Aspate of large-scale street protests around the world, from Chile and Hong Kong to Lebanon and Barcelona, is fuelling a search for common denominators and collective causes. Are we entering a new age of global revolution? Or is it foolish to try to link anger in India over the price of onions to pro-democracy demonstrations in Russia?

Each country’s protests differ in detail. But recent upheavals do appear to share one key factor: youth. In most cases, younger people are at the forefront of calls for change. The uprising that unexpectedly swept away Sudan’s ancien regime this year was essentially generational in nature.

In one sense, this is unsurprising. Wordsworth expressed the eternal appeal of revolt for the young in The Prelude, a poem applauding the French Revolution. “Bliss was it in that dawn to be alive, But to be young was very Heaven!” he declared. Wordsworth was 19 years old when the Bastille was stormed.

Yet while younger people, in any era, are predisposed to shake up the established order, extreme demographic, social and political imbalances are intensifying present-day pressures. It is as if the unprecedented environmental traumas experienced by the natural world are being matched by similarly exceptional stresses in human society.

There are more young people than ever before. About 41% of the global population of 7.7 billion is aged 24 or under. In Africa, 41% is under 15. In Asia and Latin America (where 65% of the world’s people live), it’s 25%. In developed countries, imbalances tilt the other way. While 16% of Europeans are under 15, about 18%, double the world average, are over 65.

Most of these young people have reached, or will reach, adulthood in a world scarred by the 2008 financial crash. Recession, stagnant or falling living standards, and austerity programmes delivered from on high have shaped their experience. As a result, many current protests are rooted in shared grievances about economic inequality and jobs. In Tunisia, birthplace of the failed 2011 Arab spring, and more recently in neighbouring Algeria, street protests were led by unemployed young people and students angry about price and tax rises – and, more broadly, about broken reform promises. Chile and Iraq faced similar upheavals last week.

This global phenomenon of unfulfilled youthful aspirations is producing political timebombs. Each month in India, one million people turn 18 and can register to vote. In the Middle East and North Africa, an estimated 27 million youngsters will enter the workforce in the next five years. Any government, elected or not, that fails to provide jobs, decent wages and housing faces big trouble.

Numbers aside, the younger generations have something else that their elders lacked: they’re connected. More people than ever before have access to education. They are healthier. They appear less bound by social conventions and religion. They are mutually aware. And their expectations are higher.

That’s because, thanks to social media, the ubiquity of English as a common tongue, and the internet’s globalisation and democratisation of information, younger people from all backgrounds and locations are more open to alternative life choices, more attuned to “universal” rights and norms such as free speech or a living wage – and less prepared to accept their denial.

Political unrest deriving from such rapid social evolution is everywhere. Lebanon’s “WhatsApp revolution” is a perfect example. Yet some protests, such as those in Hong Kong and Catalonia, are overtly political from the very start.

FacebookTwitterPinterest

FacebookTwitterPinterestYoung Hong Kongers face familiar problems over scarce jobs and high rents. But by taking on China’s authoritarian regime, they have assumed pole position in a struggle against autocratic “strongman” rulers everywhere. Their campaign has international resonance, which is why China’s President Xi Jinping fears it.

It is difficult, if not perverse, to watch protesters risking torture and death by challenging Egypt’s dictator, Abdel Fattah el-Sisi, and not relate their daring both to Hong Kong and, say, to Kashmiris’ efforts to throw off the yoke imposed by another “strongman”, India’s Narendra Modi. When Palestinian youths taunt the Israel Defence Forces with flags and stones, are they not part of the same global fight for democratic self-determination, basic freedoms and human rights espoused by young Muscovites opposing Vladimir Putin’s cruel kleptocracy?

In this sea of protest, a common factor is the increased willingness of undemocratic regimes, ruling elites and wealthy oligarchies to use force to crush threats to their power – while hypocritically condemning protester violence. Repression is often justified in the name of fighting terrorism, as in Hong Kong. Other culprits include Saudi Arabia, Turkey, Myanmar and Nicaragua.

Another negative is the perceived, growing readiness of democratically elected governments, notably in the US and Europe, to lie, manipulate and disinform. Distrust of politicians, and resulting public alienation, is the common ground on which stand France’s “gilets jaunes”, Czech anti-corruption marchers and Extinction Rebellion. As William Hazlitt, the 18th-century essayist and celebrated mocker of Wordsworth might have said, disbelief is the new spirit of the age.

Perhaps these protests will one day merge into a joined-up global revolt against injustice, inequality, environmental ruin and oppressive powers-that-be. Meanwhile, spare a thought for a different type of protest – the one you never hear about – and what that may entail. The stifling silence that hangs over North Korea’s gulag, China’s Xinjiang and Tibet regions, and dark, hidden places inside Syria, Eritrea, Iran and Azerbaijan could yet descend on us all. What helps protect us is the noisy, life-affirming dissent of the young.

https://www.theguardian.com/world/2019/oct/26/young-people-predisposed-shake-up-established-order-protest

Indonesia’s nickel miners agreed on Monday to stop nickel ore exports immediately, the country’s investment agency chief Bahlil Lahadalia said, after Jakarta last month brought forward a ban on shipments to January 2020 from 2022.

Exports due to be shipped from Indonesia, the world’s biggest nickel ore producer, will be bought by local smelter operators at an international price level, Lahadalia said.

“This agreement was carried out not on the basis of a letter from the government or technical ministry, but a joint agreement,” Lahadalia said. “Where the agreement is carried out by the nickel association with us the government.”

Indonesia’s government in September expedited the ore export ban by two years as part of its efforts to boost expansion of a local smelting industry.

Expectations of the Indonesian ban have pushed nickel CMNI3 prices on the London Metal Exchange (LME) up nearly 40% to around $17,000 a tonne now. In September, they hit a five-year high of $18,850 a tonne.

A spokesman at the mining ministry, which issues regulations on ore exports, said he could not immediately comment.

Lahadalia, who was appointed last week by President Joko Widodo in his new cabinet, said nickel companies agreed not to export ore based on “collective awareness” to create added value to Indonesian resource exports by processing them onshore.

Nickel smelters have been having problems buying raw material for their plants since Indonesia announced it was moving forward the ore export ban to January.

China’s Tsingshan, the biggest smelter operator in Indonesia, will cut production by 20% starting in November due to scarcity of ore and as the rainy season begins, to maintain its levels of ore inventory, said a company official in Jakarta.

Alexander Barus, executive director at PT Indonesia Morowali Industrial Park, Indonesia’s largest nickel industrial park -where Tshingshan operates - said smelters in Morowali were ready to buy ore from miners.

“We will buy according to our stockpile capacity and when the specification and prices are suitable,” Barus said after attending the meeting with the investment agency chief.

Meidy Lengkey, secretary general of Indonesian Nickel Miners Association, told Reuters that miners were fine with the export stoppage as long as the government helps to support domestic ore prices.

“We are supportive, but prices given to miners should be fair,” she said.

Miners have complained that local smelters are pricing nickel ore at much lower price compared to those exported.

The mining ministry said they will revise pricing rules to put a floor price for ore.

