Scorching weather across the globe makes fields too dry for crops, rivers too warm to cool power plants, and leaves wind turbines idle – and it’s pushing commodities prices higher

By

Rachel Morison

,

Marvin G Perez

, and

Nicholas Larkin

From

LISTEN TO ARTICLE

4:05

Commodity producers are having a summer to remember, for all the wrong reasons.

A heatwave across swathes of North America, Europe and Asia, coupled with a worsening drought in some areas, is causing spikes in the prices of anything from wheat to electricity. Cotton plants are stunted in parched Texas fields, French rivers are too warm to effectively cool nuclear reactors and the Russian wheat crop is faltering.

The scorching heat is extracting a heavy human cost – contributing to floods in Japan and Laos and wildfires near Athens. Relief from soaring temperatures, which topped 30 degrees Celsius (86 degrees Fahrenheit) in the Arctic Circle, may not arrive for at least two weeks.

It’s a timely reminder of the vulnerability of global commodity markets to the changing climate, as human activity disrupts the behavior of plants, animals and the march of the seasons.

Wheat prices surge to a three-year high as the heatwave hurts Europe's crop

Source: Euronext

The heat and lack of rainfall is pummeling crops across Europe as far as the Black Sea. Output in Russia, the world’s top wheat exporter, is set to fall for the first time in six years, while concerns continue to mount about smaller crops in key growers such as France and Germany. Wheat futures for December have jumped almost 10 percent in the past month in Paris, with prices this week reaching the highest since the contract started trading in 2015.

After years of bumper harvests, global output could drop this year for the first time since the 2012 to 2013 growing season. This could have political and social ramifications. Egypt, which relies on subsidized bread to feed its almost 100 million people, is already paying the highest price for its imports in more than three years.

High temperatures are forecast to continue in France, disrupting power plants

Source: The Weather Co. using GFS model

French farmers aren’t the only ones finding the weather too hot to handle. The country’s fleet of nuclear power plants is also suffering.

Rivers have become too warm to effectively cool the reactors, and Electricite de France SA may be forced to cut output later this week at two stations. The hot weather also has forced a German coal-fired plant to curb operations and reduced the availability of some plants in Britain fired by natural gas.

France gets more than 70 percent of its power from 58 atomic stations and is a net exporter of electricity to neighboring countries. Any reductions in output would potentially boost prices across the continent.

The sultry conditions are also leaving wind turbines virtually at a standstill. In Germany, wind output over the past 10 days has been a third lower than the average for the year so far. Windmills are also becalmed in Spain, Italy, the U.K., Denmark and Sweden. Solar operators are enjoying the weather, but they can’t fill the gap left by wind and demand for natural gas is rising.

French and German day-ahead wholesale power is at the highest for the time of year for a decade, while in Britain they’re the most since at least 2009.

Electricity prices surge as Texas heat smashes records

Source: Data compiled by Bloomberg

Over in Texas, power prices are also jumping due to the heat. The northern part of the state smashed a 93-year-old daily temperature record last week, sending demand surging as people heeded advice to stay indoors and crank up their air conditioning. Wholesale prices for electricity secured a day in advance reached three-year highs, although they’ve since fallen as temperatures moderated.

Temperatures got so high that the National Weather Service was advising north Texas residents to avoid walking their dogs, lest they burn Fido’s paws. But for farmers in the west of the state, the drought was hurting even more than the heat.

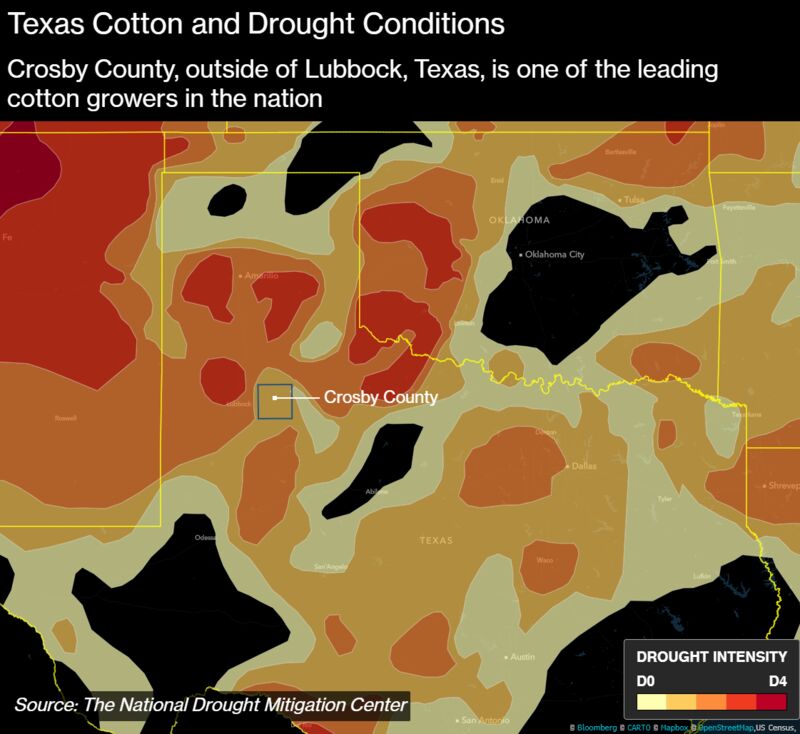

The West Texas cotton belt – the world’s most productive area for the crop – is brown, baked, cracked and dusty. The dryness is so bad that close to half of the state’s crop is in poor or very poor condition, U.S. government data show. About 4.5 million acres of the fiber are planted in the region, 60 percent of which depends on rain because it isn’t irrigated.

"I lost everything in the dry land,” said Lloyd Arthur, a fourth-generation farmer in Crosby County. He’s not expecting to harvest anything from about a quarter of the 2,000 acres of cotton he sowed this season.

Cotton futures are up more than 10% this year on drought fears

Ron Harkey, the president and chief executive officer of the world’s largest cotton warehouse in Lubbock, expects to get 1.5 million bales from members of a growers cooperative in the area this year. That’s down from 2.5 million last season. Tighter supplies have helped drive cotton traded in New York up more than 10 percent this year.

— With assistance by Mathew Carr, and Jason Gale

Mitch Ingram, Anadarko Executive Vice President, International, Deepwater and Exploration, delivered a keynote address at the World Gas Conference in Washington D.C. in which he announced that he expects the Anadarko-led Mozambique LNG project to be in position to take FID (Final Investment Decision) in H1 2019.

He also announced that the project and its contractors are realising significant cost savings amounting to approximately US$4 billion over 2016 estimates. As a result of these savings, Anadarko expects to deliver the first two onshore liquefaction trains with 12.88 million tpy capacity for approximately US$7.7 billion (less than US$600/t).

In addition, the company reiterated that it has announced 6.7 million tpy of off-take agreements and has agreed to key terms for the targeted volume of 8.5 million tpy, enabling it to proceed with incremental project financing discussions with lenders. The focus now is on converting these non-binding commitments into fully termed Sale and Purchase Agreements (SPAs).

Japanese steelmakers reported little fallout in their first-quarter earnings from the U.S. import tariffs on steel, but they all voiced growing concerns over possible U.S. duties on automobiles which could hurt a wide range of Japan’s industries.

U.S. President Donald Trump ordered a national security probe into imports of automobiles in May. Similar national security investigations were the precursor to the imposition of import tariffs of 25 percent on steel and 10 percent on aluminum in March.

Nippon Steel & Sumitomo Metal (5401.T), Japan’s top steelmaker, on Thursday reported its recurring profit fell 19 percent in the April to June quarter from a year earlier, weighed down by lower appraisal gains in raw materials inventory and rising costs of secondary materials.

But it forecast a profit gain for the year to March 31 as it plans to boost steel output to meet local demand in automobiles and construction as well as raise product prices to pass on the rising costs of materials such as manganese and zinc.

“Demand for automobiles, including SUVs for North America and electric vehicles for Europe, are strong,” Nippon Steel Executive Vice President Katsuhiro Miyamoto said, adding that demand for industrial machinery and construction are also solid.

JFE Holdings (5411.T), Japan’s second-largest steelmaker, logged a 41 percent jump in first-quarter recurring profit and raised its full-year forecast by 18 percent, on higher product prices.

Both companies shrugged off the U.S. steel tariffs in their quarterly earnings, but raised concerns of weakening demand linked with U.S. tariffs on autos.

