we get a few more weeks of export data. Still, the gains so far are impressive.

Figure 3. Corpus Christi and Ingleside Crude Oil Export Volumes. Source: RBN Energy, Bloomberg

There have been questions recently regarding just how quickly exports out of the Corpus Christi area will ramp up. Some of the uncertainty has swirled around the new pipelines’ start dates and initial capacities. Other questions have centered on the unknown capacity of the docks at Corpus Christi and Ingleside, and on storage tank capacity. Even the ability of the waterways used to reach the Gulf of Mexico have fallen under scrutiny. Does one week of exports lay all those concerns to rest? Probably not, but should last week’s surge in export volumes continue to build in the weeks ahead, the crude-oil export infrastructure at Corpus may finally get the benefit of the doubt. It’s certainly an issue — and a set of data — that we will be watching closely here at RBN.

https://rbnenergy.com/break-on-though-corpus-christi-crude-oil-exports-surge-to-a-record

China National Petroleum Corp (CNPC), a leading buyer of Venezuelan oil, will skip cargo loadings for a second month in September as the state oil giant looks to avoid breaching U.S. sanctions, two sources with knowledge of the matter said.

CNPC made a surprise halt last month in loading Venezuelan oil after the Trump administration in early August froze Venezuelan government assets in the U.S. and officials warned companies against dealing with Venezuela’s state-run oil company, Petróleos de Venezuela, S.A., or PDVSA.

“CNPC at the group level has made it clear not to load Venezuelan oil,” said one source with direct knowledge of CNPC’s position on Monday, without giving a timeline on how long the suspension would last.

A separate senior Chinese industry source said last month that CNPC interpreted the Trump administration’s executive order as a potential prelude for more extensive sanction measures that could potentially hit CNPC as a leading oil client of Caracas.

The move comes as Russian state oil major Rosneft (ROSN.MM) has become the main trader of Venezuelan crude, shipping oil to other buyers and helping Caracas offset the loss of traditional dealers who are avoiding it for fear of breaching U.S. sanctions, Reuters reported last month.

A PDVSA crude oil loading program seen by Reuters confirms that so far no CNPC cargoes are planned for this month.

The executive order Trump issued on Aug. 5 did not explicitly sanction non-U.S. companies that do business with PDVSA, including partners in crude operations like France’s Total SA (TOTF.PA), as well as Russian and Chinese customers.

However, the order threatens to freeze U.S. assets of any person or company determined to have “materially assisted” the Venezuelan government.

Other Chinese crude oil buyers have also been warned off from making Venezuelan purchases at a recent meeting between the National Development & Reform Commission (NDRC), China’s state planner, and about six independent refineries, according to a source who was briefed on the meeting.

“At the meeting NDRC told these plants, which process (Venezuelan crude) Merey to make bitumen, that there will not be supplies from CNPC and that they should look for replacements to maintain production,” said the source.

The two sources declined to be named due to the sensitive nature of the matter.

Most deliveries of Venezuelan crude oil and refined products to CNPC are to repay billions of dollars Beijing lent to Caracas through oil-for-loan pacts. PDVSA has never failed to deliver crude oil to China to repay debts, although refinancing and grace periods have been agreed over the last decade to ease the debt burden.

Chinese customs data showed China’s Venezuelan crude imports plunged 40% in July to just over 700,000 tonnes, the lowest monthly amount in nearly five years.

Oil extended its advance as U.S. stockpiles were estimated to have dropped and OPEC+ members gathered in the United Arab Emirates ahead of meetings this week.

Futures rose for a fifth day in New York, the longest run of gains since late July. U.S. crude inventories probably declined by 2.8 million barrels last week, according to a Bloomberg analyst survey before government data due Wednesday. In Abu Dhabi, new Saudi Energy Minister Prince Abdulaziz bin Salman signaled a continuation of the kingdom’s policy of output restraint.

Crude is still down more than 10% from its peak in April as a prolonged U.S.-China trade war dents the outlook for consumption. Nevertheless, this Thursday’s meeting of the OPEC+ Joint Ministerial Monitoring Committee in Abu Dhabi, as well as Prince Abdulaziz’s commitment to maintain Saudi policy, are keeping the market focused on production curbs.