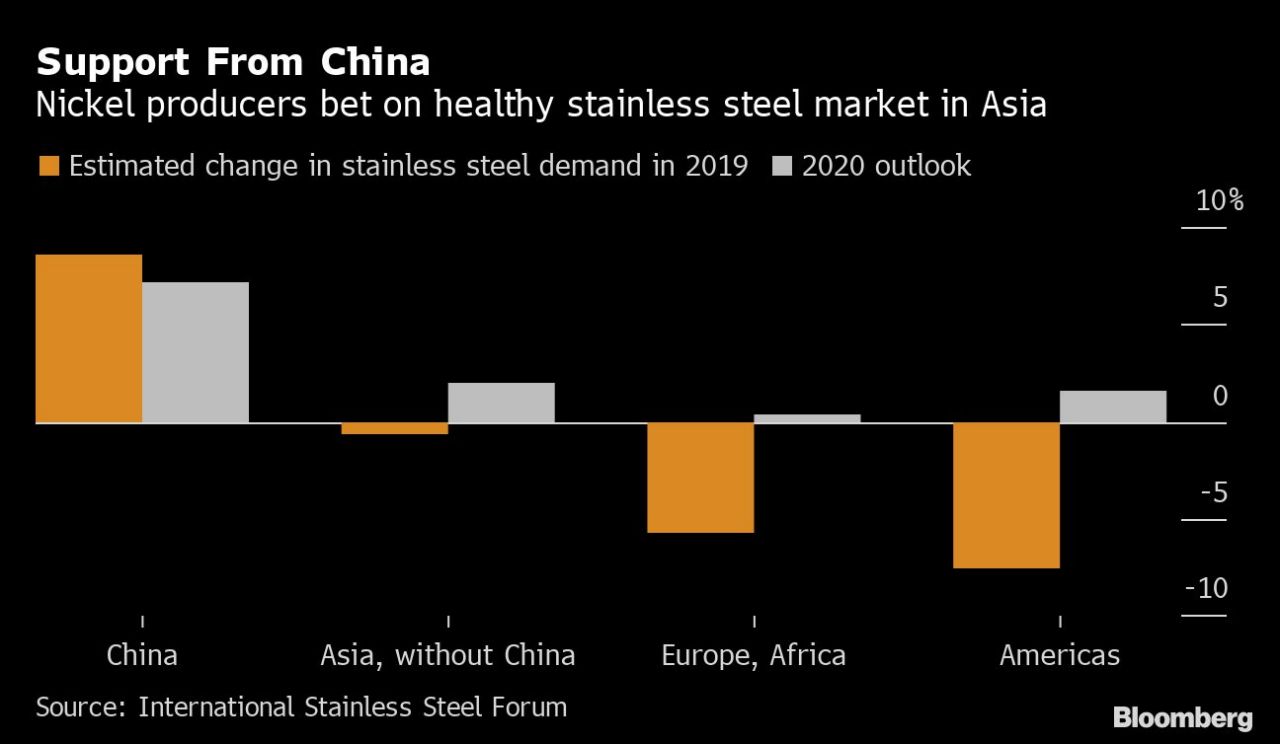

A poll conducted during LME week in London on Monday October 28 showed that both gold and nickel were voted as metals with the greatest potential for 2020, each garnering 27% of votes.

Copper, with 23% of votes, was runner-up.

Offshore, LNG buoy Baker Hughes in third quarter

Baker Hughes CEO Lorenzo Simonelli, left, comments about the new branding logo of Baker Hughes with the downgrading of GE ownership, as Chief Marketing and Technology Officer Derek Mathieson, right, listens during an interview with company officials at their offices Thursday, Oct. 3, 2019 in Houston, TX. CONTINUE to see recent earnings from area energy companies. less Baker Hughes CEO Lorenzo Simonelli, left, comments about the new branding logo of Baker Hughes with the downgrading of GE ownership, as Chief Marketing and Technology Officer Derek Mathieson, right, listens ... more Photo: Michael Wyke / Contributor Photo: Michael Wyke / Contributor Image 1 of / 39 Caption Close Offshore, LNG buoy Baker Hughes in third quarter 1 / 39 Back to Gallery

Offshore work and liquefied natural gas projects helped to buoy Houston oil field service company Baker Hughes during the third quarter.

In an early Wednesday morning statement, Baker Hughes reported posting a $57 million profit on nearly $5.9 billion of revenue during the third quarter. The figures were higher compared to the $13 million profit on nearly $5.7 billion of revenue during the third quarter of 2018.

This year’s this quarter figures translated into earnings per share of 21 cents for stockholders, which were higher compared to the 3 cents per share during the same time period last year.

Baker Hughes nonetheless missed Wall Street expectations of $6.1 billion of revenue and earnings per share of 24 cents.

Shale Slump: Oil field service sector braces for more pain

The company's earnings report come at time when $50 per barrel crude oil prices have created a drilling slump in shale fields across the United States and Canada that has sent the rest of the oilfield service sector hemorrhaging with losses.

In a statement, Baker Hughes CEO Lorenzo Simonelli said the company delivered a solid quarter based on contract wins from it turbomachinery and oilfield equipment divisions as well as improved margin from its oilfield services division.

Among the contract wins, Norwegian oil company Vår Energi tapped Baker Hughes to provide 16 underwater production systems in the Balder X field of the North Sea.

Venture Global LNG also awarded Baker Hughes a contract and granted a notice to proceed with construction for the Calcasieu Pass LNG export terminal in Louisiana.

A major oil company selected Baker Hughes as its sole artificial lift provider in the Permian Basin while Saudi Aramco signed a five-year contract with the Houston company for services in Saudi Arabia.

"Overall, we are very pleased with our execution as a team, and we believe Baker Hughes is firmly on the right path financially, operationally, and strategically,” Simonelli said.

Fuel Fix: Get daily energy news headlines in your inbox

With roots in Texas going back to 1907, Baker Hughes now employs more than 64,000 people in 120 nations. The company reported a $195 million profit on nearly $23 billion of revenue during 2018.

The earnings report comes roughly seven weeks after Boston industrial conglomerate General Electric reduce its ownership stake to around 40 percent, allowing Baker Hughes to become an independent company.

Seizing upon that momentum, Baker Hughes rolled out a new logo in early October and rebranded itself as an oilfield technology company.

Read the latest oil and gas news from HoustonChronicle.com

The US military has conducted an operation against elusive Islamic State leader Abu Bakr al-Baghdadi, a US official says, as President Donald Trump prepares to make a "major statement" at the White House.

The official, speaking on condition of anonymity, was unable to say whether the operation against Baghdadi was successful.

Newsweek said it had been told by a US Army official briefed on the raid that Baghdadi was dead.

It said the operation took place in Syria's northwestern Idlib province, and was carried out by special operations forces after receiving actionable intelligence.

The official, speaking to Reuters, did not disclose details of the operation and other US officials contacted by Reuters declined to comment. The Pentagon did not immediately respond to a request for comment.

White House spokesman Hogan Gidley announced late on Saturday that Trump would make a "major statement" at 9am US eastern time on Sunday.

Gidley gave no further details as to the topic of Trump's statement.

The president gave an indication that something was afoot earlier on Saturday night when he tweeted without explanation, "Something very big has just happened!"

Trump has been frustrated by the US news media's heavy focus on the Democratic-led impeachment inquiry, which he calls an illegitimate witch hunt.

He has also faced withering criticism from both Republicans and Democrats alike for his US troop withdrawal from northeastern Syria, which permitted Turkey to attack America's Kurdish allies.

Many critics of Trump's Syria pullout have expressed worries that it would lead the Islamic State militancy to regain strength and pose a threat to US interests. An announcement about Baghdadi's death could help blunt those concerns.

Baghdadi was long thought to be hiding somewhere along the Iraq-Syria border. He has led the group since 2010, when it was still an underground al-Qaeda offshoot in Iraq.

On September 16, Islamic State's media network issued a 30-minute audio message purporting to come from Baghdadi, in which he said operations were taking place daily and called on supporters to free women jailed in camps in Iraq and Syria over their alleged links to his group.

At the height of its power Islamic State ruled over millions of people in territory running from northern Syria through towns and villages along the Tigris and Euphrates valleys to the outskirts of the Iraqi capital Baghdad.

But the fall in 2017 of Mosul and Raqqa, its strongholds in Iraq and Syria respectively, stripped Baghdadi, an Iraqi, of the trappings of a caliph and turned him into a fugitive thought to be moving along the desert border between Iraq and Syria.

US air strikes killed most of his top lieutenants, and before Islamic State published a video message of Baghdadi in April there had been conflicting reports over whether he was alive.

Rick Perry: World “awash” in crude, thanks to U.S. shale output

By Anthony DiPaola and Manus Cranny on 10/27/2019

DUBAI (Bloomberg) --Global markets are “awash” in crude thanks to the surge in U.S. oil output, and the boom looks set to continue, U.S. Energy Secretary Rick Perry said in a Bloomberg TV interview.

U.S. shale production has turned the world “on its head,” and Goldman Sachs Group Inc. is “off a bit” in a report last week saying that the bonanza is fading, Perry said on Sunday in Dubai.

Oil and natural gas from American shale fields have made the U.S. one of the world’s largest producers and enabled it to become a net energy exporter. Perry will travel in the coming week to Saudi Arabia to discuss possible sales of U.S. liquefied natural gas and Saudi efforts to develop a nuclear power program. Perry held talks in the United Arab Emirates and visited the country’s largest solar-power facility at a site near the U.A.E.’s commercial hub of Dubai.