“We had only limited impact from the U.S. duties so far,” JFE Executive Vice President Shinichi Okada said.

“But if U.S. tariffs expand into autos, we will have some impact as automakers are our major customers,” he said.

Nippon Steel has seen no major ramifications from the U.S. duties as its exports to the U.S. market are only 2 percent of its total shipments, Miyamoto said.

Rather, its U.S. units, which have an annual production capacity of 7.1 million tonnes, are benefiting from higher U.S. steel prices, he said.

“But our biggest concern is over autos,” he said, noting that Japanese steelmakers supply about 3.5 million tonnes of material a year for automobiles that are exported from Japan to North America.

“If it happens, the impact will be big,” he said.

The United States signalled on Thursday it is set to push ahead on trade talks with Canada and Mexico after agreeing to suspend hostilities over tariffs with Europe in a fragile deal that may clear the way for renewed pressure on China.

A surprise deal struck on Wednesday will see Washington suspend the imposition of any new tariffs on the European Union, including a proposed 25 percent levy on auto imports, and hold talks over tariffs on imports of European steel and aluminum.

The deal boosted share markets initially, and U.S. industrial shares were stronger on Thursday as fears of a trade war with Europe ebbed.

Both sides claimed victory in the deal, reached by Trump and European Commission President Jean-Claude Juncker in Washington. In return for the talks and a suspension of auto tariffs, the EU will import more soybeans and energy from the United States.

A White House official told Reuters that Juncker had shown greater flexibility than expected in the talks and that while there was no deadline for an overall deal, Trump retained the power to impose tariffs if progress was not made.

One key aspect of the agreement, according to the official who spoke on condition of anonymity, was that the two sides had agreed to work together to tackle China’s market abuses.

“They want to work together with us on China and they want to help us reform the WTO (World Trade Organization),” said the official, adding that the Europeans came into the talks “with a real positive spirit”.

Trump has announced a series of punitive tariffs on Chinese imports in a bid to halt a Chinese surge in high-technology industries that threatens to displace U.S. dominance. Both the U.S. and the EU charge that Chinese companies steal company secrets.

On the North American Free Trade Agreement talks with Canada and Mexico, Treasury Secretary Steve Mnuchin said he was “hopeful that we’ll have an agreement in principal in the near future.”

“Whether it’s one deal or two deals, so long as we get the right agreement, we’re indifferent,” Mnuchin told CNBC.

Trump and officials from his administration said the EU had given ground by agreeing to import more American goods and to hold talks on tariff reductions including on cars, an industry in which Trump has accused Europe of imposing heavy duties.

EU officials said little had been given away by Juncker and that Europe had emerged as the winner by getting Trump to defer the threatened car tariffs which would have hit European carmakers hard.

The deal was hailed by commentators in the United States and Europe for drawing back from an escalation in a trade war that had threatened to take the world back to the kind of protectionism not seen since the 1930s, although some cautioned the relief may be only temporary.

French President Emmanuel Macron appeared to challenge the deal, saying on Thursday he would not discuss agriculture in talks with the United States.

If it holds, the US-EU pact could allow both to focus on China, whose economic rise threatens both. Lawmakers in Washington on Thursday passed legislation to slow Chinese investment in U.S. companies. In Europe, alarm bells have been sounded over China’s growing economic influence there.

“U.S. and EU will be allied in the fight against China, which has broken the world trading system, in effect,” Trump’s economic adviser Larry Kudlow said. “President Juncker made it very clear yesterday that he intended to help us, President Trump, on the China problem.”

In Beijing, Chinese Foreign Ministry spokesman Geng Shuang said trade disputes should be resolved through talks on the basis of mutual respect and equality.

“Engaging is unilateralism or protectionism is not the way out,” Geng said, when asked about Kudlow’s comments.

CASUALTIES IN TRADE FIGHT

Since taking office last year, Trump has implemented policies to restrict what he sees as unfair competition from other countries. He tore up an agreement to join a Pacific trade pact, has threatened to pull out of NAFTA, and imposed steel and aluminum tariffs aimed at China.

In an effort to rein in China’s high technology industries that he charges have stolen intellectual property from American companies, Trump has ramped up threats of tariffs on $50 billion worth of imports from China to $450 billion after China retaliated with its own duties on imports from the United States.

The impact has fallen mainly on U.S. farmers and Republican party lawmakers. A move by Trump to offset farmers’ losses with a $12 billion aid package drew criticism with farmers saying they wanted access to markets rather than subsidies.

U.S. Trade Representative Robert Lighthizer, a veteran of trade negotiations from former President Ronald Reagan’s administration in the 1980s who is Trump’s top trade official, told lawmakers in Washington that the United States could not afford to capitulate to China economically.

“I don’t think it’s a stupid fight,” Lighthizer said of the trade battle with China in heated exchanges in the Senate. “I don’t know a single person that has read this report that thinks it’s a stupid fight to say China should not be able to come in and steal the future of American industry.”

A more conciliatory tone emerged from Mnuchin, who told CNBC the United States was willing to reopen trade talks with China if Beijing was willing to make “serious changes,” as he said the EU had indicated it was willing to do.

In May, the United States and China initially appeared willing to strike a deal that would see China reduce its $350 billion surplus in the trading of goods by buying more U.S. agriculture and energy products.

That deal fell apart quickly and has been replaced with a rising tally of tariff retaliation that has led to Trump threatening tariffs on almost everything the United States imports from China.

China has threatened to retaliate dollar for dollar, and its refusal to sign off on regulatory approval caused a $44 billion deal from Qualcomm Inc (QCOM.O) to buy NXP Semiconductors (NXPI.O) to fall apart, a move that showed U.S. companies were being targeted unfairly, Mnuchin said.

Teck Resources Ltd boosted its production forecasts for copper, zinc and oil on Thursday as the diversified miner reported market-beating profits on the back of higher prices for a range of commodities.

Flush with C$2.9 billion ($2.22 billion) in cash and C$7 billion in liquidity, Teck is in “great shape” to fund growth, said Chief Executive Don Lindsay, including big Chilean developments like the $4.8 billion Quebrada Blanca Phase 2 project and $3.5 billion NuevaUnion project.

Shares in the base metal miner popped 4.5 percent higher on Thursday, in sharp contrast to broad declines for gold miners that reported lower production and higher costs.

With Quebrada Blanca Phase 2 permits expected in August, Teck said it will launch a formal process seeking a development partner, which could contribute some $2 billion for a 30 percent to 40 percent stake. It expects to close a deal in the fourth quarter.

Teck also aims to complete a feasibility study on NuevaUnion, a joint venture with Goldcorp (G.TO) to develop neighboring mines, by the third quarter of 2019.

With its new Galore Creek project partner, Newmont Mining (NEM.N), Teck plans to update a pre-feasibilty study in three to four years. Newmont agreed to pay $275 million to NovaGold Resources (NG.TO) on Thursday for its 50-percent stake in the copper-gold project.

Asked on a conference call whether oil remains a core business, Linsday said that if the value of its stake in the Fort Hill oil sands is inadequately reflected in its stock in 2020 or 2021, when operations are well established, he would consider a spin-out, sale or partnership.

Separately, family-controlled Teck appointed as its new chairman Dominic Barton, an outsider and global managing partner of consulting firm McKinsey & Co.

Current chair Norman Keevil, who joined Teck in 1962 as vice president of exploration, held the position of CEO from 1981 to 2001, when he became chairman. He retires from that role Oct. 1.

Teck, the world’s second-biggest exporter of steelmaking coal, stuck to its annual production forecast of 26 million to 27 million tonnes, but said production is now expected near the lower end of the range.

Third-quarter coal sales are seen rising to 6.8 million tonnes from 6.6 million tonnes in the second quarter, which lagged its 6.7 million tonne forecast due to two rail strikes. The average realized price rose 9.6 percent to $183 a tonne, Teck said.

Adjusted profit of C$1.12 per share beat analyst expectations of C$1.07.

Billionaire Anil Agarwal in July said he planned to offer around $1 billion to take London-listed Vedanta Resources Plc private, a move that has rekindled speculation his ultimate aim is a deal with miner Anglo American.

Agarwal’s Volcan family trust has until July 30 to make a firm offer or walk away from the deal, which would leave Vedanta listed only in India (VDAN.NS).

WHY THE SPECULATION?

In March 2017, Agarwal began amassing a stake in Anglo American through a three-year JPMorgan mandatory convertible bond named “POEMS”. He announced he was buying a second tranche in September 2017.

