SINGAPORE (ICIS)–Here are the top stories from ICIS News Asia and the Middle East for the week ended 19 April 2024.

Asia petrochemical shares tumble on Mideast concerns; oil pares gains

By Nurluqman Suratman 19-Apr-24 15:43 SINGAPORE (ICIS)–Shares of petrochemical companies in Asia slumped on Friday, while oil prices surged amid escalating tensions in the Middle East following reported explosions in Iran, Syria and Iraq.

Oil gains on fresh Venezuela sanctions, Iran concerns

By Nurluqman Suratman 18-Apr-24 12:48 SINGAPORE (ICIS)–Oil prices rose on Thursday, reversing sharp losses in the previous session, after the US re-instated oil sanctions on Venezuela, and amid discussions by the EU about implementing new restrictions on Iran.

INSIGHT: Bullish and bearish sentiment intertwines in April Asia chemical prices outlook – ICIS analysts

By Joey Zhou 17-Apr-24 18:29 SINGAPORE (ICIS)–There is a mixed outlook for petrochemical prices in Asia in April. Upward support comes from stronger crude oil price forecasts. The supply of some chemicals is relatively tight on plant turnarounds and operating rate cuts.

PODCAST: Asia recycled polymers slow in 2023; legislation, waste management to shape future

By Damini Dabholkar 17-Apr-24 18:18 SINGAPORE (ICIS)–Asia recycled polymers markets were sluggish for the most part in 2023. In early 2024 too, challenges that dim the short-term outlook persist.

Singapore March petrochemical exports fall 3.6%; NODX slumps 20.7%

By Nurluqman Suratman 17-Apr-24 13:22 SINGAPORE (ICIS)–Singapore’s petrochemical shipments in March fell by 3.6% year on year to Singapore dollar (S$) 1.16 billion ($853 million), extending the 2% contraction in the previous month and weighing on overall non-oil domestic exports (NODX), official data showed on Wednesday.

China’s recovery gains pace after Q1 GDP growth; property, trade headwinds remain major hurdles

By Nurluqman Suratman 16-Apr-24 13:54 SINGAPORE (ICIS)–China’s economy grew stronger-than-expected in the first quarter of this year, expanding by 5.3%, but ongoing challenges in the real estate sector, slowing exports and persistent deflationary pressures remain as major risks to its recovery.

Oil eases despite Iran attacks on Israel; Asian bourses rattled

By Nurluqman Suratman 15-Apr-24 12:46 SINGAPORE (ICIS)–Oil prices eased on Monday as Iran’s attacks on Israel over the weekend were largely priced in by the market, according to analysts, but Asian equities tumbled amid concerns over recent escalation of geopolitical tensions in the Middle East.

https://www.icis.com/explore/resources/news/2024/04/22/10991480/asia-top-stories-weekly-summary

https://pracap.com/on-china-why-the-real-risk-is-cny-5-not-9/

Louis-Vincent Gave (Gavekal):

RMB suddenly at 9 would mean US has won its Cold War with China, and that Xi is throwing in the towel on his hopes of making RMB a credible trade and financing currency for EM. Not sure Xi would survive this politically. It basically would throw out all his program of OBOR, Silk Road, Asia infrastructure investment bank etc…

Not saying it’s impossible. Saying that it would be a profound reversal in the current political rhetoric. Moreover, it would have to be a political decision since:

At this stage, the only thing foreigners own is some real estate (through funds) and some private equity. Highly illiquid stuff that they can’t liquidate anyway.

So, a big move in the currency would have to be either a political decision or a massive exodus of domestic capital. But how do you get the latter given capital controls? It would have to be a political decision. A massive change of course by the Chinese leadership. Why would they do that? Why would they bail out the US through a big deflationary wave at precisely the moment the US “feels” like it may be starting to crack?

The only reason I could think of is a power shift at the top. Xi either dies or steps down and is replaced by someone more “US compatible.” But the CIA already made their color revolution play in 2019, and it failed. Of course, they could try again. But China is now way more paranoid about such manoeuvres. The days when the US consular staff could just meet with the leaders of the students who tried to storm the HK parliament in the restaurant of the JW Marriott are well behind us now (imagine if the Chinese ambassador had met with the Jan 6 buffalo head guy and the lectern guy… that’s what the US did in HK!)

Anyway, all this to say that if RMB is at 9, then USA wins, and China loses. For me this means:

On my side, I don’t believe that a country like China — whose trade surplus at US$70bn+ per month is now bigger than the combined trade surpluses of Japan + Germany AT THEIR PEAK — will devalue meaningfully. That would be an act of mercantilist warfare such as the world has never seen.

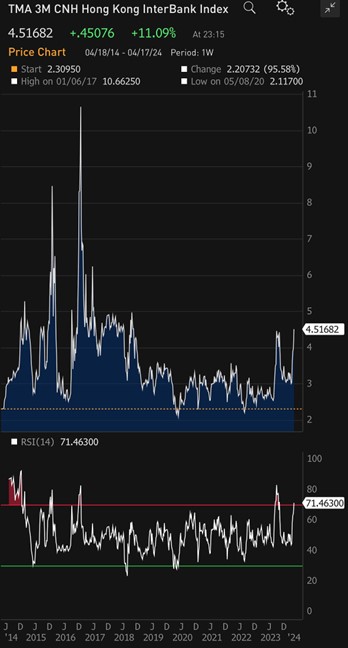

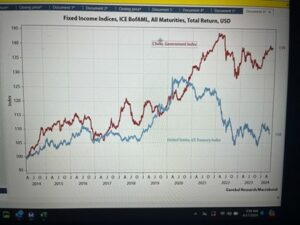

This is the total return on Chinese Govt Bonds vs UST (all maturities, in USD). This is the chart the CCP leadership cares about:

The CCP will sacrifice everything for this chart. This is the path to de-dollarization and thus to freedom. Getting out from under the USD’s dominance will finally mark the end of the “century of humiliation” in which foreign powers dictated their way to China.

I don’t think foreigners get Xi’s desire to be a “great power” once again. China will likely be the first great civilization that collapsed, dusted itself off, and came back. Rome didn’t do it. Neither did the Ottomans. Or the Egyptians. Or the Persians….

But you can’t be a great power with a weak currency. And you definitely can NOT be a great power if you settle your trade in your rival power’s currency.

Xi is playing for keeps. He will impose all the pain in the world on the Chinese economy before devaluing meaningfully. Not that a devaluation solves anything anyway. China already has a massive trade surplus, and other countries are putting up trade barriers because it is so competitive.

If you think Xi cares about anything but making China great again, you are not listening to him. The great thing about China’s leaders is they say what they do and do what they say.

The risk for the world is not that RMB goes to 9. It is that it goes to 5.

Shortages key to copper’s upward price trajectory to new peaks

By Pratima Desai

LONDON (Reuters) – Upward momentum that has propelled copper prices to within a whisker of the psychological $10,000 a metric ton mark is expected to be sustained by the appearance of shortages over the coming months.

Copper prices have recently been bolstered by expectations of tight supplies and optimism about demand prospects from energy transition applications such as electric vehicles and new technology such as artificial intelligence and automation.

A pick-up in manufacturing activity, particularly in top consumer China where surveys of purchasing managers have started to show expansion has also contributed to enthusiasm for copper which this week hit a two-year peak at $9,988 a ton for a gain of 25% since early October.

Prices accelerated higher last year after the prospect of shortages of copper concentrate, a feedstock for metal, was raised by the closure of Canadian miner First Quantum’s Cobre mine in Panama.

“The overarching reality is that we’ve lost a million tonnes of supply to mine disruptions and the industrial cycle has turned a corner,” said Piotr Ortonowski, analyst at Benchmark Mineral Intelligence.

“The long-term energy transition demand story against a backdrop of underinvestment in new mine supply remains intact.”

Copper’s gains have been partly triggered by the reversal of short — bets on lower prices — positions taken when the outlook for Chinese demand looked decidedly gloomy due to shrinking manufacturing activity.

“Prices moved up really fast in the last few weeks, we should expect a correction,” a copper trader said.

Copper prices on the London Metal Exchange (LME) are now around $9,644 a ton.

Interest rate cuts in the United States, Europe and elsewhere also offer potential for growth and demand.

Copper industry sources say tight supplies will soon be seen in draws on stocks in LME approved warehouses and those monitored by the Shanghai Futures Exchange.

Jay Tatum, portfolio manager at Valent Asset Management said copper metal scarcity would be the real test of whether copper prices can be maintained “and go higher”.

