| Port of Tianjin 天津港 | |

|---|---|

Logo of the Port of Tianjin Logo of the Port of Tianjin | |

| Location | |

| Country | |

| Location | Tianjin |

| Coordinates | 38°58'33" N 117°47'15" E |

| Details | |

| Opened | 1860 (Port of Tanggu); 1952-10-17 (Tianjin Xingang reopening) |

| Operated by | Tianjin Port Group Ltd |

| Owned by | Tianjin State-owned Assets Supervision and Administration Commission |

| Type of harbor | Deep-water Seaport/Riverport |

| Land area | 121 km2[1] |

| Size | 260 km2 (470 km2 total jurisdictional area) |

| Available berths | 217; Production Berths: 140 (2010)[2] |

| Employees | 20,000 (2008) |

| Chairman | Yu Rumin |

| UN/LOCODE | CNTXG or CNTSN (formerly CNTJP/CNTGU) |

| World Port Index Number | 60190 |

| Nautical Charts | 94363/0 (NGA/NIMA); 2653/4 (Admiralty); 11773/4(Chinese) |

| Statistics | |

| Annual cargo tonnage | 500 million tonnes (2013) |

| Annualcontainervolume | 13 million TEU (2013) |

| Value of cargo | 197.249 billion USD (2011)[3] |

| Passenger traffic | 110,000 cruiser passengers (2012)[4] |

| Annual revenue | 21.5 billion RMB (2011)[5] |

| Net income | 1.678 billion RMB (2011)[6] |

| Website http://www.ptacn.com | |

| This article contains Chinese text.Without proper rendering support, you may see question marks, boxes, or other symbols instead of Chinese characters. |

Coordinates:  38°58′33″N 117°47′15″E

38°58′33″N 117°47′15″E

The Port of Tianjin (Tianjin Gang, Chinese: 天津港; pinyin: tiānjīn gǎng), formerly known as the Port of Tanggu, is the largest port in Northern China and the main maritime gateway to Beijing. The name "Tianjin Xingang" (Chinese: 天津新港; pinyin: tiānjīn xīngǎng; literally: "Tianjin New Port"), which strictly speaking refers only to the main seaport area, is sometimes used to refer to the whole port. The port is on the western shore of the Bohai Bay, centred on the estuary of the Haihe River, 170 km southeast of Beijing and 60 km east of Tianjin city. It is the largest man-made port in mainland China,[7] and one of the largest in the world. It covers 121 square kilometers of land surface, with over 31.9 km of quay shoreline and 151 production berths at the end of 2010.[8]

Tianjin Port handled 500 million tonnes of cargo and 13 million TEU of containers in 2013,[9] making it the world's fourth largest port by throughput tonnage and the ninth in container throughput.[10] The port trades with more than 600 ports in 180 countries and territories around the world.[2] It is served by over 115 regular container lines.[11] run by 60 liner companies, including all the top 20 liners. Expansion in the last two decades has been enormous, going from 30 million tonnes of cargo and 490,000 TEU[12] in 1993 to well beyond 400 million tonnes and 10 million TEU in 2012.[13] Capacity is still increasing at a high rate, with 550–600 Mt of throughput capacity expected by 2015.

The port is part of the Binhai New Area district of Tianjin Municipality, the main special economic zone of northern China, and it lies directly east of the TEDA. The Port of Tianjin is at the core of the ambitious development program of the BNA and, as part of that plan, the port aims to become the primary logistics and shipping hub of North China.

On 12 August 2015, at least two explosions within 30 seconds of each other occurred at a container storage station at the Port of Tianjin in the Binhai New Area of Tianjin, China. The cause of the explosions was not immediately known, but initial reports pointed to an industrial accident. Chinese state media said that at least the initial blast was from unknown hazardous materials in shipping containers at a plant warehouse owned by Ruihai Logistics, a firm specializing in handling hazardous materials.

Xinhua said one of the "ignition points" came from within an automobile distribution area near the blast site and the other three were within the central blast area.

Xi’s economic planners may for the first time emphasize “population policies” over gross domestic product in the country’s next development blueprint, said the person, who asked not to be identified because the talks are private. The focus sets the stage for a host of rule changes regarding health, pensions, social welfare and possibly lifting the caps on children some families can have, the person said.

