In August 2011, the SPDR Gold Shares ETF (GLD) briefly surpassed the S&P 500 SPDR ETF (SPY) as the largest exchange-traded fund in terms of assets. Since then, the investment performance of these two funds are night and day.

The S&P 500 is up roughly 190% in total since the end of August 2011 while gold remains nearly 20% below its high watermark from that summer. There's nothing magical about becoming the biggest ETF in the world but the aftermath of this honor was none too kind to the assets in GLD:

From a high of more than $77 billion in that late-summer of 2011, assets under management (AUM) in GLD fell all the way to $21 billion by the end of 2015. What's interesting in this scenario is how much more AUM fell than performance in the underlying fund.

Assets in GLD fell more than 72% in a little over 4 years while performance in GLD itself was only down 43%. That's a fairly substantial crash in price but an even more substantial outflow in terms of assets.

The flipside was true in the run-up to becoming the world's largest ETF. From 2007 through August 2011, GLD was up more than 180%. But assets in the fund grew nearly 700% in that time. Some of this could have been due to the fact that the financial crisis created a flight to hedge systemic risk, of which gold is a favored proxy for many. But it's clear there was also an element of performance chasing going on as well.

When the fund performed well, assets poured in. And then when the fund performed poorly, assets fled. This is nothing new in the fund space. There have always been performance chasers and there will always be performance chasers.

SPY now wears the crown as the largest ETF with more than $270 billion in assets. Surprisingly, the growth in assets for SPY since GLD passed it briefly in 2011 has come from market gains, not flows from investors. Assets under management in SPY have grown just shy of 194% since August 2011, not much more than the close to 190% total returns in the fund.

Index funds and ETFs aren't immune to performance chasing but the more non-traditional asset classes and strategies tend to see more performance chasing from investors.

Following the market crash in 2008, investors were eager for alternative investments that would either hedge the stock market or offer an uncorrelated return stream with high expected returns. Few funds in the liquid alt space delivered on these promises but one fund did gain investor attention because of its performance.

The Mainstay Marketfield Fund (MFLDX) saw strong returns, delivering a return of more than 100% from 2009 through the first quarter of 2014. The S&P 500 was up more than 130% in this time, but the fact that an alternative fund that switches between a number of asset classes and has the ability to short securities was able to keep up attracted huge inflows from investors.

Assets in MFLDX exploded from just $34 million at the outset of 2009 to more than $21 billion by early-2014. So while fund performance merely doubled, assets were up 60,000%. Warren Buffett once said, "Size is the enemy of outperformance," and the Marketfield Fund was no different.

Since the first quarter of 2014, MFLDX has gone nowhere, losing a total of more than 11% up to now. U.S. stocks are up nearly 80% in this time. The fast money that poured into this fund fled just as fast as it came in. Assets are now under $200 million, down 99% from the highs in 2014.

This was a performance chase of epic proportions, most likely caused by investors who were still somewhat scarred from the financial crisis and in search of an alternative to the stock market's crazy ways. The market can be fickle but so are investors.

Performance chasing is as old as the hills so this type of behavior is never going away. There will always be certain funds or esoteric strategies that do better than others at times. Unfortunately, most investors tend to put their money into these strategies only after they've already experienced strong outperformance.

Ben Carlson, CFA is the Director of Institutional Asset Management at Ritholtz Wealth Management.

More must-read stories from Fortune:

—Airbnb plans huge IPO in 2020, continuing push by tech companies to go public

—What’s the difference between a recession and a depression? Here’s what history tells us

—Why the next recession may feel very different than 2008

—Why the repo market is such a big deal—and why its $400 billion bailout is so unnerving

—Apple Card: Here are all the credit card’s 3% cash back benefits partners

Don't miss the daily Term Sheet, Fortune's newsletter on deals and dealmakers.

BBC News-2 hours ago

There's plenty of discussion of the UK government's revised Brexit plan. The Financial Times says the prime minister will know by the weekend ...

Brexit news latest: Boris Johnson 'asking EU to block delay in ...

Evening Standard-8 hours ago

Dithering, divided, hopeless: Remain plot to sabotage Brexit in ...

Express.co.uk-8 hours ago

Boris to set out Brexit final plan – but the Irish don't like it

In-Depth-Metro-2 hours ago

The Tories have lost their ideology. Now they are merely the ...

Opinion-The Guardian-2 hours ago

Is Boris Johnson laying the groundwork for a Brexit surrender?

In-Depth-Telegraph.co.uk-20 hours ago

CNN-3 hours ago

Washington (CNN) Democrats aimed a fresh dagger at Donald Trump's inner circle by subpoenaing documents from his lawyer Rudy Giuliani, ...

Trump lawyer Rudy Giuliani subpoenaed to produce Ukraine ...

Sky News-9 hours ago

The Trump administration's latest sanctions against Russia ...

International-Vox-9 hours ago

How Trump Could Further Erode Democracy During ...

Opinion-The New Yorker-16 hours ago

Rudy Giuliani subpoenaed by House committees weighing ...

In-Depth-The Guardian-9 hours ago

Trump Seeks Whistle-Blower's Identity

International-The New York Times-12 hours ago

The Guardian-1 hour ago

China has celebrated 70 years of Communist party rule and its rise to global superpower status with a military parade showcasing the country's ...

70 years of the People's Republic of China in five graphics

CNN-1 hour ago

China Flexes Muscles In Parade Marking 70 Years Of ...

NPR-1 hour ago

China's Xi: 'No force can stop the Chinese people and the ...

CNBC-5 hours ago

Military hardware on show for China's birthday

In-Depth-BBC News-3 hours ago

China National Day Live Updates: Festivities in Beijing but ...

Live Updating-The New York Times-4 hours ago

Visa Inc., Mastercard Inc. MA -0.23% and other financial partners that signed on to help build and maintain the Libra payments network are reconsidering their involvement following backlash from U.S. and European government officials, according to people familiar with the matter. Wary of attracting regulatory scrutiny, executives of some of Libra’s backers have declined Facebook’s requests to publicly support the project, the people said.

Their reluctance has Facebook scrambling to keep Libra on track. Policy executives from Libra’s more than two dozen backers—a group called the Libra Association—have been summoned to a meeting in Washington, D.C., on Thursday, according to people familiar with the matter.

On Oct. 14, representatives from the companies are slated to meet in Geneva to review a charter for the Libra Association and appoint a board of directors, according to a memo reviewed by The Wall Street Journal.

https://www.wsj.com/articles/visa-mastercard-others-reconsider-involvement-in-facebook-s-libra-network-11569967023?mod=hp_lead_pos6

Digital transformation is the process of using digital technologies to create new — or modify existing — business processes, culture, and customer experiences to meet changing business and market requirements. This reimagining of business in the digital age is digital transformation.

Digital Transformation (DT or DX[1]) is the use of new, fast and frequently changing digital technology to solve problems often utilising cloud computing, reducing reliance on user owned hardware but increasing reliance on subscription based cloud services. Some of these digital solutions enhance capabilities of traditional software products (e.g. Microsoft Office compared to Office 365) whilst others are entirely cloud based (e.g. Google Docs).

As the companies providing the services are guaranteed of regular (usually monthly) recurring revenue from subscriptions, they are able to finance ongoing development with reduced risk (historically most software companies derived the majority of their revenue from users upgrading, and had to invest upfront in developing sufficient new features and benefits to encourage users to upgrade), and delivering more frequent updates often using forms of agile software development internally.

The change to the subscription model also reduces software piracy - which is a major benefit to the vendor.

Some of these digital solutions enable - in addition to efficiency via automation - new types of innovation and creativity, rather than simply enhance and support traditional methods.[2]

One aspect of digital transformation is the concept of 'going paperless' or reaching a 'digital business maturity'[3] affecting both individual businesses[4][page needed] and whole segments of society, such as government,[5] mass communications,[6][page needed] art,[7] medicine,[8] and science.[9]

Digital transformation is already underway, but is not proceeding at the same pace everywhere. According to the McKinsey Global Institute's 2016 Industry Digitization Index,[10] Europe is currently operating at 12% of its digital potential, while the United States is operating at 18%. Within Europe, Germany operates at 10% of its digital potential, while the United Kingdom is almost on par with the United States at 17%.

Weather. A super cold winter.

US-China Trade Deal.

President Warren bans fracking.

The global warming agenda collapses.

Iran throws a Nuke next time.

Source: Xinhua| 2019-09-29 23:42:36|Editor: huaxia

Video Player Close

Chinese Vice Premier Liu He (8th R), also a member of the Political Bureau of the Communist Party of China Central Committee and chief of the Chinese side of the China-U.S. comprehensive economic dialogue, U.S. Trade Representative Robert Lighthizer (8th L) and Treasury Secretary Steven Mnuchin (7th L) hold the 12th round of China-U.S. high-level economic and trade consultations in east China's Shanghai from July 30 to 31, 2019. (Xinhua/Liu Bin)

The two sides should seek solutions through equal dialogues on the basis of mutual respect, equality and mutual benefit, which is in line with the interests of both countries and peoples, as well as the world and people of the world.

