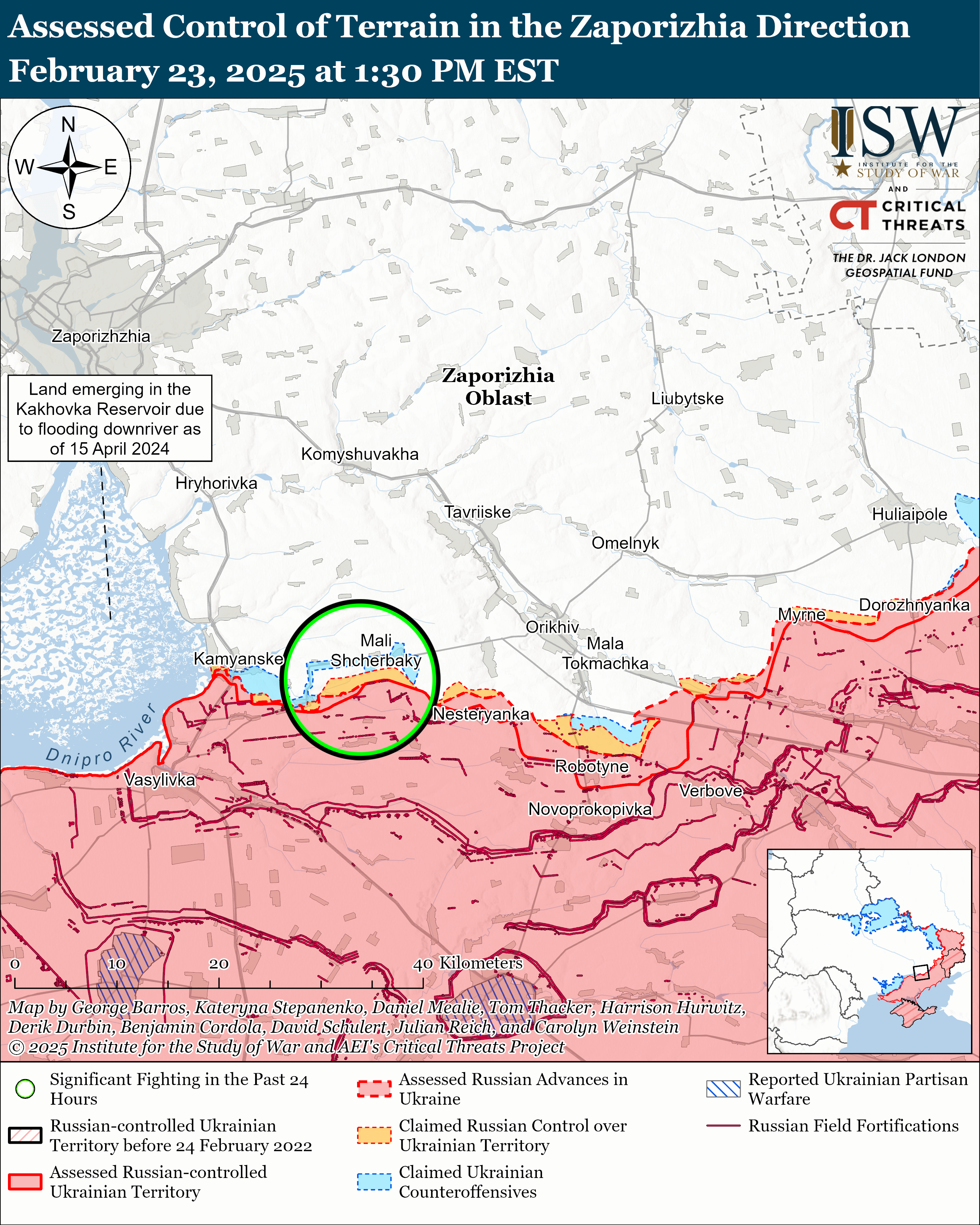

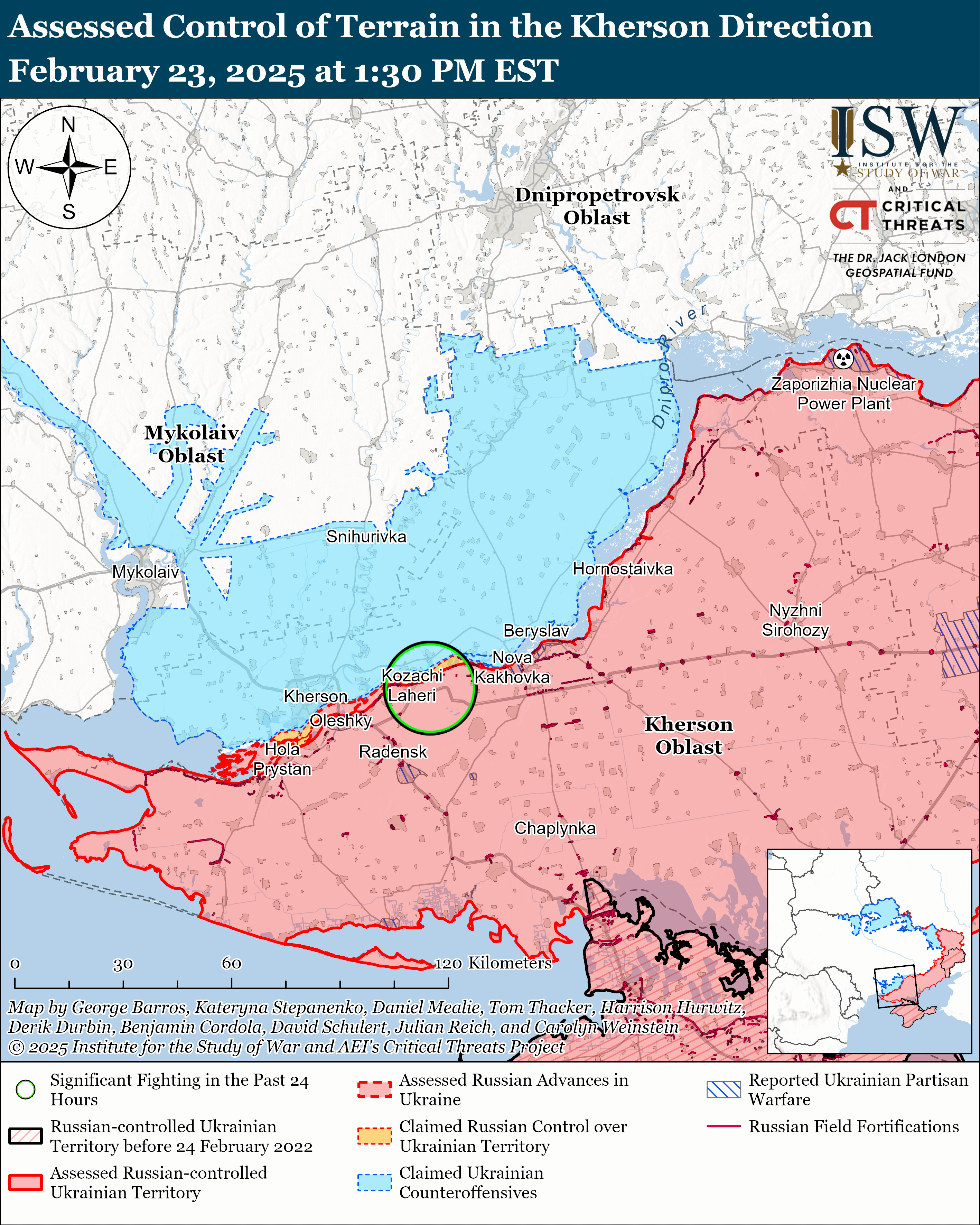

Russian Offensive Campaign Assessment, February 23, 2025

Feb 23, 2025 - ISW Press

Nicole Wolkov, Angelica Evans, Olivia, Gibson, and George Barros with William Runkel

February 23, 2025, 6:00 pm ET

Note: The data cut-off for this product was 12pm ET on February 23. ISW will cover subsequent reports in the February 24 Russian Offensive Campaign Assessment.