“Copper is transitioning from an investment story that made a lot of promises, to one where some of those promises are starting to be delivered on — rising copper intensity across the economy, supply side challenges, concentrate tightness and restocking effect after a long manufacturing slowdown.”

(Reporting by Pratima Desai; editing by David Evans)

https://srnnews.com/shortages-key-to-coppers-upward-price-trajectory-to-new-peaks/

(Bloomberg) – Matador Resources Co. pumped more oil than expected in the first three months of 2024 at a time when most U.S. producers have pledged flat to moderate production growth this year.

Matador also plans to hit the high end of its full-year output expectations, the Dallas-based company said in its earnings report Tuesday. The company’s production surprise comes on the back of better-than-expected well performance in New Mexico, in the part of the state’s Permian basin that straddles Texas.

U.S. shale producers surprised nearly everyone to the upside with their production in 2023, and the nation now pumps more oil than ever — making it the top producer globally. That’s helped to keep oil prices in check amid supply cuts from the OPEC+ alliance.

Matador’s 2% production over-performance to start the year was done while spending less money on drilling than projected, the company said. During the first quarter of 2024, Matador’s average oil production of 84,777 bpd beat its guidance of 83,500 bpd, the company said.

“We now expect full-year production for 2024 at the high end of our previously announced average production guidance for oil of 91,000 to 95,000 bopd,” the statement said.

(Kitco News) - Resource investors are living in the "best environment", noted Steve de Jong, CEO of VRIFY.

Last week Jeremy Szafron, anchor at Kitco News, interviewed de Jong.

De Jong discussed the impacts of high commodity prices on mining equities, the complexities surrounding mining permits, and potential increases in mergers and acquisitions.

The metal sector has been on an upswing with gold hitting several all-time highs in 2024 and copper prices rallying. De Jong noted that the cycles are long.

"Those of us been in the sector for enough years...you get three months of beautiful times and then 9 3/4 years of absolute pain," said de Jong. "Last year was just another one of those years. I'm an internal optimist. You have to be in this sector, but seeing these commodity prices take off...you hear a lot of chatter about how come the equities aren't reacting to the commodity prices. To me that's the best environment in the world because that is your opportunity. The upside is shrinking by the moment," said de Jong.

VRIFY is a technology platform that helps resource companies present their businesses. VRIFY, which is based in Vancouver, serves over 130 clients across 70 countries, including mineral exploration companies Southern Cross Gold and Integra Resources, as well as major mining companies Teck and Kinross Gold. Last year the company announced a $6 million series-A raise.

Prior to VRIFY, de Jong was president and CEO of Integra Gold, a Quebec-focused resource exploration company focused on advancing the Lamaque Gold Project. De Jong led the business from a C$10 million valuation in 2012 to a C$590 million acquisition by Eldorado Gold Corporation in 2017. The Lamaque Gold Project is now a fully operational mine which produces approximately 200,000 ounces of gold per year and employs more than 400 people from the local community.

The conversation also covered how technological advancements are reshaping exploration and investment within the mining industry, offering insights into the macro-outlook for 2024 amid rising metal prices and evolving market dynamics.

Local elections might be over, with new and returning councilors appointed across the state last month, but in truth, election season has only just begun.

Six months from now we'll be heading back to the polls, chowing down on another democracy sausage as we select our next State Government.

And while the date for next year's federal election is yet to be set, it's expected we'll be called upon to do our civic duty once again in the first half of 2025.

Of course, all elections matter, as each branch of government is responsible for different services and policy areas. But, from an industry perspective, the state election is the big one.

The Queensland Government is responsible for many decisions that impact the day-to-day operations of sugarcane farming businesses.

Whether this impact is felt through more red tape and regulation, funding for research and innovation, or backing a new biofuels industry in Queensland, one thing is certain - over the next four years, the State Government will set policies that either smooth the way for industry evolution and growth, or stifle growth, making operating profitably more difficult for farmers.

We all know that politicians prefer to be non-committal unless pushed. Well, in the lead-up to the state election, CANEGROWERS will be pushing for some very firm commitments from those seeking to lead our state.

For months now, the Labor Government has been making all the right noises about Queensland's potential as a Sustainable Aviation Fuel powerhouse. But pleasant words don't put boots on the ground.

Building a new and innovative industry from scratch takes money - a lot of money - and to date the government hasn't made any game-changing investments. That has to change.

It's not just important for the sugarcane industry, it's important for our regional communities, it's important for the Queensland economy, and it's important for Australia meeting its emissions reduction targets.

Of course, this is just one of the many issues we'll be pressing politicians on in coming month.

Bread and butter issues like energy and water prices, research funding, and partnering with industry on environmental and other issues are also high on CANEGROWERS' agenda.

The countdown to October 26 has begun. It's time for our future leaders to start telling us how they plan to lead Queensland in a positive and prosperous direction.

https://www.miragenews.com/election-season-just-getting-started-1219217/

A major mining company will not automate heavy vehicles at one of its operations.

Whitehaven Coal recently stopped trialling its autonomous haulage systems (AHS) at the Maules Creek mine. Management reached the decision after labour shortages eased.

“We will move back to a fully manned frame of operation there in the third quarter, so the March quarter [of 2024],” managing director Paul Flynn said at an investor update.

“The decision obviously to move back demand at AHS obviously was influenced by the fact that we do have labour available to us. That has improved … [and] we are seeing greater access to the skills that we need.”

Flynn also indicated the mine would not use driverless trucks for the unforeseeable future.

“A decision to conclude the autonomous haulage trial and resume fully manned operations was taken during the quarter and the operation is now operating fully manned,” he said.

The remarks came months after 300 employees rejected Whitehaven’s bid to introduce WorkChoices agreement offsets, which reportedly absorb future superannuation increases and strip those affected of up to $100,000 in accrued entitlements. This was feared to affect those planning to retire or accept a redundancy package.

Very negative feedback prompted management to withdraw its proposal.

“We have heard your feedback about the guarantee of annual earnings clause and the potential for this to remove entitlements that people currently enjoy. This is not Whitehaven’s intent,” executive general manager – operations Ian Humphris previously said in an internal email obtained by the Collieries’ Staff and Officials Association (CSOA).

“Whitehaven will be issuing a contract amendment to remove the guarantee of annual earnings clause. This will ensure all transferring Blackwater and Daunia staff can continue to enjoy their current entitlements once they become Whitehaven employees. Whitehaven will also apply this to open cut overseers.”

CSOA congratulated employees on an “incredible win” at the time.

https://www.amsj.com.au/employer-cancels-driverless-truck-plan-at-coal-mine/

Global advertising holding company Omnicom announced results for the quarter ended March 31, 2024. Reported revenue in the first quarter of 2024 increased $187.2 million, or 5.4%, to $3,630.5 million. Worldwide revenue growth in the first quarter of 2024 compared to the first quarter of 2023 was led by an increase in organic growth of $136.9 million, or 4.0%. Acquisition revenue, net of disposition revenue, increased revenue by $53.0 million, or 1.5%, primarily due to the Flywheel Digital acquisition in the Precision Marketing discipline. The impact of foreign currency translation reduced revenue by $2.7 million, or 0.1%.

Organic growth by discipline in the first quarter of 2024 compared to the first quarter of 2023 was as follows: 7.0% for Advertising & Media, 4.3% for Precision Marketing, 9.5% for Experiential, and 2.1% for Healthcare, partially offset by declines of 4.3% for Execution & Support, 3.8% for Branding & Retail Commerce, and 1.1% for Public Relations.

Organic growth by region in the first quarter of 2024 compared to the first quarter of 2023 was as follows: 4.3% for the United States, 3.5% for Euro Markets & Other Europe, 22.3% for Latin America, 3.0% for Asia Pacific, 3.2% for the United Kingdom, and 1.1% for Other North America, partially offset by a decline of 4.2% for the Middle East & Africa.

Bernstein in its latest noted said that despite the opinion poll data making the 390-400 target look almost certain for incumbent BJP, it believes the gain of seats for the PM Narendra Modi-led party in low penetration states may not significantly exceed the loss in others. The chances of a minor gain look high, Bernstein said adding that there are low probabilities of deviating significantly above and below its 2019 tally of 350.

Bernstein said with sky- high expectations having set in, a number near to the 2019 value might trigger a short-term negative reaction. "We believe a profit-booking post-elections is coming anyway, and the election results will only serve as a trigger point for the inevitable," it said.

Eventually, Bernstein said, the macro story will take over, and as it stays healthy, we expect modest downsides.

Bernstein said the year 2024 with Indian markets at record valuations, particularly in the small and mid cap spaces.

