China has cut its holdings of U.S. Treasuries this month to raise dollars needed to support the yuan in the wake of a shock devaluation two weeks ago, according to people familiar with the matter.

Channels for such transactions include China selling directly, as well as through agents in Belgium and Switzerland, said one of the people, who declined to be identified as the information isn’t public. China has communicated with U.S. authorities about the sales, said another person. They didn’t reveal the size of the disposals. Ten-year Treasuries pared gains and two-year notes erased an earlier advance.

The People’s Bank of China has been offloading dollars and buying yuan to stabilize the exchange rate following the Aug. 11 devaluation. The nation’s foreign-exchange reserves, the world’s largest, dropped $315 billion in the last 12 months to $3.65 trillion. The stockpile will fall by some $40 billion a month in the remainder of 2015 because of the intervention, according to the median estimate in a Bloomberg survey.

| synonyms: | unattractive, ill-favoured, hideous, plain, plain-featured, plain-looking,unlovely, unprepossessing, unsightly, displeasing, disagreeable;More |

| synonyms: | unpleasant, nasty, alarming, disagreeable, tense, charged, serious,grave, dangerous, perilous, threatening, menacing, hostile, ominous,sinister. |

| synonyms: | terrible, dreadful, appalling, frightful, awful, horrible, atrocious, grim,unspeakable, distressing, harrowing, alarming, shocking, outrageous;More |

How did Rui Hai International obtain a permit to store toxic chemicals?

For many residents, that is the key issue.

The company at the heart of the police investigation is Rui Hai International, which storedchemicals at the site without, it is claimed, the knowledge of local authorities.

With registered capital of 100 million yuan ($15.7 million), Rui Hai International was set up inDongjiang Free Trade Port Zone in 2012. The company's business facilities are made up ofwarehouses, storage terminals, storage yards, wastewater sumps and office buildings.

The company's website showed that it received a permit by Tianjin Maritime Safety Administration to operate storage and distribution works for toxic chemicals. These included calcium carbide, sodium nitrate and potassium nitrate for use in domestic and overseas markets.

Tianjin police has struggled to clearly identify the substances being stored at the blast site because the company's offices were destroyed. Confused documentation has also been a problem.

In another twist, Xinhua News Agency reported that Rui Hai International had only been granted a license to handle toxic chemicals less than two months ago. This poses the question: Had the company been operating illegally since October 2014 after its temporary license had expired.

Did the company flout government regulations?

That is impossible to say at this stage as the investigation continues, although there havebeen accusations.

Dong Shexuan, the deputy head of Rui Hai International, who holds 45 percent of thecompany's shares, is reported to be well connected with officers inside the Tianjin police forceand fire service. Although details are sketchy, it has been alleged in The Beijing News that hemet with officials of the Tianjin port fire brigade during a safety inspection.

According to claims from a senior official, who declined to be named, from the Industrial and Commercial Bureau of the Tianjin Binhai New Area, Dong gave fire service officers safety appraisal files, but an independent assessment of the site was not carried out. Dong, who is now in police custody, was unavailable to comment about these allegations.

What does appear clear is that Dong was given the green light for operating a storage facility close to a residential area. To many local residents, this appeared unusual as similar companies operating in the chemicals sector had been closed down by authorities.

So far, the police has detained senior managers of Rui Hai International, including Dong, as well as the son of a former police officer in Tianjin, and Yu Xuewei, a former State-owned company executive. Both are shareholders in Rui Hai International.

"Obtaining a safety risk assessment license should not be that easy," Zhu Liming, deputy head of the planning and land management bureau at Binhai New Area, said.

"It should involve not only the local fire brigade but also safety experts who have the experience and expertise in this area. They are needed to identify all the potential safety risks and should be part of the evaluation team," Zhu added.

Why were the warehouses located so close to residential areas?

Again, this is a difficult question to answer. Yang Baojun, vice-president of the China Academy of Urban Planning and Design in Beijing, has called for the planning process to be overhauled.

"Because of economic development, the fast pace of urbanization and rising land prices in higher-tier cities, local governments need to pay greater attention to the distance separating residential areas from dangerous manufacturing and energy facilities," Yang said. "These should include chemical plants, power stations and paper mills."