The U.S. sent 11 LNG shipments to the U.A.E. over the past three years and is seeking to sell more of the fuel there and to Saudi Arabia, Perry said.

The world needs to be prepared for attacks disrupting the global economy, and the U.S., Saudi Arabia and other allies are discussing the safety of oil supply routes, he said. Aerial strikes against Saudi oil facilities on Sept. 14 temporarily knocked out half of the kingdom’s output, and the U.S. is currently doing enough to help Saudi Arabia defend against such attacks in the future, Perry said.

Washington won’t hold a grudge forever against Saudi Arabia over the murder last October of government critic and U.S. columnist Jamal Khashoggi, though there’s not a “massive amount of forgiveness” in Congress for his killing in the Saudi consulate in Istanbul, Perry said.

The energy secretary said he asked U.S. President Donald Trump to call Ukraine to try to sell U.S. LNG there. The approach to Ukraine is important for energy sales and to break that country’s over-reliance on Russian gas, he said.

The U.S. is “making progress” with its Middle East foreign policy, while efforts to impeach Trump won’t be an issue in the U.S. presidential election next year and will go away in six months, Perry said.

Related News ///

FROM THE ARCHIVE ///

WASHINGTON — The Federal Reserve wants to know what the internet is worth to you.

The answer could help the central bank solve one of the most puzzling paradoxes of the modern economy: The current expansion is the longest in history, yet productivity gains are weak and GDP growth, while steady, is far from stellar.

In a speech this week, Fed Chairman Jerome Powell raised the possibility that the problem is with the data itself. GDP measures the value of products and services that are bought and sold. But many of the greatest technological innovations of the internet age are free. Search engines, e-mail, GPS, even Facebook — the official economic statistics are not designed to capture the benefits they generate for businesses and consumers.

"Good decisions require good data, but the data in hand are seldom as good as we would like," Powell said.

Instead, Powell cited recent work by MIT economist Erik Brynjolfsson, one of the leading academics on the intersection of technology and the economy. In a paper with Avinash Collis of the National Bureau of Economic Research and Felix Eggers of the University of Groningen in the Netherlands, the authors conducted massive surveys to estimate the monetary value that users place on the tools of modern life.

The results? The median user would need about $48 to give up Facebook for one month. The median price of giving up video streaming services like YouTube for a year is $1,173. To stop using search engines, consumers would need a median $17,530, making it the most valuable digital service.

The authors also conducted more limited surveys with students in Europe on other popular platforms. One month of Snapchat was valued at about 2.17 euros. LinkedIn was just 1.52 euros. But giving up WhatsApp? That would require a whopping 536 euros. Twitter, however, was valued at zero euros.

"Over time, we're spending more and more of our waking hours interacting with the internet or using those services on our mobile phones," Brynjolfsson told CNBC. "A bigger share of our economy is being missed by GDP."

Brynjolfsson is advocating an entirely new measure of economic health that calculates benefit rather than output. He calls it GDP-B and estimates that the welfare gains from Facebook alone would have added 0.05 to 0.11 percentage points to its annual growth.

"What we really care about if we want to know how well off people are is the consumer surplus — how much benefit you get — not how much you actually pay," Brynjolfsson said.

Inside the Fed, a separate effort is underway to value the digital economy. Powell also highlighted research by David Byrne and Carol Corrado that uses the volume of data transmitted through broadband, cable and WiFi to estimate the value of online products and services. Their analysis shows that GDP would have been half a percentage point higher over a decade if the full scope of the digital economy had been incorporated.

"The highly visible innovations in consumer content delivery raises the question of whether existing national accounts are missing consequential growth in output and income associated with content delivered to consumers via their use of digital platforms," the authors say in their paper.

Powell delivered his speech at an annual convention of economists, where the theme was integrating old and new economies. At one point, Powell even waxed philosophical.

"How should we value the luxury of never needing to ask for directions?" he asked. "Or the peace and tranquility afforded by speedy resolution of those contentious arguments over the trivia of the moment?"

The answers to those questions may not be far off.

A new winter plan to curb emissions in northern China will not be enough to reverse last year’s sharp increase, official data shows, raising concerns that a weakening economy is eroding Beijing’s resolve to tackle pollution.

In an action plan for October 2019 to March 2020, China said 28 smog-prone northern cities, including the capital Beijing, would have to curb emissions of lung-damaging small particles known as PM2.5 by an average of 4% from a year ago.

The particles are a major component of the smog that engulfs China’s northern regions over winter as people switch on coal-fired heating systems.

However, the targeted decrease is 1.5 percentage points lower than an earlier draft, and would not be enough to reverse a 6.5% surge throughout the Beijing-Tianjin-Hebei region over the same period last year.

Last year’s jump came even though authorities targeted a cut of 3%, with efforts derailed by warmer weather and an increase in industrial activity after regions were given more flexibility to devise their own anti-smog measures.

This year’s lowered ambitions mean that as many as 15 of the 28 cities could have higher levels of smog than two years ago, even if they meet their targets, said Lauri Myllyvirta, senior analyst with Greenpeace.

An environment ministry official acknowledged last week that China’s pollution situation was still “serious”, with PM2.5 in the region up 1.9% in the first three quarters.

In setting this year’s targets, China had to consider “maintaining stability” as well as “actual working conditions” in each location, the official said in a statement, adding that there were risks the goals would not be met.

Only four of the 28 cities - Beijing, Handan, Cangzhou and Jining - met targets last winter, official data showed.

PM2.5 levels in Anyang, China’s most polluted city last winter, soared 13.7% last year. It is targeting a 6.5% cut this year. Nearby Puyang will target a 6% fall this year, even though its average PM2.5 surged more than 20% a year ago.

The environment ministry has been at pains to say China’s “war on pollution” would not be affected by a slowing economy, with local governments no longer judged merely on crude economic growth.

But there have already been signs Beijing will compromise, with Premier Li Keqiang saying earlier this month that China remains dependent on coal and will encourage clean and green mining.

China’s coal imports are also set to rise more than 10% this year, driven by loosened customs restrictions aimed at boosting the economy, analysts said.

“The lower air quality targets seem to reflect changed priorities,” said Myllyvirta. “The policymakers have let smokestack industries rebound, even if it means slowing progress on air quality.”

As many as a million Chileans protested peacefully late into the evening on Friday in the capital Santiago in the biggest rallies yet since violence broke out a week ago over entrenched inequality in the South American nation.

Protesters waving national flags, dancing, banging pots with wooden spoons and bearing placards urging political and social change streamed through the streets, walking for miles (km) from around Santiago to converge on Plaza Italia.Traffic already hobbled by truck and taxi drivers protesting road tolls ground to a standstill in Santiago as crowds shut down major avenues and public transport closed early ahead of marches that built throughout the afternoon.

By mid-evening, most had made their way home in the dark ahead of an 11 p.m. military curfew.

Santiago Governor Karla Rubilar said a million people marched in the capital - more than five percent of the country’s population. Protesters elsewhere took to the streets in every major Chilean city.

“Today is a historic day,” Rubilar wrote on Twitter. “The Metropolitan Region is host to a peaceful march of almost one million people who represent a dream for a new Chile.”

Some local commentators estimated the Santiago rally well over the million mark, describing it as the largest single march since the dying years of the dictatorship of Augusto Pinochet.

Chile’s unrest is the latest in a flare-up of protests in South America and around the world - from Beirut to Barcelona - each with local triggers but also sharing underlying anger at social disparities and ruling elites.

Protests in Chile that started over a hike in public transport fares last Friday boiled into riots, arson and looting that have killed at least 17 people, injured hundreds, resulted in more than 7,000 arrests and caused more than $1.4 billion of losses to Chilean businesses.

Chile’s military has taken over security in Santiago, a city of 6 million people now under a state of emergency with night-time curfews as 20,000 soldiers patrol the streets.

Clotilde Soto, a retired teacher aged 82, said she had taken to the streets because she did not want to die without seeing change for the better in her country.

“Above all we need better salaries and better pensions,” she said.

Chile’s center-right President Sebastian Pinera, a billionaire businessman, trounced the opposition in the most recent 2017 election, dealing the center-left ruling coalition its biggest loss since the country’s return to democracy in 1990.

But as protests ignited this week, Pinera scrapped previous plans and promised instead to boost the minimum wage and pensions, ditch fare hikes on public transportation and fix the country’s ailing health care system.