A pre-election euphoria is building up, where the previously set expectations of continuity of power are further augmented by the ruling party coalition possibly winning over 400 seats, it said.

This is something started by the incumbent party and is being legitimised through opinion polls of TV media, which are giving the NDA coalition as many as 411 seats, it argued.

"The NDA got 350 seats in the last election, so where are the additional 50 seats coming from? The most obvious answer is the southern belt, where it won merely 5 out of 101 seats in 2019. But even that isn’t a cakewalk. The inroads in Kerala, though historic, will likely be limited to 1-2 seats. Even Tamil Nadu isn’t expected to be much fruitful," Bernstein said.

Besides, it felt that gains must come from AP, Telangana, West Bengal and Odisha. "Many of these will see closely fought contests with seats swinging wildly," it said.

With so much to lose and almost nothing to gain, execution of ‘Plan 400’ will be far more challenging than setting targets, Bernstein said.

(Bloomberg) -- Taiwan Semiconductor Manufacturing Co. options traders are contending with a rising wave of bearishness following the chipmaker’s cautious guidance and concerns about whether the artificial-intelligence trade is unwinding.

Most Read from Bloomberg

The volume of put options on the chipmaker’s US-listed shares climbed to the highest level since January on Friday, according to Bloomberg-compiled data. TSMC shares have dropped 13% over the past six sessions, erasing more than $100 billion in market value.

The world’s largest maker of advanced chips cut its expectations for 2024 semiconductor market growth — excluding memory chips — to about 10% last week. That added to a spate of cautious news for a sector that’s been flying high over the past year as enthusiasm about AI swelled, with some seeing the gains as overdone. Nvidia Corp and Super Micro Computer Inc., two other sector darlings, plummeted on Friday.

While put options have been on the increase, call options have also seen elevated activity, suggesting some traders see potential for a rebound. Open interest for both put and call options on Friday was each about 20% higher than their 20-day average levels.

Cautious capital spending and industry outlook have depressed sentiment for TSMC, Morningstar analyst Phelix Lee wrote in a note Friday. However, he added that the “shares remain attractive, as artificial intelligence-related demand continues to pleasantly surprise us, and there is limited downside to sentiment for the automotive and industrial markets.”

--With assistance from John Cheng.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

https://finance.yahoo.com/news/tsmc-13-rout-may-further-023722029.html

NEW DELHI (Reuters) - India's engineering goods including steel and machinery exports rose 10.7% year-on-year in March to $11.28 billion, growing in double digits for the second straight month, despite ongoing supply issues caused by disruption to shipping through the Red Sea, a trade body said.

Engineering goods, which account for one-fourth of merchandise exports, rose 2.13% in the 2023/24 financial year, to $109.3 billion from a year earlier, Engineering Export Promotion Council (EEPC), a body affiliated with the Commerce Ministry, said in a statement on Thursday.

Exports have been dented by a slowdown in global demand, the ongoing Russia-Ukraine war and the Red Sea shipping crisis brought on by conflict in the Middle East, exporters said.

Engineering exports to the U.S. declined 5.7% year-on-year to $17.62 billion in 2023/24.

India's merchandise exports fell in the 2023/24 financial year - the first decline since 2020/21 - to $437 billion from $451 billion in the previous year.

Automobile exports declined 5.5% in 2023/24 financial year, hit by a shortage of forex reserves in some markets.

"However, a revival of exports was noted in key markets including North America, EU and North East Asia," said Arun Kumar Garodia, chairman of EEPC.

North America and the European Union (EU) remained India's top destinations for engineering exports with a share of 20% and 19%.

Engineering exports to Russia grew sharply in the fiscal year to $1.35 billion from $733.6 million in the preceding year.

The exporters however remain worried about prospects in the coming months.

"The protectionist environmental policies of the EU and slow economic revival in China will continue to create uncertainties for the exporters," Garodia said.

Engineering exports to China, a key market, remained almost flat at $2.65 billion in 2023/24, compared to $2.63 billion in the previous financial year.

(Reporting by Manoj Kumar; Editing by Frances Kerry)

https://sg.news.yahoo.com/indias-engineering-exports-10-7-130548268.html

A study by research group Berkeley Research Group shows that lifecycle greenhouse gas emissions from US liquefied natural gas (LNG) are significantly lower than coal and pipeline gas resources being used by nations in Asia.

The four-year study, commissioned by US industry body LNG Allies, has been released against the backdrop of a halt to LNG export approvals announced by the US Government in late January.

The research tracks lifecycle emissions from US LNG from upstream production, through liquefication, shipping and then use in power generation in China, India, Japan, South Korea and Taiwan.

It compares these emissions against those of coal and pipeline gas use in these countries.

It found that US LNG greenhouse gas emissions are 53 per cent lower than coal and on average 63 per cent lower than pipeline gas from Turkmenistan and Russia.

The study estimates that use of US LNG in place of coal in Asia in 2022 alone resulted in as much as 130 million tonnes of greenhouse gas emissions being avoided.

"This is a very comprehensive report – and it shows why approvals for US LNG exports must be resumed quickly," Asia Natural Gas and Energy Association CEO Paul Everingham said.

"The report illustrates the importance of US LNG to Asia, as a fuel that supports emerging nations to access energy needed for economic growth while also reducing emissions from power generation.

"Large parts of Asia, particularly South Asia and Southeast Asia, remain heavily reliant on high-emitting coal for electricity.

"This report clearly demonstrates that generation from US LNG in Asia has a far lower emissions profile than coal - especially so for combustion, where the emissions intensity of coal was nearly three times higher.

"The study also found that the upstream emissions profile of US LNG is significantly smaller than that of pipeline gas from Turkmenistan and Russia currently being used in Asia.

"Emerging nations in Asia must make decisions about what their energy systems will look like decades in advance.

"The current approvals pause has resulted in uncertainty about future availability of US LNG exports and increased the likelihood that coal use in Asia will become institutionalised in the long term.

"By resuming approvals, the US Government can signal to partners in Asia that the US intends to remain a reliable LNG supplier, enabling nations to pair gas with renewable energy as they plan for low-carbon futures."

https://www.energynewsbulletin.net/global/news/4198668/study-us-lng-cleaner-asia-coal

Thailand’s Energy Ministry is working on restructuring the country’s oil price system so that local retail prices could be set by the government without referring to global prices, Deputy Prime Minister and Energy Minister Pirapan Salirathavibhaga said on Sunday.

He said it would take time to change the oil price structure that has been in use for 51 years.

Pirapan, who is the leader of the government’s coalition partner United Thai Nation Party, said there now are two major issues affecting energy prices – the structural issue and a system that no one has tried to improve to benefit the people.

Pirapan said retail diesel prices are increasing because of the rising excise tax, which is decided by the Oil Fuel Fund committee, not by the Energy Ministry.

He said he is drafting a new law to change the price structural system so that the Energy Ministry or the government would be the ones to determine retail prices instead of having the prices influenced by global prices.

Currently, oil distributors set their retail prices based on Singapore’s reference prices and their costs.

“In the final step, the government will have the power to set the retail prices,” Pirapan said.

“But we have to gradually adjust the system that has been in use for 51 years without changes.

“At least I have started changing it. And this was the first time in 51 years that oil distributors must inform the National Energy Policy Committee of their costs.”

https://business.inquirer.net/455746/thailands-energy-ministry-working-on-new-oil-price-structure

The charter contracts with PTLCL were signed at the same time that MISC tanker arm AET inked contracts with Dalian Shipbuilding Co Ltd (DSIC) to build the ammonia dual-fuelled Aframax tankers.

The contracts come 14 months after AET and PTLCL signed a Memorandum of Understanding (MoU).

“Today's signing of the Time Charter Party Contracts and the Shipbuilding Contracts is a clear testament of turning ambition into action,” said Captain Rajalingam Subramaniam, President and Group CEO of MISC.

The company did not disclose the delivery date for the ammonia dual-fuel newbuildings ordered at the yard which is part of the CSSC group.

Both the shipowner and charterer are part of Malaysian national oil and gas group Petronas.

Zahid Osman, President & CEO of AET said, “With today’s signings of the Shipbuilding Contracts with DSIC and the Time Charter Party Contracts with PTLCL for the world’s first two ammonia dual-fuel Aframaxes, we take concrete actions to deliver on our commitment as industry leaders to progress the decarbonisation of the shipping sector.”

AET has been a pioneer and in owning and operating LNG dual-fuel large tankers and is now taking on a similar role with ammonia as a marine fuel.