BEIJING, Sept. 29 (Xinhua) -- Chinese Vice Premier Liu He, a member of the Political Bureau of the Communist Party of China Central Committee and chief of the Chinese side of the China-U.S. comprehensive economic dialogue, will lead the Chinese delegation to visit Washington D.C. for the 13th round of the China-U.S. high-level economic and trade consultations in the week following China's National Day holiday, an official said Sunday.

China and the United States previously held vice ministerial-level trade talks in Washington and conducted constructive discussions on economic and trade issues of common concern, said Chinese vice commerce minister Wang Shouwen, who is also deputy China International Trade Representative, at a press conference.

The two sides also exchanged views on the specific arrangement for the 13th round of China-U.S. high-level economic and trade consultations.

China's standpoint on the consultations remains consistent and clear, Wang said, adding that China has stressed its principles repeatedly.

The two sides should seek solutions through equal dialogues on the basis of mutual respect, equality and mutual benefit, which is in line with the interests of both countries and peoples, as well as the world and people of the world, Wang said. ■

[Photo/IC]

Any agreement next month between Washington, Beijing to be only first step

China and the United States are "in close communication" and making preparations for achieving "positive progress" in their next round of trade talks in October, the Ministry of Commerce said on Thursday.

But analysts cautioned that even if an agreement is reached next month, it would only be the first step toward ultimately resolving major differences between the two countries, and the US must be consistent in implementing any agreement reached to ensure healthy bilateral economic relations.

"Our stance is always consistent and clear," said Gao Feng, a Commerce Ministry spokesman, adding that the US should "meet China halfway" and find mutually beneficial, win-win solutions through dialogue and consultation on the basis of equality and mutual respect.

Gao also stressed that Chinese companies have recently concluded significant purchases of soybeans and pork from the US in line with World Trade Organization rules and market principles. The Customs Tariff Commission of the State Council will exclude these agricultural products from additional tariffs.

China made the move following the US announcement on Sept 17 that it was exempting over 400 categories of Chinese products from additional tariffs.

China has huge market demand for high-quality agricultural products, Gao said, adding that China and the US are highly complementary in the field of agriculture and have "broad prospects" for cooperation.

Analysts said that even if agreement is reached in the upcoming talks, its smooth implementation would hinge on the consistency of US policies.

Trade negotiations between the two countries are very complex, said Chen Dongqi, an economist at the National Development and Reform Commission's Academy of Macroeconomic Research. "Government officials from both sides are now coordinating among different government branches to lay the groundwork and settle details for the talks next month," Chen said.

Wang Huiyao, president of the Center for China and Globalization, a Beijing-based think tank, said both countries should be aware that reaching an agreement is only the beginning of the process. They should also continue to seek pragmatic solutions to end the prolonged dispute.

Wei Jianguo, vice-president of the Beijing-based China Center for International Economic Exchanges, said, "More importantly, the US must ensure the consistency of its policies to avoid back-and-forth in trade talks and unnecessary political conflicts."

Indicative of the complex economic relations of the two countries, Washington announced on Wednesday sanctions on six Chinese entities and five individuals for business links with Iran.

Foreign Ministry spokesman Geng Shuang expressed strong dissatisfaction and firm opposition to the US decision. China always opposes "long-arm jurisdiction" and unilateral sanctions, as well as US bullying practices based on its domestic laws, Geng said.

Geng urged the US to immediately correct its wrong practices. China has taken and will continue to take necessary measures to safeguard the legitimate rights and interests of its companies.

http://www.chinadaily.com.cn/a/201909/27/WS5d8cf3d1a310cf3e3556db66.html

A private gauge of China’s factory activity showed an expansion for the second straight month in September, thanks to higher production and new orders from home, contrasting with official data indicating a contraction for the fifth consecutive month.

The Caixin China manufacturing purchasing managers index rose to 51.4 in September from 50.4 in August, Caixin Media Co. and research firm Markit said Monday. The reading stayed above the 50 mark that separates expansion in activity from contraction.

While total new orders grew at a faster rate in September, new export orders reported a further reduction as the protracted China-U.S. trade dispute continued to damp foreign sales, Caixin said.

“The recovery in China’s manufacturing industry in September benefited mainly from the potential growth of domestic demand,” Zhengsheng Zhong, director of macroeconomic analysis at CEBM Group said.

Faster construction of infrastructure projects, better implementation of upgrading the industrial sector, and tax and fee cuts are likely to offset the effects of subdued overseas demand and soften the downward pressure on China’s economic growth, said Mr. Zhong.

He also said trade conflicts have a marked impact on China’s exports, production costs and business confidence.

China’s official manufacturing PMI, a competing gauge, released earlier Monday, edged up to 49.8 in September from 49.5 in August, thanks to recoveries in production and total new orders.

The Caixin PMI more closely tracks small, private manufacturers, while the official index focuses more on large, state-owned firms. The official PMI has a larger sample base, surveying 3,000 manufacturers nationwide, while Caixin polls 500 companies.

by The Loadstar

By Sam Whelan, Asia correspondent (The Loadstar) – Hong Kong-based start-up 300cubits will suspend its container shipping cryptocurrency tomorrow, as the industry enters “crunch time” for freight-tech.

In 2017, the firm set out to solve container shipping’s “booking shortfall”, a $23bn problem created by five million teu of ‘no show’ and ‘rolled’ cargo every year.

By introducing a booking deposit in the form of the teu token, a cryptocurrency based on the Ethereum blockchain network, 300cubits hoped to help eliminate the industry’s “trust issue”.

Trial shipments began in March 2018, but Johnson Leung (pictured above), the company’s co-founder, said transaction volume had been “far from commercial”, despite participation from carriers Maersk, CMA CGM, MSC, and Cosco and shippers such as Li & Fung Logistics, BASF, JF Hillebrand and Esprit.

“Only a couple hundred containers have gone through the system,” Mr Leung said today.

“The lack of clarity in regulatory regimes surrounding digital currencies has proved the greatest hurdle in our marketing efforts. Many potential users simply shied away from trying, not sure about what regulatory measures the authorities may take.

“A potential partnership with INTTRA, one of the largest shipment booking portals in the world, had to be stopped at the eleventh hour, due to regulatory concerns,” he added.

And Mr Leung said the lack of liquidity in teu tokens and the volatility of cryptocurrencies in general had “cast a constant doubt among the users on whether the value of the tokens could be realised”.

300cubits also found that rolled cargo was not shippers’ biggest pain point in the booking process.

“Instead, they complain that often they could not get their bookings confirmed during peak season, despite booking volumes within contract commitment,” noted Mr Leung.

He told The Loadstar he believed blockchain still had a role to play in shipping, but “the jury is still out”.

He said: “So far, and across all sectors – shipping, banking etc – the only blockchain projects that are commercially viable are still the businesses surrounding cryptocurrencies, and particularly the crypto exchanges.

“Many blockchain features, like immutability, anonymity and avoidance of double sending, that make perfect sense for people interested in cryptocurrencies, are not particularly intuitive or appealing to most businesspeople.”

However, he believed the “equality features” in blockchain provide a good case for logistics service providers to participate in a blockchain-based platform, since this could solve the shipper pain point of using multiple platforms to manage their shipments.

“Shipping could benefit from some sort of aggregator platform, and blockchain has at least the system architecture that can attract operators to participate,” said Mr Leung.

Alphaliner chief analyst Tan Hua Joo said there were “limited applications that can effectively utilise blockchain solutions in container shipping. However, the same can also be said for many other industries outside of shipping”.

According to Lars Jensen, chief executive of SeaIntelligence Consulting, the move by 300cubits is “unsurprising”. In 2017, he predicted there would be a strong increase in the number of freight-tech companies in the short term.

“But following an initial period of a couple of years, it would be crunch time,” he explained. “The cash from initial funding rounds would be running dry and, in order to push forward, the companies would need to show real and tangible business uptake for their concepts.

“The outcome we now see from 300cubits is a sign of this anticipated change. We are getting to the point where the plethora of new freight-tech companies launched in recent years is reaching this important cut-off point in the digitalisation of the shipping industry.”

Mr Jensen is an advisor to, and former board member of, NYSHEX, a direct competitor to 300cubits.

300cubits is not the first blockchain logistics casualty this year, following the liquidation of OpenPort in January.

The first missile landed at the Abqaiq Aramco oil plant in Western Saudi Arabia at 3.50am - followed by three more strikes. Workers at the plant initially thought there had been an explosion due to a malfunction, but by the fourth strike it was clear they were the subject of a targeted attack. Some 150 miles away, workers at the Khurais processing plant went through the same shocking realisation as they, too, were targeted in a drone attack.