GAS: Natural gas prices expected to stay low through 2024

“The focus is going to be on the macro oil picture; it is going to be on the JMMC meeting,” said Olivier Jakob, managing director of consultants Petromatrix GmbH. “The new Saudi energy minister has not said anything that deviates from the previous policy.”

West Texas Intermediate oil for October delivery advanced 15 cents, or 0.3%, to $58 a barrel on the New York Mercantile Exchange as of 10:47 a.m. London time.

Brent for November settlement rose 16 cents, or 0.3%, to $62.75 a barrel on the ICE Futures Europe Exchange. The global benchmark oil traded at a $4.83 premium to WTI for the same month.

PREVIOUSLY: Oil gains as new Saudi minister signals OPEC+ cuts to continue

“There is nothing radical in Saudi Arabia; we all work for the government, one person comes one person goes,” Prince Abdulaziz said at the World Energy Congress in Abu Dhabi on Monday, his first public comments since he was appointed. Saudi Arabia has shouldered the bulk of OPEC+ production cuts, and is pumping about 500,000 barrels a day less than its agreed cap.

This week sees the publication of three key market reports. The U.S. Department of Energy will publish its monthly Short-Term Energy Outlook later on Tuesday, while the Organization of Petroleum Exporting Countries will release its monthly report on Wednesday and the International Energy Agency’s monthly review is due Thursday.

©2019 Bloomberg L.P.

A new deal between the United States and Iran may be on the horizon as US President Donald Trump just fired US National Security Advisor John Bolton—and oil prices are expected to take a turn for the worse.

"I informed John Bolton last night that his services are no longer needed at the White House. I disagreed strongly with many of his suggestions, as did others in the Administration, and therefore I asked John for his resignation, which was given to me this morning," Trump tweeted on Tuesday.

The move may go a long way to smoothing things out between Iran and the United States—a development that would have been hard to achieve with Bolton in office due to his persistent hardline stance against Iran.

The tensions between Iran and the United States has been played out most elaborately in the oil industry, fraught with oil tanker skirmishes that pulled in other US allies such as the UK. Gibraltar seized an Iranian oil tanker at the request of the United States after it suspected the tanker of carrying sanctioned Iranian oil to sanctioned Syria. Iran then seized a British tanker traveling through the Strait of Hormuz, claiming it had violated maritime laws.

Iran has threatened to close the Strait—the most important oil chokepoint in the world—on numerous occasions since the onset of sanctions, unnerving the oil industry.

While oil prices have weakened on demand fears due to the trade war between China and the United States, the tensions over Iranian oil have limited those losses. Now, with today’s administration reshuffling signaling a warming up to Iran, those trade war fears will run unchecked.

Oil prices had been trading up earlier in the day as OPEC renewed its commitment to the production quotas, and suggesting that it might extend the cuts again. By 12:28pm, WTI started to fall, reaching $57.71 (0.24%), with expectations of gloomier prices to come.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

The American Petroleum Institute reported late Tuesday that U.S. crude supplies fell by 7.2 million barrels for the week ended Sept. 6, according to sources. The API data also reportedly showed a stockpile decline of 4.5 million barrels in gasoline, while distillate supplies rose by 618,000 barrels.

Inventory data from the Energy Information Administration will be released Wednesday. The EIA data are expected to show crude inventories down by 3.6 million barrels last week, according to a survey of analysts polled by S&P Global Platts. Gasoline supplies are forecast to fall by 1.4 million barrels, while distillate stockpiles are seen higher by 220,000 barrels.

Commodity trader Trafigura’s exports of U.S. crude now account for over a quarter of the country’s total since the new Cactus II pipeline started last month, the company’s co-head of oil said, making the firm the single biggest exporter.

“We touch in excess of 1.5 million barrels per day (bpd) of physical U.S. crude, out of that we export around 500,000 bpd. The rest is domestic,” Ben Luckock told Reuters on the sidelines of the annual Asia Pacific Petroleum Conference (APPEC) in Singapore.