MISC said it would look to further collaboration with industry players for ammonia bunkering as well as Akademi Laut Malaysia (ALAM) and industry partners for the training of seafarers.

As developments push ahead with ammonia as a marine fuel safety remains a primary concern given the high toxicity of the fuel.

AET and ALAM inked an agreement with engine manufacturer WinGD on training for ammonia fuelled engines in June 2023. WinGD expects to deliver its first ammonia dual-fuel engines in 2025.

https://www.seatrade-maritime.com/tankers/misc-orders-first-ammonia-dual-fuel-aframax-tankers-dsic

Vintage Energy’s (ASX: VEN) plans to expand its Cooper Basin activities have accelerated with the signing of a farmout agreement with Sabre Energy for a 50% interest in the PEL 679 exploration licence in South Australia’s Cooper Basin.

Vintage, which currently has gas production from the Odin and Vali fields in the area, will retain the remaining 50% interest in the licence.

Sabre will fund 100% of a 150 square kilometre 3D seismic survey and pay Vintage $200,000 as reimbursement of its share of costs incurred to the time the permit is granted to obtain its interest.

Good oil neighbourhood

Comprising a total area of 393 sq km, PELA 679 is located on the western flank of the Cooper Basin, south-west of the Worrior field that has produced in excess of 4.5 million barrels of oil.

Vintage has identified three Jurassic four-way closures and one Permian Patchawarra formation stratigraphic play from the sparse 2D seismic survey it has mapped to date.

This morphology is considered analogous to Beach Energy’s (ASX: BPT) Western Flank oil fields.

“Sabre has an experienced and proven team [and] we look forward to working with them,” Vintage managing director Neil Gibbins said.

“PELA 679 is highly prospective for oil in particular and we anticipate their contribution in addressing the potential of PEL 679 will be both collaborative and valuable.”

Sabre Energy chair Allan Bougoure said the opportunity in PELA 679 acreage provides an exciting entry into oil exploration for Sabre to build the company’s portfolio.

Attractive area

Sabre’s managing director Regie Estabillo said the PELA 679 permit area is highly attractive.

“This opportunity represents near-field oil exploration allowing for short turnaround times to commercialisation.”

“PELA 679 lies within the proven oil fairway of the Cooper/Eromanga Basin as defined by DEM and is analogous to the prolific Western Flank oil fields.”

“This is an exciting addition to Sabre’s portfolio.”

Vintage was awarded the licence in the 2019 SA gazettal round.

The company is currently in negotiations with native title holders the Dieri Aboriginal Corporation RNTBC.

https://smallcaps.com.au/vintage-energy-sabre-join-forces-cooper-basin-exploration-license/

WTI crude oil is still trending higher as it continues to hang around the rising channel support on its 4-hour time frame. This lines up with the 61.8% Fibonacci retracement level at $81.50 per barrel.

A bounce could take the commodity price back up to the swing high at $87.84 per barrel or the channel top closer to $90 per barrel. The 100 SMA is above the 200 SMA to confirm that the path of least resistance is to the upside or that support is more likely to hold than to break.

However, price is already dipping below the 200 SMA dynamic inflection point as an early indicator of selling pressure. A break below the channel bottom might confirm that a reversal from the uptrend is due.

Stochastic is also on the move down to suggest that selling pressure is in play, but the oscillator is dipping close to the oversold region to signal exhaustion among bears soon. Turning higher would mean that buyers are taking over.

RSI appears to be on the move up but is also turning lower to indicate a return in bearish momentum.

WTI crude oil drew some support from a fresh round of geopolitical conflict late last week, but the gains were short-lived as demand conditions might turn lower if a full-blown war takes place.

Also, a stronger dollar appears to be weighing on risk sentiment overall, after FOMC officials have dropped hints about delaying their earlier easing plans. Upcoming US data points in the next few days could influence Fed policy expectations, which might then impact dollar and commodity price action.

Inventory figures from the API and EIA are also worth watching, as another round of larger inventory builds might mean fresh downside for the commodity. On the other hand, surprise reductions could mean a continuation of the crude oil rally.

https://fxdailyreport.com/wti-crude-oil-price-analysis-for-april-22-2024/

Wildfires erupted across Canada’s main oil producing province of Alberta and an evacuation order was issued as the region braces for a repeat of last year’s unprecedented season.

Members of the Indigenous First Nations community of Cold Lake Number 149, northeast of Edmonton on the Saskatchewan border, were told to evacuate, according to a notice issued at 4:49 pm local time. Other regions west of the Cold Lake blaze were put on standby, with three wildfires in the province listed as out of control as of late Monday.

More than 65 per cent of Canada was abnormally parched or in drought at the end of March, leading the nation to brace for another smoke-filled summer. Unusually hot, dry weather contributed to the country’s worst-ever wildfire season last year, darkening skies over New York and other U.S. cities and prompting Alberta oil and gas drillers to shut as much as 300,000 barrels of oil equivalent a day of production.

An evacuation alert for residents of Saprae Creek, about 25 kilometers (16 miles) southeast of the oil sands capital of Fort McMurray, was canceled. Massive forest fires burned down swathes of Fort McMurray eight years ago, forcing thousands of residents to evacuate and temporarily shutting more than 1 million barrels a day of oil production.

The Mopane field in offshore Namibia could contain some 10 billion barrels of oil.

Portugal's oil company Galp Energia shares skyrocketed on Monday after the company announced that the first phase of its exploration in the Mopane field in offshore Namibia could contain some 10 billion barrels of oil.

This follows on Galp operations at the Mopane-1X well in January and the Mopane-2X well in March, with, significant light oil columns discovered in high-quality reservoir sands.

The so called Mopane field, at the Orange Basin, also includes Shell and Total with Galp already extracting 122,000 bpd in 2023.

The Galp discovery at Mopane field has been compared to Guyana’s Stabroek block, an 6.6 million acre (26,800 square kilometers) area owned by US Exxon Mobil Corp, Hess Corp and China's CNOOC.

Exxon is main operator of the block with a 45% stake while Hess and CNOOC own 30% and 25%, respectively

Galp plans to sell development of the project, most likely to be a major international energy company with a strong track record in project management. Galp has hired Bank of America to run the sale process, with proceeds likely to be in the billions of dollars.

The Mopane discovery--one the largest made in the nascent basin following successful exploration campaigns by rivals TotalEnergies and Shell--could help kick-start the southern African country, a former German colony, oil industry. In recent years, Namibia has attracted huge interest from international oil companies seeking to grow their production.

In 2023, 89.1 billion cubic feet per day (Bcf/d) of natural gas was consumed in the United States, the most on record. Since 2018, U.S. natural gas consumption has increased by an average of 4% annually.

Monthly natural gas consumption set new records every month from March 2023 through November 2023. U.S. natural gas consumption has risen in the electric power sector as coal-fired electric-generating capacity has declined.

Last year, the largest monthly increases in natural gas consumed by the electric power sector were in July and August, despite cooler-than-normal temperatures than during those months in 2022. Natural gas consumption in the electric power sector, which typically increases in July and August to meet air-conditioning demand, increased by 6% in July and August 2023 compared with those months in 2022, setting monthly records of 47.5 Bcf/d in July and 47.2 Bcf/d in August.

U.S. coal production units are retiring as the nation’s coal fleet ages and coal-fired generators are replaced by generators using natural gas and renewables. Although natural gas-fired power generation increased by 6% in July and August of 2023 compared with a year earlier, overall electricity growth year-on-year was flat in July at 412 billion kilowatthours (kWh) and rose just 3% in August to 410 billion kWh.

Data source: U.S. Energy Information Administration, U.S. Energy Information Administration, Natural Gas Monthly

The most natural gas consumed in the United States in any month of 2023 occurred in January at 106.6 Bcf/d, but consumption was 8% less than in January 2022. Warmer-than-average temperatures reduced natural gas consumption in the residential and commercial sectors to meet space-heating demand.

Data source: U.S. Energy Information Administration,

Note: Other includes natural gas that was consumed as transportation fuel. U.S. Energy Information Administration, Natural Gas Monthly Other includes natural gas that was consumed as transportation fuel.

In 2023, natural gas consumption fell 10% in the residential sector to 12.3 Bcf/d compared with 2022 and 6%, or 0.5 Bcf/d, in the commercial sector. The amount of natural gas consumed in the industrial sector remained unchanged, averaging 23.4 Bcf/d. The largest increase in natural gas consumption by a U.S. economic sector in 2023 came in the electric power sector, which increased 7% (2.2 Bcf/d) from 33.2 Bcf/d in 2022 to a record of 35.4 Bcf/d.