A total of 25 drones and missiles were used in the attack on September 14, which forced the kingdom to shut down half of its oil production and sent prices soaring, Saudi Arabia has said. Authorities said the drone and missile debris recovered by investigators, as well as the direction of fire, suggested Iran was behind the strikes. Tehran has vehemently denied any involvement in the attacks on the oil facilities. But today, a report from the National Council of Resistance of Iran claims information from within the regime proves Iranian culpability.

Shahin Gobadi of the National Council of Resistance of Iran (NCRI) said: “The simultaneous missile and drone attack on Saudi Arabia’s oil facilities on September 14, 2019 emanated from inside Iran and was a blatant act of war that Khamenei, Rouhani, Zarif, and other regime heads were responsible for in deciding, approving, and implementing. “The regime hopelessly tries to prevent a popular uprising and thwart the expansion of resistance units by using internal suppression and external sponsorship of terrorism. “It seeks to contain the deep-seated anger of society at its disastrous and inhuman rule. “It is quite telling that according to numerous reports from inside the IRGC, all IRGC forces were on full alert during and after the attack. “IRGC units implemented suppressive manoeuvres to intimidate Iranians in various cities and to fend off the threat to their rule that they see in a popular uprising inside Iran as their main concern. “The regime is counting on inaction of the international community in its aggression. As long as this regime exists, it will not cease its aggression.”

Bollywood actor Akshay Kumar on Saturday said he has got the plot for Toilet - Ek Prem Katha 2. The actor was in a panel discussion in Delhi during the book launch of HarperCollins’ ‘The Swachh Bharat Revolution: Four Pillars of India’s Behavioural Transformation,’ when he made the remark.

During the course of the discussion, Unicef Representative in India, Dr Yasmin Ali Haque, mentioned how in a demographic shift, women have taken on the role of constructing toilets in India as Rani Mistris (Raj Mistri is a common term to describe someone with construction expertise and is a male dominated profession). She went on to narrate that last year, about 2,000 women in Jharkhand’s Simdega district managed to build 7,000 toilets in just five days. Reacting to this Akshay said, “Yasmin has given me the plot for Toilet - Ek Prem Katha 2”.

A file photo of Akshay Kumar

In June last year, the actor had tweeted that he will soon be coming out with Toilet 2. “Time to get ready for the next Blockbuster — Mission #Toilet2! Iss baar badlega poora desh (The whole country will change this time)! Coming soon,” Akshay had tweeted.

Akshay also shared a short video in which he said: “Toilet toh bana liya, par katha abhi bhi baaki hai. Main aa raha hun leke ‘Toilet’ part 2 bahut jald. (We made toilet, but the story is not over. I am coming soon with ‘Toilet’ part 2.” This led to the speculation about a sequel. However, Akshay later clarified that he had been appointed as the brand ambassador for a toilet cleaning product, and the teaser was a part of that campaign.

Toilet – Ek Prem Katha was inspired by Prime Minister Narendra Modi’s Swachh Bharat Mission (SBM), and told the story of a woman (played by Bhumi Pednekar) fighting for her hygiene rights.

The PM Modi-led movement that was launched in 2014 with a promise to make India open defecation free (ODF) by 2019, has helped break taboos, according to Yasmin. “Earlier, people would not talk about toilets and defecation, and that has changed,” she said.

The October 2, 2019 deadline, which is Mahatma Gandhi’s 150th birth anniversary, to make India ODF, will be met by the government, said Parameswaran Iyer, Secretary, Ministry of Drinking Water and Sanitation, who is also the editor of the book.

The book contains essays by several prominent personalities such as late Arun Jaitley, former Finance Minister; Amitabh Kant, CEO, Niti Aayog; Ratan Tata, Chairman emeritus, Tata Sons; actors Amitabh Bachchan and Akshay Kumar; Tavleen Singh, journalist and author; Arvind Panagariya, former Niti Ayog Vice-Chairman; and Bibek Debroy, Chairman of the Economic Advisory Council to the Prime Minister.

The book aims to provide a wide range of perspectives on PM Modi’s Swachh Bharat Mission. The foreword has been written by the Prime Minister himself.

Speaking on Narendra Modi’s leadership and his role in the initiative, Akshay said, it is important to listen to what the “leader of the country” is saying. “If he is taking us in the right direction, everyone will be willing to follow...and that is what has happened with Swachh Bharat,” he said. He also added that he was motivated by Parameswaran Iyer to make the first ‘Toilet’ movie.

According to Parameswaran, who took up the role in the ministry in March 2016, it was a “little bit of business as usual” when he came on board. He went on to elaborate, “I realised we needed some disruption in the ministry. We got in youngsters, I started hanging out with Amitabh Kant who brought about great change with Niti Aayog. Then, we started doing grassroots trips and programmes to spread the word. We had PM Modi, our communicator-in-chief, and then we had Akshay with his movie Toilet, which was transformational. We did things that were different that created a buzz.”

Gajendra Singh Shekhawat, Union Minister for Jal Shakti, who was also present at the event, said that social taboos can only be broken by opinion makers like the media and Akshay. The government alone cannot do it without the participation of such influencers and people’s participation, he added.

Amitabh Kant concurred and said community participation is essential, otherwise such programmes cannot succeed. The Niti Aayog CEO went on to add that the most successful and revolutionary move by the Narendra Modi government has been the ‘Swachh Bharat Mission’. “And mind you, there have been GST, demonetisation, and several other crucial initiatives by this government,” he added.

According to the government, over the past five years, nearly 10 crore toilets have been built under the SBM-Grameen programme, and rural sanitation coverage has increased from 39 percent in 2014 to 99 percent in June 2019.

(Edited by Megha Reddy)

China’s imports of major commodities, including crude oil, iron ore, liquefied natural gas (LNG) and coal, appeared to have once again shown resilience in September, challenging the prevailing narrative that the world’s second-largest economy is weakening.

While official customs data for the month will only be published next week after the national day holidays, vessel-tracking and port data compiled by Refinitiv suggest that imports held up in September.

The steady commodity imports sit somewhat at odds with soft readings in other economic data, with the both the official and private Purchasing Managers’ Indexes painting a picture of a sluggish manufacturing sector.

The official PMI stayed in negative territory in September, improving slightly to 49.8 points from 49.5 in August, while the private Caixin survey rose to 51.4 from 50.4, staying above the 50-level that separates expansion from contraction.

The PMI readings did little to convince markets that a recovery was underway in China, with the breakdown showing domestic demand was where there were signs of strength, but export orders remained weak in the face of the ongoing trade dispute with the United States.

But imports of major commodities have yet to feel a chill wind from the softer economic numbers in China.

Seaborne imports of crude oil in September were estimated by Refinitiv at 8.1 million barrels per day (bpd), down slightly from 8.3 million bpd in August, but up from the 7.85 million bpd in September last year.

There is also the possibility that the Refinitiv numbers will be adjusted higher depending on whether vessels that were discharging their cargoes managed to complete the offloading by the end of the month.

For LNG, China imported 4.46 million tonnes in September, down from 5.02 million in August, but about the same as volumes in May, June and July.

The September arrivals also exceeded the 4.02 million tonnes from the same month in 2018.

IRON ORE, COAL

Seaborne iron ore imports were 86.1 million tonnes in September, down from 88.4 million in August, but at 2.87 million tonnes per day, September’s daily imports were above August’s 2.85 million.

Taken together, August and September have been the two strongest months for iron ore imports since March, a sign that China is now able to source sufficient supply following outages in top exporters Australia and Brazil earlier this year.

The only major commodity not showing strength was coal, with September seaborne arrivals totalling 22.2 million tonnes, down from 26.5 million in August.

However, the September imports were still well above the 16.8 million tonnes recorded in the same month last year,

Coal may be a special circumstance as its known that the authorities wish to restrict 2019 coal imports to the level in 2018.

Total coal imports, including both seaborne and overland, rose 8.1% in the first eight months of the year to 220.28 million tonnes, according to official customs data.

This leaves just 60 million tonnes available for the September to December period, if 2019 imports are to be kept to the 281.2 million tonnes total for 2018.

It would appear that September coal imports are well above the 15 million tonnes a month average needed for the final four months if the target of no increase is to be met.

This implies coal imports may pull back further in the final quarter of the year, but this should probably not be taken as a sign of economic weakness, rather it should be viewed as a policy imperative unrelated to supply and demand fundamentals.

But so far imports of the other major commodity imports have yet to mirror signs of slower growth in the Chinese economy.

Excavation and demolition contractors cannot find any legal dumping sites for construction waste and the industry risks “imminent paralysis”, the Malta Developers Association warned.

The warning follows similar cautions issued over the past couple of months as dumping prices in the only two quarries accepting construction waste started to rise.