Existing laws in China state that warehouses containing toxic materials must be at least 1,000 meters from major transport hubs and public buildings. But the Rui Hai International complex was only 560 meters away from a residential area and 630 meters from the railway station.

"It is impossible to improve production technology and storehouse methods over a night,"Yang said. "But governments at different levels should be able to produce an urban plan that safeguards people's homes from potential harmful plants."

In Germany, industrial facilities, or warehouses, that use toxic or store chemicals, are built in isolated areas to protect the general public. The Berlin government also stipulates that these facilities have detailed safety and rescue plans in place. Plants are constantly monitored and regular safety checks are carried out.

How can disasters such as the Tianjin port explosion be averted in the future ?

Views on this subject are mixed. He Liming, chairman of the China Federation of Logistics and Purchasing, an industry body in Beijing, has pointed to the financial costs involved.

Moving chemical plants and warehouses outside of cities could prove difficult unless companies are heavily compensated

"As many chemical plants are located in the cities where land prices in China's urban area shave surged, they will not easily relocate unless they are paid the full value for the land they occupy," He said.

In addition, local governments rely on these companies to generate jobs, growth and taxes. In fact, they have become vital to domestic economies across the country.

Palladium fell by the most since 2011 on concerns that the market is heading for oversupply. Gold dropped as gains in U.S. consumer confidence damped demand for a haven.

In South Africa, mine output of platinum and related metals, including palladium, surged 84 percent in June from a year earlier, official data showed Tuesday. The country is the world’s top palladium producer after Russia. Futures in New York plunged as much as 8.1 percent, the most since December 2011.

While most industrial metals climbed Tuesday on easing concerns over Chinese economic growth after the nation cut interest rates, palladium failed to get a boost because of speculation that the move won’t be enough to buoy auto sales in the country. China accounts for about 22 percent of global demand for the metal used in pollution-control devices, according to Bloomberg Intelligence data. Prices are heading for a third straight monthly decline.

Yurun Group real estate company intends to suppliers can not deliver votes ham debt ], " Die Zeit " reported that a Shanghai steel suppliers said that from the beginning of August , Jiangsu Yurun to China 's Industrial Group Co., Ltd. will not be commercially votes cashed . More wonderful is that they even forced to use ham to offset each other's attitude is no money , enough to ham intestine . It refuses to offset the ham , you can select the property to arrive .It is understood, easy stuff barter global platform is a professional "barter" global barter platform, from easy stuff Group's investment operations platform is based on the concept of the establishment of modern barter, with independent intellectual property rights, the platform relies Things to actively carry out cross-border barter, barter provide enterprises information release, query, barter settlement transactions and other specialized services to help enterprises to develop multilateral barter transactions, realize barter, as repossessed assets in order to barter shares, an inventory of asse ts and other functions.

ts and other functions.

Legislation to repeal a 40-year ban on most domestic oil exports will probably become law in the first quarter of next year, according to analysts at Evercore ISI.

A move to end the ban would probably include a condition that allows the administration of President Barack Obama to set export levels, Evercore analyst Terry Haines said in a research note Friday. While there is some congressional support to lifting the ban, some analysts said its unlikely to happen before the 2016 elections.

“Obama and his regulators are likely to have a more positive view of an oil export ban repeal that empowered regulators generally to decide oil export levels,” Haines said in the note. “That sort of repeal also would be attractive to congressional Republicans and Democrats that would see it as a compromise alternative that overturns the ban and is a significant step on the road to full unregulated repeal.”

Haines said repealing the ban is “60 percent likely” by the end of the first quarter. Earlier this month the U.S. allowed some crude to flow to Mexico in a swap of light oil and condensate for heavy Mexican crude. Canada is the only other nation that is exempt from the prohibition on exports.

Bloomberg commodity index is trading around year 2000 levels.

Bloomberg commodity index is trading around year 2000 levels.

President Xi Jinping's wide-ranging reform push, covering everything from politics to the military, has come up against "unimaginably" fierce resistance, according to a tersely worded commentary carried by state media on Thursday.