Principal contributor: Andrew Iraola

MOSCOW, April 23 (Reuters) - Kremlin-controlled energy giant Gazprom said on Tuesday work is underway on further links between its east and western pipeline networks after it launched construction of an 800-km pipeline in Russia's far east last month.

The Belogorsk-Khabarovsk pipeline is designed to connect the China-bound Power of Siberia with the existing Sakhalin-Khabarovsk-Vladivostok link.

"Design and survey work is underway on other (connectors)," Gazprom said, without elaborating.

Russia has long sought to connect its vast western gas grid, which serves Europe, with its still-developing eastern pipeline network. An ability to redirect gas flows is seen as key to bolstering its negotiating position with buyers.

That has become more pressing due to the political fallout from the conflict in Ukraine, during which flows of Russian gas to Europe have dropped sharply. That has led to Russia looking to forge closer ties with Asia, especially with the world's No.2 energy consumer China.

Russia is seeking to boost pipeline gas exports to China through the construction of the Power of Siberia 2 pipeline, which is designed to carry 50 billion cubic metres (bcm) of natural gas a year from the Yamal region in northern Russia to China via Mongolia.

That is almost as much as the now idle Nord Stream 1 pipeline to Europe under the Baltic Sea that was damaged by blasts in 2022.

However Moscow and Beijing have not yet reached an agreement on key terms, especially on the price of gas.

Russia currently exports gas to China through the Power of Siberia 1 pipeline, which began operating in 2019. Annual gas exports via the pipeline are scheduled to reach 38 bcm by 2025. (Reporting by Vladimir Soldatkin; Editing by Jan Harvey)

Saudi Arabian Oil Co. (Aramco) is in talks for the potential acquisition of a 10 percent stake in China’s Hengli Petrochemical Co., Ltd. in a bid to grow its downstream segment.

Hengli Petrochemical, a subsidiary of Hengli Group, owns and operates a 400,000-barrel-per-day refinery and integrated chemicals complex in Liaoning Province, as well as several plants and production facilities in the Jiangsu and Guangdong Provinces, Aramco said in a news release Monday.

The two companies signed a memorandum of understanding (MoU) on the proposed transaction, which is still subject to due diligence and required regulatory clearances.

The move aligns with Aramco’s strategy to “expand its downstream presence in key high-value markets, advance its liquids-to-chemicals program, and secure long-term crude oil supply agreements,” the company noted.

“This MoU supports our efforts to grow our global downstream footprint,” Aramco Downstream President Mohammed Al Qahtani said. “We continue to explore new opportunities in important markets, as we seek to progress in our liquids-to-chemicals strategy”.

”We look forward to forging new partnerships and are excited by the prospect of expanding our presence in the important Chinese market,” he added.

Hengli Petrochemical targets to become one of the largest purified terephthalic acid (PTTA) production bases, according to the company’s website.

Earlier in the month, Aramco awarded engineering, procurement, and construction (EPC) contracts amounting to $7.7 billion for the development of the Fadhili Gas Plant, in the Eastern Province of Saudi Arabia.

The expansion project is expected to increase the capacity of the Fadhili Gas Plant from 2.5 to up to 4 billion standard cubic feet per day (bsfcd). This adds up to an increase of 1.5 billion standard cubic feet per day, according to an earlier statement. The additional 1.5 bscfd of processing capacity will contribute to the company’s strategy to raise gas production by more than 60 percent by 2030, compared to 2021 levels, Aramco said.

The Fadhili Gas Plant expansion is expected to be completed by November 2027. It is also expected to add an additional 2,300 metric tons per day to sulphur production. Aramco awarded EPC contracts for the Fadhili Gas Plant increment project to SAMSUNG Engineering Company, GS Engineering & Construction Corporation, and Nesma & Partners.

The state-owned oil major reported net income of $121.3 billion for 2023, its second highest ever annual net earnings after posting $161.1 billion in 2022. Aramco produced 12.3 million barrels of oil equivalent per day (MMboepd) in 2023, 10.7 million barrels per day of which were liquids.

To contact the author, email rocky.teodoro@rigzone.com

HOUSTON (Reuters) - U.S. oil and gas deals hit a record $51 billion in the first quarter, a continuation of last year's fierce merger pace centered in the top U.S. shale field, data provider Enverus said on Tuesday.

Energy companies have rushed to expand oil and gas drilling inventories, especially in the Permian Basin of West Texas and New Mexico, where producer break-even costs are about $64 a barrel. Oil prices averaged about $77 a barrel last quarter and this week traded near $83 per barrel.

Most of the high-quality U.S. drilling prospects are in the Permian "so it is unsurprising the prolific basin was yet again the primary driver for M&A within oil and gas," said Andrew Dittmar, Enverus Intelligence Research's principal analyst.

The biggest proposed acquisition last quarter was Diamondback Energy's $26 billion bid for closely held Endeavor Energy Partners, a merger that brings together two Permian-centric drillers.

Apache Corp parent APA's $4.5 billion deal for Permian oil rival Callon Petroleum, and Chesapeake Energy's April $7.4 billion deal for Southwestern Energy rounded out the period's most valuable deals.

The Chesapeake acquisition and last year's blockbuster deals by Exxon Mobil and Chevron remain stalled by antitrust reviews in part because they concentrate holdings in the Permian or Haynesville shale fields, said Dittmar.

"The most likely outcome is all these deals get approved, but federal regulatory oversight may pose a headwind to additional consolidation within a single play," he added.

The number of deals rose to 27 last quarter, compared with 20 in the same period a year ago, and 60% of first quarter transactions by value were in the Permian, Enversus calculates.

That high pace is unlikely to persist, Dittmar said, with strong oil prices allowing more companies to justify holding onto non-core drilling assets rather than discard them as they once did.

"Inventory scarcity is the top theme among E&Ps (exploration and production companies)," he said.

KeyBanc's Tim Rezvan raised their price target on Murphy Oil (NYSE: MUR) by 8% from $50 to $54 on 2024/04/22. The analyst maintained their Strong Buy rating on the stock.

In a Q1 2024 preview note on names in their Oil & Gas (Exploration & Production) portfolio, Rezvan explained that the price target adjustment for Murphy Oil was based on several factors. The analyst anticipates rising oil prices driven by increasing geopolitical risk, a flattening of U.S. production, and declining inventories of refined products in the United States.

Regarding natural gas, Rezvan expects prices to decline due to strong production, bloated inventories, and debottlenecking that will occur in the second half of 2024.

In addition to the update on Murphy Oil, Rezvan also made adjustments to other companies in their portfolio. The price target for Diamondback Energy Inc was raised by 7.1% from $210 to $225, while Kimbell Royalty Partners LP saw a 5% increase from $20 to $21. Vital Energy Inc received a 14.5% boost from $55 to $63, Talos Energy Inc's target was raised by 5% from $20 to $21, and Sitio Royalties Corp saw a 7.4% increase from $27 to $29. In each case, the analyst maintained their Strong Buy rating.

Currently, 71.4% of top-rated analysts view Murphy Oil as a Strong Buy or Buy, while 28.6% consider it a Hold. No analysts recommend or strongly recommend selling the stock.

According to the consensus forecast among analysts, Murphy Oil is expected to deliver earnings per share (EPS) of $6.71 in the upcoming year. If these predictions hold true, the company's next yearly EPS will experience a 57.4% increase year-over-year.

Since Murphy Oil's last quarterly report on December 31, 2023, the stock price has risen by 7.9%. On a year-over-year basis, the stock has increased by 22.7%. During this period, Murphy Oil has outperformed the S&P 500, which has grown by 21.1%.

KeyBanc analyst Tim Rezvan stands in the top 19% of Wall Street analysts, according to WallStreetZen. With an average return of 5.2% and a win rate of 50.7%, Rezvan specializes in the Utilities and Energy sectors.

Murphy Oil Corporation, headquartered in Houston, TX, is engaged in the production of crude oil, natural gas, and natural gas liquids. The company operates primarily in the U.S., Canada, and targeted areas globally, with a focus on fields in the Gulf of Mexico and the Eagle Ford Shale area of South Texas. Founded in 1950, Murphy Oil has a longstanding presence in the energy industry.

Crude oil prices have recouped some of the losses posted on Monday as fears of an escalation between Israel and Iran dissipated.

Brent crude was trading above $87 per barrel and West Texas Intermediate remained above $82 per barrel as the news about fresh U.S. and UK sanctions on Iran failed to impress traders.

According to a Bloomberg report, the U.S. sanctions, which are due to be passed by Congress this week, may end up not being enforced at all. The reason? President Biden would be wary of doing anything that could further push retail fuel prices higher with elections just months away.