Trafigura signed a long-term agreement with Cactus pipeline operator Plains All American Pipeline LP last year to transport a total of 300,000 barrels per day (bpd) of crude and condensate.

It is the first of three large pipelines expected to start up this year from the Permian Basin, the biggest in the United States, and is expected to alleviate a bottleneck that had depressed regional prices for more than a year.

The Geneva-based trading firm expects total U.S. crude exports to hit 3.5 million bpd by the end of this year as other pipelines ramp up though port infrastructure still lags.

U.S. crude oil exports averaged 2.69 million barrels per day (bpd) in July, data from the U.S. Census Bureau showed, not including re-exported foreign crude.

Several major port expansion proposals are pending approval. Trafigura has also proposed to build a new loading terminal at Corpus Christi in Texas capable of loading very large crude carriers.

GREAT ARBITRAGE

Luckock said that the volume is being sold spot for now though there were many people who wanted to buy long-term supplies.

“China has been a big swing buyer. There’s plenty of people that want to term barrels up but at the moment we’re selling to about 20-30 customers,” Luckock said referring to the impact of the U.S.-China trade war.

“It’s one of the great arbitrage barrels. We have tripled our buyers in the last year.”

Last week, the trading arm of China’s Sinopec began reselling some of the crude oil it imports from the United States to buyers in India and South Korea to avoid tariffs Beijing imposed in its trade war with Washington.

“You don’t know what U.S. policy is going to be on a number of key topics. It seems to me that this trade war is going to be an extended affair,” Luckock said.

Concerns over consistent quality have been an issue during the ramp up of U.S. crude production due to the myriad of logistics in getting the oil to the coast. Several cargoes were rejected in South Korea earlier this year and though consistency has improved, many buyers in Europe for instance remain wary of Houston terminals and Eagle Ford, preferring to take Midland.

Trafigura said it can control the stream from “wellhead-to-water”, which creates strong demand for its oil.

Saad Rahim, Trafigura’s chief economist, said European buyers accounted for just over a third of the firm’s exports while Asia was seen taking close to 45% so far this year.

Oil prices jumped higher after the Energy Information Administration reported a draw in crude oil inventories of 6.9 million barrels for the week to September 6. A day earlier, the American Petroleum Institute estimated inventories had shed 7.23 million barrels in the reporting period.

A week earlier, the EIA said inventories had fallen by 4.8 million barrels.

As the market prepares for the next OPEC meeting later this week and many expect an extension and possibly a deepening of production cuts, prices continued to be depressed by the global economic growth fears plaguing the market and the continued rise in U.S. oil production.

The relief granted Brent and WTI by bullish reports about OPEC considering deeper cuts while industry insiders expect healthy demand has been temporary and likely to continue this way until either the trade conflict between the United States and China is resolved or a production outage in any of the less politically stable producing countries makes a dent in global supply.

In the meantime, the weekly EIA reports continue to draw the attention of traders every Wednesday, not jut in crude oil but in gasoline and distillate fuels as well.

Last week, the EIA said, gasoline inventories shed 700,000 barrels, which compared with a 2.4-million-barrel draw a week earlier. Production averaged 10.4 million bpd, versus 10.3 million bpd a week earlier.

Distillate fuel inventories increased by 2.7 million barrels last week, which compared with a decline of 2.5 million barrels a week earlier. Distillate fuel production rose to 5.3 million barrels daily, from 5.2 million bpd in the previous week.

Refineries processed 17.5 million barrels daily, compared with 17.4 million barrels daily in the last week of August.

At the time of writing, Brent crude was trading at $62.83 a barrel and West Texas Intermediate was changing hands at $57.51 a barrel, both modestly up from yesterday’s close.

By Irina Slav for Oilprice.com

More Top Reads From Oilprice.com:

Global oil demand will peak in three years, plateau until around 2030 and then decline sharply, energy adviser DNV GL said in one of the most aggressive forecasts yet for peak oil.

Most oil companies expect demand to peak between the late 2020s and the 2040s. The International Energy Agency (IEA), which advises Western economies on energy policy, does not expect a peak before 2040, with rising petrochemicals and aviation demand more than offsetting declining oil demand for road transportation.