In total, Agarwal has 19.35 percent, making him Anglo American’s largest shareholder, although only for three years unless he acts to buy the shares or seek to roll over the arrangement, which is effectively a loan.

Agarwal has always said the stake was an investment, based on his belief in Anglo as a company, for his family trust. He said it was unrelated to Vedanta and he was not planning a takeover.

However, he has made no secret of wanting to grow Vedanta into a major diversified player or of his commitment to South Africa, Anglo America’s heartland.

Vedanta’s international operations are copper mines in Zambia and Vedanta Zinc with operations in South Africa and Namibia.

Agarwal has said he wants to buy the Indian government’s 30 percent stake in Hindustan Zinc, of which he has majority control. Anglo has declined to comment on reports it rebuffed previous approaches for a tie-up with Hindustan Zinc.

WHY THE DELISTING AND WHAT DOES IT CHANGE?

Vedanta was the first Indian company to list in London, in 2003. It raised around 500 million pounds ($657 million), giving it a market capitalization just over 1 billion pounds.

Since then, the market capitalization has roughly doubled to 2 billion pounds.

But the bigger part of the company is Indian-listed Vedanta with a market capitalization of 803.84 billion rupees ($11.66 billion). It also has significant levels of debt and is dwarfed by Anglo, with market capitalization around 24 billion pounds.

The London delisting simplifies Vedanta’s structure, potentially making it more attractive as a company, but the loss of the listing would reduce Agarwal’s deal-making capacity as potential buyers would prefer London shares to Indian ones, analysts say.

A spokesman for Agarwal said he was not giving interviews.

In his announcement of the planned delisting, Agarwal cited “the maturity of the Indian capital markets”, saying a London listing was no longer necessary.

Mark Cutifani, CEO of Anglo American, said Agarwal has been “a very supportive shareholder”.

“Our conversation is consistent with the conversation with all of our other shareholders,” he said when asked about Agarwal at the company’s interim results on Thursday.

WHAT DO THE SHAREHOLDERS THINK?

At least one significant investor has said it is unhappy with the price Agarwal has offered to buy out other shareholders.

Anglo shareholders have benefited from Agarwal’s interest, which has helped to drive up the stock, but some investors for whom ESG (Environmental, Social and Governance) issues are a concern say Vedanta’s track record would be worrying.

The most significant shareholder is South Africa’s state-run Public Investment Corporation, which was the biggest shareholder in Anglo American until Agarwal’s purchase.

Deon Botha, PIC’s head of corporate affairs, said it could not comment as “public statements to this effect will constitute market sensitive information”.

Analysts and fund managers say PIC has a commitment to ESG issues that could set it at odds with Vedanta. Others say PIC’s quest for a national champion based on separating out Anglo’s South African assets might persuade it to work with him.

IS VEDANTA’S ESG RECORD WORSE THAN OTHERS?

While most miners, including Anglo, have had issues with leaks and fatalities, Vedanta’s troubles have attracted particular criticism.

In India, the Tamil Nadu government has ordered the permanent closure of a Vedanta copper smelter and disconnected its power supply in May following protests that turned violent as police opened fire on protesters, killing 13.

Vedanta is seeking to overturn the decision.

It is also fighting a London high court judgment linked to alleged pollution from copper operations in Zambia.

IMPLICATIONS OF THE NEW CEO?

At the end of August, Srinivasan Venkatakrishnan, known as Venkat, will take up the Vedanta helm after stepping down as CEO of AngloGold Ashanti (ANGJ.J).

Before becoming chief executive in 2013, he was AngloGold’s chief financial officer, while Mark Cutifani, CEO of Anglo American since 2017, was AngloGold’s CEO.

Analysts say the two have worked well together.

At the same time, the chairman of Anglo American Stuart Chambers has a strong record of securing buyers for the companies he leads.

South Africa’s National Treasury has concluded its investigation of alleged corruption at state power utility Eskom and state logistics firm Transnet and will give the relevant parties two weeks to respond before making its findings public.

In a statement on Sunday the treasury said it had completed a draft report of its investigation into coal supply agreements between Eskom and Tegeta Exploration and Resources - a company owned by the Gupta business family which South Africa’s corruption watchdog accuses of using its relationship with former president Jacob Zuma to wield influence and win government contracts.

The report also covers allegations of misconduct concerning state logistics firm Transnet’s purchase of over 1,000 trains from China South Rail.

A judicial inquiry into what has been termed “state capture” - widespread corruption involving billions of rands worth of state contracts during Zuma’s presidency - is due to start next month. International companies affected include global consultancy McKinsey, Germany’s SAP and public relations giant Bell Pottinger.

“The report has been given to the relevant parties for comment. These parties have been given two weeks to respond,” the treasury said.

Its investigation of Eskom and Tegeta focused on the 2015 sale of Optimum Coal Mine by multinational resource giant Glencore to Tegeta.

Zuma and the Guptas have denied wrongdoing. Reuters has not been able to independently verify the allegations.

Earlier in July Zuma’s son, Duduzane, was arrested before being granted bail over allegations he took the former deputy finance minister to meeting in 2015 with the Guptas, who - according to the former deputy minister- then tried to bribe him ith 600 million rand ($45.58 million) in his presence.

China’s capital Beijing will shut around 1,000 manufacturing firms by 2020 as part of a program aimed at curbing smog and boosting income in neighboring regions, state media said on Monday.

Beijing will focus on dynamic, high-tech industries and withdraw from “ordinary” manufacturing, the Communist Party paper People’s Daily reported, citing a recent policy document published by the Beijing municipal government.

The city has already rejected registration applications from 19,500 firms, and shut down or relocated 2,465 “ordinary” manufacturers, the paper said.

China launched a plan to improve coordination in the smog-prone Beijing-Tianjin-Hebei region in 2014 amid concerns that competition between the three jurisdictions was wasting resources and creating overcapacity and pollution.

It plans to strip Beijing of manufacturing and heavy industry, as well as relocating universities and some government departments into Hebei’s new economic zone of Xiongan.

The government also wants to create an integrated transport network and unify standards in areas such as welfare and education to make Hebei, known for its heavy industry, more attractive for investors.

An official with Hebei province earlier this year said the plan has helped drive average incomes in Hebei up 41 percent since 2013, although they are still only half the level in Beijing.

The city of Changzhou in Jiangsu province is planning to implement production curbs in heavy industry, the latest case of Chinese cities scrambling to cut emissions as part of Beijing’s intensified anti-pollution campaign.

The city has issued a draft plan ordering steel mills, copper smelters, chemical makers and cement producers to shut down or cut production by as much as 50 percent by Aug. 3 at the latest, according to a city government document reviewed by Reuters.

“It is not sure when the output curbs will last...probably until the end of this year,” told Yu Le, an official at Changzhou Environmental Bureau, to Reuters on the phone, who confirmed the authenticity of the document.

Jiangsu is China’s second-largest steelmaking province.

Yu said the draft plan has been submitted to the Ministry of Ecology and Environment for review and some adjustments might be made after the city receives a response.

“Rates of production curbs are based on the operation situations and emission levels at companies and will be adjusted dynamically,” said the draft plan.

The draft plans follows Beijing’s push to adopt a more nuanced and “scientific” approach when it comes to curbing emissions from polluting firms as the country vowed to make the measures more efficient in order to meet the politically crucial targets.

More than 400 companies in Changzhou will have to enforce the compulsory production cuts though rates will vary.

Changzhou, home to steel mills and steel processing firms, mainly pipeline makers, produced 12.96 million tonnes of crude steel last year, accounting for 1.6 percent of the country’s total steel output.

Earlier this month, China’s top steelmaking city Tangshan in Hebei province ordered steel mills, coke producers and utilities to deepen output curbs for six weeks this summer in order to clear smog in one of the country’s most polluted areas.

Meanwhile, most of the steel firms in the city of Xuzhou, also in Jiangsu, remain shut due to environmental reasons.

Concerns over tight supplies in the market drove steel prices to a 5-1/2 year high on Monday.

South Korea plans to increase its tax on thermal coal, while lowering the tax on liquefied natural gas (LNG) to support the use of cleaner fuels for power generation, the finance ministry said on July 30.

The ministry said in a statement that it will increase the tax on thermal coal by 10 won to 46 won ($0.0412) per kilogram reflecting environmental costs of using the fossil fuel.

Meanwhile, the government plans to lower the tax on LNG to 23 won per kg from 91.4 won per kg.