“Oil traders are nonchalant because they know Biden will certainly sign whatever waivers are necessary to keep Iranian oil flowing into the market just as he is keeping Russian barrels flowing into the market,” an analyst with investment advisors Capital Alpha Partners told Bloomberg.

According to another firm, energy consultancy ClearView Energy Partners, the enforcement of the new sanctions could add $8.40 per barrel to crude oil prices. That’s not something a president running for re-election and already losing popularity fast wants to see.

On the other hand, bullish factors for oil in the form of geopolitical risk in the Middle East appear to have largely fizzled out, at least for the time being.

"The unwinding of geo-political risk premium has dented crude oil prices recently as supply was not disrupted meaningfully," the founder of India research firm SS WealthStreet told Reuters.

"While there are no indications of an imminent full-scale war between the countries involved, any escalation in tensions could quickly reverse the current trend," Sugandha Sachdeva added.

"The geopolitical backdrop is still very fraught with so many risks at the moment, so clearly we're going to see a lot of volatility until there's a lot more clarity around it," ANZ analysts said in a note, commenting on the latest developments in the world of geopolitics.

Schlumberger (NYSE:SLB) First Quarter 2024 Results

Key Financial Results

- Revenue: US$8.71b (up 13% from 1Q 2023).

- Net income: US$1.07b (up 14% from 1Q 2023).

- Profit margin: 12% (in line with 1Q 2023).

- EPS: US$0.75 (up from US$0.66 in 1Q 2023).

Schlumberger Meets Expectations

Revenue was in line with analyst estimates. Earnings per share (EPS) was also in line with analyst expectations.

Looking ahead, revenue is forecast to grow 8.5% p.a. on average during the next 3 years, compared to a 7.8% growth forecast for the Energy Services industry in the US.

Performance of the American Energy Services industry.

The company's shares are down 3.7% from a week ago.

https://sg.finance.yahoo.com/news/schlumberger-first-quarter-2024-earnings-105024281.html

Some shippers on Canada's Trans Mountain expansion project are raising concerns that the long-delayed oil pipeline will not be fully in service by its projected start date of May 1, according to a letter to the Canada Energy Regulator on Tuesday.

Deliveries for all shippers will be subject to the expanded system's tolls and tariffs from that date, Trans Mountain Corp told Reuters in an email, adding that line fill on the expanded pipeline will be completed in early May.

But in a letter to the Canada Energy Regulator (CER), shipper Suncor Energy SU said reasonable questions remain over whether Trans Mountain will be able to deliver contracted crude volumes from May 1 given some sections of the pipeline are still awaiting leave to open from regulators.

As a result shippers are concerned about the obligation to pay tolls from the start of next month, said the letter filed by Suncor's legal counsel on behalf of other shippers including BP BP. and Marathon Petroleum MPC.

"While it is possible that Trans Mountain might be able to complete the physical construction of Expansion facilities by May 1, 2024, there appears to be a real likelihood that those facilities will not be capable of providing Firm Service at that time," said the letter, which appeared on the CER website.

The C$30.9 billion ($22.62 billion) project, bought by the Canadian government in 2018 to ensure it went ahead, will carry an extra 600,000 barrels per day (bpd) of oil from Alberta to Canada's Pacific coast.

It has struggled with years of regulatory delays and cost overruns and Canadian oil producers are keenly anticipating its start-up, which will open up access to export markets on the U.S. West Coast and Asia and should narrow the price discount on Canadian heavy crude versus U.S. benchmark oil.

However a number of contracted shippers are locked in dispute with Trans Mountain over tolls on the expanded system, citing concerns about significant cost increases.

Trans Mountain is facing a number of complaints from its shippers, who have contracted 80% of the expanded pipeline's volume.

In a separate filing on April 12, Canadian Natural Resources Ltd CNQ, supported by Suncor and Imperial Oil IMO, wrote to the CER arguing that the vapor pressure limit on the expanded pipeline is too high and would hurt the sales price of the crude.

In its email on Tuesday, Trans Mountain also said the first ship carrying crude from the pipeline expansion is expected to load in the second half of May.

Westridge Marine Terminal in the Port of Vancouver, where the pipeline terminates, will have three berths able to load vessels with oil, Trans Mountain said. The dock has a maximum capacity of 630,000 bpd, or 34 partially laden Aframax-sized tankers a month.

"On average, we anticipate one empty tanker in, one partially laden tanker out every day with variability throughout the year," a Trans Mountain spokesperson said.

($1 = 1.3660 Canadian dollars)

Japan’s Mitsui & Co said on Tuesday nothing has been decided on a liquefied natural gas (LNG) project in the UAE, after the Nikkei reported it was teaming up with Abu Dhabi National Oil Company (ADNOC) on it.

The Nikkei reported ADNOC would have a stake of around 60 per cent and Mitsui 10 per cent of the $7bn LNG project at Ruwais, adding Mitsui‘s investment is estimated to be several tens of billions of yen.

Other oil majors Shell, BP and Total Energies are also expected to invest, the report said.

A Mitsui spokesperson said nothing had yet been decided when asked about the report. ADNOC, BP and Shell declined to comment. TotalEnergies did not immediately respond to a request for comment.

ADNOC’s focus on LNG

ADNOC has big ambitions in gas and LNG, which along with renewable energy and petrochemicals, it sees as pillars for its future growth.

Demand for natural gas soared as Europe scrambled to secure supplies to replace Russian gas in the wake of Moscow’s invasion of Ukraine last year.

The planned Ruwais LNG project, to the west of Abu Dhabi city, will help ADNOC reach its goal of doubling its LNG production capacity. It currently has liquefaction capacity of about 6 million metric tons per annum at its Das Island facility.

The Ruwais plant will have electric-powered processing facilities and run on renewable and nuclear grid power, making it one of the lowest carbon intensity LNG facilities globally, ADNOC has said. It will have two 4.8 mtpa LNG liquefaction trains when completed.

ADNOC said in March it had issued a limited notice to proceed for early engineering, procurement and construction on the Ruwais LNG project to a consortium led by Technip Energies and including JGC Corporation and National Petroleum Construction Company.

A final investment decision is expected this year.

ADNOC has since last year signed several LNG supply deals, including two for LNG from the Ruwais project, expected to begin commercial operations in 2028.

ADNOC has eyed acquisitions of foreign companies in part to help boost its gas portfolio.

https://gulfbusiness.com/mitsui-says-no-decision-adnoc-lng-project-tie-up/

The German economy ministry sees " signs of a slight economic upturn"in the country as energy-intensive industries have expanded their production since the beginning of the year. "Electricity and gas now cost around the same on the wholesale market as before the energy price shocks [and] inflation is therefore continuing to fall," economy minister Robert Habeck said. "This boosts people's purchasing power and supports recovery in private consumption." The government adjusted its economic growth forecast for 2024 only slightly from 0.2 percent in a report from February to 0.3 percent, and expects 1 percent growth next year. "0.3 percent is of course not something we can be satisfied with," said Habeck. "Despite the signs of hope, I am still concerned about the structural problems of Germany as an economic location," Habeck said, calling for strengthening innovation, reducing bureaucracy and tackling the labour shortage.

A string of crises in the past years, including the Covid-19 pandemic and the energy crisis – exacerbated by Russia's war against Ukraine – have put a damper on Germany's economic development and highlighted structural issues, such as the lack of skilled workers. Record-high energy prices, particularly for natural gas, had impacted the economy as a whole, in which energy-intensive industry still plays a key role. Overall, since their peak in 2022, prices have decreased almost to pre-crisis level. However, fossil gas remains more expensive compared to before the crisis, when Russia supplied the largest share of the country's gas demand. Chancellor Olaf Scholz recently had defended his government's efforts to navigate the energy crisis against critcisim from industry leaders. Scholz said energy prices by and large had dropped back to pre-crisis levels after "two turnaround years" during which the country transformed its energy import structure, especially regarding natural gas. This had helped make the country as competitive regarding energy prices as it had been "for decades," the chancellor said.

A report by the Potsdam Institute for Climate Impact Research (PIK) said given the fact that some countries have much better conditions for renewable electricity generation, production of key energy-intensive industrial commodities – such as steel, urea and ethylene – could benefit from cost savings if relocated to such regions. However, the cost of energy is just one of many factors behind companies’ relocation decisions.

Dutch and British wholesale gas prices traded higher on Wednesday morning, as planned and unplanned outages in Norway and Britain tightened the supply picture, offsetting a return to milder temperatures.