US Special Envoy to the Middle East Steve Witkoff referred to the early 2022 Istanbul protocols as offering "guideposts" for negotiations between Russia and Ukraine on February 23. An agreement based on those protocols would be a capitulation document. Russian President Vladimir Putin and other senior Russian officials have repeatedly identified the 2022 peace negotiations in Istanbul as their ideal framework for future peace negotiations to end Putin's war in Ukraine, as such a framework would force the West to concede to all of Russia's long-standing demands. The Wall Street Journal (WSJ) and the New York Times (NYT) reported in March and June 2024 that both publications obtained several versions of the draft treaties from the March and April 2022 Ukrainian-Russian peace negotiations in Istanbul that indicate that both sides initially agreed that Ukraine would forgo its NATO membership aspirations and be a "permanently neutral state that doesn't participate in military blocs."The draft treaties also reportedly banned Ukraine from receiving any foreign weapons or hosting any foreign military personnel. The WSJ and NYT reported that Russia pushed for the Ukrainian military to be limited to 85,000 soldiers, 342 tanks, and 519 artillery systems. Russia also reportedly demanded that Ukrainian missiles be limited to a range of 40 kilometers (25 miles), a range that would allow Russian forces to deploy critical systems and materiel close to Ukraine without fear of strikes. The draft treaties reportedly listed the United States, United Kingdom (UK), the People's Republic of China (PRC), France, and Russia as guarantors of the treaty, and Russia reportedly wanted to include Belarus as a guarantor. The guarantor states were supposed to “terminate international treaties and agreements incompatible with the permanent neutrality [of Ukraine]," including military aid agreements. The draft treaties did not specify if other non-guarantor states would have to terminate their agreements with Ukraine as well, although this is likely considering that the treaty would ban Ukraine from having any foreign-supplied weapons. Russia insisted on these terms in the first and second months of the war when Russian troops were advancing on Kyiv City and throughout northeastern, eastern, and southern Ukraine and before Ukrainian forces conducted successful counteroffensives that liberated significant swaths of territory in Kharkiv and Kherson oblasts.

Ukraine is unlikely to accept any peace agreement based on the Istanbul negotiations as such terms are effectively a full Ukrainian surrender to Russia's long-term war goals. The Istanbul negotiations effectively conceded to Russia's long-standing demands to "denazify" — overthrow and replace the democratically elected Ukrainian government and install a pro-Russian puppet state — and "demilitarize" — constrain and shrink the Ukrainian military beyond the point of being able to defend itself against future Russian aggression — Ukraine. The Istanbul negotiations also conceded to Russia's demands that Ukraine abandon its aspirations to join NATO or any other security blocs in the future. Ukrainian President Volodymyr Zelensky walked away from the Istanbul negotiations with the backing of Europe and the United States in 2022 and will almost certainly reject such terms in 2025.

Ukrainian President Volodymyr Zelensky continues to demonstrate his commitment to preserving Ukraine's democracy and a just resolution to the war. Zelensky responded to a hypothetical question during the "Ukraine. Year 2025" Forum on February 23 about stepping down as president and stated that he is ready to step down in the event of or to facilitate peace or immediate NATO membership for Ukraine. Zelensky noted that he remains committed to holding elections after the war ends and has no interest in being in power "for a decade" and reiterated that Ukraine cannot hold elections until after Russia stops attacking Ukraine and after Ukraine lifts martial law. The Ukrainian Constitution bars the government from holding elections or amending the Ukrainian constitution in times of martial law, and the Ukrainian government legally cannot abolish martial law while Russia continues to attack Ukraine. Zelensky has repeatedly noted Ukraine's commitment to holding fair and democratic elections in the future.

Zelensky stated during the press conference that several European officials will visit Kyiv for the third anniversary of Russia's full-scale invasion of Ukraine on February 24, 2025 and reiterated that European countries should be involved in future peace negotiations about the war in Ukraine. Zelensky noted that NATO membership is one of the best security guarantees that Ukraine could receive and that Ukraine would also consider membership in the European Union (EU), Western financing for an 800,000-person-strong Ukrainian military, and the presence of a Western peacekeeping contingent in Ukraine as acceptable security guarantees in the event of a ceasefire with Russia.

Ukrainian officials continue to highlight Ukraine's domestic defense industry and domestically produced strike capabilities. Ukrainian President Volodymyr Zelensky stated during the "Ukraine. Year 2025" forum on February 23 that Ukraine produced 2.2 million first person view (FPV) drones and over 100,000 long-range drones in 2025 and intends to increase its drone production rate in 2025. Zelensky stated that Ukraine produced 154 artillery systems in 2024 and intends to increase production of artillery systems in 2025 and noted that Ukraine is working to develop an analogue to the US-produced Patriot air defense system. Zelensky noted that Ukraine funded 40 percent, European countries funded 30 percent, and the United States funded another 30 percent of Ukraine's domestic defense production in 2024. Zelensky stated that Ukraine intends to fund 50 percent of its domestic defense production in 2025.

Ukrainian Defense Minister Rustem Umerov stated at the forum that Ukraine has become the largest producer of tactical and long-range drones in the world and that 96 percent of the Ukrainian military's drones are purchased or produced in Ukraine.[13] Ukrainian Digital Transformation Minister Mykhailo Fedorov announced that Ukraine intends to operationalize technology that will allow a single drone operator to control multiple drones in a "swarm" in 2025.[14] Ukrainian Commander-in-Chief General Oleksander Syrskyi stated that Ukrainian Unmanned Systems Forces conducted 130 long-range operations and struck 377 objects in Russia in 2024.[15] Syrskyi noted that Ukraine has deployed over 1.3 million drones to the frontline and is working to increase its production of fiber-optic drones. Syrskyi stated that Ukrainian long-range drones can strike targets up to 1,700 kilometres deep in Russian territory.

Russian President Vladimir Putin appointed Russian Direct Investment Fund (RDIF) CEO Kirill Dmitriev as Special Presidential Representative for Investment and Economic Cooperation with Foreign Countries on February 23. Dmitriev was part of the Russian delegation that met with US officials in Saudi Arabia on February 17, and a source close to the Kremlin told Russian opposition outlet Meduza in an article published on February 19 that Dmitriev's appointment to the delegation appeared largely as a response to US demands that Russia appoint someone that would "understand" the United States, likely given his experiences living and studying in the US at Standford University and Harvard University and working for US companies.

Russian forces launched a record number of drone strikes against Ukraine on the night of February 22 to 23, ahead of the third anniversary of Russia's full-scale invasion of Ukraine on February 24. The Ukrainian Air Force reported on February 23 that Russian forces launched three Iskander-M/North Korean-provided KN-23 ballistic missiles from occupied Crimea and 267 Shahed and other drones from the directions of Oryol, Bryansk, and Kursk cities; Shatalovo, Smolensk Oblast; Millerovo, Rostov Oblast; Primorsko-Akhtarsk, Krasnodar Krai; and occupied Cape Chauda, Crimea. The Ukrainian Air Force reported that Ukrainian forces downed 138 Shahed and decoy drones over Kharkiv, Poltava, Sumy, Kyiv, Chernihiv, Cherkasy, Kirovohrad, Zhytomyr, Khmelnytskyi, Rivne, Mykolaiv, Odesa and Dnipropetrovsk oblasts; that 119 drones were “lost,” likely due to Ukrainian electronic warfare (EW) interference; and that three drones flew toward Belarusian airspace. Ukrainian officials reported that drones damaged infrastructure in Dnipropetrovsk, Odesa, Poltava, Kyiv, and Zaporizhia oblasts and that a missile damaged civilian infrastructure in Kryvyi Rih, Dnipropetrovsk Oblast. Ukrainian President Volodymyr Zelensky stated on February 23 that Russia launched the largest number of Shahed drones against Ukraine on the night of February 22 to 23.

Russia appears to be relying more on Iran and North Korea to support its war in Ukraine. Iran has largely enabled Russia to launch near nightly series of large drone strikes as it has provided Russia with Iranian designed and produced Shahed drones and helped Russia establish its own Shahed drone production facility in Tatarstan Republic. Ukraine's Main Military Intelligence Directorate (GUR) Head Lieutenant General Kyrylo Budanov stated on February 23 during the "Ukraine. Year 2025" Forum on February 23 that half of Russia's ammunition comes from North Korea and that North Korea has started large-scale deliveries of 170mm self-propelled artillery system and 240mm multiple launch rocket systems (MLRS). Budanov added that North Korea plans to provide Russia with 148 ballistic missiles, presumably in 2025.

Russian forces continue to execute Ukrainian prisoners of war (POWs) in clear violation of international law. Ukrainian Ombudsman Dmytro Lubinets reported on February 23 that footage circulating on social media shows a Russian servicemember executing a Ukrainian POW in an unspecified area of Kursk Oblast. ISW has observed and reported on numerous instances of Russian servicemembers executing Ukrainian POWs along the frontline in Ukraine and Kursk Oblast and continues to assess that this is a systemic trend in the Russian military and that Russian commanders are either complicit in or directly enabling their subordinates to conduct such atrocities.

Key Takeaways:

https://understandingwar.org/backgrounder/russian-offensive-campaign-assessment-february-23-2025

More than three-quarters of the world’s cobalt comes from Congo. Credit: The Impact Facility

The Democratic Republic of Congo says it’s suspending cobalt exports for four months to rein in oversupply of the battery metal on the international market.

Cobalt production in Congo – which produces about three-quarters of the material used in electric-vehicle batteries – has soared in recent years, as China’s CMOC Group Ltd. ramped up output at two large mines in the country causing supply to race ahead of demand and prices to tumble.

“Exports must be aligned with world demand,” Patrick Luabeya, president of the Authority for the Regulation and Control of Strategic Mineral Substances’ Markets, known as ARECOMS, told Bloomberg News in written responses to questions.

The measure came into force on Feb. 22, according to Luabeya. A day earlier, the prime minister and mines minister signed a decree, seen by Bloomberg, allowing the regulator to take temporary action, including barring exports, “in case of circumstances affecting the stability of the market.”