Asia's fourth-largest economy, which imports almost all of its energy needs, has favoured coal and nuclear power to generate cheaper electricity and to ensure stable power supply.

South Korea now generates more than 70% of its power from coal and nuclear, while renewables account for 6%, but the country aims to gradually phase out coal and nuclear power.

Under the country's power supply plan, coal's share of power generation will fall to 36.1% in 2030 and nuclear to 23.9%, but those sectors will still make up more than half of the country's total power generation.

The revised tax is expected to go into effect from April 1, 2019, should the government plan be approved by parliament.

Caterpillar Inc on Monday raised its full-year profit outlook after earnings in the second quarter nearly doubled, beating market expectations, helped by global demand for its equipment.

The Deerfield, Illinois-based company now expects adjusted profit per share to be in a range of $11 to $12 in 2018, compared with $10.25 to $11.25 projected earlier.

The second increase to the profit outlook in the past two quarters helped allay investors’ concerns about the health of the global economy amid increasing trade frictions and pressure on costs. But the stock gave up early gains on worries that earnings might be approaching their peak.

“We are just stuck in this backdrop of ‘is this cycle getting toward the higher end?’ And if it is, you don’t want to own these cyclical stocks near the peak of the cycle,” said Stephen Volkmann, an analyst with Jefferies.

“Unfortunately, you can see good quarters get sold in that type of sentiment,” he said, adding that profit margins in the quarter were near the high end of the company’s own targets.

Those concerns have been weighing on the company’s stock since April, fueled in part by Caterpillar’s comments that its first-quarter performance was the “high-water mark” for the year.

Caterpillar’s shares were last up about 0.4 percent at $143.10. The stock has lost about 18 percent since January and last month fell to its lowest level since late October before recovering modestly.

Monday’s results, however, showed that a strong global economy, which is having its best run since 2011, is helping manufacturers like Caterpillar book more orders and deliver higher profits despite growing cost pressures.

For example, the company said demand for oil and gas and mining machines is so strong that it was taking orders for delivery well into 2019. At the end of the second quarter, its order backlog was $17.7 billion, up about $200 million from the first quarter.

It saw positive pricing in all of its principal business segments except construction industries.

This is in contrast to companies such as Ford Motor Co (F.N) and Harley-Davidson Inc (HOG.N), which are battling weak demand and do not enjoy the same pricing power to offset increased input costs.

Caterpillar, which serves as a bellwether for global economic activity, said tariffs could inflate material costs in the second half of the year by up to $200 million. It also expects supply chain challenges to continue to pressure freight costs.

However, it expects to take higher costs in its stride through the price increases it carried out on July 1 and through cost discipline.

In resource industries, higher commodity prices and strong global growth have helped improve the finances of mining customers, underpinning replacement demand and mine expansions.

In Caterpillar’s energy & transportation division, robust oil prices are supporting demand for well-servicing and gas compression applications in North America.

In the Asia-Pacific region, which accounted for nearly a quarter of company revenues, equipment sales were up 39 percent from a year ago, helped by increased construction activity and infrastructure investment in China.

Caterpillar reported an adjusted profit of $2.97 a share in the second quarter, compared with $1.49 a share last year. Analysts on average had expected earnings of $2.73 a share.

The company repurchased $750 million of shares in the second quarter and announced an up to $10-billion buyback authorization from January 2019.

The purchasing managers' index (PMI) for China's manufacturing sector came in at 51.2 this month, down from 51.5 in June, the National Bureau of Statistics (NBS) said Tuesday.

Activities of the country's non-manufacturing sector also expanded at a slower pace in July, with its PMI standing at 54, compared with 55 in June.

Though PMIs for both sectors dropped compared with the previous month, they still pointed to steady expansion as a reading above 50 indicates expansion, while a reading below reflects contraction.

The PMI for the manufacturing sector remained above 51 for five consecutive months while that for the non-manufacturing sector maintained at or above 54 for 11 months in a row.

The general PMI output index for July reached 53.6, down from 54.4 in June, indicating steady but slower production and operation activity expansion for the country's enterprises.

NBS senior statistician Zhao Qinghe attributed the slight drops in July's PMI figures to bad weather conditions, escalating trade tensions and a slack season for some sectors.

Vedanta Resources Plc Chairman Anil Agarwal’s family trust on Tuesday offered about $1 billion in cash to take the London-listed miner private.

Volcan, which currently holds about 67 percent of Vedanta, offered $10.89 or 825 pence per share to buy the rest of the stake. The deal valuing Vedanta at $3.07 billion represents a premium of about 6 percent to the stock’s Monday close.

An independent committee that evaluated the proposal unanimously recommended Volcan’s offer to Vedanta shareholders, the mining conglomerate said.

Shares of the company have risen 20.5 percent since Volcan made a possible offer at the same price on July 2.

Vedanta shareholders will also be entitled to receive a $0.41 dividend per Vedanta share, the company added. The offer price and dividend represent a total value of $11.30 per share.

The offer comes as the company faces scrutiny after police killed 13 people protesting Vedanta’s copper smelter in India in May.

China's energy consumption grew at a faster pace in the first half of this year, compared to the same period last year, as use of renewable energy posted steady momentum, official data showed on July 30.

Nationwide coal consumption rose 3.1% year on year, Li Fulong, an official with the National Energy Administration (NEA), said in a press briefing.

China's use of petroleum remained steady in the first half, up 2.5% year on year, while the use of natural gas saw an increase of 16.8% year on year, according to the NEA.

"China's energy mix has continued to improve, with the acceleration of greener growth and a low-carbon model," Li said.

According to Li, the share of clean energy has been increasing, and investment in overcapacity industries slowed.

In the first half, the increased installed capacity of renewable energy, including nuclear power, wind power, and solar power, accounted for 66.1% of China's total increased installed power generation capacity, according to the NEA.

The Trump administration plans to propose slapping a 25-percent tariff on $200 billion of imported Chinese goods after initially setting them at 10 percent, in a bid to pressure Beijing into making trade concessions, a source familiar with the plan said on Tuesday.

President Donald Trump’s administration said on July 10 it would seek to impose the 10-percent tariffs on thousands of Chinese imports.

They include food products, chemicals, steel and aluminum and consumer goods ranging from dog food, furniture and carpets to car tires, bicycles, baseball gloves and beauty products.

While the tariffs would not be imposed until after a period of public comment, raising the proposed level to 25 percent could escalate the trade dispute between the world’s two biggest economies.

The source said the Trump administration could announce the tougher proposal as early as Wednesday. The plan to more than double the tariff rate was first reported by Bloomberg News.

There was no immediate reaction from the Chinese government. In July it accused the United States of bullying and warned it would hit back.

Investors fear an escalating trade war between Washington and Beijing could hit global growth, and prominent U.S. business groups have condemned Trump’s aggressive tariffs.

Stock markets edged up globally on Tuesday on a report that the United States and China were seeking to resume talks to defuse the budding trade war.

Representatives of U.S. Treasury Secretary Steven Mnuchin and Chinese Vice Premier Liu He have been speaking privately as they seek to restart negotiations, Bloomberg reported, citing sources.

A spokeswoman for the U.S. Trade Representative’s Office declined to comment on the proposed tariff rate increase or on whether changing them would alter the deadlines laid out for comment period before implementation.

In early July, the U.S. government imposed 25-percent tariffs on an initial $34 billion of Chinese imports. Beijing retaliated with matching tariffs on the same amount of U.S. exports to China.

Washington is preparing to also impose tariffs on an extra $16 billion of goods in coming weeks, and Trump has warned he may ultimately put them on over half a billion dollars of goods - roughly the total amount of U.S. imports from China last year.

The $200 billion list of goods targeted for tariffs — which also include Chinese tilapia fish, printed circuit boards and lighting products — would have a bigger impact on consumers than previous rounds of tariffs.

Erin Ennis, senior vice president of the U.S. China Business Council, said a 10 percent tariff on these products is already problematic, but more than doubling that to 25 percent would be much worse.

“Given the scope of the products covered, about half of all imports from China are facing tariffs, including consumer goods,” Ennis said. “The cost increases will be passed on to customers, so it will affect most Americans pocketbooks.”

Trump had said he would implement the $200 billion round as punishment for China’s retaliation against the initial tariffs aimed at forcing change in China’s joint venture, technology transfer and other trade-related policies.

He also has threatened a further round of tariffs on $300 billion of Chinese goods. The combined total of over $500 billion of goods would cover virtually all Chinese imports into the United States.