The benchmark front-month contract (TRNLTTFMc1) at the Dutch TTF hub was up 0.43 euro to 28.95 euros per megawatt hour (MWh) at 0817 GMT, LSEG data showed.

The Dutch day-ahead contract was up 0.27 euro at 29.50 euros/MWh.

In the British market, the within-day contract (TRGBNBPWKD) was up 1.75 pence at 72.75 pence per therm and the day-ahead contract (TRGBNBPD1) traded 2.40 pence higher at 73.60 p/therm.

The flow of Norwegian gas to Britain was down 26 million cubic metres (mcm) per day compared with Tuesday, while unplanned outages in the UK at Bacton Seal and Bacton Perenco cut 8 mcm/day of supply, LSEG analyst Saku Jussila said in a daily research note.

Further Norwegian maintenance scheduled from Thursday would cut another 39 mcm/day, according to Jussila.

"Due to Norwegian maintenance action, NEW balance is still quite tight and significant withdrawals from storages are needed. This should add some bullish pressure," the analyst said.

Europe's gas storage sites are around 62% full and saw a small dip for April 22, the most recent data point published by Gas Infrastructure Europe.

Further market support stemmed from the unplanned outage at Norway's Hammerfest liquefied natural gas (LNG) terminal.

The plant in Arctic northern Norway was evacuated on Tuesday because of a gas leak during maintenance and will remain offline until Friday, operator Equinor EQNR said.

"In addition to geopolitical risk factors, this is the kind of incident that prevents the market from being completely calm and to hesitate to take a decidedly bearish stance," analysts at Engie EnergyScan said in their daily report.

However, the potential for prices to move higher is limited by bearish fundamental factors such as a return to milder weather from the weekend following the current cold spell, analysts said.

Meanwhile, the first tanker in 12 days set sail from major U.S. LNG export terminal Freeport on Tuesday, signalling the resumption of gas processing after an outage this month that raised concerns over supplies.

In the European carbon market, the benchmark contract (CFI2Zc1) was up 1.04 euro at 66.71 euros per metric ton.

LONDON (Reuters) - Russia's liquefied natural gas (LNG) exports could stagnate in the next four years under the two less-rosy of three Economy Ministry scenarios - a sign that Western sanctions might be cramping Moscow's energy plans.

Under the ministry's "conservative" and "stress" scenarios, the latter not made public, LNG output would stagnate at 38.6 million metric tons each year in 2025-2027, according to a document seen by Reuters.

The baseline scenario, the most optimistic, calls for a rise to 56.6 million tons in 2027 from 33.3 million in 2023.

Russia says it wants to secure 20% of the global LNG market by 2030-2035, compared to around 8% at present, thanks to new plants predominantly located in the Arctic.

However, myriad Western sanctions present obstacles, not least to a new Arctic LNG 2 project that is yet to export a cargo after tentatively starting production in December.

The project is due to become one of Russia's largest such plants with eventual annual output of 19.8 million metric tons of LNG and 1.6 million tons of stable gas condensate from three production units, or trains.

Sources have said the conversion of methane into liquid at minus 163 degrees Celsius (minus 261 Fahrenheit) has now been suspended at the plant.

The Kremlin-controlled energy giant Gazprom also delayed the start-up of a huge gas complex at the Baltic port of Ust-Luga since the withdrawal of Western companies such as Linde after the start of Russia's conflict with Ukraine in February 2022.

Russia currently has two large-scale LNG plants: the Novatek-led Yamal LNG, which produced around 20 million tons last year, and Gazprom's Sakhalin-2, with an output of more than 10 million tons last year.

(Reporting by Darya Korsunskaya; Editing by Kevin Liffey)

https://uk.finance.yahoo.com/news/exclusive-russia-does-not-rule-142532407.html

Crude oil prices ticked higher today after the U.S. Energy Information Administration reported an estimated decline of 6.4 million barrels in inventories for the week to April 19.

This compared with an inventory build of 2.7 million barrels for the previous week, which pressured prices last week.

It also compared with an inventory draw of 3.23 million barrels as estimated by the American Petroleum Institute on Tuesday, with the group also reporting a gasoline inventory decline of about half a million barrels. Analysts had expected an inventory build in crude oil.

In fuels, the EIA estimated mixed inventory changes in the reporting period.

Gasoline inventories shed 600,000 barrels in the week to April 19, with production averaging 9.1 million barrels daily.

This compared with an inventory decline of 1.2 million barrels for the previous week, when production averaged 9.4 million barrels daily.

In middle distillates, the EIA estimated an inventory build of 1.6 million barrels for the week to April 19, with production averaging 4.8 million barrels daily.

This compared with an inventory draw of 2.8 million barrels for the previous week, when production averaged 4.6 million barrels daily.

Oil prices rose earlier on Wednesday, driven by the surprise draw in inventories estimated by the API on Tuesday, recouping some of the losses made earlier in the week as tensions in the Middle East appeared to have quietened.

"Recent reports suggest that both Iran and Israel consider the current operations concluded against one another, with no follow-up action required for now," ING said in a note quoted by Reuters, adding "The US and Europe are preparing for new sanctions against Iran – although these may not have a material impact on oil supply in the immediate term."

Separately, the Dutch bank’s head of commodity strategy Waren Patterson wrote that the upward potential for oil prices appeared limited thanks to spare capacity.

“The market is obviously of the view that spare OPEC production capacity will come into play in the event of any supply shocks, or that ongoing tension is unlikely to lead to significant supply losses,” he said Monday.

By Irina Slav for Oilprice.com

https://oilprice.com/Energy/Crude-Oil/Oil-Moves-Higher-on-Inventory-Draw.html

By Chen Aizhu

SINGAPORE (Reuters) -Asia's largest oil and gas producer PetroChina Co Ltd reported a 60% year-on-year rise in nine-month net profit to record highs, lifted by stronger global energy prices, even as weaker domestic fuel consumption continued to drag on earnings.

Net profit for the January to September period reached 120.3 billion yuan ($16.66 billion), the company said in a statement.

Domestic crude oil output increased 2.7% during the first nine months versus a year earlier to 577 million barrels, while gas output was up 5.1% to 3,296 billion cubic feet.

PetroChina, which is also China's second-largest oil refiner, processed 1.8% less crude oil than a year earlier at 896 million barrels in the first nine months, or 3.28 million barrels per day.

Domestic fuel consumption has been weighed down by Beijing's lengthy COVID restrictions that crimped mobility and economic activities, forcing refiners to cut operations.

Highlighting weakened domestic fuel demand, PetroChina's gasoline output dropped 12% on the year during the period and that of aviation fuel tumbled 33%.

However, the firm's gas business benefited from a 6.6% increase in domestic natural gas sales at 147 billion cubic meters, resulting a 30% growth in operating income in the gas marketing segment.

"As a result of the recurrence of COVID19 in some areas, the demand for refined oil in domestic market declined, while the demand for natural gas in domestic market has been growing," the firm said in a filing to the Hong Kong Stock Exchange.

Its Hong Kong listed shares have dropped 4.9% year-to-date, versus a 34% fall in the Hang Seng index.

($1 = 7.2220 Chinese yuan renminbi)

(Reporting by Chen Aizhu; Editing by Jan Harvey and Bernadette Baum)

https://uk.movies.yahoo.com/movies/petrochina-posts-record-16-7-092707356.html

(Reuters) - Spanish steelmaker Acerinox said on Thursday it expects earnings before interest, taxes, depreciation and amortization (EBITDA) to improve only slightly in the second quarter due to the weak European market and the prolonged strike at its Spanish mill.

The company said that there is no guarantee that the labour dispute at its Spanish steel mill Cadiz will be resolved in the short term.

Workers have been on strike for three months due to discrepancies with several points of the proposed agreement including salaries and flexible hours.

Its European business reported an EBITDA loss of 31 million euros ($33.22 million) in the first quarter due to the industrial action and poor market.

European steelmakers have struggled with softer demand amid a fragile economic environment and stiff competition from cheaper Asian rivals.

"The European market continues to be weak and has not experienced the expected recovery...even with the reduction in supply," the company said.

Steel demand in Europe, which has been challenged by high inflation and tighter monetary policy, is expected to show very modest growth this year before a 5.3% projected gain in 2025, the World Steel Association said earlier this month.

Meanwhile, steel prices in America, where around half of the group sales come from, remained robust, CEO Bernardo Velazquez said in a conference call, reflecting the divergence between a lagging European industry and a more resilient US manufacturing.

Acerinox also said it will stop production at its factory in Malaysia's Bahru in the second quarter.