Benchmark metal prices have dropped below $10 a pound, a level not breached for 21 years apart from a brief dip in late 2015, according to Fastmarkets data. Cobalt hydroxide, the main form of the metal produced in Congo, has slid below $6 a pound.

Glencore Plc, which operates a pair of mines in Congo, was the biggest miner of the metal for years until it was overtaken by CMOC in 2023. The Chinese company’s output tripled that of the Swiss commodities giant last year, accounting for more than 40% of total global supply. It’s targeting similar volumes in 2025.

While overall demand for cobalt continues to rise, it’s been outpaced by fresh supply and EV batteries that don’t contain the metal have been gaining market share. The surplus is expected until the end of the decade, according to Benchmark Mineral Intelligence analysis completed before the suspension was announced.

The government of Congo, which is also the world’s second-biggest producer of copper, “has been carefully reviewing market dynamics” for a year, Luabeya said.

The situation required “immediate action” as years of illegal mining and uncontrolled exports from both industrial and semi-industrial producers led to excessive supply, “posing a serious threat to the country and its domestic and international investors,” he said.

Cobalt is extracted as a byproduct of copper mining in Congo. While the block on cobalt shipments applies to all producers “unilaterally and without exception,” there are no curbs on production and there should be no impact on copper exports, Luabeya said. “Since copper and cobalt are marketed separately, exports of copper can continue.” CMOC is also Congo’s top copper producer.

The largest cobalt miner after CMOC and Glencore is Kazakhstan-backed Eurasian Resources Group Sarl. Glencore declined to comment, while CMOC and ERG didn’t respond to questions seeking comment on the export suspension.

About two-thirds of global mine supply is owned by companies from China, which accounted for around 60% of cobalt demand last year, according to specialist trading house Darton Commodities.

Congo will review the export curbs in three months, Luabeya said. Meanwhile, ARECOMS is preparing additional measures to balance the cobalt market, encourage the processing of strategic minerals in the country and achieve “a transparent and fair pricing mechanism,” he said.

The suspension comes a year after President Felix Tshisekedi tasked his government with designing policies to improve cobalt prices. Export quotas – one of the options suggested by Tshisekedi – are being considered “but no decision has been made yet,” Luabeya said.

https://www.mining.com/web/congo-suspends-cobalt-exports-for-four-months-amid-oversupply/

Ukraine-Russia war latest: Zelensky strikes minerals deal with Trump but ‘no specific US security guarantees’

Ukraine has agreed on a crucial minerals deal with the US after the Trump administration dropped key demands.

The draft agreement, however, does not specify any US security guarantees or continued flow of weapons but says that the US wants Ukraine to be free, sovereign and secure, Reuters reported, citing sources.

Kyiv hopes the deal, which will see a fund established between the two countries as they jointly develop Ukraine’s mineral resources, according to the Financial Times, will boost its faltering relationship with Washington.

Ukrainian president Volodymyr Zelensky plans to visit Washington on Friday to meet Mr Trump after the terms were agreed.

The US dropped Mr Trump’s demand for $500bn in potential revenue from Ukrainian resources, a condition which was rejected out-of-hand by the Ukrainian president.

Included in the deal was a US commitment to back Ukraine’s economic development into the future. Deputy prime minister Olha Stefanishyna told the FT: “The minerals agreement is only part of the picture. We have heard multiple times from the US administration that it’s part of a bigger picture.”

Germany's Election and the Shifting Sands of European Security

By Eurasianet - Feb 26, 2025, 2:00 PM CST

The incoming conservative-led government in Germany will face daunting challenges as it confronts a rapidly changing security environment in Europe while trying to protect Ukrainian sovereignty.

On the one hand, there is “an autocratic, perhaps even totalitarian aggressor” in the Kremlin, and on the other, “an unpredictable actor within the system of checks and balances” in the White House, Timm Beichelt, a professor at the European University Viadrina, told Eurasianet. The “aggressor versus friend” dichotomy has disappeared, and an unprecedented shift in Germany’s trans-Atlantic relations is occurring, Beichelt added.

This is the situation now facing Friedrich Merz, Germany’s chancellor-in-waiting. After winning the federal election February 23, his center-right Christian Democrats (CDU) now must engage in difficult talks on forming a government with the likely coalition partner being the Social Democratic Party (SPD). Only after a government is in place will Merz be able to address the security conundrum.

Merz has made it clear that his immediate foreign policy priority is strengthening European defense capabilities as quickly as possible “so that we can really achieve independence from the US step by step.” He has previously toyed with the idea of a new European defense alliance, hinting at the possibility of persuading France to extend its nuclear umbrella over Germany. On February 23, he went so far as to ask whether, at a NATO summit in June, “we will still be talking about NATO in its current form” or whether “we will have to establish an independent European defense capability much more quickly.”

“It is a completely different constellation now,” Beichelt said. “So, it might be time for the German government to look at [the Treaty on European Union] and somehow spell out to what extent this could actually be an operational mechanism” to bolster European defense capabilities.

According to Zsuzsanna Végh, a program officer at the German Marshall Fund, Merz’s government will strive to act as “a driving force behind strengthening the defense agenda within the EU.” This transformation, she added, will take time.

In the meantime, what to do about Ukraine? As Merz tries to form a stable German government, the Trump administration is trying to cut a Ukraine deal with Russia that could place Europe in a precarious security position. By all appearances, the White House is willing to agree to a ceasefire agreement that is highly beneficial to Russia. After talks with Trump in Washington, French President Emmanuel Macron said a truce could come within weeks.

“The United States is moving forward without Europe right now because it sees the EU as a minor player on the field,” Végh said.

There is not much Merz can do presently to bolster Ukraine’s defense capabilities. In December 2024, he promised to supply long-range Taurus missiles to Ukraine if he became chancellor. The question is whether he will now go ahead with these deliveries, in a symbolic gesture to demonstrate Berlin’s leadership on the Ukrainian agenda as Kyiv has entered the fourth year of war.

Végh believed that circumstances have become much more complex and that “the context itself is changing rapidly.” Members of the Free Democrats (FDP), a centrist party that did not make it into parliament, have called on Merz to act immediately. But as early as December, he indicated that Berlin would not act “unilaterally” on the missile-supply issue, but only in close consultation with Washington and European allies.

“The move would also have to be approved and decided by the new coalition government between the CDU, its sister party the Christian Social Union (CSU), and the SPD,” Végh added.

The negotiations to form a government promise to be complicated, but a grand coalition will likely not mean a significant shift on Germany’s Ukraine stance. Leading Social Democratic Party politicians, including Lars Klingbeil and Boris Pistorius, have been stoutly pro-Ukraine. Pistorius, the outgoing defense minister, has been an outspoken critic of Russia, and earlier in February said it was “regrettable” that the Trump administration “has made public concessions to [Russian leader Vladimir] Putin before [ceasefire] negotiations have even begun.”

One of the key issues on the table is the reform of Germany’s constitutionally enshrined debt brake. Defense spending is becoming increasingly important given the security gap Germany and Europe face as the Trump administration’s rapprochement with Russia grows. “The goal is not to remove the debt brake altogether, but to create room for fiscal maneuver,” said Nils Diederich, a German Social Democratic Party politician and political scientist.

The conservative bloc, the Social Democrats, and the Greens will not have the two-thirds majority in the new parliament to push through the reform. And the Left Party would only support an increase in defense spending if it were linked to social improvements. These potential difficulties in getting the changes through, whether in this or the next parliament, make the question of Germany’s ability to fund its growing defense ambitions while balancing this with support for Ukraine all the more challenging.

Meanwhile, amid mounting financial strains, a growing rift with the US, and difficulties on the Ukrainian front, experts believe Berlin’s Central Asia policy under Merz’s leadership will remain on the back burner. Beichelt does not expect a drastic departure from the regional course set by the outgoing government. “I don’t see any reason why Germany should withdraw from the Z5+1 format it has established with all five Central Asian states. It is a useful framework,” he said.

Beichelt believes the format contributes to the German government’s view that multilateralism is the way forward. “The fact that Trump is now turning to bilateralism is an encouragement for Berlin to invest even more in multilateral formats,” he said.

https://eurasianet.org/what-does-german-election-mean-for-ukraine

The Renegade Order

How Trump Wields American Power

Hal Brands

March/April 2025 Published on February 25, 2025

Donald Trump has already transformed the American political order. Not since Ronald Reagan has a president so dominated the national landscape or shifted its ideological terrain. In his second term, Trump could reshape global order in ways no less profound.

Today’s reigning, U.S.-led international system—call it Pax Americana, the liberal order, or the rules-based international order—arose from a brutal Eurasian century. The great global struggles of the modern era were contests to rule the Eurasian supercontinent. They inflicted horrific damage on humanity. They also created the most successful international order the world has ever known. That system has provided generations of great-power peace, prosperity, and democratic supremacy. It has bestowed pervasive, world-changing benefits that are now taken for granted. After the West’s victory in the Cold War, Washington sought to make that order global and permanent. Now, however, a fourth battle for Eurasia is raging, and the system is being menaced on every front.