“We’ve all heard the message. We’ve all changed,” said Pinera on Twitter following the peak of the rallies. “Today’s joyful and peaceful march, in which Chileans have asked for a more just and unified Chile, opens hopeful paths into the future.”

Still, many protest placards, chants and graffiti scrawled on buildings around the city call for his exit.

MULTICOLORED CROWD

As crowds of colorful demonstrators stretched along Santiago’s thoroughfares as far as the eye could see, the noise of pots and pans being clanged with spoons, a clamor that has become the soundtrack for the popular uprising, was ear-splitting.

“The people, united, will never be defeated,” the crowds chanted over the din.

By early evening there had been no signs of violence or clashes with the security forces, who maintained a significant but low-key presence inside paint-spattered and stone-dented armored vehicles parked in side streets.

Beatriz Demur, 42, a yoga teacher from the suburb of Barrio Brazil, joined a stream of demonstrators shuffling toward Plaza Italia with her daughter Tabatha, 22.

“We want Chile to be a better place,” said Demur. “The most powerful have privatized everything. It’s been that way for 30 years.”Eyeing the crowds packing the square, her daughter said: “I have waited for this a long time ... It’s not scary, it’s exciting. It means change.”

Anali Parra, 26, a street hawker, was with her daughter Catalina, 9, and five-month-old son Gideon Jesus, his buggy decked in streamers and an indigenous Mapuche flag.

“This isn’t going to go away,” Parra said. “Pinera should just go now.”

‘URGENT’ REFORMS

On Friday morning, trucks, cars and taxis had slowed to a crawl on major roads, honking horns and waving Chilean flags. “No more tolls! Enough with the abuse!” read bright yellow-and-red signs plastered to the front of vehicles.

Many bus drivers in Santiago also staged a walk-off on Friday after one of their number was shot.

While much of wealthy east Santiago has remained calm under evening lockdown, the poorer side of the city has seen widespread vandalism and looting.

Pinera told the nation on Thursday he had heard the demands of Chileans “loud and clear.”

Chilean President Sebastian Pinera on Saturday added a major cabinet reshuffle to a growing list of reforms he has promised to tame inequality and quell mass protests that have rocked the South American nation.

October 25, 2019 18:58:46

Source: Xinhua News Agency

Xinhua News Agency, Beijing, October 25th The Political Bureau of the Central Committee of the Communist Party of China conducted the 18th collective study on the status quo and trend of blockchain technology development on the afternoon of October 24. In his study, General Secretary Xi emphasized that the integrated application of blockchain technology plays an important role in new technological innovation and industrial transformation. We must take the blockchain as an important breakthrough for independent innovation of core technologies, clarify the main direction, increase investment, focus on a number of key core technologies, and accelerate the development of blockchain technology and industrial innovation.

Chen Chun, a professor at Zhejiang University and an academician of the Chinese Academy of Engineering, explained the issue and discussed opinions and suggestions.

The comrades of the Political Bureau of the CPC Central Committee listened carefully to the explanations and discussed them.

General Secretary Xi delivered a speech while presiding over the study. He pointed out that the application of blockchain technology has extended to digital finance, Internet of Things, intelligent manufacturing, supply chain management, digital asset trading and other fields. At present, major countries in the world are accelerating the development of blockchain technology. China has a good foundation in the field of blockchain. It is necessary to accelerate the development of blockchain technology and industrial innovation, and actively promote the development of blockchain and economic and social integration.

General Secretary Xi stressed that it is necessary to strengthen basic research, enhance the original innovation ability, and strive to let China take the leading position in the emerging field of blockchain, occupy the commanding heights of innovation, and gain new industrial advantages. It is necessary to promote collaborative research, accelerate the breakthrough of core technologies, and provide safe and controllable technical support for the development of blockchain applications. It is necessary to strengthen the research on blockchain standardization and enhance the right to speak and rule in the world. It is necessary to speed up industrial development, give play to market advantages, and further open up the innovation chain, application chain and value chain. It is necessary to build a blockchain industry ecology, accelerate the deep integration of blockchain and frontier information technologies such as artificial intelligence, big data, and Internet of Things, and promote integrated innovation and integration applications. It is necessary to strengthen the construction of the talent team, establish and improve the personnel training system, build a variety of high-level talent training platforms, and cultivate a group of leading figures and high-level innovation teams.

General Secretary Xi pointed out that it is necessary to seize the opportunity of blockchain technology integration, function expansion and industry segmentation, and play the role of blockchain in promoting data sharing, optimizing business processes, reducing operating costs, improving synergy efficiency, and building a credible system. The role. It is necessary to promote the deep integration of the blockchain and the real economy, and solve the problems of difficulty in financing loans for SMEs, difficulties in controlling the risks of banks, and difficulties in departmental supervision. It is necessary to use blockchain technology to explore digital economic model innovation, provide power for creating a convenient, efficient, fair and competitive, stable and transparent business environment, and provide services for promoting supply-side structural reforms and realizing the effective docking of supply and demand in various industries, in order to accelerate new and old kinetic energy. Provide support for continuous transformation and promote high-quality economic development. It is necessary to explore the application of “blockchain+” in the field of people's livelihood, and actively promote the application of blockchain technology in the fields of education, employment, pension, precision poverty alleviation, medical health, commodity anti-counterfeiting, food safety, public welfare, social assistance, etc. The masses provide more intelligent, more convenient and better public services. It is necessary to promote the combination of the underlying technical services of blockchain and the construction of new smart cities, explore the promotion and application in the fields of information infrastructure, smart transportation, energy and power, and improve the level of intelligence and precision of urban management. It is necessary to use blockchain technology to promote greater inter-connectivity between cities in terms of information, capital, talents, and credit information, and ensure the orderly and efficient flow of production factors within the region. It is necessary to explore the use of the blockchain data sharing model to achieve the joint maintenance and utilization of government data across departments and regions, promote business synergy, deepen the “run-up once” reform, and bring better government service experience to the people.

General Secretary Xi emphasized that it is necessary to strengthen the guidance and regulation of blockchain technology, strengthen the research and analysis of blockchain security risks, closely follow development trends, and actively explore development laws. It is necessary to explore the establishment of a safety guarantee system that adapts to the blockchain technology mechanism, and guide and promote blockchain developers and platform operators to strengthen industry self-discipline and implement safety responsibilities. It is necessary to implement the rule of law network into the management of blockchain and promote the safe and orderly development of blockchain.

General Secretary Xi pointed out that the relevant departments and their responsible leaders should pay attention to the status quo and trend of blockchain technology development, improve the application and management of blockchain technology capabilities, and enable blockchain technology to build a network power, develop a digital economy, and help the economic society. Development and other aspects play a greater role.

The UK index of leading shares finished 25.02 points at 7,306.26. The FTSE 250 fell 41.83 points to close at 20,168.33

FTSE 100 closes down 25 points

Sterling higher as MPs begin debating December 12 election

The date of 9 December has also been mooted.

“Little is straightforward here, as is seemingly always the case with Brexit,” said market analyst David Cheetham at XTB.

China’s manufacturing sector continued to dwell in the doldrums in October, with sentiment among factory operators remaining in negative territory for the sixth month in a row.

The manufacturing purchasing managers’ index (PMI), released by the National Bureau of Statistics (NBS) on Thursday, stood at 49.3 in October, down from 49.8 in September and below the expectation in a Bloomberg survey of analysts for an unchanged reading. The October figure was the lowest since hitting 49.2 in February.

The non-manufacturing PMI – a gauge of sentiment in the services and construction sectors – came in at 52.8 in October, below analysts’ expectations for a 53.6 reading. The figure was also down from September’s 53.7, dropping to its lowest level since February 2016.

The composite PMI, a combined reading of both manufacturing and non-manufacturing, was 52, down from 53.1 in September.

The official PMI is a gauge of sentiment among larger and state-owned factory operators, with 50 being the line between expansion and contraction in sector activity. In the survey, manufacturers are asked to give a view on business issues such as export orders, purchasing, production and logistics.

The decline in manufacturing activity was led by a deterioration in the new orders which fell to the lowest level since June, with export orders declining to the lowest level since July. Overall production continued to expand in October, but at the slowest pace since February.