Wednesday’s annual report from DNV GL, which operates in more than 100 countries and advises both oil and renewable energy companies, would appear to be at odds with ongoing investment in developing new oil and gas fields.

“The main reason for forecasting peak oil demand in the early 2020s is our strong belief in the uptake of electric vehicles, as well as a less bullish belief in the growth of petrochemicals,” Sverre Alvik, head of DNV GL’s Energy Transition Outlook (ETO), said in an email to Reuters.

While DNV GL’s latest forecast shows oil demand peaking in 2022, one year sooner than it estimated last year, the difference is marginal and demand is expected to remain relatively flat over the 2020-2028 period, Alvik added.

DNG GL expects electric vehicles to reach 50% of global new car sales in 2032, compared with last year’s forecast of the mid-2030s. By the middle of the century 73% of the global passenger car fleet will be electric-powered, up from 2.5% today, the company estimates.

In Norway, where the DNV GL has its headquarters, more than 40% of all new cars sold in the first eight months of this year were electric — the highest proportion in the world. The government wants this to reach 100% by 2025.

Demand for natural gas, which oil companies say could serve as a bridge in the global transition from fossil fuels to renewable energy, is seen surpassing oil demand in 2026 and plateauing in 2033, DNV GL said.

Meanwhile, electricity’s share of the total energy mix is predicted to double by mid-century to 40% of today’s levels, with solar and wind generation accounting for two thirds of electricity output.

Annual power grid spending is forecast to more than double to $1.7 trillion to connect thousands of new solar and wind farms and millions of electric vehicles.

Meanwhile, upstream fossil fuel investment as a proportion of total energy expenditure is seen dropping to 38% from 68%, DNV GL said.

Multiple oil refineries in Europe will be too unprofitable to continue trading once the industry has dealt with sweeping new rules governing shipping fuel that start next year, according to an executive at a UK plant.

Refineries globally are bracing for one of the biggest mandated changes in the the industry’s history – rules forcing the vast majority of ships to use fuel containing less sulfur. The regulations, widely known as IMO 2020, start in January and have been touted as positive for companies that turn crude into more valuable products. But smaller, simpler plants in Europe often churn out excess gasoline, as well as the type of fuel that will soon become outlawed for most vessels.

“Post the shift, I believe some of these old weak refineries will have to shut down,” Srinivasalu Thangapandian, the chief executive officer of Stanlow-oil refinery owner Essar Oil UK, said in an interview in Singapore. “Fuel oil is going to be negative and gasoline, you see margins of almost zero sometimes. Europe is heavily oversupplied in gasoline.”

The refineries hardest hit would be those designed to devote almost half their production to gasoline, and as much as 14% to high sulfur fuel oil, he said, adding that Stanlow won’t suffer the same pressures because it churns out smaller proportions of those fuels.

Still, analysts at Wood Mackenzie Ltd. and Facts Global Energy said Europe’s refineries – long pressured by expanding capacity elsewhere in the world – may be able to continue a while longer. A surge in capacity in the Middle East and Asia in the mid-2020s is what would be most likely to force halts in Europe, they said.

“EU demand for gasoline is falling but Asian demand is growing, albeit slowly,” said Steve Sawyer, London-based head of refining at Facts Global Energy.

And while Europe’s older refineries will miss out on some of the margin boost from IMO 2020 for diesel-like fuels, they still stand to gain from changing crude prices that mean certain types of oil that they process will fall in price – such as Russia’s Urals, said Alan Gelder, London-based vice president of refining, chemicals and oil markets at Wood Mackenzie.

Some Mediterranean plants could reduce their operating rates if exports to the East struggle, but Gelder said he doesn’t see earnings falling far enough to justify any closures.

“If exports to Asia are proving difficult there will be run cuts,” he said. “But we see the current weakness in margins as very short term, margins won’t fall to rationalization levels.”