All around Eurasia’s vibrant, vital periphery, revisionist states are on the move. China, Iran, North Korea, and Russia are attacking the regional foundations of Eurasian stability. They are forging alliances based on hostility to a liberal system that threatens illiberal rulers and inhibits their neoimperial dreams. War or the threat of war has become pervasive. The norms of a peaceful, prosperous world are under assault. The recurring terror of the last century was that Eurasian aggressors might make the world unfit for freedom by making it safe for predation and tyranny. That danger has flared anew today.

Trump isn’t the ideal defender of an imperiled American order. Indeed, one suspects he hardly thinks about international order at all. Trump is a hard-line nationalist who pursues power, profit, and unilateral advantage. He thinks in zero-sum terms and believes the United States has long been made a sucker by the entire world. Yet Trump intuitively understands something that many liberal internationalists forget: order flows from power and can hardly be preserved without it.

In Trump’s first term, that insight helped the United States begin a messy adjustment to the realities of a rivalrous age. In his second term, it could inform a foreign policy that—by squeezing adversaries as well as allies—bolsters the free world’s defenses for the fateful fights ahead. The world has long passed the point at which American leaders can aspire to globalize the liberal order. But Trump could succeed at today’s more limited and more vital undertaking: upholding a balance of power that preserves that order’s essential achievements against Eurasian aggressors determined to tear them down.

The problem is that this will require Trump to consistently channel his best geopolitical instincts when he will be sorely tempted to follow his most destructive ones instead. If he follows this destructive path, the United States will become less globally engaged but more aggressive, unilateral, and illiberal. It won’t be an absent superpower but a renegade one—a country that stokes global chaos and helps its enemies break the U.S.-led system. Trump’s presidency offers an opportunity to steer Washington toward a stronger, if less sweeping, defense of its global interests. Yet it also presents a grave danger: that Trump will take the United States not into isolationism but into something far more lethal to the world his forebears built.

CYCLES OF CONFLICT

Eurasia has long been the crucial theater of global politics. The sprawling landmass holds most of the earth’s people, economic resources, and military potential. It touches all four oceans, which carry goods and armies around the world. An empire that ruled Eurasia would have unmatched power; it could batter or intimidate the most distant foes. Three times in the modern era, the world has been convulsed by fights over the supercontinent and the waters around it.

In World War I, Germany sought a European empire stretching from the English Channel to the Caucasus. In World War II, a fascist alliance ran roughshod over Europe and maritime Asia and invaded the Eurasian interiors of China and the Soviet Union. In the Cold War, the Soviet Union assembled an empire of influence that stretched from Potsdam to Pyongyang and waged a decades-long struggle to overthrow the capitalist world.

Eurasian conflicts shattered continents and confronted humanity with the risk of atomic annihilation. Yet they also created opportunities for order. In the world wars, transoceanic coalitions turned back Eurasian aggressors, forging patterns of cooperation that brought the United States into the Old World’s strategic affairs. In the Cold War, Washington—twice burned by Eurasian conflagrations—opted to keep the supercontinent from combusting again.

American alliances deterred aggression against Eurasia’s industrially dynamic margins—Western Europe and East Asia—while also smothering old tensions within them. A U.S.-led international economy muted the autarkic, radicalizing impulses of the pre–World War II era. Washington cultivated a Western community in which democracy survived, thrived, and later spread to other regions. Only unprecedented investments by the overseas superpower could break the cycle of Eurasian conflict. The payoffs were historic advances—the avoidance, since 1945, of global war and global depression; the ascendancy of democratic values; seas made safe for trade and states made safe from death by conquest—that would have seemed impossible just decades before.

During the Cold War, the achievements of this order—then confined to the West—helped defeat the Soviet Union. In the unipolar era that followed, Washington tried to take its system global. The United States preserved and even expanded its Eurasian alliances as sources of influence and stability. It promoted democracy and markets in eastern Europe and other regions, trying to co-opt potential challenges by showing that people there could flourish in Washington’s world. Over time, the thinking went, this three-part package of U.S. hegemony, political convergence, and economic integration would foster a deep, enduring peace across Eurasia and beyond.

This post–Cold War project probably prevented an earlier, faster reversion to global rivalry. It made the world freer, richer, and more humane. But lasting Eurasian peace remained elusive. To illiberal states that sought to build or rebuild their own empires, the liberal order looked not enticing but oppressive. China and Russia used the prosperity that the U.S.-led system fostered to bankroll renewed geopolitical challenges. And American overreach in Afghanistan and Iraq left the United States poorly situated to resist the resulting threats during a critical decade. Today, a new geopolitical era is unfolding. The enemies of the liberal order have reclaimed the initiative, and Eurasia is once again the site of vicious struggles.

REVISIONISTS’ BALL

Every crucial corner of Eurasia is alight with coercion and conflict. In Europe, Russia’s war against Ukraine is also a war to rebuild a post-Soviet empire and fracture the existing security order. The covert counterpart of that war is a campaign of subversion spanning the continent, as the Kremlin conducts sabotage and political destabilization operations meant to punish its European foes. In the Middle East, Iran and its proxies have been battling Israel, the United States, and their Arab allies while Tehran has crept closer to the nuclear weapons it believes will indemnify its regime and ensure its regional primacy. In Northeast Asia, North Korea is improving its nuclear arsenal and long-range missiles, and it means to use the resulting leverage to sever the U.S.–South Korean alliance and bring the peninsula under its control. China, for its part, is bent on global power. For now, it is bullying its neighbors as part of a bid for a hulking sphere of influence—“Asia for Asians,” Chinese leader Xi Jinping calls it—and readying for war in the western Pacific by conducting one of the biggest military buildups in modern history.

From eastern Europe to East Asia, revisionist powers are seeking dramatic changes in the global balance of power. They are also trying to wreck the liberal order by smashing its most crucial norms. Russian President Vladimir Putin is reasserting the principle that strong states can swallow weaker neighbors. China’s revanchist claims and maritime coercion in the South China Sea are meant to show that big countries can simply grab the global commons. Putin’s quasi-genocidal barbarities in Ukraine and Xi’s industrial-scale repression in Xinjiang threaten to restore a world of autocratic impunity and rampant atrocity. The Houthis, a Yemeni militia backed by Iran, have created their own fundamental challenge to freedom of navigation, using drones and missiles to attack shipping in the Red Sea.

Each revisionist power seeks an environment conducive to repression and predation. Each understands it can best achieve its aims if the American order is laid low. The world is undergoing changes “the likes of which we haven’t seen for 100 years,” Xi told Putin in 2023—and the revisionists are pursuing those changes together.

China and Russia are linked in a “no limits” partnership that features ever-deeper economic, technological, and military cooperation. Iran and Russia have an expanding relationship that includes the exchange of weapons, technology, and expertise in how to evade Western sanctions. North Korea and Russia have sealed a full-blown military alliance and are fighting together against Ukraine. These ties don’t yet add up to a single, multilateral alliance. U.S. officials sometimes dismiss them as proof of Russia’s isolation and desperation amid its war in Ukraine. But the relationships are part of a thickening web of ties among the world’s most dangerous states, and they are already inflicting serious strategic harm.

Autocratic alliances intensify challenges to the existing order. Putin’s war in Ukraine, for example, has been sustained by the arms, troops, and trade he gets from his illiberal friends. A dictators’ peace within Eurasia also raises the risk of conflict around its margins. Putin can focus on Ukraine and Xi can more aggressively probe American power in maritime Asia because the two leaders know that their long, shared border is secure. These alliances are also changing regional military balances by giving Putin the arms he needs in Ukraine and by giving Putin’s partners the Russian weapons, technology, and know-how to accelerate their own buildups. Perhaps most alarming, these relationships fuse Eurasian crises.

Ukraine’s war has become a global proxy war, pitting the advanced democracies that support Kyiv against the Eurasian autocracies that back Moscow. And as autocratic alignments cohere, Washington must face the prospect that a war that starts in one region could spill over into others—and that the next country the United States fights could receive aid from its autocratic friends. In the meantime, the multiplicity of Eurasian problems overtaxes American resources and creates an atmosphere of pervasive, proliferating disarray. The strategic nightmare of the twentieth century—that Eurasian aggressors might combine forces to upend the global order—has been revived in the twenty-first.

HOLLOW VICTORIES

Trump is not the obvious man for this moment—in some ways, it’s hard to imagine anyone worse suited to it. He originally rode to power on a blistering critique of American globalism. He spent his first term tormenting allies and threatening to withdraw from trade deals and defense pacts that serve as pillars of the U.S.-led world order. His illiberal, even insurrectionary tendencies made him a model for would-be strongmen from Brazil to Hungary. If analysts have obsessed over the state of the liberal order during the Trump era, it is because he often seems set on throwing it all away.