“The official PMIs fell by more than expected this month, reinforcing our view that the improvement at the end of Q3 didn’t mark the start of a sustained recovery,” said Julian Evans-Pritchard, senior China economist at Capital Economics. “The main driver was a sharp drop in the output component but new orders softened too. The decline in new export orders points toward a further slowdown in export growth. And the output price index, which closely tracks producer price inflation and industrial profit growth, also dropped back.”

The official PMIs fell by more than expected this month, reinforcing our view that the improvement at the end of Q3 didn’t mark the start of a sustained recoveryJulian Evans-Pritchard

The broad economic slowdown weighed more heavily on the construction and services sectors in October with the official non-manufacturing PMI falling to its lowest level in three and half years.

While there was a decline in October’s official manufacturing PMI reading, the fact that it remains in negative territory is indicative of the weak sentiment among producers even as trade negotiators from China and the United States agreed on the outlines of small-scale trade deal.

The China Federation of Logistics and Purchasing, who produce the survey with the NBS, said that while growth is slowing, the “quality of development is improving”.

China's economic structure is being optimised as high energy consuming industries are gradually being degraded, having a big impact on the overall economic growthChina Federation of Logistics and Purchasing

“China's economic structure is being optimised as high energy consuming industries are gradually being degraded, having a big impact on the overall economic growth,” they said in a statement.

Southeast Asia Energy Outlook 2019 Comprehensive review of a region on the rise

The IEA's 4th Southeast Asia Energy Outlook provides a comprehensive review of the energy system and current market trends in the ten countries of the Association of Southeast Asian Nations (ASEAN). It explores a set of possible futures for the region with a particular focus on cooling, regional power trade, and investment in the electricity sector. Download the full report Read press release

The growing weight of Southeast Asia

Any assessment of the outlook for global energy has to reckon with the growing weight of Southeast Asia. Home to nearly one-in-ten of the world’s population, the rapidly growing economies of the region are shaping many aspects of the global economic and energy outlook. Southeast Asia is a very diverse and dynamic region, but one common element is that policy makers across different countries have been intensifying their efforts to ensure a secure, affordable and more sustainable pathway for the energy sector. This includes action to facilitate investment in fuel and power supply and infrastructure, while focusing also on efficiency. The potential benefits of a well-managed expansion of the region’s energy system, in terms of improved welfare and quality of life for its citizens, are huge. There are encouraging indications in many areas, but also some warning signs. Rising fuel demand, especially for oil, has far outpaced production from within the region. Southeast Asia as a whole is now on the verge of becoming a net importer of fossil fuels for the first time.

Southeast Asia's growing economic and energy role

At the same time, Southeast Asia is well on the way to achieving universal access to electricity by 2030. Millions of new consumers have gained access to electricity since 2000, yet some 45 million people in the region are still without it today and many more continue to rely on solid biomass as a cooking fuel.

Southeast Asia’s growth in electricity demand, at an average of 6% per year, has been among the fastest in the world, but a number of power systems in the region are facing significant financial strains.

Since 2000, overall energy demand has grown by more than 80% and the lion’s share of this growth has been met by a doubling in fossil fuel use. Oil is the largest element in the regional energy mix and coal – largely for power generation – has been the fastest growing. This has underpinned the region’s development and industrial growth, but has also made air pollution a major risk to public health and driven up energy-related carbon dioxide (CO 2 ) emissions.

Southeast Asia has considerable potential for renewable energy, but (excluding the traditional use of solid biomass) it currently meets only around 15% of the region’s energy demand. Hydropower output has quadrupled since 2000 and the modern use of bioenergy in heating and transport has also increased rapidly. Despite falling costs, the contribution of solar photovoltaics (PV) and wind remains small, though some markets are now putting in place frameworks to better support their deployment.

Driven by rising incomes, industrialisation and urbanisation

In the Stated Policies Scenario, which explores the implications of announced policy targets as well as existing energy policies, Southeast Asia’s overall energy demand grows by 60% to 2040. The region’s economy more than doubles in size over this period, and a rise of 120 million in the population is concentrated in urban areas. The projected rate of energy demand growth is lower than that of the past two decades, reflecting a structural economic shift towards less energy intensive manufacturing and services sectors, as well as greater efficiency. Nonetheless, it still represents some 12% of the projected rise in global energy use to 2040.

All fuels and technologies play a part in meeting the growth in demand in this scenario. Southeast Asia’s oil demand surpasses 9 million barrels per day (mb/d) by 2040, up from just above 6.5 mb/d today. Oil continues to dominate road transport demand, despite an increase in consumption of biofuels. Electrification of mobility, with the partial exception of two and three wheelers, makes only limited inroads. This pathway suggests little change in Southeast Asia from today’s congested roads and poor urban air quality.

Southeast Asia is one of a few regions where the share of coal in the power mix increased in 2018 and, based on today’s policy settings, coal demand is projected to rise steadily over the coming decades. This is largely to fuel new and increasingly efficient coal-fired power plants, although the headwinds facing these projects are growing – including increasing difficulty to secure competitive financing for new coal facilities.

Natural gas faces competing pressures in Southeast Asia. It appears to be a good fit for the needs of the region’s fast-growing cities and lighter industries, as well as (in the form of liquefied natural gas [LNG]) a way to displace costly oil use in some island communities. However, increasing reliance on imports makes the fuel less price-competitive. In our projections, it is industrial consumers rather than power plants that are the largest source of growth in gas demand.

In the Stated Policies Scenario, the share of renewables in power generation rises from 24% today (18% of which is hydropower) to 30% by 2040, but this still lags far behind the levels reached in China, India and some other economies in Asia. Wind and solar are set to grow rapidly from today’s low levels, while hydropower and modern bioenergy – including biofuels, biomass, biogas and bioenergy derived from other waste products – remain the mainstays of Southeast Asia’s renewable energy portfolio.

Heading for rising energy import bills

The pathway that Southeast Asia is on includes the realisation of some major energy policy goals, including the vital task of ensuring universal electricity access and some progress with diversification of the energy mix.

Yet our Stated Policies Scenario also highlight some major potential risks. A widening gap between indigenous production and the region’s projected oil and gas needs results in a ballooning energy trade deficit. By 2040, Southeast Asia is projected to register a net deficit in payments for energy trade of over $300 billion per year, almost entirely due to imports of oil. This would also imply growing strains on government budgets, especially if subsidy policies remain in place that shield consumers from paying market-based energy prices.

The large increase in imports also raises energy security concerns. In the case of oil, the region’s overall dependence on imports exceeds 80% in 2040, up from 65% today.

... and rising emissions

The consequences of energy-related air pollution on human health remain severe. The number of annual premature deaths associated with outdoor and household air pollution in Southeast Asia rises to more than 650 000 by 2040, up from an estimated 450 000 in 2018. Some 175 million people across the region still remain dependent on the traditional use of solid biomass for cooking in 2040.

The projected increase in fossil fuel consumption, particularly the continued rise in coal demand, is felt in a two-thirds rise in CO 2 emissions to almost 2.4 gigatonnes (Gt) in 2040. In most other parts of the world, the power sector’s share of total energy-related emissions falls to 2040 even as electricity expands its role in final consumption. However, the relatively high carbon intensity of an expanding generation fleet in Southeast Asia means that the region’s power sector is responsible for just under half of CO 2 emissions in 2040, up from 42% today.

The future is electrifying in Southeast Asia

Southeast Asia’s electricity sector is in a very dynamic phase of development, both for supply and demand.

Relatively low generation costs and indigenous supply have traditionally given coal a prominent place in power sector planning. This is maintained in the Stated Policies Scenario – our measured assessment of planned additions means that the share of coal-fired generation in the region’s power mix remains broadly flat at near 40% over the next two decades, Natural gas-fired plants, based on domestic supply as well as imported liquefied natural gas are also set to maintain a strong foothold in Southeast Asia.

However, the declining costs of renewables and concerns over emissions and pollution are starting to alter the balance of future additions to the power mix. Recent revisions to policy planning documents have tended to boost the long-term share of renewables, typically at the expense of coal. Moreover, a switch is visible in near-term project developments, with a significant slowdown in decisions to move ahead with new coal-fired capacity and a rise in additions of solar and wind. In the first half of 2019, approvals of new coal-fired capacity were exceeded by capacity additions of solar PV for the first time.