The U.S. Trade Representative’s office initially had set a deadline for final public comments on the 10 percent proposed tariffs to be filed by Aug. 30, with public hearings scheduled for Aug. 20-23.

It typically has taken several weeks after the close of public comments for the tariffs to be activated.

Fifteen units are currently down at nine South African power stations, taking over 6,000 megawatts of power or 13 percent of Eskom’s output off the national grid, an internal document seen by Reuters showed on Tuesday.

Eskom provides more than 90 percent of the power for Africa’s most industrialised economy, but the state-owned utility has been hit by labour unrest over wage talks as it tries to reverse a decade of financial decline by cutting costs.

Earlier, it warned there was a high risk of electricity cuts on Tuesday because of “unplanned outages”. Power cuts during the ongoing winter are likely to cause hardship for millions.

U.S. Treasury extends time to divest from EN+, GAZ, Rusal

The U.S. Treasury Department said on Tuesday it had extended the deadline for investors to divest holdings in sanctioned Russian companies EN+, GAZ Group and Rusal to Oct. 23 from Aug. 5.

The U.S. Treasury in April imposed sanctions against billionaire Oleg Deripaska and eight companies in which he is a large shareholder, including giant aluminum exporter Rusal, in response to what it called “malign activities” by Russia.

Deripaska has held a controlling interest in En+, which in turn controls Rusal. Automaker GAZ is also part of his business empire.

Global miner Rio Tinto said on Wednesday its first half profit grew 12 percent, missing estimates and sending shares lower, but earmarked an additional $1 billion to buy back London-listed stock.

Underlying earnings for the six months to June 30 grew to $4.42 billion as higher iron ore output overcame lower prices. That was below forecasts of $4.53 billion, according to estimates in an independent survey of 15 analysts, though above $3.94 billion in the same period a year ago.

“Versus consensus, it’s a slight miss. It looks like aluminium was the problem at the divisional level,” said Jason Teh, chief investment officer at Sydney based Vertium Asset Management, which owns Rio shares.

Chief Financial Officer Chris Lynch attributed the miss partly to the market not taking into account pricing in old alumina contracts the company has, which cost Rio “a couple of hundred million” dollars as it missed out on exposure to recent price gains in alumina after the United States imposed sanctions on Rusal.

Rio declared a half-year dividend of $1.27 a share, equivalent to $2.2 billion, up 15 percent from $1.10 a share a year ago.

The increase in funds for share buybacks comes as asset sales worth $5 billion already announced in 2018 have left the world’s No. 2 iron ore miner with a cash pile well in excess of the $5.5 billion outlined for planned capital expenditure this year.

In one deal, Rio has outlined the proposed terms of the sale of its 40 percent stake in Grasberg, the world’s second biggest copper mine, to an Indonesian government-owned holding firm for $3.5 billion.

China’s southeastern province of Guangdong has issued draft guidelines that call for a ban on new industrial capacity for a range of businesses in the Pearl River Delta region, to limit air pollution.

The Delta, a manufacturing hub on the edge of the South China Sea that includes Guangdong’s main cities of Guangzhou and Shenzhen, was one of the few regions to meet China’s national air quality standard in 2017.

The Guangdong Environmental Protection Bureau said on Tuesday that the restrictions on new industrial capacity, which are subject to public consultation until Aug. 29, apply to business sectors including coal-fired power generation, steel, petroleum, petrochemicals, glass, ceramics and non-ferrous metal smelting.

No implementation date for the restrictions was mentioned.

The latest draft represents a tightening of previous guidelines, issued in April, for all new steel, petrochemical and cement plants in Guangdong to meet tougher emissions standards by December.

But, the move would match tougher action taken elsewhere. China’s State Council said in June it was banning new steel, coke and primary aluminum capacity in the Beijing-Tianjin-Hebei and Yangtze River Delta regions.

The Guangdong Environmental Protection Bureau also said it would strive to achieve concentrations of particulate matter smaller than 2.5 microns (PM2.5), a hazardous form of air pollution that can penetrate deep into the human lung, that are below 25 micrograms per cubic meter, without giving a time frame.

A separate document the Bureau released last month gave a province-wide average PM 2.5 concentration target of below 33 micrograms per cubic meter by 2020. It also said cities in the Pearl River Delta needed to eliminate no less than 10 percent of high-energy consuming companies every year until 2020. For cities outside the Delta, the target is 5 percent.

In Tuesday’s document, the bureau also said it was planning to work with Hong Kong, Macau and other nearby regions on pollution control.

Factory growth stuttered across the world in July, heightening concerns about the global economic outlook as an intensifying trade conflict between the United States and China sent shudders through trading partners.

Global economic activity remains solid, but it has already passed its peak, according to economists polled by Reuters last month. They expect protectionist policies on trade - which show no signs of abating - to tap the brakes.

But slowing growth, wilting confidence, and trade war fears are not likely to deter major central banks moving away from their ultra-loose monetary policies put in place during the last financial crisis.

“Growth overall is still there, and while there are risks, it’s holding up. The big picture of a trade war and protectionism is that it is a slow death - a death by a thousand paper cuts instead of anything sudden and shocking,” said Richard Kelly, head of global strategy at TD Securities.

“Growth is still resilient, unemployment rates are low, inflation and wages are rising - that’s the bigger picture and so they (central banks) have to keep tightening in the face of that,” he said.

Last month, China and the United States imposed tit-for-tat tariffs on $34 billion of each other’s goods and another round of tariffs on $16 billion is expected in August.

U.S. President Donald Trump’s administration, according to a source familiar with its plans, is poised to propose 25 percent tariffs on a further $200 billion of imports, up from an initial proposal of 10 percent. Its threat of tariffs on the entire $500 billion or so worth of goods imported from China still stands.

Beijing has pledged equal retaliation, although it only imports about $130 billion of U.S. goods.

World stocks fell and the dollar strengthened on Wednesday on fears of an imminent escalation in the U.S.-China tariff war. [MKTS/GLOB]

Morgan Stanley analysts estimate an 81-basis-point impact on global growth in a scenario of 25 percent tariff hikes across all imports from China and Europe, with U.S. growth slowing by 1 percentage point and China’s by 1.5 points.

Despite lethargic expansion rates, the European Central Bank last week reaffirmed plans to end its 2.6 trillion-euro stimulus programme this year and the Bank of England is widely expected to raise borrowing costs on Thursday [BOE/INT].

On Tuesday, the Bank of Japan pledged to keep its massive stimulus in place but made tweaks to reduce the adverse effects of its policies on markets and commercial banks as inflation remains stubbornly out of reach.

China has been cutting bank reserve requirements to ease the pain of its campaign to de-risk the financial system for smaller companies and support growth. It is also planning more spending on infrastructure to cushion the impact of trade tensions.

Nevertheless, any fiscal and monetary measures would take time to filter through.

“China’s economy is on track to slow this quarter and next,” said Julian Evans-Pritchard, senior China economist at Capital Economics in Singapore.

In the United States, growth is expected to cool slightly, but remain strong enough for the Federal Reserve to stay on track for two rate hikes this year, even if it is likely to hold rates steady this week [ECILT/US].

SIGNS OF SLOWDOWN

European factory growth remained subdued in July, with scant sign of a pick up anytime soon. Manufacturers across Asia provided evidence of a loss of momentum across the region.

IHS Markit’s July final euro zone manufacturing Purchasing Managers’ Index only nudged up to 55.1 from June’s 18-month low of 54.9, unchanged from an initial reading and still comfortably above the 50 level that separates growth from contraction. [EUR/PMIM]

Meanwhile, British factories lost momentum and manufacturers were their most downbeat in nearly two years, likely raising fresh questions about the actual need for a Bank of England interest rate hike on Thursday [GB/PMIM].

China’s Caixin/Markit Manufacturing PMI dropped to 50.8 from June’s 51.0, broadly in line with an official survey on Tuesday.

The headline number remained above the 50-point mark for the 14th consecutive month, but a reading on new export orders showed a marked contraction at 48.4.

“The data breakdown indicates that an uncertain demand outlook amidst the U.S.-China trade tariffs weighed on both output and sentiment,” said Aakanksha Bhat, Asia economist at HSBC in Hong Kong.

Similar surveys revealed slowing activity from Australia to Japan. PMIs also showed a contraction in Malaysia, a slowdown in Vietnam and Taiwan, and only a modest pick-up in Indonesia. South Korea’s exports showed slower-than-expected growth.