More than three decades into an industrial boom that has created the world’s second-largest economy, China’s struggling to get rich before it grows old. The working-age population shrank for the first time in at least two decades last year as growth slowed, echoing Japan’s downturn in the late 1990s. As part of the shift, the party may lower its hard growth target of 7 percent to a range between 6.5 percent and 7 percent and make that a flexible guideline, the person said.

Mu Guangzong, a professor at Peking University’s Institute of Population Research, said that avoiding the same fate requires immediate action to loosen birth limits and strengthen the social safety net for the elderly.

Under pressure. Saudi banks whinging that the gov't is borrowing from them without giving them an insight into the budget.

Under pressure. Saudi banks whinging that the gov't is borrowing from them without giving them an insight into the budget.

Tianjin Port, am 20/08/2015.

Tianjin Port, am 20/08/2015. Japanese TV reporting cloud over sea over East China Sea.

Japanese TV reporting cloud over sea over East China Sea.Toyota Motor Corp (7203.T) and rival global automakers are looking to divert shipments to Shanghai and other ports from Tianjin after massive explosions last week disrupted operations indefinitely at China's largest auto import hub.

Authorities have restricted access to areas affected by the Aug. 12 blasts at a hazardous chemicals warehouse which killed at least 114 people. Automakers are struggling to reach lots and warehouses to assess damage and clear thousands of charred cars to make facilities usable, though the port continues to operate.

On Wednesday, Renault SA (RENA.PA) and Subaru maker Fuji Heavy Industries Ltd (7270.T) said they would re-route imports![]() to Shanghai, while Hyundai Motor Co (005380.KS) said it would send further shipments to Shanghai and Guangzhou.

to Shanghai, while Hyundai Motor Co (005380.KS) said it would send further shipments to Shanghai and Guangzhou.

Toyota is considering re-routing imports to Shanghai and Dalian which have enough capacity to prevent any significant logistical problems, a senior Beijing-based executive said.

"Port of Tianjin will likely be unusable for a long while, although I have no idea at the moment how long these disruptions would last," said the executive, who was not authorised to speak with media on the matter and so declined to be identified.

Toyota suspended its two final assembly lines near Tianjin port on Monday to Wednesday, partly to assess any damage. It made 432,340 cars at the plants last year, and is likely to lose 2,200 a day due to the blasts, said researcher IHS Automotive.

A Toyota spokesman in Japan said, without elaborating, that the automaker was looking to re-route shipments![]() to other ports.

to other ports.

SHANGHAI

Tianjin, regarded as a gateway to China's industrial northeast, handles 40 percent of car imports in the world's biggest auto market. But the explosions are likely to hamper normal operations for at least a couple of months, said IHS.

Amalie Mater

Amalie Mater It ain't over till (or until) the fat lady sings is a colloquialism. It means that one should not presume to know the outcome of an event which is still in progress. More specifically, the phrase is used when a situation is (or appears to be) nearing its conclusion. It cautions against assuming that the current state of an event is irreversible and clearly determines how or when the event will end. The phrase is most commonly used in association with organized competitions, particularly sports.

The phrase is generally understood to be referencing the stereotypically overweight sopranos of the opera. The imagery of Richard Wagner's opera cycle Der Ring des Nibelungen and its last part,Götterdämmerung, is typically the one used in depictions accompanying reference to the phrase. The "fat lady" is the valkyrie Brünnhilde, who is traditionally presented as a very buxom lady withhorned helmet, spear and round shield (although Brünnhilde in fact wears a winged helmet[citation needed]). Her aria lasts almost twenty minutes and leads directly to the end of the opera.[1] AsGötterdämmerung is about the end of the world (or at least the world of the Norse gods), in a very significant way "it is [all] over when the fat lady sings."

The first recorded use appeared in the Dallas Morning News on 10 March 1976, by journalist Ralph Carpenter:[2]

Despite his obvious allegiance to the Red Raiders, Texas Tech sports information director Ralph Carpenter was the picture of professional objectivity when the Aggies rallied for a 72–72 tie late in the SWC tournament finals. "Hey, Ralph," said Bill Morgan, "this... is going to be a tight one after all." "Right", said Ralph, "the opera ain’t over until the fat lady sings."