Another factor that could help struggling European refiners is a delay in starting up new refining capacity. While a giant new plant in Nigeria is currently slated to start producing in late 2020, it may take a little longer than that to be fully up and running, delaying increased competition for European operators, Gelder said.

“The future of EU refining will largely depend on how refinery investment goes in the Middle East and Asia,” FGE’s Sawyer said. “If it continues aplenty, then some EU refiners will be in trouble post-2025 as there will be too much capacity globally. If the Middle East and Asia show some restraint it might not be too bad, although margins will be at a lower level than those over the last few years.”

Output from U.S. shale fields will lift the country’s oil production by 1.3 million barrels per day this year, according to consultancy Rystad Energy.

U.S. production will rise next year by 1.1 million bpd, slightly above U.S. government forecasts of around 990,000 bpd.

The consultancy expects U.S. oil and condensate production to hit 12.9 million bpd in December and 14 million bpd by the end of 2020.

The U.S. Energy Information Administration expects output in 2020 to rise to 13.23 million bpd.

Rystad expects 2020 to be “not too rosy but not too bleak” for the oil industry, said Bjornar Tonhaugen, head of oil market research, with U.S. oil prices between $50 and $55 per barrel in 2020, with international prices around $60 per barrel.

Despite concerns about a possible global recession, crude demand will benefit from tougher rules on sulfur emissions from ships that will come into effect next year, Tonhaugen said.

U.S. crude output has surged thanks to the Permian basin in Texas and New Mexico, the country’s biggest oil field. The U.S. is now the world’s largest producer, ahead of Saudi Arabia and Russia.

But the rate of growth has slowed, with U.S. energy firms reducing the number of oil rigs operating for the ninth straight month to its lowest since January 2018. Producers face pressure from investors to return cash in the form of dividends or share buybacks, and are trimming budgets to try to spend within cash flow.

New production from countries including Norway and Brazil, along with U.S. output, will add around 2 million new bpd to the global market from non-OPEC countries and their partners, according to Rystad, pressuring the Organization of the Petroleum Exporting Countries to continue production cuts.

OPEC, Russia and other producers have since Jan. 1 implemented a deal to cut output by 1.2 million bpd. The alliance, known as OPEC+, in July renewed the pact until March 2020 and a committee reviewing the pact meets on Thursday.

Norwegian oil and gas company Equinor is progressing oil spill recovery at the South Riding Point terminal in the Bahamas after the impact of Hurricane Dorian.

In the aftermath of Hurricane Dorian, Equinor said earlier this week it would clean up the oil spills from its South Riding Point oil terminal, spilled due to damage caused by the hurricane.

In an update on Wednesday, Equinor said that there was no observed leakage of oil to the sea from the terminal.

Equinor informed on Thursday that an onshore team had started to recover oil and move it into tank storage.

“A response team continues to assess the damage and plan the recovery work. Initial recovery assets have been deployed and additional machinery and equipment is being added,” the Norwegian company said.

Equinor also noted that recovery was expected to be significantly stepped up over the coming days in close dialogue with local authorities.

It is still Equinor’s assessment that no oil is leaking from the terminal. An area with suspected oil spill in open water has now been confirmed to be a patch of seaweed.

Another area with potential product 70-80 kilometers north east of the terminal on the other side of the island has been observed from air and results are being processed. Currently, there are no indications that the terminal is the source for this.

Spotted a typo? Have something more to add to the story? Maybe a nice photo? Contact our editorial team via email.

Also, if you’re interested in showcasing your company, product or technology on Offshore Energy Today, please contact us via our advertising form where you can also see our media kit.

The Norwegian Petroleum Directorate (NPD) has granted DEA Norge, a Norwegian unit of Wintershall Dea, a drilling permit for a wildcat well located in the Norwegian Sea.

The well 6611/1-1 will be drilled from the West Hercules drilling rig after completing the drilling of wildcat well 32/4-2 for Equinor in production license 921.

The drilling program for well 6611/1-1 relates to the drilling of wildcat wells in production licence 896. DEA Norge is the operator with an ownership interest of 40 percent. Other licensees are Petoro, Lundin Norway, and Equinor, each with an ownership interest of 20 percent.