Growth in India’s manufacturing industry also slowed last month, according to a survey released showed just before the Reserve Bank of India raised interest rates.

The shipping container market, in which the vast majority of finished manufacturing goods are imported and exported, shows a similar gloomy picture: the Harpex container index CHT-IDX-HARPX has fallen by 10 percent from the highest levels since 2011 that it hit in June.

Australia’s trade surplus blew past expectations in June as exports to China boomed to their second highest on record, a sign the commodity-leveraged country was weathering the early stages of Sino-U.S. tariff hostilities.

A report on Thursday from the Australian Bureau of Statistics showed Australia’s trade surplus swelled by 158 percent to A$1.87 billion ($1.38 billion), double the market forecast and the largest since May last year.

Exports climbed 2.6 percent on a pick-up in a broad range of goods from iron ore and gold to farm and manufactured items, the data showed. Imports fell 0.7 percent as a pullback in petrol outweighed strength in transport and telecoms equipment.

The windfall owed much to China, which has been hoovering up Australia’s iron ore and coal output even as trade tensions with the United States have escalated.

Analysts noted that much of Australia’s exports to China are primary products used in the Asian nation’s domestic economy rather than for re-export. There has also been no sign of a slowdown in the rapid growth of Chinese tourism or the flow of students from the country.

Indeed, exports of goods to China hit the second strongest on record in June at A$10.34 billion, an increase of almost 40 percent from the same month last year.

“U.S. President Donald Trump would have few concerns with the U.S.-Australia trade imbalance - it is in the U.S. favor by A$18 billion over 2017/18,” noted Craig James, chief economist at fund manager CommSec.

“By contrast Australia’s trade surplus with China stands at almost A$38 billion.”

A PLUS FOR GROWTH

Liquefied natural gas sales to China and Japan have been a major growth area, with export earnings up 14 percent in June alone at just over A$4 billion.

Shipments are set to ramp up further as the giant Ichthys field off northern Australia has finally started producing after a long wave of delays. The $40 billion project run by Inpex Corp is Japan’s biggest overseas investment.

One risk to exports is a drought currently ravaging large parts of the farm belt in Australia, which is likely to cut agricultural shipments later in the year.

For the whole of the June quarter, Australia’s trade surplus came in at a seasonally adjusted A$2.9 billion, down modestly from the first quarter when a rebound in resource shipments flattered the accounts.

Much of that pullback looked to be due to changes in prices rather than volumes and thus not a drag on gross domestic growth (GDP), said Westpac senior economist Andrew Hanlan.

“Net exports are likely to be slightly positive in Q2, adding in the order of 0.1 percentage points to activity,” he estimated.

Analysts had thought trade - exports minus imports - would subtract from GDP in the second quarter given it had added a sizable 0.4 percentage points the quarter before.

The establishment of special-purpose companies tasked with state asset investment and operation will improve the allocation efficiency of state capital while giving substantial autonomy to state-owned enterprises.

The State Council released a series of guidelines on July 30 on promoting the pilot reform of state capital investment and operation companies, aiming to inject more vitality and anti-risk capacity into SOEs.

According to the guidelines, the companies will be solely state-owned and can be set up either via restructuring or new registration. State capital investment companies will make investments that are in line with national strategies and increase industrial competitiveness while state capital operation firms will be mainly be tasked with enhancing returns and operational efficiency, it said.

Wang Shifeng, an SOE researcher, said the restructuring gives SOEs more rights to self-management and greater decision-making power, which will in turn optimize state capital.

The guidelines allow SOEs more freedom in effectively allocating the assets, bringing in the modernized enterprise system through focusing on financial benefits and capital returns, said Wang.

"Under the guidelines, state capital investment companies will focus on serving the national strategy and helping state capital increase its industrial competitiveness, especially in sectors regarding national security and key aspects of the national economy," he said.

"The mechanism also allows private capital to play a bigger role," he added.

Li Jin, chief researcher at the China Enterprise Research Institute, said state capital investment and operation companies will carry out some of the responsibilities of the State-owned Assets Supervision and Administration Commission, including SOE restructuring and equity swaps.

What's more important is that the companies undertake the important tasks of structural adjustment optimization and restructuring of some industrial sectors, and the state-owned companies can be more market-oriented, a new chapter in state-owned capital management, he said.

The focus of SOE reform in the second half of 2018 will focus on authorized operation mechanism reform as well as mixed ownership reform, he said.

According to the State Council, the program will run on a pilot basis, and good practices are expected to be expanded.

China has been injecting vitality into thousands of SOEs in recent years through a series of reforms, including mixed ownership and market-oriented management reform.

China has pledged to step up reform of state-owned enterprises in the second half of this year, as the SOE regulator plans to carry out the diversification of equity at headquarters or group level, at two to three central SOEs within the year and push forward the strategic restructuring of central SOEs in key industries including further stepping up mixed-ownership reforms, according to the State-owned Assets Supervision and Administration Commission.

The commission on July 30 also released a document aimed at avoiding state asset losses with an accountability mechanism to punish illegal business operations and investments by centrally administered SOEs.

The document detailed 72 responsibility-tracking scenarios in 11 areas, including risk control, fixed asset investment, mergers, restructuring and overseas investment.

China plans to continue imposing pollution curbs measures in its smog prone Beijing-Tianjin-Hebei region and nearby areas from Oct. 1 until March 31, 2019, a draft plan issued by the environmental ministry showed on Thursday.

It aims to cut the concentration of breathable particles, known as PM2.5, by around 5 percent year on year during the winter in the region.

Heavy industries in the steel, non-ferrous, coke and construction materials sectors will be ordered to cut output capacity in the heating season, which typically begins in mid-November.

It also plans to switch 3.92 million households in the region to gas from coal heating by end-October.

https://www.reuters.com/article/china-pollution/china-to-impose-beijing-tianjin-hebei-pollution-curbs-oct-1-to-end-march-document-idUSB9N1SZ01N

Republican and Democratic U.S. senators introduced legislation on Thursday to impose stiff new sanctions on Russia and combat cyber crime, the latest effort by lawmakers to punish Moscow over interference in U.S. elections and its activities in Syria and Ukraine.

The bill includes restrictions on new Russian sovereign debt transactions, energy and oil projects and Russian uranium imports, and new sanctions on Russian political figures and oligarchs.

It also expresses strong support for NATO and would require that two-thirds of the Senate to vote in favor of any effort to leave the alliance.

Russian markets reacted quickly to the measure, with the rouble slumping toward two-week lows.

“The current sanctions regime has failed to deter Russia from meddling in the upcoming 2018 midterm elections,” said Republican Senator Lindsey Graham, one of the measure’s lead sponsors. Earlier this week, Graham had told reporters he planned a “sanctions bill from hell” to punish Russia.

Congress passed a Russia sanctions bill last summer but some lawmakers chafed at what they saw as President Donald Trump’s reluctance to implement it; he signed it only after Congress passed it with huge majorities.

Several provisions of the measure introduced on Thursday sought to toughen that law.

Democratic Senator Bob Menendez said the administration had not fully complied with those sanctions.

“This bill is the next step in tightening the screws on the Kremlin and will bring to bear the full condemnation of the United States Congress so that Putin finally understands that the U.S. will not tolerate his behavior any longer,” Menendez said.

Republicans and Democrats united last month in repudiating Trump’s failure to publicly condemn Russian President Vladimir Putin for interfering in the 2016 U.S. elections. Still, Congress failed to pass anything before lawmakers left Washington for their weeks-long summer recess.

The latest measure’s prospects were not immediately clear.

It would have to pass both the Senate and House of Representatives and be signed by Trump to become law.

Aides to the Senate’s Republican majority leader, Mitch McConnell, referred questions about the bill to the Senate Banking Committee. A committee spokeswoman said she had no details on what measures the panel might consider.

McConnell said last month Senate committees should hold hearings on legislation to stop Russia from future election meddling.

Both the Banking and Foreign Relations Committees have since scheduled hearings relating to Russia.

Japan’s biggest electric utilities are firing up old fossil fuel power plants and ramping up others that are already operating, pushing to meet demand as power prices hit record highs amid a deadly heatwave.

The deployment of older, dirtier stations that use commodities such as crude and fuel oil highlights the lingering effects of the Fukushima nuclear disaster in 2011, which has left most of the country’s reactors offline as operators upgrade them.

