The Blue Dog Coalition announced their support today for H.R. 702, a bill to repeal the ban on crude oil exports in the United States. The Coalition backs the bill as changing market conditions have proven that the 1970’s-era ban on crude exports is hopelessly outdated. Among countries with the largest energy reserves, the United States is the sole nation that prohibits the export of its own domestically-produced oil.

The bill repeals a section of the Energy Policy and Conservation Act of 1975, which gives the president the authority to restrict oil exports.

"It makes no sense that the U.S. can export refined oil products, but not crude oil," said Blue Dog Co-Chair for Administration Kurt Schrader (OR-05). "Currently, crude oil from the U.S., one of the world’s leading producers, is excluded from determining the global market price of oil. In order to expand our markets and decrease gasoline prices globally, this ban must be lifted. Allowing U.S. oil into foreign markets also has the potential to increase stability in volatile regions of the world by creating competition on the global market and limiting the ability of countries like Russia to use crude oil as a political weapon. Lifting this ban would help improve the U.S.’s trade balance problem and improve the future budget picture for America. It’s high time that Congress moves forward on this commonsense, bipartisan and straightforward solution to a ban which has outlived its usefulness.”

“For the first time in two decades, we are producing more oil than we are buying from foreign countries,” said Blue Dog Co-Chair for Policy Jim Cooper (TN-05). “And our gas production is at an all-time high and growing so fast that we will soon be producing more than we will be able to use at home. The boost to job creation that comes from low energy prices and weaning ourselves from foreign oil is huge, and gives us an international competitive advantage. All of this, including exporting crude, gives us a chance to become an energy leader and we shouldn’t squander this opportunity.”

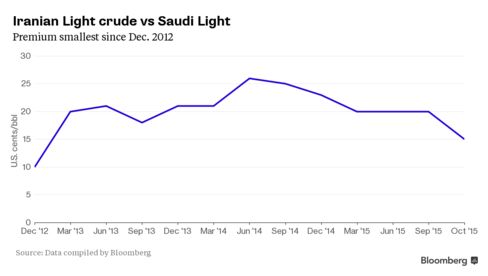

“The ban on crude oil exports is an outdated policy that frankly, no longer makes sense,” said Blue Dog Co-Chair for Communications Jim Costa (CA-16). “New technologies have provided the United States with an abundance of domestic crude oil production and expanding our export opportunities to include crude oil, in addition to gasoline and natural gas products, will further stimulate our economy and create jobs. Additionally, and importantly, providing our domestic producers the ability to sell crude oil to the global market will reduce the geopolitical influence of bad actors like Iran and Russia. This is commonsense, bipartisan legislation that will have a positive impact here in the United States and abroad.”

“As the representative for one of the largest oil-producing regions in the country, I have seen the negative effects of the crude oil export ban on industry in my district,” said Congressman Henry Cuellar (TX-28), lead Democratic whip for the bill. “With jobs being lost and equipment being taken offline, we need to take proactive steps to ensure that the new product being drawn out of the ground with new extraction technologies can be sold. Lifting the ban will benefit the U.S. economy and will likely lead to lower gas prices. It will also jump-start the economy by creating as many as 800,000 new jobs.”

H.R. 702 currently has 123 cosponsors from both parties and will receive a vote in the House Subcommittee on Energy and Power tomorrow. The legislation received a hearing in the Subcommittee in July.