In the same newspaper on 26 November 2006, Steve Blow followed up the discovery by contacting Bill Morgan about the incident:[3]

"Bill vividly remembers the comment and the uproar it caused throughout the press box. He always assumed it was coined on the spot. 'Oh, yeah, it was vintage Carpenter. He was one of the world’s funniest guys,' said Bill, a contender for that title himself."

China's move to weaken the yuan last week could head off further similar "adjustments", and the yuan is likely to move in both directions as the economy stabilizes, Ma Jun, chief economist at the central bank said on Sunday.

The People's Bank of China (PBOC) shocked global markets by devaluing the yuanCNY=CFXS by nearly 2 percent on Aug. 11. The PBOC called it a free-market reform but some saw it as the start of a long-term yuan depreciation to spur exports.

The yuan's drop last week and its increased flexibility could help "sharply reduce the possibility" of similar adjustments in future, Ma said.

In the near term, it is more likely there will be "two way volatility," or appreciation and depreciation of the yuan, Ma said in a question-and-answer statement sent by email.

The central bank would move only in "exceptional circumstances" to iron out "excessive volatility" in the exchange rate, Ma said.

Ma played down market fears that a "currency war" could be triggered by China's devaluation, which dragged some other Asian currencies to multi-year lows.

"China has no intention or need to participate in a 'currency war'," Ma said in the statement.

The death toll in China from explosions at a warehouse storing hazardous materials rose to 112 Sunday, as authorities worked to remove chemical contamination.

Some 95 people, including 85 firefighters, remain missing following the blasts Wednesday night in the port city of Tianjin, 75 miles east of Beijing, the state-run Xinhua News Agency reported.

State-run news publications The Paper and the Southern Metropolis reported that the warehouse was storing 700 tons of sodium cyanide — 70 times more than it should have been.

Sodium cyanide is a toxic chemical that can form a flammable gas upon contact with water, and several hundred tons would be a clear violation of rules cited by state media that the warehouse could store no more than 10 tons at a time, the Associated Press reported.

Some 250 miles above the Earth, a flock of shoebox-size Dove satellites is helping to change our understanding of economic life below.

In Myanmar, night lights indicate slower growth than World Bank estimates. In Kenya, photos of homes with metal roofs can show transition from poverty. In China, trucks in factory parking lots can indicate industrial output.

Images from these and other satellites, combined with big-data software, are helping to create what former NASA scientist James Crawford calls a “macroscope” to “see things that are too large to be taken in by the human eye.” Aid organizations can use the results to distribute donations. Investors can mine them to pick stocks.

“This is one of those really rare game changers that come along very infrequently but has the ability to remake the whole stock- and economic-research industry,” said Nicholas Colas, chief market strategist at Convergex Group, a New York-based brokerage. “We still make monetary policy in this country based on surveys of a few thousand households and businesses.”

Here's the emerging middle class, from 2000-2012, if you like the classic period of emerging catch up.

Here's the emerging middle class, from 2000-2012, if you like the classic period of emerging catch up. Another graph showing the same effect.

Another graph showing the same effect. This slide shows the classic, easy to understand, 'catch up' slide for the emerging economies: growth at OECD's expense, via low wage manufacturing job replacements.

This slide shows the classic, easy to understand, 'catch up' slide for the emerging economies: growth at OECD's expense, via low wage manufacturing job replacements. Taking China as a superb example: Miners and Steelworkers simply do not have the 'earnings power' to drive wage growth higher.

Taking China as a superb example: Miners and Steelworkers simply do not have the 'earnings power' to drive wage growth higher.  Here's the IEA on coal today, according to the IEA we are quite literally at peak coal usage NOW. The emerging middle class hates pollution.

Here's the IEA on coal today, according to the IEA we are quite literally at peak coal usage NOW. The emerging middle class hates pollution. Yet, the urban middle class youth is in revolt in Brazil, Turkey and other fast-growing countries. The controversy around Easterlin Paradox, a key concept of happiness economics, suggests that happiness grows more slowly than incomes. Leaders in many emerging countries are today confronted with a dilemma that reflects the dual rural-urban structure of their large societies. While the internet-savvy young urban middle-class has left poverty behind and demands voice, participation and efficient public services, there still coexist the poor in the rural hinterland striving to leave individual poverty behind.