On the demand side, electricity consumption in Southeast Asia doubles to 2040; the annual growth rate of nearly 4% is twice as fast as the rest of the world. The share of electricity in final energy consumption is 18% today but this rises rapidly to 26% in 2040 and reaches the global average.

Space cooling is one of the fastest growing uses of electricity to 2040, propelled higher by rising incomes and high cooling needs. For the moment, less than 20% of households across the region have air conditioning: in Indonesia, the most populous ASEAN country, around 10% do. In our projections, appliance ownership and cooling demand skyrocket, not only raising overall electricity demand but accentuating strains on power systems as the share of cooling in peak power demand rises towards 30%.

There are real opportunities for efficiency policies to reduce some of these projected strains: our detailed market analysis shows that the average efficiency of air conditioning units sold today is well below the global average, even though much more efficient units, including those manufactured locally, are available at comparable cost. Enhanced efforts to improve building and equipment efficiency (as in the Sustainable Development Scenario) would be sufficient to reduce the growth in cooling demand in 2040 by around half (read more in The Future of Cooling in Southeast Asia).

Energy investment

Whichever pathway the region takes, meeting Southeast Asia’s energy needs and policy priorities will require higher levels of investment. The need to step up investment is particularly acute in the power sector. Today’s investment levels fall well short of the projected needs in the Stated Policies Scenario and are more than 50% lower than what would be required in the Sustainable Development Scenario.

Mobilising investment requires broad participation from the private sector, as well as the targeted use of public funds. Public sources have thus far played a very important role in financing thermal power plant projects and large-scale renewables (such as hydropower or geothermal) with sizeable upfront capital needs. By contrast, wind and solar PV projects have relied much more on private finance, spurred by specific policy incentives.

There is a critical need in Southeast Asia to attract additional private sources of capital. This would require governments to address the risks that affect the bankability of projects; we highlight four priority areas for action:

- enhancing the financial sustainability of utilities;

- improving procurement frameworks and contracting mechanisms, especially for renewables;

- creating a supportive financial system that brings in a range of financing sources

- promoting integrated approaches that take the demand-side into account.

The types of investment that go ahead will also depend on the extent of regional cooperation and integration, especially progress with the ASEAN Power Grid – an ambitious project to interconnect the power systems in the region and establish multilateral power trading.

Regional power system integration is vital to facilitate growth in renewable sources of generation, in particular from wind and solar PV. Integration allows access to a larger and more diverse pool of flexible resources on the supply side (from sources such as hydro or gas-fired power) as well as the demand side. Interconnecting with neighbouring grids also reduces the system variability of wind and solar output, which is smoother when individual plants are aggregated over larger geographic areas.

Our detailed case study shows that multilateral power trading and an expansion of cross-border transmission bring major cost savings in building and operating the region’s power systems. They also bring significant environmental gains when they accompany and enable an expansion of renewables-based power.

Bradley armored vehicles rolled into eastern Syria on a mission to combat ISIS and prevent oil wells from falling back into the hands of the Islamic extremist group, according to an official with Operation Inherent Resolve.

Army Col. Myles B. Caggins III, a spokesman for the U.S.-led mission to defeat ISIS in Iraq and Syria, said the mechanized forces moving into Deir ez-Zor province, Syria, hailed from the 30th Armored Brigade Combat team, a National Guard unit from South Carolina.

NBC News was first to report it, citing OIR commander Army Lt. Gen. Pat White, that Bradleys and Army grunts had crossed into Deir ez-Zor.

Officials with the Pentagon and OIR did not detail the number of troops or armored vehicles tasked with protecting the oil wells in eastern Syria. But Secretary of Defense Mark Esper said Monday that American troops would continue to withdraw from northern Syria.

“We are repositioning" U.S. forces to Deir ez-Zor to continue partnering with the SDF “to defeat ISIS remnants, protect critical infrastructure” and to deny ISIS access to revenue sources. "Mechanized forces provide infantry, maneuver, and firepower,”OIR tweeted Thursday.

Esper said he expected troop levels to be below the 1,000 troops that were deployed to northern Syria prior to President Donald Trump’s decision to withdraw American troops from the country following a Turkish incursion.

Turkey launched operations on Oct. 9 to combat U.S.-backed Kurdish forces. Turkey believes the American anti-ISIS partner force in Syria is a terrorist group.

The decision to redeploy American forces into Syria appears to be reversal by Trump of his much criticized plan to withdraw U.S. troops from the country.

× Fear of missing out? Sign up for the Early Bird Brief - a daily roundup of military and defense news stories from around the globe. Thanks for signing up. By giving us your email, you are opting in to the Early Bird Brief.

American military veterans who served in armor units have argued mechanized forces in Syria could add logistical and manpower strains for U.S. forces in Syria — countering Trump’s aim to withdraw from the region and end America’s involvement in forever wars.

.@USArmy troops in 4-118th Infantry Regiment, @30thabct, @NCNationalGuard attached to the 218th Maneuver Enhancement Brigade, @SCNationalGuard, load M2A2 Bradley Fighting Vehicles to support the @CJTFOIR mission in Deir ez Zor, Syria. #DefeatDaesh pic.twitter.com/ZbFsvIemRW — OIR Spokesman Col. Myles B. Caggins III (@OIRSpox) October 31, 2019

The oil wells in eastern Syria are a contentious issue. Analysts contend the decision to deploy American armor to safeguard Syrian oil was made due to the threat of Russian and Syrian armor in the region.

How the Bradley will stack up to Russian armor is unknown. The small armor vehicle packs a 25 mm Bushmaster chain gun and is armed with the aging anti-tank missile system known as the TOW. But the Bradley could be highly effective against ISIS up-armored bomb-laden vehicles — a tactic that has grown in prominence among ISIS and Taliban fighters.

The vehicle is also highly maneuverable.

Syrian Democratic Forces, abandoned by their American partners, were forced to invite Russian and Syrian regime forces into towns and cities across northern Syria as Turkish troops and their Free Syrian Army proxy force rolled through the region.

The oil fields in eastern Syria were also the site of a clash between American commandos and Russian mercenaries. In February 2018, U.S. troops called in airstrikes against Russian mercenaries and pro-Syrian regime forces moving towards the American position near the Conoco oil fields in eastern Syria. Nearly 200 enemy troops were killed in the attack.

Esper and other U.S. defense officials have oft repeated that the U.S. wants to keep the Syrian oils from falling back into the hands of ISIS. Captured oil wells was a main source of income for ISIS during the height of its power in the Iraq and Syria.

But on Monday, Esper also said Russia and Syria would be denied access to the oil fields. Esper said the U.S. wanted to ensure its SDF partner force could use the oil revenue to fund their fighters and prison camps that are currently holding thousands of ISIS detainees.

Esper told reporters Monday that American forces protecting the oil fields where prepared to use “overwhelming military force” in self defense.

Esper said Monday that he has seen no sign of Syrian or Russian forces challenging U.S. control of the oil fields.

Russia calls US move to protect Syrian oil ‘banditry’ Russia’s Defense Ministry on Saturday harshly criticized the United States decision to send armored vehicles and combat troops into eastern Syria to protect oil fields, calling it “banditry.”

The Associated Press, citing a U.S. official, reported that the U.S. has detected what appears to be a massing of Russian and Syrian forces on the western side of the Euphrates River near Deir el-Zour.

Russian officials were contacted by phone, and the U.S. was given assurances that the staged forces would not move east, the official said, speaking on condition of anonymity to discuss a sensitive issue.

Jim Jeffrey, the Trump administration’s special envoy for Syria, seemed to refer to this episode when he said last Friday, “We are currently very concerned about certain developments in the south, in the Deir el-Zour area. I’ve talked to my Russian colleague about that and we’re having other contacts with the Russians concerning that situation. We think it is under control now.”

After expelling Islamic State militants from southeastern Syria in 2018, the Kurds seized control of the more profitable oil fields to the south in Deir el-Zour province.

In addition to that mission, the U.S. will also keep a small number of U.S. troops at the Tanf garrison near the Syria-Iraq border. American commandos housed at Tanf are tasked with training an anti-ISIS force separate from the SDF mission. And there is a Joint Special Operations Command compound in Syria, south of Kobani. where the raid that resulted in the death of ISIS leader Abu Bakr al-Baghdadi was launched.