However, the MDA is now lamenting that the problem is no longer a situation of escalating dumping costs pushing up property prices but members simply not finding any dumping sites that will accept their construction waste at any cost.

“The emergency situation over the shortage of dumping sites for construction waste, has now reached critical proportions as some 400 excavation and demolition contractors are facing a total standstill as they cannot find any legal dumping solution at any price,” the association said on Tuesday.

The warning precedes a conference on the property market that will be held tomorrow, and which is expected to be addressed by Prime Minister Joseph Muscat.

The MDA appealed to the government to take “immediate and definitive action” on the problem, which it insisted was not caused solely by private construction projects.

“The industry cannot be left in limbo indefinitely,” the MDA said, adding there were substantial public projects underway that generated construction waste.

There are a number of quarries with a permit to receive waste but only two were doing so. Others belong to large construction companies that are using them for their own waste, while in other instances quarries are still being used to extract stone.

The government has warned that it will expropriate quarry space to solve the problem unless the private sector finds its own solution.

Another possibility being considered is the dumping of construction waste at sea in a location earmarked for the purpose off Malta’s south eastern coast.

Katrina Holte is not a modern woman.

After three years of happy marriage, and getting stressed out by her job in a busy payroll department, she decided in 2018 to turn back time — and live like a 1950s housewife.

That’s when Holte, 30, transformed her Hillsboro, Oregon, home into a suburban shrine to the pre-ERA era, busying herself cleaning, making dresses using vintage patterns — and getting dinner on the table by the time her husband, Lars, 28, gets home from his job as an engineering manager.

“I feel like I’m living how I always wanted to. It’s my dream life and my husband shares my vision,” she says as a vinyl Doris Day soundtrack plays in the background. “It is a lot of work. I do tons of dishes, laundry and ironing, but I love it and it’s helping to take care of my husband and that makes me really happy.”

Yes, her closet is full of “flattering” frocks she sewed herself, and the home’s decor is retro as all get-out, but it’s not “like it’s a museum,” Holte tells PA Real Life.

“When I look at everything that is happening in the world now, I feel like I belong in a nicer, more old-fashioned time,” she says. “I agree with old-fashioned values, like being a housewife, taking care of your family, nurturing the people in it and keeping your house in excellent condition, so everyone feels relaxed.”

But of course the part-time seamstress of 10 years, who sells her handmade garments online, asked for Lars’ permission before leaving the workforce.

“I spoke to my husband and told him I want to be a housewife and he said that was fine with him,” Holte says. “It was a fantastic feeling when I quit. I can do what I want to now and run my house as I want to run it. Now I’m a full-time homemaker.”

A day in the retro life

Holte’s typical day starts at 6:30 a.m., when she wakes up and lays out Lars’ clothes before preparing his breakfast and packing his lunch. After feeding herself, she does 15 minutes of “gentler” exercises from yesteryear.

“We have the idea today that we have to push our bodies to the limit, but in the 1950s, the attitude was simply that you had to take care of it,” she says. “I have a vintage slant board, which is a small wooden ramp, to do core exercises like situps. I do them for about 10 to 15 minutes a day and they keep me in shape to fit into my 1950s dresses.”

After her workout, she heads upstairs for a shower and “full face of vintage makeup,” complete with Pond’s cold cream and Revlon red lipstick, with “well-drawn eyebrows” and “traditional hot rollers to curl my hair.”

When she looks her best, it’s time to get to her chores.

“I will then spend a good hour doing the laundry, dusting and sweeping. I make sure everything is kept in its place,” she says matter-of-factly. “After lunch, when my house is tidy and smelling fresh, I will go upstairs and sew either for myself, for my customers or to try out new patterns.”

Holte starts supper around 4 p.m. to ensure everything is ready when Lars arrives home from work.

“I usually cook recipes from the era like pot roasts or chicken pies and make sure there are vegetables,” she says. “In the 1950s, housewives liked to make sure all the food groups were there.”

As the man of the house returns

When Lars gets home, he actually likes to hang up his own coat, but Holte doesn’t mind: “I read in a 1950s book that if a man wants to hang his own coat up, you should not feel like it makes you a bad housewife.”

Instead, she serves him a refreshing glass of water and a plate of snacks — cheese, dried fruits or nuts — before putting the finishing touches on her entree.

“After dinner, we play board games like Scrabble, or watch our vintage shows like ‘I Love Lucy’ or ‘The Donna Reed Show,’ ” Holte says. “Sometimes we read. I like reading 1950s cookbooks and vintage beauty and sewing magazines.”

Yes, when they aren’t spinning Sinatra or Day on their record player, the couple does watch TV (no cable or streaming channels, thank you) — but when it’s not in use, they keep it hidden away so as not to disrupt the midcentury modern vibe.

But make no mistake, Holte says, Lars is not a controlling hubby.

“He grew up in a house where he helped his mom with the cooking and the cleaning, so he is not domineering in any way,” she says. “If I did, heaven forbid, have dinner late, he would not make a fuss, but I can tell it means a lot to him that it’s normally on time.”

The bottom line: “A man needs his wife to make him feel spoiled every once in a while.” Besides, that’s the payoff “because he makes a lot more money than I do. He works very long hours and makes my dreams come true, so I try to make his come true, too. It’s an equal partnership.”

Living by the Golden Rule

“I think we, as women, should support each other. If a woman says she wants to be a homemaker, we should not say that’s not right,” Katrina says. “What’s right for me might not be right for someone else. We all have to do what’s right for ourselves.”

Her ultimate goal is to embody a timeless “Do to others what you want them to do to you” mantra.

“No decade is perfect, definitely we had big social problems in the ’50s, but the people I talk to who lived through the era say it was a time when you could leave your door unlocked and you didn’t need to worry about people breaking in,” she says. “People today have forgotten how to talk to people they don’t agree with and they have lost all their manners.”

She longs for a bygone era when neighbors were neighborly.

“All the stories I’ve read are about women borrowing dishes or butter from each other, and the neighborhood kids all playing together. You find now neighbors will go from the car to the garage to the house and won’t speak to each other.”

Holte now looks forward to having four children — but realizes that could alter her domestic bliss.

“I’m not sure I’ll be able to keep my house in perfect order but we would love to have a big family,” she says. “I definitely plan to put my little girls in vintage dresses, petticoats and hats, but when they get older, they can make their own choices.”

Chile’s economic activity rose 3.7 percent in August from the same month a year ago, the central bank said on Tuesday, beating expectations and boosted by a surge in mining following several months of sluggish growth.

The IMACEC economic activity index encompasses about 90 percent of the economy tallied in gross domestic product figures.

Mining activity in August grew 5.3 percent compared with the same month in 2018, an improvement over past sluggish performance this year.

Chile, which produces nearly one-third the world’s copper, has suffered amid floundering prices for the red metal. Heavy rains in the country’s normally parched northern desert that is home to many of its mines, labor strife and a blistering drought in its central agricultural region have added to the pain.

Non-mining activity grew by 3.5 percent, the bank said, boosted by growth in the construction and service sectors.

In which we take a robust look at the scale of the secular issues facing our sector.

في أعقاب ورود إفادات عن رفض جمهورية تنزانيا المتحدة توفير معلومات مفصلة حول حالات الإصابة بفيروس الإيبولا المشتبه بها إلى منظمة الصحة العالمية ('دبليو إتش أو')، تدعو مؤسسة الرعاية الصحية لمرضى الإيدز 'إيه إتش إف' الحكومة التنزانية إلى إعتماد الشفافية والانفتاح، لأن عدم القيام بذلك يؤدي إلى تحديات هائلة في الحد من انتشار هذا الفيروس المميت ويهدد حياة ملايين الناس في أفريقيا وخارجها.

ووفقاً لبيان صادر عن منظمة الصحة العالمية في 21 سبتمبر، تلقت المنظمة معلومات غير رسمية تفيد بوفاة شخص يشتبه بإصابته بمرض فيروس الإيبولا في عاصمة البلاد المكتظة بالسكان، دار السلام، بالإضافة إلى تقارير غير رسمية تفيد بأن أشخاص يعرفهم المتوفي تم وضعهم في الحجر الصحي في مواقع مختلفة داخل البلاد.

كما ذكرت منظمة الصحة العالمية أنها تلقت بلاغاً غير رسمي بأن التحاليل الطبية أثبتت إصابة الشخص المتوفي بفيروس الإيبولا وبوجود حالتين جديدتين مشتبه بهما. في حين جاءت نتيجة اختبار الحالة الثانية سلبية في وقت لاحق، إلا أن المعلومات المتعلقة بنتائج الفحوص المختبرية للحالة الثالثة ظلت غير واضحة، وعلى الرغم من الطلبات الكثيرة التي وُجهت إليها، احتفظت السلطات التنزانية بالصمت.