Like many other regions of the world, Japan has been hit by record temperatures in a two-week heatwave, with more than 80 people dying and thousands rushed to emergency rooms.

Surging appetite for power as households and businesses crank up their air conditioning has driven utilities to start up old fossil fuel plants that had been mothballed but kept on standby or to boost output at already-operational fossil units.

Kansai Electric Power, which supplies Japan’s western industrialized heartland where the heatwave has been most persistent, has started up two old oil-fired units, with total capacity of 1.2 gigawatts (GW), a spokesman told Reuters.

The nation’s second-biggest utility has also run one station fuelled by natural gas and another fired by oil at higher than planned output levels, he said, adding that Kansai had also received 1 GW of power from five other utilities.

The sweltering weather has driven prices on the Japan Electric Power Exchange for the Kansai region to just above 100 yen ($0.90) yen per kilowatt hour this week, the highest on record.

Meanwhile, Tokyo Electric Power the country’s biggest electricity provider and the operator of the wrecked Fukushima nuclear plant, has run oil, coal and gas plants at rates higher than their typical maximum capacity, a spokesman told Reuters.

He declined to say which plants were operating at these levels.

Japan relied on nuclear power for nearly a third of its electricity supply before the Fukushima disaster, but now has just six out of 40 available nuclear reactors running.

And the scorching conditions could be set to stay as July turns to August, typically the hottest month in Japan. Western Japan has a 50 percent chance of experiencing above-average temperatures over the month, the country’s weather bureau said this week.

Chubu Electric Power, the country’s third-biggest utility, sees electricity demand in July and August potentially exceeding initial estimates, President Satoru Katsuno told reporters on July 20.

“Our old thermal power plants are working hard. We must get our act together to keep them well maintained,” he said.

The Keystone XL crude oil pipeline project cleared a hurdle on Monday as the Trump administration said in a draft environmental assessment that an alternative route through Nebraska would not do major harm to water and wildlife.

The State Department’s assessment of a plan for an alternative route through Nebraska submitted by TransCanada Corp, the company trying to complete the pipeline, said Keystone XL’s cumulative effects would be “minor to moderate” on issues including water and biological resources.

It said the pipeline would have only minor impacts on cultural resources, such as Native American graves.

The Nebraska Public Service Commission approved the pipeline, but not TransCanada’s preferred path. The alternative route will cost TransCanada millions of dollars more than its original route.

The $8 billion 1,180-mile (1,900-km) pipeline that would transport heavy crude from Canada’s oilsands in Alberta to Steele City, Nebraska, has been fought by environmentalists and ranchers for more than a decade. Canadian oil producers who face price discounts for their crude due to transportation bottlenecks, support the project.

TransCanada did not immediately respond to a request for comment on the draft assessment which will be open for 30 days of public comment by the State Department before being finalized.

TransCanada plans to start preliminary work in Montana in coming months and full construction in 2019, according a letter sent in April from the State Department to Native American tribes.

Former President Barack Obama rejected the pipeline in 2015 saying it would mainly benefit Canadian oil producers.

President Donald Trump’s State Department approved the pipeline last year based on an environmental impact statement from 2014 that environmentalists said was outdated.

The Sierra Club, an environmental group, said the State Department was attempting a short cut to get the project built and a full review is required that considers changes in oil prices and market forces.

Keystone “is a threat to our land, water, wildlife, communities, and climate, and we will continue fighting, in the courts and in the streets, to ensure that it is never built,” said Kelly Martin, the director of Sierra Club’s Beyond Dirty Fuels Campaign.

The State Department said it could not comment on the new assessment due to ongoing litigation.

As Gulf Coast marine terminal owners consider ways to at least partially load Very Large Crude Carriers (VLCCs) at their facilities, a handful of midstream companies also are planning offshore terminals in deep water that would allow the full loading of VLCCs via pipeline. Projects under development by Oiltanking and other for sites along the Texas coast would appear to have at least two legs up on the Louisiana Offshore Oil Port, or LOOP. For one, they’d have more direct access to the Permian, Eagle Ford and other crudes flowing to coastal Texas. For another, the new terminals would be focused on crude exports — no double-duty for them. Today, we begin a review of the projects vying to be the first LOOP-like project in the deep waters off the Lone Star State.

U.S. crude exports hit the 3-MMb/d mark a few weeks back (the week ending June 22), and while they’ve since retreated slightly, there’s every reason to believe that export volumes will be ratcheting up in the months and years to come. They’ll almost have to, really. As we said in Got That Swing, the three production-forecast price scenarios that we assessed in our most recent update — crude prices flat at $70/bbl or $55/bbl to 2023, or (like the forward curve) ramping down to $55/bbl over the next five years — would result in crude production growth of between 2.0 MMb/d (under the flat-at-$55 scenario) and 5.0 MMb/d (under the flat-at-$70 scenario). That’s on top of the 11 MMb/d the U.S. is already producing, which is twice the 5.5 MMb/d rate back in 2010. U.S. refineries already are operating at close to full capacity, cranking out increasing volumes of gasoline, diesel and jet fuel for export, and while at least a few refinery expansion projects are being planned, they would only be capable of absorbing a small portion of the incremental crude production we’re likely to see. So export the U.S. must.

As of the week ending July 20 (the most recent data available from the Energy Information Administration or EIA), U.S. crude exports have averaged just over 1.8 MMb/d so far in 2018, up from 1.1 MMb/d on average in 2017 and 590 Mb/d in 2016. The clear preference of many long-distance shippers is to move their barrels in VLCCs, each of which can economically transport about 2 MMbbl of crude. The VLCC is the largest of the four types of tankers that account for the vast majority of international oil shipments (see Come Sail Away), the other prominent classes being (in descending size order) Suezmax (capacity ~1MMbbl), AFRAmax (~750 Mbbl) and Panamax (350 Mbbl to 550 Mbbl). They are giants — a typical VLCC is about 1,100 feet long, with a beam (or width) of nearly 200 feet and a fully loaded draft of 72 feet. But as we said in Rock the Boat, there’s still only one terminal on the Gulf Coast that can fill a VLCC to the brim — LOOP (green diamond in Figure 1), which is located in 110-foot-deep waters 18 miles off Port Fourchon, LA — and pipeline connections from key Texas and Oklahoma plays to LOOP are limited. (More on LOOP in a moment.) Elsewhere along the coast, VLCCs need to be loaded in offshore deep water by “full reverse lightering” from smaller vessels — a slower and more costly loading process that typically involves shuttling crude out in AFRAmaxes or other smaller vessels to a VLCC in a trans-shipment area (TSA) and transferring the crude onto the larger ship. More recently, a number of companies have been testing the docking and partial loading of VLCCs at terminals along the Texas coast, with the hope of using a hybrid approach — partially loading of VLCCs at the dock, followed by partial reverse lightering offshore in TSAs (see Working on a Dream), mostly in the Galveston Offshore Lightering Area (GOLA). That would be more efficient than the full reverse lightering in common usage today, but an even more efficient alternative would be to fully load a VLCC at an onshore dock — or at an offshore terminal in deep water á la LOOP.

Figure 1. Source: RBN

Fully loading VLCCs at land-based terminals along the Texas coast would require multi-year channel-deepening projects — even the ambitious dredging program planned for Corpus Christi (deepening the channel to 54 feet from the current 45 feet by 2022) wouldn’t be nearly enough to allow fully laden VLCCs there. A potentially simpler and quicker alternative would be to develop a new, greenfield offshore loading terminal in waters deep enough to accommodate fully laden VLCCs (72 feet or more), and to connect the facility by large-diameter pipe to onshore storage and pipeline networks to allow for rapid loading.

A number of such projects are now in various stages of planning. One we’ve learned about is a joint plan by Oiltanking, Enbridge and Kinder Morgan to build a new crude storage terminal in Freeport (TX) and connecting pipelines to a new offshore crude loading facility by 2022. The loading terminal would be located in the Gulf of Mexico about 30 miles offshore (yellow diamond) in waters about 100 feet deep — enough to easily accommodate VLCCs. (There would be space for two tankers to dock simultaneously.) The storage terminal would have about 10 MMbbl of capacity, and would be interconnected with Phillips 66 Partners and Andeavor’s planned 700-Mb/d Gray Oak Pipeline (purple line) from the Permian to the Corpus Christi and Freeport/Sweeny areas, and via Kinder Morgan’s existing Crude & Condensate Pipeline (green line) from the Eagle Ford to Sweeny. [As we said in All Dressed Up With Nowhere to Go, P66 Partners currently owns 75% of Gray Oak and Andeavor (now in the process of being acquired by Marathon Petroleum) owns the other 25%; Enbridge and other third parties hold an option to acquire up to a 32.75% stake, which if exercised would reduce P66 Partners’ share to 42.25%.] The planned Freeport storage capacity would be connected by pipeline to the Texas City and Houston areas. The connection between the new storage assets and the new offshore terminal would include about three miles of pipeline on land and another 30 miles of underwater pipe — all of it 42 inches in diameter. Loading onto VLCCs could occur at a rate of up to 85 Mb/hour, or 2 MMb/d — in other words, the storage and pipeline connector would enable a VLCC to be fully loaded in 24 hours.