“All Coalition military operations are de-conflicted with other forces operating in the region, through pre-existing channels and interlocutors in order to reduce the risk of interference, miscalculation, or unintended escalation of military operations,” Caggins said.

Partner pay at Grant Thornton has slumped and it has delayed publishing its accounts, as the UK’s sixth-largest accounting firm attempts to recover from a difficult year - FT

The firm has told the regulator that it would file its accounts next year, having changed its year end from 30 June to 31 December

The FT has revealed that Grant Thornton, the sixth largest accounting firm in the UK, won’t be publishing its accounts before the end of this year having extended its accounting period by six months.

This is the first time in roughly 15 years that the firm hasn’t published accounts before the new year.

In a tough year for the firm, it has been under scrutiny for its audit of Patisserie Valerie and faced questions over the sudden departure of CEO Sacha Romanovitch in 2018.

Grant Thornton also stepped down as auditor for Sports Direct this year, which left the company without an auditor until RSM took the post.

Documents seen by the FT also show that Grant Thornton partners will also be paid 13% less this year than the average profit per partner in 2018. Average pay will fall from £373,000 to £323,000.

The firm will not be required to publish a full transparency report until March, but has voluntarily published an interim report today.

Grant Thornton said that “full-share equity partner” pay was £343,000 last year. The figure wasn’t previously reported, the firm said, but means that the actual drop in pay this year is only 6%.

Profits have stagnated in the firm’s UK business, flatlining at around £72m, although the there has been a modest increase in turnover for the year to June 2019.

A spokesman for Grant Thornton said, "The firm has decided to adjust its financial year from 30 June to 31 December, as a later year end better matches the seasonality of our business and aligns with our global reporting commitments. This will not have any adverse impact on our people or clients."

Ipredicted well before the 2016 presidential election that Donald Trump would be elected. I had felt that way ever since he rode down that golden escalator with his rapist invective. Ever since he was elected, I’ve also believed that he’ll be re-elected, more easily this time.

An illustrative personal anecdote, one of many over the last three years: A creative writing PhD I know with tons of debt, whose wife happens to be an undocumented Filipina, became mightily angered by the promise of student debt cancelation. What about those who have paid their dues by taking out debt, he asked? No doubt he would refuse a blanket amnesty for “illegals” too. His DACA wife, as he sees it, paid her dues.

Columnists at the New York Times are all angry at the possibility of decriminalizing of border crossings, health care for the undocumented and the abolition of private insurance. In fact, they don’t want to do away with Trumpian inhumanity. They want the oppression to continue, but without the transparent rhetoric.

Minus the Trumpian rhetorical overlash, war, empire, violence, hollowness, junk goods and a junk life are all the people have ever known and all they want.

Historical movement in long cycles can’t be short-circuited, as we can see in the resistance of the liberal elite toward Bernie Sanders, the only candidate who could beat Trump, versus the stampede toward Elizabeth Warren, who provides a "safe" alternative and will surely lose.

But what kind of a fascist doesn’t start a war in three years? Trump doesn’t need war: He has brought the war home by making us confront our emptiness directly. He is the catalyst we needed at this time, and he is fulfilling his purpose beautifully. America is exhausted, which the liberal elites don’t get.

Trump keeps making noises about Iran, but he hasn’t actually done it yet. His pullback at the last moment, when the bombers were supposedly already on their way, is a trope that makes sense to a lot of people. We could have, in a science-fiction world, the repetition of this particular action — pulling back from the brink, the antithesis to Strangelove-style irrevocability — day after day, and it would be the right psychotropic drug to rouse us.

And what kind of a huckster is he? He constantly keeps changing his mind, which is not a character flaw, but the essence of his “deal-making.” America can’t find a better deal — from the New Deal to the Fair Deal to the imaginary Green New Deal, a landscape of lost opportunities and blighted dreams — so contingent honor, betrayed promises and infinite self-cancellation constitute the only kind of deal-making possible. And unlike on "The Apprentice," there can be no winner at the end, while the rest get fired, because the endless prevarication — saying two things at the same time, often diametrically opposite — is what constitutes deal-making. We’d better get used to it: It is the end point to a century of liberal social planning.

To be totally adrift, Trump is saying, is to have total freedom. The empire embraces its most recent eruption of vulgarity, barbarism and eco-destruction as a welcome development — or at least the dispossessed do, if not the meritocrats. To move beyond the dead language of liberal political correctness, which all the Democratic candidates suffer from, is a great service. Trump is preparing us for the imminent turmoil of the coming decades — concluding in secession and fragmentation by mid-century — with the kind of language the empire needs now. He’s reading history well, only too well, far better than his ideological opponents, the neoliberal globalizers or the democratic socialists.

Not one of his opponents is prepared to say that power is America — brute, unforgiving, no-second-chances power. This kind of power requires a base removed from liberal education. He reforms language every day, in his tweets, which emanate from our deepest unconscious, such as when liberal stand-up comedians turn out to be racists and misogynists in their revealing moments.

As we prepare for the age of brutality, he’s telling us — as the Times columnists confirm every day in the limits they impose to compassion — that the recent gloss of multicultural tolerance, in the Reagan/Clinton/Obama years, was the final fantasy. His border wall seeks to literalize the walls of segregation and inequality that have been going up relentlessly all throughout the interior. He won’t start wars of humanitarian liberation, because that was the foreign aspect to the domestic malevolence passing as tolerance.

Former UN ambassador Jeane Kirkpatrick counseled in the 1970s that we could work with good authoritarians around the world, but not with socialists. Trump’s affection for Narendra Modi, Jair Bolsonaro, Vladimir Putin, Kim Jong-un, and Mohammed bin Salman is nothing new. It is how we have always operated, even in the halcyon days of Henry Kissinger’s détente, when we violently crushed democracy in Chile and elsewhere, or under the spiritual Jimmy Carter, when we trapped the Russian bear in Afghanistan, much to Zbigniew Brzezinski’s delight.

Trump doesn’t want to restart history, to repudiate Francis Fukuyama or Bill Clinton. Nor does he want to start a clash of civilizations, to validate Samuel Huntington or George W. Bush. He is content with leaving history alone, which seems natural, coming so soon after the younger Bush's counselors, who wanted full-spectrum dominance. The deal, as Trump sees it, is ever-changing, immune from textual recreation, legal solidity, constitutional affirmation.

What is his obsession with China then? China for the last three decades has been a management consultant’s dream come true. Trump is not playing a zero-sum game, a chessboard called economic nationalism, with China. With him we move beyond oligarchic nationalism or even democratic fascism. China helps construct a total vacuum of thought, reaching even beyond the vulgarity of trashy American consumerism. We no longer want their tacky goods. We want the Harley-Davidsons back — or not, it’s OK if they don’t come back. If we can’t recall manufacturing, and we leave world trade, then we are thrown upon a manly ideal, where we make things and do things for ourselves, except that Trump and his followers know that that ideal is well past reach, going out of fashion with the rise of consumerism precisely a century ago.

The 2020s: An exact reversal of the rise of optimistic consumerism in the 1920s. History does have its symmetries, if you know where to look. The end to advertising, news broadcasting, modernist propaganda, the religion of self-help and therapy, physical fitness, institutionalized spying and technological utopia.

Trump's attack on the media, the breathing tube for an empty liberal consumerism that died long ago, is the most welcome move to his fervent supporters. You can’t believe a word you see. You have to create your own reality, which the Internet helped bring about starting in the 1990s. Consider the real scandal of Joe Biden’s son’s corruption, already noted matter-of-factly in leading newspapers, versus the impeachable scandal of just talking — airing out possible deals to land political opponents in trouble. Torture, assassination, deportation and ecocide are all within the pale, for the resistance, for those who would like to replace him with an acceptable alternative who will take empire back to where it was.

But it’s not going to happen, because he was never the bearer of a virus, which implies something alien. He is the perfect mirror, just as Nixon followed Lyndon Johnson, Reagan followed Carter, and Bush followed Clinton, in performing not so much an oscillation but an exaggerated return to form. Empires, heavy and difficult to maneuver, don’t engage in circular or sideways motions. Trump is the accelerant to the end point that empire needs now, just as Reagan and Bush served their functions earlier, and in that sense he is a true man of the people. You don’t beat a man of the people electorally. You just don’t.

Italian oil giant Eni has discovered new resources in the Abu Rudeis Sidri development lease, in the Gulf of Suez, offshore Egypt.