Trump certainly lacks admiration for the liberal order’s achievements and sympathy for its basic ethos. His “America first” agenda holds that the world’s mightiest power has been systematically exploited by the system it created and that a country that has long shouldered unique global burdens has no obligation to pursue anything but its own self-interest, narrowly construed. He has little interest in the flourishing of liberal values overseas. Moreover, Trump has no respect for the orthodoxies of his predecessors, including their belief in the geopolitically soothing effects of globalization or their tendency to treat alliances as sacred obligations. Throughout Trump’s first term, his disdain for these traditions drove committed internationalists to despair and produced corrosive uncertainty within the democratic world. But Trump’s instincts also helped him spot accumulating problems in the post–Cold War project and initiate some needed adjustments.

First, Trump recognized that globalization had gone too far. Welcoming autocratic states—China, in particular—into the world economy had not made them members of a global community or primed them for political evolution. Instead, it had entrenched dictators and empowered them to challenge the United States. Whatever its economic merits, globalization created strategic vulnerabilities, such as Europe’s dependence on Russian energy and the democratic world’s entanglement with Chinese telecommunications firms. Trump recognized that defending American interests would require limiting and even reversing global integration—especially with countries on the other side of the widening geopolitical divide.

Trump also saw that the post–Cold War defense paradigm—in which U.S. allies disarmed and relied ever more heavily on a unipolar superpower—was out of date. That approach worked in the 1990s, when tensions were low and many analysts feared that U.S. allies, such as Germany and Japan, might rise again as threats. Instead, autocratic rivals reemerged and rearmed. Trump’s first term thus saw sustained, sometimes humiliating pressure on allies to raise defense spending, along with efforts to pivot the Pentagon away from counterterrorism and counterinsurgency and toward great-power threats.

Most fundamentally, Trump concluded that the ascendancy of the liberal order was over and the world of cutthroat power politics was back. Washington would henceforth demand more from its friends because it faced growing dangers from its enemies. The United States would have to wield its influence more aggressively against countries trying to reshape the system to their advantage—including through a “maximum pressure” campaign against Iran and strategic competition with China. It might have to downgrade democratic values to cultivate motley balancing coalitions, such as anti-Chinese alliances in the Indo-Pacific and stronger Arab-Israeli cooperation against Iran. In sum, Washington should focus less on the positive-sum project of globalizing the liberal order and more on the zero-sum imperative of stopping determined adversaries from imposing their own, antithetical visions of how the world should work.

Unfortunately, Trump never got as much as he could have out of these insights, because his good ideas were always at war with his bad ideas and because his administration was always at war with itself. His policies were often incomplete, inconsistent, or contradictory. His record during his first term was highly ambiguous: Trump damaged and derided the American order but also protected it from its excesses and its enemies. In the higher-stakes environment of his second term, he has a chance to be the ambivalent savior of that system—if he can resist the temptation to be its gravedigger.

REBALANCING ACT

One thing is certain: Trump will not become a lover of the liberal order. His geopolitical inclinations have not changed, and his antidemocratic tendencies have only gotten worse. His “America first” platform still features a stark, omnidirectional nationalism aimed at friends, enemies, and everyone in between. Yet given the state of the world, a sharp-elbowed superpower might not be the worst thing right now. If Trump can harness his more constructive impulses, he has a chance to pressure adversaries, coax more out of allies, and reinforce resistance to the Eurasian assault. More fundamentally, he has an opportunity to rightsize the U.S. approach to international order—to complete the shift to an era in which the United States isn’t expanding the liberal project but simply preventing its achievements from being destroyed.

Step one would be a major military buildup. The international order is sagging because the military balance of power is sagging. The Pentagon doesn’t have the resources to thrash Iran’s proxies while also countering China; it struggles to both arm Ukraine and support Taiwan. The United States probably could not buy enough military power to face all its rivals simultaneously. But if Trump’s “peace through strength” program took U.S. spending from just over three percent to around four percent of GDP, it could ease crippling munitions shortfalls and narrow the gap between Washington’s commitments and its capabilities. This would also require significantly more military spending by U.S. allies, which Trump—who might really kick free riders to the curb—could probably get.

Thus, a second initiative: tougher bargains with allies. Trump is wrong if he thinks that Washington doesn’t need alliances. But he is right that imperiled allies need them even more. There is an opportunity here to renegotiate existing security pacts. If frontline Asian democracies expect the United States to potentially fight World War III against China, they should make outlays commensurate with the existential threat they perceive. Likewise, the price for Trump’s commitment to NATO might be a European pledge to spend dramatically more—say, 3.5 percent of GDP—on defense, buy U.S. weapons to support Ukraine, and align with American tech and trade controls vis-à-vis Beijing. The process of renegotiating the transatlantic compact could be ugly. But the payoff would strengthen the alliance against two Eurasian threats.

Of course, Europe will not be stable without a decent peace in Ukraine. Trump’s promise to end that war quickly and cleanly is unrealistic. He might fail to end it at all. But his desire to do so does coincide with the imperative of preventing Ukraine from losing and the autocratic axis from winning a war that is gradually, but unmistakably, going in the wrong direction. In the near term, this will require accelerating the crisis facing Putin’s war effort by ramping up sanctions on Russia’s energy sector and its trade with China while delaying an equivalent crisis in Kyiv by conditioning continued support on fuller mobilization of Ukraine’s military-age population. In the longer term, Washington will need to fashion security guarantees for Ukraine that foreground European initiative but feature a credible American backstop.

Meanwhile, Trump could challenge the Eurasian axis by squeezing its weakest link. In recent months, Israel has brightened a grim geopolitical landscape by battering Iran and its proxies. Trump could increase the strain through aggressive sanctions and threats of fresh military action, whether U.S. or Israeli, against Tehran and what remains of its “axis of resistance.” The goal would be to bolster Middle Eastern stability by imposing new curbs on Iran’s nuclear program and limiting its capacity for sowing regional chaos. If Trump simultaneously compelled a vulnerable Iran to stop sending Putin drones and missiles—or simply revealed the limits of Moscow’s support for Tehran in a crisis—he might start the long, difficult process of straining the revisionist entente.

Trump could also craft a sharper China strategy by building on Biden-era policies that, in turn, built on Trump’s own first-term initiatives. Beijing’s belligerence should help the Pentagon keep stitching together tighter security relationships—and perhaps establish more military basing opportunities—in the Indo-Pacific. Higher U.S. and allied defense spending and larger weapons sales to Taiwan could slow the erosion of Washington’s military advantage. Harsher technology controls and tariffs could compound China’s economic crisis—if Trump doesn’t trade them away for a deal to sell Beijing more soybeans. Trump won’t win the struggle between Washington and Beijing, but he might strengthen the U.S. position for the long contest ahead.

Finally, Trump should seek to exploit escalation rather than avoid it. From Ukraine to the Middle East, the Biden administration painstakingly calibrated and telegraphed its moves to avoid escalatory spirals. Minimizing that risk sometimes allowed U.S. adversaries to predict and even dictate the tempo of these interactions. Trump, for his part, prizes unpredictability. If he showed, however, that he would cross new thresholds with little warning—by sanctioning Chinese banks that are facilitating Putin’s war or striking Iran in response to Houthi attacks in the Red Sea—he could force U.S. adversaries to contemplate uncontrolled escalation with the world’s strongest power.

All this would amount to an ambivalent defense of the liberal order. Trump might still engage in gratuitous protectionism and pick pointless diplomatic squabbles. But he could nevertheless achieve something essential: shoring up the strategic bargains and geopolitical barriers that keep the enemies of the U.S.-led order from breaking through.

REFORM OR REVOLUTION?

This agenda could stumble on its own contradictions: Trump will struggle to boost military spending, cut taxes, and slash the deficit all at once. Likewise, it will be hard to rally U.S. allies against China while pummeling them with protectionist measures. Trump could also falter because a world of ambitious, colluding autocracies is difficult even for the most skillful superpower to handle. Most fundamentally, Trump might fail because he is more of a wrecking ball than an architect—and he may take American policy down a darker course.

The most crucial question about Trump has always been whether he means to reform or revolutionize U.S. foreign policy. In his first term, the answer was usually closer to reform than revolution, thanks to the moderating influence of advisers and Republican allies and also because Trump—who delights in extorting diplomatic ransoms—hesitated to shoot the hostage by tearing up the North American Free Trade Agreement or leaving NATO. Yet Trump did, by all accounts, seriously consider pulling the trigger. His “America first” slogan is straight out of the 1930s. So if the optimistic scenario is that a president focused on posterity keeps reforming U.S. strategy for a viciously competitive era, the pessimistic scenario is that a president who now rules his party and administration will unleash the revolution with a purer, more radical version of “America first.”

This latter scenario would not mean a return to isolationism, since there is no such American tradition. Before World War I, the United States wasn’t a Eurasian stabilizer, but it was a hemispheric hegemon with a long, sometimes bloody record of territorial expansion. Today, a nastier version of “America first” would be lethal to the liberal order not just because the United States would say goodbye to Eurasian security commitments but because it would become more predatory and illiberal to boot.