In unusually strong language, the article said the reforms were at a critical stage and had encountered immense difficulties, affecting the interests of various groups.

"The in-depth reform touches the basic issue of reconfiguring the lifeblood of this enormous economy and is aimed at making it healthier," the article said. "The scale of the resistance is beyond what could have been imagined."

The commentary was attributed to "Guoping", an apparent pen name used by state media to comment on major state and Communist Party issues. It appeared in state media including the websites of CCTV and Guangming Daily.

Observers said the commentary suggested the reforms had not achieved the desired results and were opposed by various factions.

Xu Yaotong, a political science professor at the Chinese Academy of Governance, said the publication came amid concerns the anti-corruption campaign, which had targeted several top military officials and politicians, was waning and that other reforms had attracted opposition.

Observers said the commentary suggested the reforms had not achieved the desired results and were opposed by various factions. Photo: AP"The tone [of the commentary] reads furious," Xu said.

Observers said the commentary suggested the reforms had not achieved the desired results and were opposed by various factions. Photo: AP"The tone [of the commentary] reads furious," Xu said.

The Reserve Bank has predicted a decline in the number of automated teller machines, as digital payments allow consumers to make fewer cash withdrawals and avoid pesky fees.

Banks and other owners of ATMs say their returns from the machines are being crunched, as they spend more money on maintaining machines that are being used less.

ATMs were introduced widely in the 1980s and there are more than 31,000 cash machines around the country now, which the RBA says is high relative to Australia's population.

However, the number of withdrawals has fallen by about 20 per cent since from a 2009 peak. This has occurred as more shoppers use cards, including contactless payments, where they would have previously paid in cash.

Oil headed for its biggest weekly advance since April after rising the most in more than six years as U.S. economic growth beat forecasts.

Futures climbed as much as 2.1 percent in New York, extending a 10 percent rally on Thursday. U.S. gross domestic product increased at a 3.7 percent annualized rate in the second quarter, exceeding all projections in a Bloomberg survey of economists. The nation’s crude stockpiles declined last week, paring a surplus, government data showed Wednesday.

Oil is poised for its first weekly gain in nine weeks, sustaining a rebound above $40 a barrel as concerns eased over a slowdown in the U.S. and China. Prices fell Monday to the lowest close since February 2009 and are still down almost 20 percent this year on signs a global supply glut will persist.

“The volatility in the market will continue,” David Lennox, an analyst at Fat Prophets in Sydney, said by phone. “Any rallies are going to be quite extreme and probably short. There is adequate global oil supplies and we still have more than 450 million in U.S. stockpiles.”

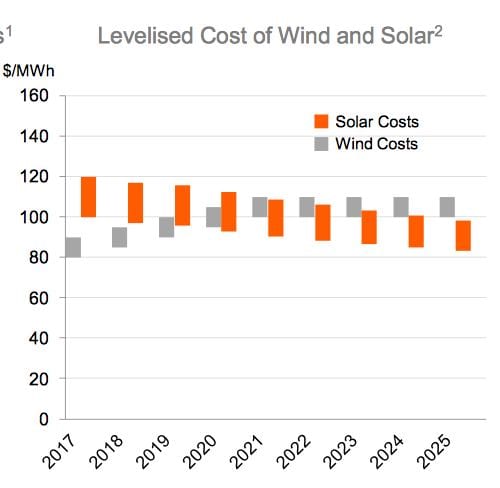

“Wind, which has traditionally supplied renewable energy, is unlikely to come down in cost,” King told a media briefing following the company’s annual results on Thursday.

“Wind, which has traditionally supplied renewable energy, is unlikely to come down in cost,” King told a media briefing following the company’s annual results on Thursday.

Copper premiums in Shanghai jumped this week on supply tightness in the market, as some traders continue to stockpile material to push up premiums further.

Some market participants remain unwilling to sell amid slumped copper prices, while buying interest is stable due to the favourable arbitrage between London and Shanghai. Metal Bulletin sister publication Copper Price Briefing assessed London Metal Exchange (LME) premiums at $110-130 per tonne on an in-warehouse Shanghai basis on Wednesday August 26, $25 higher than a week ago.