تجدر الإشارة إلى أن تخلّف تنزانيا عن نشر تفاصيل مهمة حول حالات الإيبولا المشتبه فيها يشكّل انتهاكاً فاضحاً لمعايير اللوائح الصحية الدولية، التي تنص على أن 'فيروس مرض الإيبولا/ فيروس مرض الإيبولا المشتبه به يعتبر مرضاً ينبغي الإبلاغ عنه' باعتباره حالة طوارئ صحية عامة محتملة. ونظراً لقربها من جمهورية الكونغو الديمقراطية- التي تشهد تفشي وباء الإيبولا القاتل للمرة الثانية في تاريخها منذ 14 شهراً – يعتبر الصمت المستمر من جانب تنزانيا منافياً للسلامة العامة ويهدد الجهود في مجال تقييم المخاطر والتأهب لحالات الطوارئ داخل وخارج حدودها.

وفي معرض تعليقها على الأمر، قالت الدكتورة بينيناه أيوتانج، رئيسة مكتب 'إي إتش إف' في أفريقيا: 'ينبغي على الحكومة التنزانية أن تفهم أن هناك قضايا كثيرة على المحك، وأن افتقارها للشفافية بشأن فيروس الإيبولا يعرّض مواطنيها والدول المجاورة والمجتمع العالمي بأكمله للخطر'. وأضافت: 'فقدنا أكثر من 2100 شخص منذ بدء تفشي المرض في الكونغو، ويتعيّن على جميع الدول العمل معاً لضمان إبلاغ منظمة الصحة العالمية رسمياً بكل حالة يشتبه في إصابتها بفيروس الإيبولا بما يتماشى مع إرشادات اللوائح الصحية الدولية'.

ومما يبعث أكثر على القلق هو أن التفاصيل السريرية والنتائج المخبرية للمرضى لا تزال غامضة بالنسبة لمنظمة الصحة العالمية. وجاء في البيان ما يلي: 'لغاية الآن، لم تتم مشاركة التفاصيل السريرية ونتائج التحقيق، بما في ذلك الفحوصات المخبرية التي أجريت لتحديد التشخيصات الطبية الأخرى المحتملة لحالة هؤلاء المرضى، مع منظمة الصحة العالمية'. 'ولا تسمح المعلومات غير الكافية التي تلقتها منظمة الصحة العالمية بصياغة فرضيات تتعلق بالسبب المحتمل للمرض'.

وأضافت أيوتانج قائلةً: 'إن دعوتنا إلى المسؤولين في تنزانيا بسيطة للغاية - ليس الوقت مناسباً الآن لممارسة السياسة. يجب أن تتعاون تنزانيا بشكل كامل مع منظمة الصحة العالمية من خلال نشر المعلومات السريرية ونتائج الدراسات وقائمة الاشخاص الذين يحتمل أن تكون لهم صلة بالمرضى والامتثال لتوصيات الاختبار التأكيدي الثانوي - وكذلك الإبلاغ عن الحالات المشتبه فيها أو المؤكدة لتمكين المنظمة من تقييم المخاطر المحتملة لهذه الحالات. وعندما يتعلق الأمر بالتهديدات الصحية الخطيرة مثل الإيبولا، فإننا نعيش جميعاً في عالم واحد موحد - بلا حدود'.

كما قامت مؤسسة الرعاية الصحية لمرضى الإيدز 'إيه إتش إف' مؤخراً بمناشدة منظمة الصحة العالمية لتوفير شفافية كاملة فيما يتعلق باستراتيجيات التطعيم في جمهورية الكونغو الديمقراطية بعد اتهامات وجهتها منظمة أطباء بلا حدود بقيام منظمة الصحة العالمية بتقنين لقاح إيبولا من إنتاج شركة 'ميرك'، وحثت الأمين العام للأمم المتحدة أنطونيو غوتيريش خلال زيارته لبؤرة التفشي قبل أسبوعين لاتخاذ الخطوات اللازمة لضمان وضع نهاية لهذه الأزمة المدمرة التي استمرت عاماً كاملاً.

للمزيد من المعلومات، يرجى الاتصال بـ جيد كينسلي عبر البريد الإلكتروني التالي: gedk@aidshealth.org أو على الرقم التالي: 3237915526

لمحة عن مؤسسة الرعاية الصحية لمرضى الإيدز ('إيه إتش إف')

تعتبر مؤسسة الرعاية الصحية لمرضى الإيدز 'إيه إتش إف' أكبر منظمة لمكافحة الإيدز حول العالم، وتوفر حالياً رعايةً و/أو خدماتٍ طبية لأكثر من 1.2 مليون عميل في 43 دولةً في العالم في كل من الولايات المتحدة الأمريكية، وأفريقيا وأمريكا اللاتينية/الكاريبي ومنطقة آسيا/المحيط الهادئ وأوروبا الشرقية. لمزيد من المعلومات عن المؤسسة، يرجى زيارة موقعنا الإلكتروني: www.aidshealth.org، كما يمكنكم زيارة صفحتنا على موقع 'فيسبوك' على الرابط الإلكتروني التالي: www.facebook.com/aidshealth ويمكن متابعتنا عبر 'تويتر' على: @aidshealthcare و'إنستغرام' على: @aidshealthcare.

يمكنكم الاطلاع على النسخة الأصلية من هذا البيان الصحفي على موقع 'بزنيس واير' (businesswire.com) على الرابط الإلكتروني التالي: https://www.businesswire.com/news/home/20191001005524/en/

إنّ نص اللغة الأصلية لهذا البيان هو النسخة الرسمية المعتمدة. أما الترجمة فقد قدمت للمساعدة فقط، ويجب الرجوع لنص اللغة الأصلية الذي يمثل النسخة الوحيدة ذات التأثير القانوني.

wind

Provider of predictive maintenance in the wind energy industry Onyx InSight has been selected by Dongkuk S&C to replace the main bearing on a wind turbine generator at their wind farm in the Jollanam Province, South Korea.

Onyx InSight was chosen by Dongkuk S&C to replace one of the three main bearings at its Shinan project in South Korea. Following a competitive tender, the company was awarded the contract based on its previous experience of wind turbine main bearing replacements with one of the biggest wind energy companies in South Korea. The project involves a turbine model largely unique in South Korea, with only three others in operation in the country.

On this particular turbine an abnormal sound and vibration was initially detected by a Dongkuk service engineer. After the detection of this condition, Onyx was requested to conduct a full site inspection. As a result of the inspection, the company recommended Dongkuk stop operations on the faulty turbine immediately and replace the mainbearing to avoid a potentially catastrophic failure.

“Regular technician inspections are important for tracking turbine health” said Kyunghyun Lee, Prediction team leader at Onyx InSight. “However, because data is only collected intermittently, some health indicators can get overlooked, reducing the amount of warning maintenance teams might get of failure. A condition monitoring system (CMS) installed in the turbine and capable of collecting continuous data on drive train vibration would likely have identified the fault sooner. In this instance, without more warning of the failure, Onyx InSight had to recommend the complete replacement of the main bearing for the wind turbine. Installed CMS allow owners and operators to manage the health of their turbine to extend the useful working life of parts.”

The company has many years experience and expertise across a multi-brand portfolio of turbine models in the field, and was therefore well positioned to complete this replacement project. The company has developed a new methodology, which allows the replacement of wind turbine parts quickly and efficiently and therefore presenting a saving of up to 50 percent on this replacement project.

South Korea has a target to increase the amount of renewable energy it generates, from 6 percent to 20 percent of total energy production by 2030. The country will therefore need to both build new renewable energy sources and maintain and improve the efficiency of older renewable energy generators in the country. This means that Onyx InSight will have an important role in predictive maintenance and providing solutions to wind farm owners in the country by allowing older wind turbines to remain operational and efficient.

With main bearings operating in harsh environments, wear and tear is an unavoidable fact and, if ignored, it can be catastrophic. Proper installation and condition monitoring of the main bearing is essential if a wind turbine is to be safely operated and reach its expected useful life.

For additional information:

Onyx InSight

https://www.renewableenergymagazine.com/wind/onyx-insight-to-replace-generator-main-bearing-20191002

ATLANTA (AP) — More than 45 million people across 14 Southern states are now in the midst of what’s being called a “flash drought” that’s cracking farm soil, drying up ponds and raising the risk of wildfires, scientists said Thursday.

The weekly U.S. Drought Monitor report released Thursday shows extreme drought conditions in parts of Texas, Alabama, Georgia, Kentucky, South Carolina and the Florida panhandle. Lesser drought conditions also have expanded in parts of Arkansas, Louisiana and Mississippi.

Overall, nearly 20 percent of the lower 48 U.S. states is experiencing drought conditions.

The drought accelerated rapidly in September, as record heat combined with little rainfall to worsen the parched conditions, said Brian Fuchs, a climatologist at the National Drought Mitigation Center in Nebraska.