The outlines of this agenda are not a mystery; Trump talks about them all the time. He has long mused about quitting NATO and other alliances, which bother him precisely because they tie the fate of the United States—history’s most physically secure country—to obscure disputes in distant regions. If U.S. allies cannot or will not hit higher spending targets, perhaps because Trump makes his demands too extreme, he might finally obtain his pretext to bring the legions home.

Likewise, if Trump tires of the travails of peacemaking in Ukraine, he might just walk away from that conflict and leave the Europeans to deal with the mess. If he sees Taiwan primarily as a high-tech rival, not a crucial security partner, he might slash U.S. support in exchange for economic benefits from Beijing. The United States would still maintain a mighty military, no doubt, but it would be one that is focused on fighting cartels in the New World rather than containing expansionists in the Old World. In the near term, this approach would insulate the United States from Eurasian quarrels and produce “wins” in trade concessions and dollars saved. Over time, however, it would dramatically raise the odds of key regions plunging into chaos or falling under the sway of aggressive states.

Rival powers might still suffer under this agenda. If Trump imposes the extreme 60 percent tariffs that he has threatened, he will hammer China’s export-dependent economy. If he wields tariffs mercilessly as tools of leverage, he will surely squeeze some concessions out of allies and adversaries alike. Yet harm to economic competitors might be outweighed by self-harm to the American system. Aggressive protectionism would reduce the collective prosperity that has long held the democratic world together and kill the cohesion needed to check a mercantilist China. Similarly, if Trump uses tariffs and sanctions, rather than global leadership and security commitments, to bolster the dollar’s primacy, he might make Washington look just as exploitative as the countries whose ambitions it means to thwart.

Meanwhile, the United States wouldn’t simply be de-emphasizing liberal norms and values; it would be casting a long, illiberal shadow. If Trump shutters hostile media outlets or turns the military or law enforcement agencies against his enemies, he will weaken American democracy while offering political cover, and a playbook, to every aspiring autocrat who wishes to attack a free society from within. Trump might also set back democratic values by coercing Ukraine into a lousy peace or supporting Hungarian President Viktor Orban and other rulers who seek to dismantle European liberalism. The balance of ideas reflects the balance of power. The democratic recession of recent years could become a rout if Washington quits the fight for the world’s ideological future—or, worse still, joins the other side.

Indeed, this version of “America first” wouldn’t just clear the way for Eurasia’s revisionists; it could well aid their cause. The revisionists aim to create an environment primed for expansion and plunder. Perhaps Trump gets along so well with Putin and Xi because he wants the same thing. Trump has said that the United States must annex Greenland, make Canada the 51st state, and reclaim the Panama Canal. He seems to envision a world in which strong states and strong rulers can do more or less as they like. Maybe this is all clever diplomacy—or mere trolling. But the further Trump takes this expansionist agenda, the more he risks alienating Washington’s closest allies and abetting the autocrats’ spheres-of-influence game.

These possibilities constitute a nightmare scenario for those who rely on the American order, but nightmares don’t always come true. Such a radical reengineering of U.S. strategy would face resistance from Democrats and some Republicans in Congress, and from the bureaucratic and international inertia that generations of American engagement have fostered. Stock markets would not react well to a protectionist onslaught. Yet the disquieting fact remains that a country with an extremely powerful executive branch has twice elected a president who seems deeply attracted to a slash-and-burn approach. Imagining an illiberal, renegade United States is only a matter of taking seriously what Trump says. The greatest risk of his second term, then, is not that he will abandon the liberal order. It is that he will make the United States actively complicit in its demise.

WHICH WAY IS UP?

The potential upside of Trump’s presidency is substantial. The potential downside is an abyss. The existence of such extreme possibilities is a source of international instability in its own right. It is also a testament to the double-edged nature of the hard-line nationalism Trump represents. If applied with discipline and a constructive spirit, such an approach could plausibly help the United States hold the Eurasian aggressors at bay. In a more extreme, unmoderated form, it could prove fatal to a system that requires a broad view of U.S. interests, a commitment to liberal values, and an ability to wield unmatched power with the right blend of assertiveness and restraint.

Here, unfortunately, lies the real problem with the optimistic framing: it requires assuming that Trump, a man who assiduously nurses his personal and geopolitical grievances, will discover—at the very moment he feels most empowered—the best, most globally minded and most diplomatically savvy version of himself. All those in the United States and elsewhere with a stake in the survival of the liberal order should hope that Trump rises to this challenge. But they should probably brace for the prospect that Trump’s world could become a very dark place.

https://www.foreignaffairs.com/united-states/renegade-order-trump-hal-brands

I have asked around my circles and can't seem to get a straight answer on why Nvidia's (NVDA) stock looks so cheaply valued on a price-to-earnings multiple basis.

So, I am coming to you for answers — drop them to me on X @BrianSozzi. What am I missing with Nvidia? Let's discuss!

I caution this is not me suggesting a Nvidia buying spree heading into earnings on Feb. 26. Yahoo Finance isn't a stock trading platform or investment bank. We are in the context game as it pertains to investing.

This is just a general callout that the market may have a flaw in how it's valuing Nvidia.

Nvidia is among the most cheaply valued AI stocks at the moment, if you can wrap your head around that one!

On a forward price-to-earnings multiple basis, Yahoo Finance data shows Nvidia trading at 31 times. Broadcom (AVGO) and Marvell Technology (MRVL) are valued at 35 times and 41 times, respectively. Arm Holdings (ARM) clocks in at 76 times.

Zoom out further, and Nvidia's stock is trading at a discount to several other "Magnificent Seven" members.

Tesla's (TSLA) stock is trading at 121 times forward earnings. Amazon (AMZN) trades at 36 times.

There are two reasons for this odd valuation level on Nvidia, the former analyst in me posits.

One, the Street is underbaking its forward estimates on Nvidia's earnings power.

Yahoo Finance data shows Nvidia's first quarter earnings per share (EPS) trend has drifted modestly lower over the past 30 days. The Street has also not pushed up its 2025 EPS estimates on Nvidia for more than 60 days.

I find this bizarre.

Despite China-based DeepSeek rocking the super-bullish AI thesis earlier this year, Wall Street still sees Nvidia profiting from the global buildout of AI infrastructure. Aggressive 2025 capital expenditures assumptions by hyperscalers such as Amazon (AMZN) and Meta (META) shared during this earnings season underscore the point.

"Over the coming decades, the investment [in artificial intelligence] is happening," Russell Investments chief investment officer Kate El-Hillow told me on Yahoo Finance's Opening Bid podcast.

Then the other possible explanation is with EPS estimates not rising, Nvidia's stock price is in wait-and-see mode. While the stock has rallied hard off the February DeepSeek lows, it has still underperformed the S&P 500 (^GSPC) this year. Shares are down from early November 2024 highs.

Given the DeepSeek and China trade war worries, I get it. But I come right back to the impressive structural drivers powering Nvidia's business.

Notes KeyBanc analyst John Vinh, "Nvidia remains uniquely positioned to benefit from AI/ML secular data center growth within the industry. With significant barriers to entry created by its CUDA software stack, we see limited competitive risks and expect Nvidia to continue to dominate one of the fastest-growing workloads in cloud and enterprise."

I suspect seconds after earnings hit on Feb. 26 after the close, this valuation disparity may be more easily explained.

https://finance.yahoo.com/news/one-ridiculous-chart-on-nvidia-ahead-of-earnings-133020976.html

Kyiv (Ukraine): Ukrainian President Volodymyr Zelenskyy has expressed his willingness to step down from office in exchange for Ukraine's membership in NATO.

"If there is peace for Ukraine, if you really need me to leave my post, I am ready. ... I can exchange it for NATO," Zelensky told a press conference in Kyiv, adding he would depart "immediately" if necessary.

Meanwhile, around $350 billion of worth of Ukraine's critical resources are in areas captured by Russia, Ukrainian authorities said Sunday, as Washington pushes for a deal to secure preferential access to the country's resource base.

Zelenskyy also said that he and US president Donald Trump should meet to discuss an accord granting Washington access to Ukrainian natural resources before any meeting between Trump and Russian leader Vladimir Putin.

To make an agreement on Ukrainian security concerns, "we need to meet and talk about it. I think that this meeting should be fair, which means before Trump meets Putin," Zelensky said.

They are vital for the production of electronics.

Trump and his aides have expressed frustration at Zelenskyy's unwillingness to sign a deal.

A source in Ukraine told AFP on Saturday the Ukrainian leader was "not ready" to agree to the current US demands.

Kyiv is pushing back against President Donald Trump's calls for Ukraine's resources to be used as compensation to the United States for aid delivered under President Joe Biden.

Rare earth metals are being highlighted by Donald Trump as the trump card for continued support to Ukraine. But if they exist in the Ukrainian mineral-rich soil – and can be extracted – is uncertain. It's not something you do overnight, says expert Alireza Malehmir.

Rare earth metals have come into focus as the USA wants to make a deal with Ukraine, where US President Donald Trump wants compensation for his support to Ukraine.