This is the location where Petrobel, a JV between Eni and by the Egyptian General Petroleum Corporation (EGPC), drilled an appraisal well of the discovery of Sidri South, announced last July.

The Sidri 36 appraisal well, drilled to assess the field continuity westward in a down-dip position with respect to Sidri-23 discovery well, encountered an important hydrocarbon column in the clastic sequences of the Nubia Formation (200 meters of hydrocarbon column), Eni said on Friday.

“This new and important result continues the positive track record of the “near field” exploration in Eni’s historical concessions in Egypt and prove how the use of new play concepts and of the technology allows to re-evaluate areas where exploration was considered having reached a high level of maturity,” Eni said.

The well will be completed and put into production in the next few days with an expected initial flow rate of about 5.000 barrels per day.

According to Eni, Petrobel immediately came up with a rapid development plan for the new discovery with a “fast-track” approach, leveraging on existing infrastructures in the vicinity of the well and maximizing facilities synergies; this strategy will be applied also in future activities in the Sidri area with the next delineation and development wells connected to the production in a short time.

The Sidri South discovery, which is estimated to contain about 200 million barrels of oil in place, will be reassessed following these new results, Eni said.

Eni’s current equity production in Egypt is around 350,000 barrels of oil equivalent per day. Production is expected to further grow within the year, thanks to the Zohr gas field and to the Baltim SW field ramp-up, Eni said.

At least three tankers are on their way to Asia with U.S. oil cargoes after Washington gave temporary approval to wind down transactions with a Chinese shipping company that it sanctioned last month, according to data and shipping sources.

In one of the biggest sanctions actions taken by the U.S. government since its crackdown on Iranian oil exports, Washington on Sept. 25 announced sanctions on Chinese tanker companies, including COSCO Shipping Tanker (Dalian), a subsidiary of China’s state-owned shipping group COSCO.

The surprise move by Washington and concern over shippers falling foul of U.S. sanctions led to oil freight costs hitting record highs around the world, adding millions of dollars in costs for every voyage.

Shipping sources said Washington had begun to grant temporary waivers for the conclusion of shipments around Oct. 15.

Refinitiv data showed three tankers - carrying millions of barrels of oil and owned by the designated COSCO subsidiary - set sail from the U.S. Gulf for destinations in Asia around that time, after waiting in the area for several weeks after sanctions were imposed.

The sources said on Friday that further COSCO tankers were preparing to sail with cargoes on board that had been held up.

This followed a notice from the U.S. Treasury on Thursday which allowed for the “maintenance or wind down of transactions” including offloading non-Iranian crude oil involving the COSCO subsidiary until Dec. 20.

One shipping source said ships with cargoes on board were more comfortable to discharge their cargoes, adding Thursday’s notice by the Treasury maybe formalizes what was already known.

“These sanctions by the Trump administration were worded in a way that you can never feel completely secure. I think that’s deliberate,” the source said.

Earlier this month, a source said a separate tanker owned by the affected COSCO subsidiary had received a temporary waiver from U.S. sanctions that allowed it to discharge its cargo.

Jonathan Chappell, an analyst with advisory firm Evercore ISI, said the Treasury notice was “fraught with legalese and therefore difficult to fully comprehend, opening the content up to possible misinterpretation.

“It appears that the intent of the update is to enable voyages/transactions that are already under way to be completed by Dec. 20 ... and it does not end or place a waiver on the current sanctions,” Chappell said in a note on Thursday.

CNOOC, China’s largest offshore oil and gas producer, said this week it would be affected by U.S. sanctions on COSCO’s subsidiary but there would be no impact on its oil and gas production.

A ambitious new Arctic oil project led by Russia’s top oil producer Rosneft will require about 10 trillion roubles ($157 billion) of investment, Russia’s deputy energy minister Pavel Sorokin told reporters.

Vostok Oil, a joint project of Rosneft and Independent Petroleum Company (IPC), is set to include some oil fields that are already producing and others which have yet to start, including Rosneft’s Vankor group and IPC’s Payakhskoye field.

The government has broadly agreed a new tax relief package to help develop the Arctic, seen as a new oil-producing region for Russia, which is among the world’s top crude exporters, Deputy Prime Minister Yuri Trutnev said this week.

Russia’s heavy support of oil production via a number a special tax breaks has been hotly debated at a time when the government is raising other taxes on its citizens and increasing pension ages.

Alexei Sazanov, the head of the tax department at Russia’s finance ministry, told reporters at the same event on Friday that tax benefits for Vostok Oil could cost up to 60 billion roubles per year. The comments by Sorokin and Sazanov were embargoed until early on Monday.

Russia’s budget surplus, projected at 1.7% of gross domestic product this year, is expected to shrink to 0.2% in 2022, partly due to the various supports offered to the energy sector, a cornerstone of budget revenue.

Rosneft hopes that foreign investors will also invest in Vostok Oil, which it expects to produce up to 100 million tonnes of oil per year (2 million barrels per day), or a fifth of what Russia currently pumps.

IPC is led by Eduard Khudainatov, a former Rosneft chief executive and a close ally of Igor Sechin, who now runs Rosneft.

U.S. refiner Phillips 66 beat estimates for quarterly profit on Friday, boosted by strong performance in its fuel sales business.

Phillips 66 processes, transports, stores and markets fuels and products and has been redesigning its Phillips 66, 76 and Conoco branded sites in the United States.

The efforts paid off with adjusted earnings in the segment jumping nearly 30% to $498 million.

Refined product exports rose nearly 16% to 220,000 barrels per day in the third quarter, the company said.

Net earnings fell to $712 million, or $1.58 per share, in the third quarter ended Sept. 30, from $1.49 billion, or $3.18 per share, a year earlier.

Excluding a $690 million impairment related to investments in DCP Midstream, the company earned $3.11 per share.

Analysts on average had expected a profit of $2.59 per share, according to IBES data from Refinitiv.

Buenos Aires — Argentina elected a left-leaning moderate as president Sunday, while a tighter race in neighboring Uruguay goes to a second round, elections closely watched by the energy sector because of the region's large oil, natural gas and power resources.

The focus for energy companies is on what happens next in Argentina, home to Vaca Muerta, one of the world's largest shale plays, which could make the country a major oil and gas exporter.

Alberto Fernandez, 60, emerged as the winner with 48% of the votes, according to the National Electoral Department. That was enough for him to avert a runoff against right-leaning incumbent President Mauricio Macri, 60, who received 40% of the votes.

After accepting defeat late Sunday, Macri said he would work on a smooth transition for Fernandez to take power December 10.

In his victory speech, Fernandez said, "Four years ago, they told us, 'We won't be back,' but tonight we came back, and we'll be better."

That may prove a challenge, and he said he understands that.

"The times that are coming are not going to be easy," he said.

Related podcast Oil Markets podcast Our podcast that provides analysis of key oil price movements across the globe. Listen

Argentina is entering its third year of recession and has defaulted on some bonds and may have to default on more. Inflation is more than 50%, the benchmark interest rate is touching 70%, and the fiscal accounts are in deficit. The central bank has tightened capital controls to contain the exchange rate and capital flight, and to stem inflation.

With the global economy slowing, the next government may struggle to attract the more than $10 billion a year in capital needed to develop Vaca Muerta, of which only 5% is yet in production.

"Vaca Muerta needs more than $100 billion in investment to achieve its full potential, but it will not be able to attract anything if the country is perceived to be a deadbeat," Walter Molano, head of sovereign research at BCP Securities, a Connecticut investment banking services firm, wrote in a recent note to clients.

ENERGY POLICY UNCERTAINTY

On the campaign trail, Fernandez was vague on his energy policies. His advisers have recommended freezing energy tariffs and unlinking oil and refined product prices from the US dollar as a way to reduce inflation and make the economy more competitive. There are proposals as well to improve the legal security for investing in Vaca Muerta, such as with tax incentives and leniency on keeping dollars from export sales outside the country, now restricted.

Analysts, however, have said that until there are concrete definitions on energy policy, it's hard not to think that the coalition will resort to the capital, currency, price and trade controls from when it was in power from 2003 to 2015. The last eight years of that period were governed by Cristina Fernandez de Kirchner, who is Fernandez's vice president-elect. While it is widely thought that she was on the ticket because of her popularity, a question is whether she will have any influence on economic and energy policy.