The Oiltanking/Enbridge/Kinder Morgan project’s biggest selling points appear to be optionality and, of course, the ability to fully load VLCCs. Pipelines from the Permian that run only to Corpus Christi can really only serve the export market — there is relatively limited refinery capacity in Corpus compared to the Upper Texas Coast — but pipes like Gray Oak that also swing up the coast to Freeport/Sweeny (and connect to pipes to Texas City and Houston) enable shippers to respond to changing market dynamics and to serve a wider variety of customers. To be determined is whether the Freeport project would benefit (economically) from the fact that it requires “only” about 30 miles of undersea pipe — one competing project would require a much longer pipe and another calls a pipe only one-fifth as long.

How would the Freeport-area offshore project stack up against LOOP from an optionality/flexibility standpoint? Well, LOOP has direct pipeline access to what is one of the U.S.’s most extensive crude blending and staging storage facilities: the 72-MMbbl Clovelly storage hub (red dot) a few miles inland from where the LOOP Pipeline makes landfall. The problem for LOOP (as we discussed in Clovelly Calling?) is that Clovelly’s access to crude from the Permian, SCOOP/STACK and some other plays is relatively limited. In addition to crude imported through LOOP, Clovelly receives crude produced in the offshore Gulf of Mexico; its only direct pipeline link from Texas and other points west, though, is Shell Midstream Partners’ Zydeco Pipeline (blue line), which can transport no more than 350 Mb/d from storage terminals in Houston and Port Arthur/Beaumont, TX, and Lake Charles, LA. In contrast, the Oiltanking/Enbridge/Kinder Morgan project would have direct, unimpeded access to the Permian, which is not only the #1 production area in North America but which is poised for another round of rapid growth as soon as more takeaway pipeline capacity comes online.

https://rbnenergy.com/deep-water-contenders-in-the-race-to-build-crude-oil-export-terminals-off-the-texas-coast

The US Gulf Coast sweet-sour crude oil spread — which represents Light Louisiana Sweet over sour benchmark Mars — is at its narrowest point since late April, with the WTI-Brent spread returning to 2018 averages after spiking wider in May and June.

The 10-day moving average LLS-Mars spread was $3.12/b at the end of last week, having not been narrower since three months earlier when the spread was at or less than $3/b, S&P Global Platts data shows. The 2018 average is about $3.55/b and has fluctuated between $2.60/b on the narrow end seen on April 17 and $6.20/b at its peak on June 24.

That sweet-sour peak coincided with a wider Brent-WTI spread and caused LLS differentials to spike at a faster rate than those of Mars. A light sweet grade, LLS tends to react with better fundamentals for US crude exports, the

majority of which is light crude, with medium sour Mars seeing sporadic exports that mostly flow to Asia and South America.

However, the Brent-WTI spread narrowed sharply in July, causing US Gulf Coast crude oil values to collapse. The 10-day moving average Platts Brent-WTI Houston swaps spread was minus $5.71/b on Friday, down by about more than $4/b from its peak between $10/b and $11/b in mid-June, Platts data shows.

The extreme peaks and valleys may be stabilizing. Within the past two weeks, the Brent-WTI spread has started widening again and has returned to a typical for 2018 spread of $5-$6/b.

September differentials for Mars, which began active trading last week, have recovered from dropping to multi-year lows earlier this month when Brent-WTI was narrow. A bid for Mars was heard Monday afternoon at WTI cash plus 10 cents while it was offered at WTI plus 25 cents/b. The Mars differential has not been assessed at a premium to WTI since June 22.

Meanwhile, the LLS market remained rather quiet. It was assessed Friday at WTI plus $3/b. It was heard bid Monday at WTI plus $2.70/b and offered at WTI plus $2.90/b.

http://blogs.platts.com/2018/07/31/us-sweet-sour-crude-spread-loop/

Economic sanctions imposed on Iran will impact maritime traffic in the Strait of Hormuz, a main oil artery, an Iranian naval commander said Tuesday.

"The cruel sanctions being imposed on Iran will affect Strait of Hormuz functions," Rear-Admiral Hossein Khanzadi was quoted by the official Islamic Republic News Agency as saying.

The waterway between Iran and Oman is among the world's most heavily trafficked oil arteries, hosting about 35 percent of all of the world's oil moving by sea, or nearly 20 percent of the global trade in oil. Iran has said that if its oil exports are isolated by U.S. sanctions that go into force in November, it would ensure that nobody's oil would flow through the strait.

"It should be remembered that decisions made in international arena would not affect just a country; rather they would influence measures by other players too," the naval commander said.

Iran's latest warning follows signs that economic pressures are already taking their toll. The nation's currency, the rial, hit an all-time low against the U.S. dollar during the weekend. Iranian officials blamed their "enemies" for tryingto collapse the economy and stoke domestic unrest.

The U.S. decision in May to pull out of the multilateral Joint Comprehensive Plan of Action, a nuclear agreement that extended sanctions relief to Iran, leaves the deal in jeopardy. Without U.S. involvement, Iranian President Hassan Rouhani said Tuesday the agreement is in the hands of European powers.

"The ball is in Europe's court in the limited time remaining," he said during a meeting with the British envoy to Tehran.

European leaders have introduced measures aimed at protecting companies doing business with Iran, though U.S. sanctions pressures in Iran's Central Bank make those efforts complicated.

On Monday, U.S. President Donald Trump said he'd be willing to talk to Rouhani without preconditions. Bahram Qasemi, a spokesman for the Iranian Foreign Ministry, said that was unlikely.

"With this United States and with its policies, there will remain no way to negotiations as Washington has already proved its untrustworthiness," he was quoted by IRNA as saying.

Sidelining Iran from the energy markets could leave about a million barrels of oil per day off the market at a time when few other producers could make up for the difference in short order. Some U.S. sanctions go into force on Wednesday and oil-related measures snap back in November.

The American Petroleum Institute reported Tuesday that U.S. crude supplies rose by 5.6 million barrels for the week ended July 27, according to sources. The API data also showed supplies of gasoline fell by 791,000 barrels, while distillate stockpiles added 2.9 million barrels, sources said.

Supply data from the Energy Information Administration will be released Wednesday. Analysts polled by S&P Global Platts expect the EIA to report a fall of 2.4 million barrels in crude supplies. They also forecast a supply decline of 1.5 million barrels for gasoline and an increase of 560,000 barrels for distillates.

Brazilian oil exports hit a record of 8.1 million tonnes in July, nearly three times its shipments in June and 50 percent higher than a year ago, Brazilian government data showed on Wednesday.

In June, exports of the commodity totaled just 2.86 million tonnes, as Petroleo Brasileiro SA, known as Petrobras, directed more of its oil output to refineries to boost fuel production.

The government did not provide an explanation for the record July export figures.

Petrobras has begun operations on two platforms this year: the P-74 platform in the Buzios field in offshore Santos Basin in April, and the Campos de Goytacazes platform in the Tartaruga Verde Field in the offshore Campos Basin, in June.

Reuters reported last month that output from Buzios would only be shipped to China, Petrobras’s top destination for exports, starting in October.

While crude oil producers in the prolific Permian Basin are living out a Shale Revolution, the Midcontinent region of the U.S. is having a Refining Renaissance. Crude takeaway constraints, mainly due to insufficient pipeline capacity, are driving the prices of crude in Western Canada and West Texas to attractive lows against the WTI NYMEX benchmark for crude at the Cushing, OK hub. Cheaper oil can contribute to bigger margins for refiners, who are supplying increasing volumes into a retail market that’s selling gasoline at the highest prices in four years. What will happen if the refiners don’t rein in their runs? Today, we’ll explore the implications of record-high run rates in the U.S. refining industry.