Ukraine has around five percent of the world's mineral deposits and ranks 40th among the world's mineral-producing countries, according to World mining data from last year. The country tops the world lists when it comes to iron, manganese, titanium, and graphite.

However, a lot of exploration is required to know if the country has extractable finds of the 17 elements classified as rare earth metals, according to Alireza Malehmir, professor of applied geophysics at Uppsala University.

Often, they are found together with other minerals that are then dominant – such as iron.

To be able to say that you have rare earth metals, you must first find the main raw material. Ukraine has that, so there may be potential, says Malehmir.

Highly Uncertain

But if they can be found, how large the finds are and whether they can be extracted is currently highly uncertain. Moreover, peace in the country is required to make the enormous infrastructure investments needed to begin extraction.

For example, in Sweden and globally, from the time you find evidence to the time you start mining – with all environmental considerations, access to water, and qualified personnel – it usually takes five to ten years.

He believes that the USA is primarily interested in critical minerals, such as lithium and titanium, which are already being extracted in Ukraine. They are important for modern technology, just like rare earth metals.

"Some Confusion"

I think there is some confusion, Ukraine has critical minerals but not rare earth metals in that sense. They certainly have lithium and some rare earth metals, but several other countries have that, he says, emphasizing the difference between what is known to exist and what may exist in the ground, says Malehmir.

Trump is said to have demanded rare earth metals worth $500 billion. Alireza Malehmir compares the sum to the $200 billion that the world's largest mining companies are worth – together.

With $500 billion, you could invest a lot. You could take over copper production worldwide.

Rare earth metals are a group of elements, including:

Lanthanum (La), cerium (Ce), praseodymium (Pr), neodymium (Nd), promethium (Pm), samarium (Sm), europium (Eu), gadolinium (Gd), terbium (Tb), dysprosium (Dy), holmium (Ho), erbium (Er), thulium (Tm), ytterbium (Yb), and lutetium (Lu).

Sometimes, scandium (Sc) and yttrium (Y) are also included.

The group is often abbreviated as REE, after the English term rare-earth elements.

Source: Swedish Geological Survey

https://swedenherald.com/article/unclear-if-rare-metals-can-be-extracted

The value of minerals in Ukraineʼs territories temporarily occupied (TOT) by Russia reaches $350 billion. But geological research still needs to be conducted to know the full extent of what Ukraine has.

This was reported by the Minister of Economy Yulia Svyrydenko during the forum "Ukraine. Year 2025".

According to her, Ukraine has significant deposits of lithium, titanium, and uranium. And the aggressor is currently using these resources, including in the fight. For example, for the aviation industry.

In the context of the agreement with the US on rare earth minerals, she emphasized that attracting investment, processing and development of deposits, and not just exports, are important for Ukraine.

"First, there needs to be an agreement on minerals, and then they will decide who will sign it," said the head of the Presidential Office Andriy Yermak, when asked who will sign the agreement on minerals with the United States.

What kind of agreement on Ukrainian minerals?

The US Treasury Secretary Scott Bessent brought a pilot draft of a minerals agreement to Ukraine on February 12. Washington had hoped that Kyiv would sign it immediately. President Zelensky said that he had banned the agreement from being signed because it would not protect Ukraine’s interests — it had no connection to investments, profits, or security guarantees.

Previously, Trump had stated that Ukraine had "essentially agreed" to transfer half a trillion dollars worth of rare earth metals to Washington as payment for American military aid.

Ukraine is ready to sign an agreement on rare earth metals, but Kyiv needs security guarantees, and they were not in the agreement. Zelensky added: "The document was clear in only one thing — we must give 50% of everything that is listed there."

After refusing to sign the document, Washington made the agreement even tougher, writes the NYT. Now the US demands 100% of revenues from natural resources, including minerals, gas and oil, as well as revenues from ports and other infrastructure.

The collapse of a food court roof at a shopping mall in northwestern Peru killed six people and left at least 78 others injured, the defense minister said Saturday.

The heavy iron roof at the Real Plaza Trujillo shopping mall, a city in the La Libertad region, fell Friday night on dozens of people who were at the site.

Defense Minister Walter Astudillo said at a news conference that according to the information provided by local firefighters in La Libertad, five people died on site and a sixth at a hospital after the collapse.

Astudillo also said that 30 injured people have already been discharged and 48 remain hospitalized. Three remained in critical condition. The minister expressed his condolences to the victims' families.

Luis Roncal, head of the local fire department, confirmed that they "did not find any signs of life" as they monitored with rescue dogs, but said that the search for survivors would continue with more than 100 firefighters and police officers searching through the debris.

Dozens of families were in the food court of the shopping mall when the roof collapsed, according to local media reports.

The Real Plaza shopping complex in Trujillo, the country's third-largest city, is located about 500 kilometers (310 miles) north of the capital Lima.

"There is a child trapped" under the roof's metal structures, said local government health official Anibal Morillo to broadcaster Panamericana.

Interior Minister Juan Jose Santivanez estimated the collapsed roof area was 700 to 800 square meters.

"We need hydraulic cranes to lift part of the roof that has not yet been removed because it is so heavy and to continue rescue operations for those who may be trapped," the minister told Canal N television channel.

According to the Regional Emergency Operations Center, the collapse occurred at 8:41 p.m. local time but was reported about half an hour later.

Some information in this report is from The Associated Press.

https://www.voanews.com/a/dead-78-injured-after-roof-of-peru-shopping-mall-collapses/7984708.html

By Felicity Bradstock - Feb 22, 2025, 4:00 PM CST

Despite Europe being home to some of the world’s biggest automakers, many of whom have developed several electric vehicle (EV) models, China is quickly becoming the global leader in EV manufacturing. Favourable government policies, easy access to critical minerals and battery technology, and low-cost manufacturing capabilities have spurred the development of a large EV production industry in China, and other parts of the world are struggling to compete. However, some European automakers are working to develop cheaper EVs to appeal to a market that might otherwise turn to China for its cars.

China, which was not well known for its car manufacturing until recently, is suddenly developing some of the world’s most popular EV models. Some established companies, as well as several startups, have grown at an accelerated pace over the last decade as the global demand for EVs has increased and the Chinese government has encouraged production.

The Chinese government began investing in research into EVs as early as 2001 and has since massively increased investment. To tackle air pollution and grow its EV industry, the Chinese government introduced incentives for EV uptake in the 2010s. It then reformed its industrial policy for the EV industry, introducing tax exceptions and subsidies for automakers. This has allowed the country’s EV market to grow rapidly, with several Chinese automakers offering a wide range of low-cost EV models to consumers worldwide. By 2024, the Chinese EV market size was estimated at almost $305.6 billion and it is expected to increase to almost $674.3 billion by 2029, growing at a CAGR of 17.15 percent.

Europe’s EV market meanwhile has been growing steadily as consumer demand for cleaner vehicles increases. Many well-known automakers have expanded their portfolios in recent years to offer several EV models. While these manufacturers may be known for their internal combustion engine (ICE) vehicles, many are finding it difficult to compete with Chinese offerings when it comes to EVs. While China now sells several low-cost EVs, no new European EV models for less than $26,200 were introduced to the market in 2022 or 2023.

The higher costs associated with European EVs are largely due to more expensive manufacturing costs, reliance on China and other countries for critical minerals and batteries, and strict EU regulations. While governments across the region were offering financial incentives for EV uptake in the early days of the technology, many of these schemes have now ended, driving up prices. However, this gradually appears to be changing, with more automakers now offering lower-cost EV models.

The EU introduced stricter carbon emissions targets at the beginning of the year, meaning that automakers that do not comply could face fines. This has resulted in a new wave of low-cost EVs entering the EU market. Consumers now have access to cheaper EV models in Europe, including the Fiat Grande Panda, the Citroën ë-C3, the latest Dacia Spring model and the Renault 5.

Experts believe that automakers may have held back models as they waited for the new regulations to be introduced in the region. Will Roberts, the head of automotive research at the consultancy Rho Motion, explained, “Selling a BEV [battery electric vehicle] for VW in December is basically worthless for them… If you can delay selling that EV to 2025” then it helps to avoid fines.” As new low-cost models flood the market, industry experts expect EV car sales to rise dramatically in 2025, after sales fell by an estimated 1.4 percent across the 18 largest western and northern European markets in 2024.

In October, several European automakers revealed low-cost EVs at the Paris Motor Show, suggesting the region may once again become more competitive with China. Julia Poliscanova, the senior director for vehicles and e-mobility supply chains at the Transport and Environment campaign group, said, “It feels like Europe is fighting back… There are so many new models on show, and what is really great is that there are a lot of launches that are more affordable. So, Citroen, Peugeot [and] Renault, they are all showing some smaller affordable models.” Poliscanova added, “This is exactly what we need for the mass market, for people to buy those vehicles more, and this is also where the competition from the Chinese is also the hardest.”