“Typically we look at drought as being a slow onset, slow-developing type phenomenon compared to other disasters that rapidly happen, so this flash drought term came about,” Fuchs said. “The idea is that it’s more of a rapidly developing drought situation compared to what we typically see.”

Fuchs said he expects scientists to have further discussions about flash droughts, and perhaps develop parameters for what constitutes a flash drought.

The drought has been putting stress on a wide variety of crops across the South, including cotton in Alabama, peanuts in Georgia and tobacco in Virginia, according to reports from the National Drought Mitigation Center.

Pumpkins are faring better in Alabama, though they’re somewhat smaller this year due to the drought.

“We would have liked to have had a few more pumpkins this year, but we do have pumpkins and we are selling pumpkins _ that’s the good news,” said Doug Chapman, a commercial horticulture expert with the Alabama Cooperative Extension System.

In Mississippi, wildfires have been on the rise, Gov. Phil Bryant said this week, as he ordered a statewide burn ban. Outdoor burning is also restricted in parts of several other states including Texas, Alabama, Georgia, Tennessee and West Virginia, according to the drought center.

The drought was also affecting some water supplies across the region. Lake levels have been falling throughout Georgia, including at Lake Lanier, which provides much of Atlanta’s drinking water.

In North Carolina, rivers and streams are running low, Rebecca Cumbie-Ward, the state climatologist, said in a statement. Some North Carolina water systems are limiting use, and state officials are asking residents to follow those water restrictions .

Alabama Power said last week it was reducing water releases from its hydroelectric dams because of the drought. The move was intended to prevent lakes from shrinking too much.

The Drought Monitor is produced by researchers at the University of Nebraska-Lincoln, the National Oceanic and Atmospheric Administration and the U.S. Department of Agriculture.

In our article three weeks ago, we cited lower crude oil prices as one of the key reasons to remain bullish on the Philippines (see Bullish on the Philippines, Sept. 9). The decline of oil prices helped ease inflation pressures and tempered the country’s current account and trade deficits. These, in turn, contributed to the stability of the Philippine peso and enabled the BSP to cut key interest rates for the third time this year.

BSP lowers inflation target for 2019, 2020

Last week, the BSP lowered its inflation forecasts for 2019 and 2020 to 2.5 percent and 2.9 percent, respectively. BSP’s economic team cited slower global economic growth, as well as low crude oil prices, as the basis for their reduced inflation projections. The Philippine inflation rate, which peaked at 6.7 percent in October of 2018 dropped to a 31-month low of 1.7 percent last August.

A long-term perspective on oil prices

Since oil prices peaked at $147 per barrel in 2008, it has been on a decade-long decline. It fell to the $30-$35 levels twice (2009 and 2016). From these levels, oil prices rebounded and formed lower highs of $110 in 2011-2014 and $75 in 2018. Since 2015, oil prices have remained on the lower half of the 11-year $30-$140 price range.

Source: Tradingview.com, Wealth Securities Research

US shale oil – the game changer

Shale oil fracking has been the game changer this past decade. With advances in fracking technology, the US, which previously was the biggest oil importer in the world, is now self-sufficient. Over the last decade alone, advances in shale oil production have enabled the US to increase its oil output from 5.4 million barrels per day to 12.3 million barrels per day.

EIA, IEA and OPEC forecast lower oil prices

All three of the major oil organizations (EIA, IEA and OPEC) see lower oil prices going forward. In its latest energy outlook, the US Energy Information Administration (EIA) reduced its 2019 and 2020 price forecasts on West Texas Intermediate and Brent crude oil. EIA cited the continued decline in global manufacturing Purchasing Manager’s Indices (PMIs), which is a leading indicator of economic growth.

In its monthly oil market report, the Organization of Petroleum Exporting Countries (OPEC) cut its oil demand growth forecast in 2020 by 60,000 barrels per day (BPD) to 1.08 million BPD. OPEC pointed out the continuation of the US-China trade dispute and the ongoing slowdown in major economies as the reasons for lowering its oil demand forecast.

Huge oil surplus projected for 2020

Despite production cuts by OPEC and the drop in Iran and Venezuelan output due to sanctions, there is a growing surplus in the oil market led by non-OPEC oil. According to the International Energy Agency (IEA), the US had been the main driver of oil supply growth this year, briefly overtaking Saudi Arabia as the world’s top oil exporter in June. Brazil and Norway also expanded their production this year, adding to the considerable oil surplus well into 2020.

Oil price spikes were short-lived

Geopolitical risk also plays a part in the pricing of crude oil. In recent months, several high-profile incidents have increased tensions in the Middle East. Attacks on oil tankers, tanker seizures and most recently, a drone attack on Saudi Arabia’s oil infrastructure, have increased the geopolitical risk premium of oil. However, while it led to heightened volatility, the effects so far have proven to be transitory, and the price spikes were short-lived.

Saudi restores oil production capacity

Oil futures spiked as much as 20 percent during the aftermath of the drone strike last Sept. 14. Today, the prices are back to the levels before the attack as Saudi Arabia restores oil production capacity to 11.3 million barrels per day – the level before the attacks on its oil facilities.

Crude prices remain in a long-term downtrend

Despite the rise in geopolitical risk, oil prices have failed to recover above the 11-month downward trend line. From its most recent peak of $76.88 per barrel in October 2018, WTI crude prices are down 27 percent, while the Asian benchmark Dubai crude is down 28 percent to $60.72 per barrel over the same period.

It appears that the market is less worried about the rising geopolitical tensions and is focused more on the global oil supply-demand outlook. Given the weak demand and the supply surplus, low crude oil prices will likely persist. Lower oil prices, low inflation, and a steady peso mean more room for the BSP to cut rates to ease financial conditions and sustain economic growth.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 689-8080 or email ask@philequity.net.

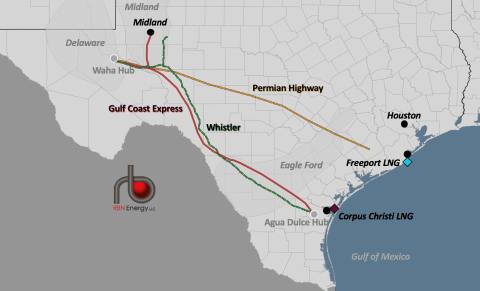

There already are indications that newly available takeaway-pipeline capacity out of the Permian Basin is goosing crude oil production growth there. Flows on those new pipes — Plains All American’s Cactus II and the EPIC system — are ramping up, crude exports are setting new records, and the end of big price discounts for oil at Midland versus Cushing and the Gulf Coast are giving Permian producers an economic incentive to produce more. And more takeaway capacity is on the way, including the 900-Mb/d Gray Oak Pipeline, which is slated to come online in the fourth quarter. Fast-rising production is putting new pressure on producers and their midstream partners to build and expand crude gathering systems and shuttle pipelines — especially in the Permian’s Delaware Basin, which has a lot less gathering pipe in the ground than the Midland Basin and which is poised for phenomenal production growth the next few months and years. Today, we discuss highlights from our second Drill Down Report on Permian gathering systems, this one focusing on developments in the fast-growing Delaware Basin in West Texas and southeastern New Mexico.

The greater Permian Basin, which includes all or part of 54 counties in the two states, has been producing crude oil in commercial volumes since the early 1920s. By 1960, the region’s crude output was averaging 1 MMb/d, and through most of the 1970s, production there hovered around the 2-MMb/d mark. That’s a lot of oil, and transporting it all to market efficiently and economically required the development of extensive crude gathering systems. As followers of the Permian’s up-down-and-up-again story know, however, the region’s crude output declined over the next three decades to less than 1 MMb/d, leaving unused much of the gathering capacity that had been installed. So, when Permian production finally started rebounding in the early 2010s with the use of horizontal drilling and hydraulic fracturing there was a good bit of gathering pipe in the ground, much of which producers could use to help gather crude produced at their new horizontal wells. By 2016, though, Permian production was back above 2 MMb/d, crude gathering pipelines — and takeaway pipes — were filling up fast and a big push was underway to expand existing systems and build new ones.