The area in this license consists of the eastern part of block 6610/2 and blocks 6610/3, 6611/1 and 6611/2. The well will be drilled about 150 kilometers northeast of the Norne field, and about 150 kilometers southwess of Bodø.

Production license 896 was awarded on February 10, 2017 in APA 2016. This is the first exploration well to be drilled in the license.

Spotted a typo? Have something more to add to the story? Maybe a nice photo? Contact our editorial team via email.

Also, if you’re interested in showcasing your company, product or technology on Offshore Energy Today, please contact us via our advertising form where you can also see our media kit.

Oil prices are likely to head towards $50/b in the next six months in light of the global economic slowdown, unless OPEC makes larger production cuts, Ben Luckock, co-head of oil trading at commodities trading house Trafigura, told S&P Global Platts on the sidelines of the APPEC conference over September 9-11 in Singapore.

"We are worried about the underlying sort of macro-economic set of fundamentals. We see a number of bearish headwinds from the market, which exacerbated by a trade war does not seem to be coming to a conclusion anytime soon," Luckock said in an interview.

He added that trade uncertainty between the US and China is especially a concern when "an international commodity trader cannot assess how the trade war is going based on whether a phone call is made for a meeting set in a month's time," highlighting the unpredictability the Trump administration has brought to the market.

Trafigura's downbeat assessment of the oil market is a far cry from last year's APPEC when oil traders warned of the possibility of $100/b oil on the back of sanctions on Iran and healthy oil demand. Since then, demand growth has slowed with S&P Global Platts Analytics putting oil demand on "negative watch", while Iran's supply shortfall was offset first by waivers and then by record US production growth.

STRAIT OF HORMUZ

Indeed, even geopolitical tensions across the Middle East, with a number of incidents near the strategically important Strait of Hormuz in recent months failed to move the dial on oil prices, a point Luckock was keen to make.

"It shows you how problematic the market is right now and even that [incidents near the Strait of Hormuz] cannot help the market get ahead of itself," he noted, suggesting that the glut will be tough to shift. The Strait of Hormuz is the most important oil chokepoint with more than 20% of global petroleum liquids demand flowing through the narrow waterway.

Overwhelmingly bearish economic sentiment has sent oil prices spiraling lower. They are now 20% below their 2019 high seen in late April. OPEC's continued commitment to keep crude production limited, in conjunction with US economic sanctions on Iran and Venezuela had lifted front-month ICE Brent crude futures above the $75/b mark in April.

However, oil prices turned lower as Beijing's counter tariffs on US goods announced last month prompted energy and financial market participants to unwind their long paper positions on concerns over a wider slowdown in China as the trade row escalates and its detrimental impact on oil demand.

Brent futures fell below $56/b on August 7, the lowest level since January 7. The front-month futures contract was last quoted at $62.41/b at 0212 GMT Wednesday.

$70/B OIL AHEAD

Luckock does see the market turning upwards after six months, but whether OPEC, Russia and its allies have the patience and confidence in a recovery is open to question as it heads into a key monitoring committee meeting on Thursday.

The OPEC pact has agreed to cut 1.2 million b/d until the end of the first quarter of 2020, with Saudi Arabia trying its best to accelerate the market rebalancing by cutting close to 600,000 b/d more than its agreed quota according to Platts' OPEC monthly survey.

However, some OPEC members such as Iraq and Nigeria have been laggards in complying with their quotas.

"I think OPEC has been pretty good but...I think they need to do more than they are currently rather than less," Luckock said. Oil prices have been hovering just above the $60/b mark, but have ticked upwards on an improved US oil stock picture, which may encourage OPEC to stay on its current course.

The trader was upbeat for the early part of the next decade, predicting buyers and sellers in the industry will converge around a return to $70/b oil. "In the medium to longer term of two to five years the market should return to a price somewhere in the 70s/b, that kind of range. That's a good price for the oil industry as a whole looking forward."

OPEC on Wednesday cut its forecast for growth in world oil demand in 2020 due to an economic slowdown, an outlook the producer group said highlighted the need for ongoing efforts to prevent a new glut of crude.