Exit, voice and loyalty, the late Albert O Hirschman´s intriguing basic categories that drive societal change, can be used to better understand the current conundrum. Loyalty, through adherence to a political party or to religion, can block change but is waning. Exit and voice have different potential in a rural-urban context: exit from the rural to the urban sector is a preferred option for the rural poor but is mostly a one-way street; whence voice as the preferred option for the urban middle class.

Much of the emerging-country middle class is fragile. Lousy education, poor health and urban congestion are the biggest risks to the lower strata of the middle class, by way of social and economic exclusion. A higher proportion of middle-class citizens translates into higher prices for private schools, hospitals and transports or, alternatively, overcrowding. The private provision of quality public services is a socially dividing, hence limited, costly option. In other words, exit to private education and health services – an option for the “happy few” – will raise prices to the point that it triggers voice while the size of the middle class rises.

“First-world soccer stadiums; third-world schools and hospitals”, was one of the slogans advanced by Brazil´s protesters. Brazil has already spent more than $3bn, three times South Africa’s total four years earlier, and only half the World Cup stadiums are finished. Public health spending occupies a mere 4 per cent of GDP in Brazil (despite a constitutional declaration for universal health care rights), compared to 6 in Turkey and 7 in the OECD on average. The latest PISA test scores rank Brazil 57th out of 65 survey countries for mathematics, Turkey is ranked 43rd. These numbers suggest that there is a political and social premium on best practices in the governance and allocation of public spending of tax receipts. Apparently, that premium has not been reached.

Emerging-country leaders might ignore the insights of the OECD Latin American Outlook 2011 at their peril. The policy recommendations put forth there rightly emphasize the need for “fiscal legitimacy”. To avoid the emerging middle class blues, public finances need to strengthen the social contract, provide better opportunities for the vulnerable people and better quality public services. Middle-income citizens are more willing to pay taxes for services, such as transport, health care and education, if they perceive them to be of high quality and if “white elephants” – trophy public investments with little social value – are avoided.

Grace Poe’s emergence as a potential “third force” in Philippine politics has led many commentators to ask if something fundamentally new may be emerging this presidential season: a major candidate who is neither backed by the administration nor is seen to lead the opposition to it.

But a look back at previous post-Marcos elections suggests a very different interpretation is more plausible.

Poe, like all major presidential contenders, has aligned herself with one of the two major “narratives” of Philippine politics, that of “reformism” or “good governance” carried out by “moral leaders.”

She is seemingly aligned against a “populist” narrative of helping the poor against an uncaring elite that Vice President Jejomar “Jojo” Binay has made his own following in the footsteps of former president Joseph Estrada. (READ: Battle of Aquino, Binay narratives)

Thus it is not surprising that Poe has won strong support from the middle and upper classes while basking in the favorable publicity provided by the press. In the same manner, Binay enjoys a core support of the poor while being denounced as corrupt by many key elites.

HOUSTON, Aug. 19 (UPI) -- Approval for oil swaps with Mexico opens the spigot for U.S. crude oil, but might not be the export indication supporters hope for, an industry analyst said.

The U.S. Commerce Department last week granted a request from Mexican energy company Petroleos Mexicanos, known also as Pemex, to swap as much as 100,000 barrels of U.S. crude oil per day for Mexican refining. The deal forbids the re-export to other nations.

One big-name investor is predicting an even sharper drop.

"There is no evidence whatsoever to suggest we have bottomed. You could have $15 or $20 oil -- easily," influential money manager David Kotok told CNNMoney.

A further decline to $15 a barrel would be huge. Oil hasn't traded that low since early 1999, when gasoline at the pump was selling for under $1 a gallon.

Kotok's views on the economy and financial markets are closely watched. The 72-year-old co-founder of Cumberland Advisors manages more than $2 billion in assets and hosts an annual invite-only fishing trip that doubles as an economic summit. Known as "Camp Kotok," the event lures leaders in finance to Maine each summer.

"I'm an old goat. I remember when oil was $3 a barrel," said Kotok, whose clients include former New Jersey Governor Thomas Kean.

Figure 1. Tight oil horizontal rig counts since January 1, 2015. Source: Baker Hughes & Labyrinth Consulting Services, Inc.