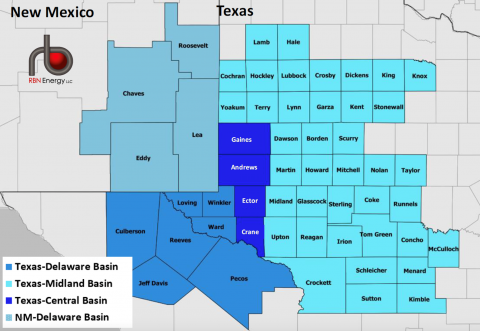

Figure 1. Sub-Basins Within the Permian. Source: RBN

This has been especially true in the Permian’s Delaware Basin, which until the mid-2010s produced considerably less crude than the Midland Basin and had much less crude pipeline, storage and other infrastructure in place than the Midland. (It still does, but it’s catching up.) The Delaware Basin — the focus of the newly released Part 2 of our Drill Down Report on Permian crude gathering systems —includes all or part of seven counties in West Texas (Culberson, Reeves, Loving, Winkler, Ward, Pecos and Jeff Davis) and four counties in southeastern New Mexico (Eddy, Lea, Chaves and Roosevelt). Figure 2 shows historical and forecasted Permian production by sub-basin (burnt orange yellow, brown and orange layers) from 2012 through 2024, as well the price of West Texas Intermediate (WTI) — the basin’s primary crude oil product — over that same period. (The solid black line shows historical WTI prices, and the dashed black line shows RBN’s Base Price Scenario of $55/bbl WTI through 2024.) At the start of 2012, the Delaware Basin accounted for 29% of total Permian crude production (322 Mb/d of the 1.118 MMb/d total), with the Midland Basin accounting for 50% and the Central Basin 21%. By the end of the summer of 2019, Delaware Basin production had increased more than seven-fold to 2.4 MMb/d, and it now accounts for just over half of total Permian production.

Figure 2. Permian Crude Oil Production by Sub-Basin, 2012-24. Source: RBN

The Delaware Basin’s share of total Permian production is expected to continue rising through the early 2020s. Under RBN’s Base Price Scenario (again, a WTI price of $55/bbl through 2024), production in the Delaware is seen increasing to nearly 4.0 MMb/d by the end of 2024, a gain of about 65% from current volumes. The Midland Basin, in turn, is forecasted to be producing nearly 2.9 MMb/d by late 2024, with Central Basin production lagging at about 320 Mb/d.

Gathering systems play a critically important role in the Delaware Basin. They transport the vast majority of the crude oil produced in the region; generally speaking, the use of tanker trucks to move crude to downstream pipelines is limited to wells that are too remote, that produce too little crude to justify the investment in a gathering system, or that are new and have not yet been connected to a nearby system. Several types of entities are involved in developing crude oil gathering systems in the Delaware, including (1) producers themselves; (2) midstream affiliates of producers; and (3) producers partnering with unaffiliated midstream companies to help them develop systems to meet their crude-gathering needs — and, often, the needs of producers with wells close by. And sometimes, individual midstream companies or joint ventures of two or more such firms have pursued the development of gathering systems in areas where drilling activity is intensifying — in these cases, the midstreamer or midstreamers often seek to line up an “anchor” producer to jump-start the project, then work to sign on additional producers in the same area.

The ownership of crude gathering systems and other midstream assets within the Permian has also evolved over time. In many instances, the systems have been expanded through a combination of organic growth and acquisitions, often with the involvement of new midstream companies backed by private equity. As some of these systems grew, established good relationships with producers, and increased their fee-based revenue streams, they became attractive targets for acquisition themselves.

The aim of our newly released Drill Down Report is to describe and discuss a representative sample of the Delaware Basin ’s expanding gathering systems. These range from smaller networks like EnLink Midstream’s new, 115-mile Avenger gathering system in Eddy and Lea counties, NM, which started coming online in late 2018, to the far more extensive Oryx Trans-Permian (OTP) gathering and regional transport system, which has been developed from scratch by Oryx Midstream Services over the past five-plus years.

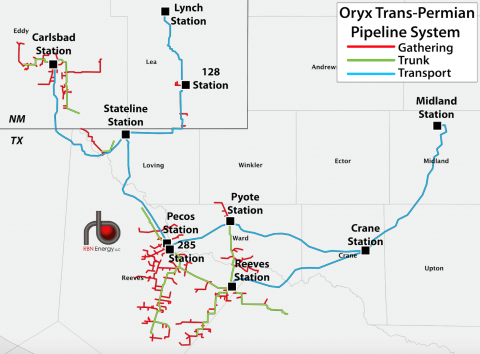

Oryx’s OTP network provides a prime example of how sophisticated and well-connected these systems can become. As shown in Figure 3, the OTP system includes gathering lines (red lines) and trunk lines (green lines) that serve more than 20 producers that have dedicated a total of nearly 1 million acres; OTP also has regional transport pipelines (blue lines). The gathering and trunk lines — the latter mostly 10 or 12 inches in diameter — move crude to six existing gathering hubs: Reeves Station (southeast of Pecos, TX), Pecos Station (northwest of Pecos), Pyote Station and 285 Station (both northeast of Pecos), Stateline Station (on the Texas side of the Texas/New Mexico border), and Carlsbad Station (near Carlsbad, NM). Two additional gathering hubs are being added: 128 Station and Lynch Station (both in Lea County, NM). At the gathering hubs, crude is fed into the OTP regional transport system — long-distance runs of 16-, 20- and 24-inch-diameter pipes (again, blue lines) that together have the capacity to move between 650 Mb/d (without drag-reducing agents) and 850 Mb/d-plus (with DRAs) to the marketing hubs in Crane and Midland.

Figure 3. The Oryx Trans-Permian Gathering and Regional Transport System. Sources: Oryx Midstream and RBN

From Crane, crude can flow onto Magellan Midstream Partners’ Longhorn Pipeline to the Houston area — and will be able to flow onto Phillips 66 Partners, Enbridge, Marathon Petroleum and Rattler Midstream’s new Gray Oak Pipeline to Corpus Christi when Gray Oak begins operating in the fourth quarter of 2019. At Midland, OTP connects to Enterprise Products Partners’ Midland Terminal and soon will tie into Plains’ Midland South Station as well. From those terminals, Delaware Basin crude transported via OTP can flow onto a number of pipelines (either directly or via pump-over), including Enterprise’s Midland-to-ECHO I and II; Energy Transfer’s Permian Express II and III and Amdel Pipeline; ExxonMobil’s PELA pipeline; Plains’ Basin pipeline system; and Lotus Midstream’s Centurion Pipeline — and, starting in the first half of 2021, to the Wink-to-Webster Pipeline being co-developed by ExxonMobil, Plains, Lotus Midstream and MPLX, among others.

Our new Drill Down Report discusses in depth Delaware Basin gathering systems and shuttle pipelines owned by 10 joint ventures or individual companies, as well as the takeaway pipelines to which those systems connect.

Saudi Arabia has moved to impose a partial cease-fire in Yemen, say people familiar with the plans, as Riyadh and the Houthi militants the kingdom is fighting try to bring an end to the four-year war that has become a front line in the broader regional clash with Iran.

Saudi Arabia’s decision follows a surprise move by Houthi forces to declare a unilateral cease-fire in Yemen last week, just days after claiming responsibility for the Sept. 14 drone and cruise missile strike on Saudi Arabia’s oil industry. While the Houthis fired two missiles at Saudi Arabia earlier this week, the strike wasn’t seen by Saudi leaders as a serious attack that would undermine the new cease-fire efforts.

Houthi leaders initially said they were responsible for the attack on the oil facilities, but Saudi, U.S. and European officials have dismissed the claims as a transparent attempt to obscure Iran’s role in the strike. Yemeni fighters, these officials say, have neither the weapons nor the skills to carry out such a sophisticated strike.

In the days that followed the attack, an internal Houthi rift expanded between those who want to distance themselves from Iran and those who want to strengthen ties.

Some Houthi leaders privately disavowed the group’s claim of responsibility for the Sept. 14 attack, according to two Saudi officials who asked not to be identified. And Houthi officials told foreign diplomats that Iran was preparing a follow-on attack, says one of these officials and other people familiar with the evolving plans.

Official Houthi spokesmen have rejected any suggestions that they disavowed their initial claim or warned Riyadh about future strikes by Iran. The group didn’t immediately respond Friday to requests for comment.

Yemen’s war has become a political and military morass for Saudi Arabia and Crown Prince Mohammed bin Salman, the country’s de facto ruler and original architect of the war plans. The war has eroded support for his country in Washington, where bipartisan opposition to the conflict has solidified.

The Houthis’ unilateral cease-fire last week has raised hopes in Riyadh and Washington that the Yemeni fighters might be willing to distance themselves from Tehran. The U.S. has accused Iran of providing the Houthis with missiles, drones and training they have used to target Saudi Arabia for years. Iran has dismissed the claims, but Tehran has moved to deepen its ties with the Houthi forces.

In response to the Houthi move, Riyadh has agreed to a limited cease-fire in four areas, including San’a, the Yemeni capital Houthi forces have controlled since 2014.

If the mutual cease-fire in these areas takes hold, the Saudis would look to broaden the truce to other parts of Yemen, according to people familiar with the discussions.

The new cease-fire faces steep odds, as similar arrangements have crumbled before. Both sides continue to carry out attacks, including a Saudi airstrike north of San’a on Tuesday that killed several civilians. The internal Houthi divisions could undermine the peace efforts, as they have in the past.