This month, Volkswagen teased a $20,500 entry-level EV that it plans to launch within the next few years. It is expected to be named ID.1 and replace the company’s Up hatchback. VW is expected to unveil the car in March, with the commercial launch provisionally set for 2027, in Europe only. Low-cost EVs are a core part of VW’s future plans, which include the ID.2 and the newly announced model. As the demand for affordable EVs increases, Volkswagen hopes these models will boost the company's profitability.

By Felicity Bradstock for Oilprice.com

Market leaders quickly becoming laggards — that's what investors have witnessed lately, provided one looks underneath the surface of the daily market action.

Some pros warn it could be sending a near-term negative sign for the broader market, which is dealing with new concerns ranging from tariffs to the possibility of no rate cuts from the Federal Reserve this year.

Many of the best-performing stocks in the market meaningfully declined last week, 22V Research strategist Jeff Jacobson pointed out in a client note on Monday. It's not just that many of the leaders stopped going up or outperforming, Jacobson said. In several instances, stocks that had broken out to the upside on earnings ended last week below where they trended before results were disclosed.

Two examples based on Jacobson's work include Robinhood (HOOD) and DraftKings (DKNG) — the former has lost 16% in the past five sessions while the latter has shed 25%.

Other leaders under pressure include JPMorgan (JPM), Goldman Sachs (GS), and Palantir (PLTR). All three stocks have underperformed the S&P 500's (^GSPC) modest gain in the past five sessions. Palantir has lost the most, with a 22% plunge amid heightened worries about insider stock selling.

Interestingly, after a stunning 20-day run of gains, Meta (META) saw its worst week since July, with a drop of 7.2%. The stock fell every day last week and continued to slide today.

Jacobson said the action is an "incredible reversal of fortune."

"If the largest, best performing, names have lost their market leadership for now, it may be hard for the indices to make new meaningful highs in the short-term," Jacobson wrote.

He added, "In addition, continued weakness in the very names that had lifted the market to new highs could result in some further short-term pain on the index level."

"This negative price action also comes at a seasonally weak period for the market and ahead of several potentially key catalysts," including Nvidia earnings, the February jobs report, key inflation reports, and a Fed policy decision, Jacobson wrote. "The market will also have to deal with a potential government shutdown deadline on 3/14 and the looming tariff deadlines on products from Canada and Mexico that were pushed back from early Feb to March."

The real leaders of the bull market also continue to perform weakly.

The "Magnificent Seven" trade of Meta (META), Amazon (AMZN), Google (GOOG), Apple (AAPL), Nvidia (NVDA), Microsoft (MSFT), and Tesla (TSLA) has been a mixed bag in 2025.

https://finance.yahoo.com/news/theres-an-ugly-trend-developing-in-the-stock-market-173015701.html

The two leaders discussed at length the recent developments in Russia-U.S. relations, a sign that such talks will not impact China and Russia’s close partnership.

On February 24, China’s President Xi Jinping held a phone conversation with his Russian counterpart, Vladimir Putin, in which the two men emphasized that no external force can drive a wedge between their two countries.

According to the Chinese Foreign Ministry readout, Xi told Putin: “History and reality make it clear to us that China and Russia are good neighbors that cannot be moved apart, as well as true friends that share hardships, support each other, and pursue common development.” He later emphasized that the China-Russia relationship “has a strong internal driving force and unique strategic value. It is neither targeted at any third party nor affected by any third party.”

Putin agreed. A statement from the Kremlin quoted him as saying: “Russian-Chinese political ties are an essential stabilizing factor in global affairs. This relationship is strategic in nature, not subject to political bias, and not aimed against anyone.”

The message was clear: the recent resumption of dialogue between the United States and Russia will not impact China-Russia ties. Some Trump administration figures had argued that their efforts to normalize ties with Russia – including seeking an end to the Russia-Ukraine War on terms extremely favorable to Moscow – could drive a wedge between Beijing and Moscow.

U.S. Secretary of State Marco Rubio, after talks with Russia in Riyadh earlier this month, spoke of “incredible opportunities” to partner with Russia, which he said “hopefully will be good for the world and also improve our relations in the long term.”

Most analysts believe the prospect of a “reverse Kissinger” is vanishingly unlikely; the latest Putin-Xi call should put to rest any such hopes.

(However, China may be trying to obscure the strength of this message to foreign audiences. Notably, in the Foreign Ministry’s official English translation of its readout, the line that China and Russia “cannot be moved apart” was removed.)

The call reportedly lasted over an hour and a half, a length all the more notable because Xi and Putin last spoke just over a month ago, on January 21. The frequency and length of their conversations itself is evidence that Moscow is taking pains to keep Beijing informed of new developments so as to avoid any disruptions to the China-Russia relationship.

The subject of Russia-U.S. relations was explicitly discussed during the latest call. “Putin informed his counterpart about the recent Russian-American contacts,” the Kremlin statement said. “The President of China expressed his support for the dialogue initiated between Russia and the United States, as well as China’s readiness to help find ways to settle the Ukrainian conflict peacefully.”

China’s own readout quoted Xi as saying that “China welcomes positive efforts made by Russia and relevant parties to resolve the crisis.”

China and Russia will be holding a number of exchanges this year. Not only is China hosting the Shanghai Cooperation Organization’s annual meeting – which will see Putin visit China – but both countries are planning to host events celebrating the 80th anniversary of the end of World War II. China and Russia will use such commemorations to highlight their relationship and to boost their global standing by leveraging the 1945 victory in the “World Anti-Fascist War.”

China and Russia should take advantage of the anniversary to “jointly safeguard… the fruits of victory in World War II… and to call on all countries to observe the purposes and principles of the U.N. Charter, uphold universally recognized basic norms of international relations, and follow true multilateralism,” Xi said.

With that in mind, China’s leader expects China-Russia relations to reach “new heights” in 2025.

A look at the day ahead in European and global markets from Stella Qiu.

It is a sea of red in Asia as investors grapple with risk posed by the U.S. intensifying its technology war with China in areas as varied as artificial intelligence, quantum computing and aerospace.

The U.S. also is seeking to toughen restrictions on the export of semiconductor technology to China - particularly chips from artificial intelligence leader Nvidia - with the help of allies, Bloomberg reported.

Hong Kong's Hang Seng index initially fell as much as 2.7%, dragged down by an almost 8% plunge in tech giant Alibaba following a 10% drop in its American Depository Receipts. The sell-off abated, though, as investors chose to buy the dip given that stock's recent world-beating rally.

The Hang Seng was last down 0.6% as Hong Kong-listed tech companies recouped early loss with more talk of demand for low-cost AI models from DeepSeek.

On Wall Street, investors continue to question whether massive spending on AI is justified, as evident in the cautious mood ahead of Nvidia's earnings on Wednesday where analysts expect a whopping 72% increase in quarterly revenue.

Gold is benefiting from the U.S. presidency of Donald Trump who was busy with Russia advocating a quick end to war in the Ukraine while dialling up tariff rhetoric against Canada and Mexico. The old-world asset set a record overnight, drawing tantalisingly close to $3,000 an ounce.

Curbing risk appetite is a series of soft U.S. economic data including retail sales, consumer confidence and surveys on the manufacturing and services sectors. They all came in weak and pointed to intensifying price pressure, eroding confidence in the exceptionalism of the U.S. economy.

Market participants have now fully priced in the prospect of the Federal Reserve lowering its policy interest rate by 50 basis points this year rather than 40 bps seen just last week.

Treasury yields duly touched fresh lows in the Asian trading session. Benchmark Treasury yields hit a two-month low of 4.377% while two-year yields touched 4.156%, the lowest since early December.

Next up will be the Conference Board's U.S. Consumer Confidence survey where analysts are wary of a repeat of the slump seen in the University of Michigan's equivalent poll.

Dallas Fed President Lorie Logan and Richmond Fed President Thomas Barkin speak later in the day with central bank watchers expecting them to echo the message that the Fed will be cautious in cutting rates.

European Central Bank board member Isabel Schnabel is also set to speak in London about the future of the central bank balance sheet.

https://finance.yahoo.com/news/sea-red-us-china-tech-054529318.html

Part of Putin's proposal could see Russia working with the US on aluminium production and supply from Russia [Getty Images]

Russian President Vladimir Putin said he is open to offering the US access to rare minerals, including from Russian-occupied Ukraine.

This comes after US President Donald Trump has repeatedly pushed for Ukraine to give up some of its minerals in exchange for support, in a deal which is currently being finalised, according to a Ukrainian minister.

In a state TV interview on Monday, Putin said he was ready to "offer" resources to American partners in joint projects, including mining in Russia's "new territories" - a reference to parts of eastern Ukraine that Russia has occupied since launching a full-scale invasion three years ago.

The proposal could also see the two countries collaborating on aluminium extraction and supply to the US to stabilise prices, he added.

In his televised interview, Putin countered Trump's push to access Ukraine's mineral deposits, saying they were ready to work with "foreign partners" including companies on mining minerals.

Ukraine has been facing growing pressure from the Trump administration to sign the deal, which has ended up in the centre of the growing rift between the US and Ukrainian presidents.