Figure 1. Tight oil horizontal rig counts since January 1, 2015. Source: Baker Hughes & Labyrinth Consulting Services, Inc. Figure 2. Tight oil and shale gas rig counts as of August 14,2015. Source: Baker Hughes & Labyrinth Consulting Services, Inc.

Figure 2. Tight oil and shale gas rig counts as of August 14,2015. Source: Baker Hughes & Labyrinth Consulting Services, Inc.This year is proving to be a bad one for Saudi.

The collapse of oil prices walloped Trican Well Service Ltd. in the first quarter as customers slashed capital spending, prompting the fracking company to cut 2,000 jobs and cancel dividends.

Trican, which has operations in Canada, the United States and elsewhere, warned it’s at risk of breaching conditions of its sizable debt, which could threaten its ability to keep operating. It is seeking relief from its lenders. The shares tumbled 14.5 per cent Wednesday.

Like the rest of the drilling and well-completion business, demand for Trican’s services plummeted in the quarter – normally the busiest of the year – as producers whittled down drilling plans. Trican suffered a $19-million operating loss even after opting to park more than a third of its equipment.

“It’s a very, very difficult time for the frackers, and Trican’s leverage is exacerbating the situation for them,” AltaCorp Capital Inc. analyst Dana Benner said. “Other service companies have cut their dividend … so Trican is not unique in this respect. But if you look at its ratios, the leverage is very high for the company. I think the market is looking at the leverage, the fact that they were not able to obtain covenant relief from their lenders yet.”

That's a key question because Iran's nuclear deal with the West could lift crippling sanctions, and pave the way for tons of Iranian oil to hit the market. A surge in Iranian exports would only deepen the oil supply glut that has sent prices to fresh six-year lows this week to below $43.

Iran claims it's not stockpiling oil in tankers in the Persian Gulf, but no one believes it. Up until recently, energy experts thought Iran's vessels held 30 million to 40 million barrels of oil.

But maritime surveillance firm Windward has harnessed sophisticated technology to determine Iran is actually hoarding 50 million barrels of oil. That's up nearly 150% from April 2014 when Windward started tracking this closely-watched metric.

Somebody had to go first—why not the Swiss?

News that Switzerland has become the first Western country to start lifting sanctions on Iran will no doubt be followed swiftly by reports of other nations (and corporations) seeking some of the Islamic Republic’s soon-to-be-unfrozen billions. Russia and China have already begun talking up arms sales to Tehran; over the weekend, Moscow sent a pair of warships to the port of Anzali, to display Russian naval wares.

Sources told Platts that the maiden trade was completed at $7.20 per mmBtu and the cargo will be delivered onboard the 162,000 cbm Clean Ocean LNG carrier in July to an Asian buyer.

Cheniere has chartered the vessel from Dynagas on a five-year deal ending in the second quarter of 2020 with an option to extend the deal for additional two years. The vessel has been chartered together with two Teekay’s 173,400 cbm LNG carrier newbuilds under construction by Daewoo Shipbuilding & Marine Engineering of South Korea scheduled for delivery in the first half of 2016.

Cheniere plans to market up to 5 mtpa of LNG from its US-based export projects through its office in Singapore.

The Clean Ocean LNG carrier is currently on idle offshore Singapore, according to shipping data.

The population of a U.S. oil boomtown that became a symbol of the fracking revolution is dropping fast because of the collapse in crude oil prices , according to an unusual metric: the amount of sewage produced.

Williston, North Dakota, has seen its population drop about 6 percent since last summer, according to wastewater data relied upon heavily by city planning officials.

They turned to measuring effluent because it was a much faster and more accurate way to track population than alternatives such as construction permits, school enrollment, tax receipts or airport boardings.

U.S. Census Bureau figures are usually too old as a full-fledged population count only happens once a decade, with sporadic updates in between. That’s not going to catch any swift changes in the population of cities like Williston.

“Here in Williston, the growth rate is not predictable,” said David Tuan, director of the city’s public works department. “Measuring wastewater flow tends to be the most-efficient way to track population.”

The recent high-water mark for Williston’s population was 33,866 in August of last year, just before the oil price collapse. Crude oil has fallen more than 50 percent in the past year and hurt many companies’ finances, leading to massive cost cutting, including the cancellation of projects and lay offs.