First-quarter group EBITDA fell 51% to 111 million euros compared to the same period one year earlier.

That was slightly better than the 109.5 million euros expected by analysts in an LSEG poll.

The steelmaker's net profit also more than halved over the period to 53 million euros from one year ago.

Shares were up 1.7% at 0938 GMT, supported by a 31% net debt reduction to 234 million euros from the previous quarter, analysts pointed out.

($1 = 0.9330 euros)

(Reporting by Matteo Allievi and Natalia Siniawski; Editing by Josephine Mason and Miral Fahmy)

By Matteo Allievi and Natalia Siniawski

Range Resources Corporation (RRC) reported first-quarter 2024 adjusted earnings of 69 cents per share, which beat the Zacks Consensus Estimate of 56 cents. However, the bottom line declined from the prior-year quarter’s 99 cents per share.

Total quarterly revenues of $718 million beat the Zacks Consensus Estimate of $689 million. The top line, however, declined from the prior-year quarter’s figure of $853 million.

Better-than-expected quarterly results were driven by higher-than-projected gas equivalent production and lower total costs and expenses. However, lower realizations of commodity prices partially offset the positives.

Operational Performance

The company’s production averaged 2,141.5 million cubic feet equivalent per day (Mcfe/d) in the reported quarter, almost in line with the prior-year period. The figure beat our projection of 2,121.6 Mcfe/d. Natural gas accounted for 68% of total production, while NGLs and oil contributed to the rest.

Oil production increased 5% year over year, while NGL output jumped 4%. Natural gas production, however, decreased 2% during the same time frame.

Total price realization (excluding derivative settlements and before third-party transportation costs) averaged $2.91 Mcfe, down 24% year over year. Notably, price realization was higher than our estimate of $2.74 Mcfe. Natural gas prices declined 38% on a year-over-year basis to $2.05 per Mcf. NGL prices declined 5%, while oil prices fell 3%.

Costs & Expenses

Total costs and expenses declined 8% year over year to $535 million. The reported figure was lower than our expectation of $571 million. Transportation, gathering, processing and compression costs, which form a major part of the total costs, increased to $290.9 million from $285.5 million in the prior-year quarter.

Capital Expenditure & Balance Sheet

The company’s drilling and completion expenditure amounted to $152 million in the reported quarter. An amount of $18 million was used for acreage, infrastructure and other investments.

RRC had a total long-term debt of $1,755.7 million at the end of the reported quarter.

Outlook

Range Resources forecasts its total production for 2024 in the range of 2.12-2.16 billion cubic feet equivalent per day, with more than 30% of this attributed to liquids production. RRC estimated a capital budget of $620-$670 million for the year.

Zacks Rank & Stocks to Consider

RRC currently carries a Zacks Rank #3 (Hold). Some better-ranked energy companies are Sunoco LP (SUN) , PBF Energy Inc. (PBF) and Valero Energy Corporation (VLO) . All the stocks carry a Zacks Rank #2 (Buy).

https://www.zacks.com/stock/news/2262279/range-resources-rrc-q1-earnings-beat-on-gas-production

Key Takeaway

- Cnooc Ltd. reported a 24% increase in net income to 39.72 billion yuan in Q1, driven by higher drilling output and sales.

- Despite a slight drop in global crude prices, the company's realized oil price rose by 6.2%.

- Overseas production surged by 17%, with significant contributions from Canada and Guyana, aligning with Beijing's energy security efforts.

Cnooc's Record Profits Amid Global Volatility

Cnooc Ltd., China's largest offshore oil driller, reported a significant increase in profits and revenue in the first quarter, setting new records. The company's net income surged 24% year-over-year to 39.72 billion yuan ($5.48 billion), with revenue growing 14% to 111.47 billion yuan. This financial growth was bolstered by a 21% increase in oil and gas sales, despite a slight decrease in global crude prices. Notably, Cnooc's realized price for oil climbed 6.2%, showcasing the company's resilience and strategic positioning in the volatile global market.

Strategic Expansion Boosts Output

In line with Beijing's strategy to enhance China's energy security, Cnooc has aggressively increased its production output. The company reported a 9.9% increase in production, reaching 180.1 million barrels of oil equivalent in the first quarter, marking another record achievement. This growth was significantly supported by a 17% increase in overseas output, particularly from operations in Canada and Guyana. Cnooc's commitment to expanding its global footprint and increasing production capacity is evident in its 17% rise in total capital expenditure to 29 billion yuan during the same period.

Navigating Global Market Dynamics

The backdrop to Cnooc's impressive performance includes a complex global market environment. Global benchmark crude futures were slightly lower by 0.5% in the first quarter compared to the previous year. However, prices have rallied since March due to escalating tensions in the Middle East. Cnooc's ability to achieve record profits and increase output amidst these conditions highlights the company's strategic market navigation and operational efficiency. The firm's success is a testament to its robust business model and the effectiveness of its strategies in responding to global market dynamics.

https://super.news/en/articles/2024/04/25/cnoocs-net-jumps-24-to-5-48-b-boosted-by-global-ventures

Antero Resources Corporation (AR Quick QuoteAR - Free Report) reported first-quarter 2024 adjusted earnings of 7 cents per share, which beat the Zacks Consensus Estimate of 4 cents. However, the bottom line declined significantly from the year-ago quarter’s level of 51 cents.

Total quarterly revenues of $1.12 billion surpassed the Zacks Consensus Estimate of $1.08 billion. The top line, however, decreased from the year-ago quarter’s figure of $1.41 billion.

Better-than-expected quarterly earnings can be primarily attributed to higher production volumes, driven by strong well performance and lower operating expenses. However, a decline in natural-gas-equivalent price realization has offset the positives.

https://www.zacks.com/stock/news/2262540/antero-resources-ar-q1-earnings-beat-on-higher-production

Freeport LNG shipped its first tanker in 12 days from its Texas export terminal on Tuesday, marking a resumption of gas processing after an outage last month.

In March, Freeport shut down the train 2 liquefaction unit at its Texas plant and said that train 1 would be closed imminently. Each of the trains can turn around 700 million cubic feet (mcf) per day of feed gas into LNG.

The company said it could afford the fall in output associated with shutting down the trains as train 3, which froze in January and was out of action, had come back online. However, on 9 April, train 3 tripped and output from the plant dropped to near zero.

Freeport LNG is one of the US’s largest LNG export facilities and the US was the largest exporter of LNG in the world last year. Fluctuations in output at Freeport have therefore had major impacts on global gas prices. At the time of the drop in output, gas futures were up around 6% at the Dutch Title Transfer facility.

According to data seen by Reuters, the tanker BW Pavilion Leeara was partially loaded when it left Freeport LNG’s dock late Tuesday. This was the first vessel to depart the Quintana, Texas, plant since 11 April.

Pipeline gas flows were on track to reach 800mcf, up from 100mcf last Friday. At normal times, flows to the plant are around 2.2 billion cubic feet per day (bcf/d) to 2.4bcf/d.

In other news, Freeport was fined $152,173 last week for violating state air pollution emissions rules between 2019 and 2021.

The Texas Commission on Environmental Quality said on 11 April that Freeport LNG had released carbon monoxide, hydrogen sulphide, nitrogen oxides, sulphur dioxide and volatile organic compounds over several years in excess of the permitted levels from flaring at the plant in Quintana.

Vista Energy First Quarter 2024 Results

Key Financial Results

- Revenue: US$317.4m (up 4.7% from 1Q 2023).

- Net income: US$78.7m (down 39% from 1Q 2023).

- Profit margin: 25% (down from 43% in 1Q 2023).

- EPS: US$0.82 (down from US$1.43 in 1Q 2023).

Vista Energy. de Earnings Insights

Looking ahead, revenue is forecast to grow 18% p.a. on average during the next 3 years, while revenues in the Oil and Gas industry in South America are expected to remain flat.

Performance of the market in Mexico.

The company's shares are up 4.5% from a week ago.

BRUSSELS (Reuters) -The European Commission's next sanctions package is expected to propose restrictions on Russian liquefied natural gas (LNG) for the first time, including a ban on trans-shipments in the EU and measures on three Russian LNG projects, three EU sources said.

The Commission is in the final stages of ironing out its proposal and is engaged in informal talks with member states this week. The Commission declined to comment.

The proposal would not ban imports of Russian LNG to Europe, but instead target trans-shipments, which move LNG from one vessel to another that then sails onto its final destination. The transfers are usually done in port areas.

The other proposed measure would be to impose sanctions on three Russian LNG projects - Arctic LNG 2, Ust Luga and Murmansk - that are not yet operational.