“Yemen needs to break from this vicious cycle of violence now and be safeguarded from the recent tension in the region that could risk its prospects for peace,” said Martin Griffiths, the U.N.’s special envoy for Yemen who brokered peace talks last December in Stockholm that helped defuse tensions and pave the way for new diplomatic initiatives.

Saudi Arabia has been accused of carrying out errant airstrikes that have killed thousands of civilians. Yemen is home to what the U.N. calls the world’s worst humanitarian crisis. Millions are on the brink of famine, and cholera remains a constant danger. Nearly 100,000 people have died since the Houthis seized San’a, according to the Armed Conflict Location and Event Data Project, a non-profit organization that tracks global violence.

The U.A.E., Saudi Arabia’s most important ally in the fight, withdrew most of its forces from Yemen earlier this year in a move that created friction between the two countries.

Both units at Venezuela’s 955,000 barrel-per-day capacity Paraguana Refining Center remain down one week after a blackout halted operations, workers said on Friday.

The Amuay and Cardon refineries, which make up the OPEC nation’s largest refining complex, were already operating well below capacity, before a lightning storm eight days ago knocked out power and caused a fire.

Though electricity was quickly restored and the fire at Amuay was controlled, output is still halted, the sources said. “There’s no output at all. The restart is planned for Tuesday or Wednesday of next week,” an Amuay worker told Reuters.

At the Cardon refinery, one operator said only a steam generator had been restarted.

Both refineries had anyway been operating under a third of capacity in recent months due to shortages of both crude and parts for maintenance.

A test shipment of bitumen oil from Alberta is on its way to China, but it didn’t get to a B.C. port by pipeline – it was moved by train through Prince Rupert in a semi-solid form commonly known as neatbit.

Melius Energy in Calgary is not the first company to propose moving bitumen through B.C. in a semi-solid form by train, but it appears to be the first to actually land a potential customer in China and start shipping semi-solid bitumen by train.

It has sent its first container, containing 130 barrels of bitumen, to China in a test shipment, and is currently building a new demonstration plant in Edmonton that turns diluted bitumen into a solid called TrueCrude.

Using existing rail infrastructure, Melius says it could potentially move 120,000 barrels per day of pure bitumen in 100-unit trains through the Port of Prince Rupert.

“Prince Rupert is expanding and they’re looking for lot of containers to move through there,” said Yuri Butler, Melius’ manager of logistics and supply. “That’s one of the reasons we’re excited about working with Prince Rupert is they’re looking for a lot of containers. We’re looking to export a lot of containers. Right now there’s a lot of containers coming into Prince Rupert, but there’s not necessarily a lot leaving.”

Moving bitumen in semi-solid form addresses environmental concerns associated with moving diluted bitumen by rail, pipeline and oil tanker.

The concern is that an oil spill on either land or at sea could have serious environmental impacts. Shipping it in a solid, non-flammable form addresses those concerns. Should a container of TrueCrude ever crack open and end up in the ocean, it would float in one large block that could easily be recovered, the company says.

Bitumen is a thick, tarry form of oil that has to be diluted with lighter oils – condensate – in order to transport it in liquid form. Melius developed a process, called BitCrude, whereby the diluent is taken back out of the diluted bitumen. The diluent can be recycled back to dilbit producers.

The pure bitumen is heated so it can be poured into modified shipping containers, where it then solidifies when it cools. It is then shipped by train and put onto container ships. When it reaches its destination, the bitumen is heated to allow to flow into a refinery.

Melius is currently building a demonstration diluent recovery plant in Edmonton. Butler said the plants could be built and sold as turn-key operations to oil producers in Alberta.

Melius says transporting bitumen by train and container ship is cost competitive with pipeline and oil tanker transport. For one thing, there are no capital costs associated with the transportation, since the railway lines already exist.

“We’re moving on existing rail lines, it’s a safe product and we can efficiently move volume at scale,” Butler said.

There are also economies of scale associated with moving products by container ship, as opposed to oil tanker, since there are so many containers ships plying the ocean.

“When you ship in a container, your costs to ship that container are very competitive because there’s so much volume of containers moving,” Butler said.

He said there is a huge demand in China for bitumen, largely because China’s Belt and Road project will require so much asphalt.

Because of its high asphaltene content, bitumen is a highly desired feedstock for making asphalt. Roughly half of a barrel of bitumen can be turned into asphalt, with the rest being turned into other petroleum products.

“The demand from Asia right now for heavy crude oil is growing and it’s almost insatiable, especially with what’s happening with Venezuela, and Iran and Saudi Arabia,” Butler said.

“They’re looking for supply, and right now they’re struggling to find it. Whereas here in Alberta we have quite a bit of supply and we’re trying to export it to the U.S., where we’re fighting to get a low dollar. If we can get this to the China, we can get a much better dollar and sell our premium product at a premium price.”

Singapore — Two more petrochemical companies in Saudi Arabia announced over the weekend that feedstock supplies from Saudi Aramco have returned to normal levels.

Not registered? Receive daily email alerts, subscriber notes & personalize your experience. Register Now

Sadara and Advanced Petrochemical Co. were the two companies that announced resumption of normal supplies.

Late last week, six of Saudi Arabia's petrochemical firms said feedstock ethane supplies from Saudi Aramco returned to normal. The companies were -- Sipchem, Saudi Kayan, Tasnee, Yansab, Sabic and Petro Rabigh.

Feedstock supplies were cut to crucial Saudi petrochemical companies after the attacks on key Saudi Aramco oil facilities on September 14. The attacked oil field also produces and supplies gas for petrochemical production, and the country's petrochemical industry was particularly hit by the gas supply cut.

Feedstock ethane supplies were cut 16%-50% just after the attacks.

FIRMS ANNOUNCED NORMAL FEEDSTOCK SUPPLIES SUNDAY

Sadara Basic Services Company (Sadara)

Current feedstock supply cut: 10% from 16%

Key production:

Ethylene: 1.5 million mt/year

PE: 1.1 million mt/year

Advanced Petrochemical Company

Current feedstock supply cut: 20% from 40%

Key production:

Propylene: 500,000 mt/year

PP: 450,000 mt/year

ETHANE SUPPLIES AT NORMAL LEVELS LAST WEEK

Sipchem

Key production:

Ethylene: 1.3 million mt/year

VAM: 330,000 mt/year

AA: 400,000 mt/year

LDPE: 400,000 mt/year

Saudi Kayan

Key production:

Ethylene: 1.5 million mt/year

Propylene: 430,000 mt/year

PP: 350,000 mt/year

PE: 600,000 mt/year

National Industrialization Co (Tasnee)

Key production:

Ethylene: 1 million mt/year

Propylene: 740,000 mt/year

PP: 450,000 mt/year

PE: 800,000 mt/year

(Note: Combined capacity of Saudi Polyolefins Company and Saudi Ethylene and Polyethylene Company)

Yanbu National Petrochemical Company (Yansab)

Key production:

Ethylene: 1.3 million mt/year

Propylene: 400,000 mt/year

PE: 900,000 mt/year

MEG: 700,000 mt/year

PP: 400,000 mt/year

Benzene, MX toluene: 250,000 mt/year

Butene-1 and butene-2: 100,000 mt/year

Saudi Basic Industries Corp (Sabic)

Key production:

Ethylene: around 9 million mt/year

MEG: around 6.1 million mt/year (including JV)

Petro Rabigh

Current feedstock supply cut: 20% from 8%

Key production:

Ethylene: 1.6 million mt/year

MEG: 600,000 mt/year

PE: 1.06 million mt/year

PP: 700,000 mt/year

-- Fumiko Dobashi, fumiko.dobashi@spglobal.com

-- Edited by Manish Parashar, manish.parashar@spglobal.com

Neptune Energy taps Valaris jackup for Seagull development

9/30/2019

LONDON - Neptune Energy and its joint venture partners BP and JAPEX announced Valaris has been awarded a contract to provide a heavy-duty jack-up drilling rig for the Seagull development oil project in the UK North Sea.

Valaris will provide the Rowan Gorilla VI (VALARIS JU-248) to drill four firm wells for the development, which is located in the Central North Sea.

The approximately 18-month drilling campaign is scheduled to start Q3 2020.

Neptune Energy’s UK managing director, Pete Jones, said: “This is an important milestone for the Seagull project and a further demonstration of how the development is progressing at pace, following the award of the SPS and SURF contract to TechnipFMC in July.”

“We are pleased to be working again with Valaris which continues to demonstrate strong safety and operational performance.”

“Seagull is a very positive example of what our industry is working hard to achieve in terms of MER UK; the project partners have embraced a collaborative, commercially-innovative approach and extended the life of operating assets through the use of existing infrastructure in order to maximize recovery of North Sea hydrocarbons.”