By June of this year, the town had shrunk to 31,800 people, according to the sewage data.

“I attribute that to the slowdown in oil prices,” said Tuan.

Among the companies who have made big job cuts here are Halliburton Co and Schlumberger NV, alongside many smaller peers.

Executives of Occidental Petroleum Corp., on Thursday reported finding savings by extracting more oil for less money and reinvesting that money in the Permian Basin, where the company is the biggest oil producer in the region.

Oxy, as the company is known, saved about $450 million by cutting costs during the first half of the year, and it channeled that money into the Permian Basin, where crude production grew by about 78 percent in the second quarter compared to the same period last year.

Incoming CEO Vicki Hollub attributed those efficiency gains to reduced drilling and completion times aided by technological improvements in geophysical modeling, drilling fluid systems and 3-D seismic imaging.

In the Permian Basin, the company saw the time it takes to drill a well drop from about 40 days to about 20 days. Well costs dropped from $10.9 million to $6.8 million. Hollub said the goal is to shave another $600,000 off those costs.

Oxy’s report represented the latest case of Permian Basin oil and gas producers showing they can continue to drive up production amid low oil prices. That is an upside for energy and production companies who depend on continued production gains, said Joseph Triepke, a financial analyst from Odessa and managing director of Oilpro.com.

But building production in a region that already pumps more than 2 million barrels of oil per day offers little relief to the oilfield services companies who make up some of Odessa’s top employers, Triepke said. That’s because the price drop resulted in part from global oversupply, and worry mounts that continued production growth will put more downward pressure on oil prices.

So far, Oxy executives reported that company managers shifted employees around rather than opt for shrinking their workforce.

“In previous industry down cycles we’ve seen in the industry overreact through widespread layoffs,” Hollub said. “We’re taking a different approach with our response to lower oil prices and have deployed many of our engineers in the early stages of their careers out into the field where they have replaced contractors. They are successfully helping to optimize our base production, improve drilling times and gain on the ground experience.”

In the first half of the year, Oxy executives reported drilling 47 wells — 42 of which were horizontal. And they placed 71 wells, some drilled before 2015, on production.

Hollub pointed to two of those wells as some of the best-producing ever in the Permian Basin, producing about 2,400 boe per day at their peak rates. Both were in the Delaware Basin west of the Odessa-Midland area, including parts of New Mexico.

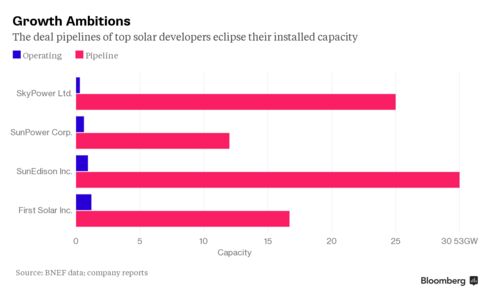

SunEdison (NYSE:SUNE) has experienced a disastrous past month, with the stock price approximately halving during this time period. With a growing number of acquisitions and businesses, SunEdison is clearly making investors more wary of a possible overextension. SunEdison's recent Q2 earnings results only further stoked this sentiment, as the company reported a whopping $263M in net losses. Despite the fact that the company crushed its growth guidance, delivering 404 MWs of solar/wind projects during the quarter, losses are clearly becoming a focal point for investors.

With 8.1 GW of pipeline projects and a growing number of businesses, investors are right to be increasingly focused on losses. As debt has been one of the primary reasons for solar bankruptcies over the past decade, growth may become irrelevant if the company's losses keep piling up. With debt levels starting to surpass the double digit billions, SunEdison is clearly one of the riskier solar plays. While SunEdison is still likely undervalued at current valuations(especially after its recent drop), the risks associated with this stock are only rising. Some of the downsides of SunEdison's incredibly ambitious approach are finally started to show.

Prices for Gem Diamonds Ltd.’s stones that are larger than 10 carats have fallen about 3 percent in the first half of this year, Chief Executive Officer Clifford Elphick said by phone on Wednesday. That compares with declines of about 30 percent for smaller gems.

“The big stones seem to be holding up their value,” Elphick said.