In this context, China is not facing a choice between Keynesian stimulus or supply-side reform, but rather a challenge in balancing the two. In order to avoid a hard landing that would make structural adjustment extremely difficult to implement – not, it should be noted, to prop up growth – another stimulus package that increases aggregate demand through infrastructure investment is needed. Given that China’s fiscal position remains relatively strong, such a policy is entirely feasible.

The new stimulus package should be designed and implemented with much more care than the CN¥4 trillion ($586 billion) package that China introduced in 2008. With the right investments, China can improve its economic structure, while helping to eliminate overcapacity.

The key will be to finance projects mainly with government bonds, instead of bank credit. That way, China can avoid the kinds of asset bubbles that swelled in the last several years, when rapid credit growth failed to support the real economy.

To accommodate this approach, the People’s Bank of China should adjust monetary policy to lower government-bond yields. Specifically, it should shift the intermediate target of monetary policy from expanding the money supply to lowering the benchmark interest rate. Needless to say, in order to uphold monetary-policy independence, China has to remove the shackles from the renminbi exchange rate.

Structural adjustment remains absolutely critical to China’s future, and the country should be prepared to bear the pain of that process. But, under current circumstances, a one-dimensional policy approach will not work.

Expansionary fiscal policy and accommodative monetary policy also have an important role to play in placing China on a more stable and sustainable growth path.

Yu Yongding served on the Monetary Policy Committee of the People’s Bank of China from 2004 to 2006.

| |||||||||

The flow of digital information around the world more than doubled between 2013 and 2015 alone, to an estimated 290 terabytes per second, McKinsey says. That figure will grow by a third again this year, meaning that by the end of 2016 companies and individuals around the world will send 20 times more data across borders than they did in 2008 ...

CAD and its associated computer-aided manufacturing (CAM) have typically been on-premises, not remote, systems because of the highly detailed and voluminous designs they must work with. The Engineering Cloud will use a Fujitsu technology, Remote Virtual Environment Computing (RVEC), for high-speed display of virtual desktops developed by Fujitsu Laboratories. RVEC can compress images at high speed and decompress them in the user display, allowing a cloud-based CAD/CAM solution, the spokesmen said.

One goal of the Engineering Cloud is to allow large and small manufacturers to escape the constraints of PC desktops and use larger cloud-based systems without needing to invest in them directly. If such systems were available from a cloud supplier, then small manufacturers could share data across engineering teams and product designers, regardless of where they were located. Such a move could speed products to market if there was no need to set up common systems between distributed team members. Fujitsu also will supply a product lifecycle management system and a parts database as components of its offering.

A new IBM Center for Applied Insights study, “Growing up Hybrid: Accelerating Digital Transformation,” revealed an elite group of front-runners achieving business benefits at a higher rate than other organizations. These pack leaders are leveraging hybrid cloud to drive digital change, spring-boarding them into next-generation initiatives such as Internet of Things (IoT) and cognitive computing.Thanks to very simple programming, applications can connect to support the swift and efficient flow of information ranging from product SKUs to media buys, CRM data, and credit card transaction details.

“Cloud based APIs and microservices simplify information exchange,” says Chris Hoover, global vice president of product and marketing strategy at Perforce Software. “It lowers the barrier for new vendors to enter the market.”

The result, according to Hoover, is a trend in which enterprise companies are moving away from a ‘top down’ approach to software and information exchanges

Milestones and achievements in 2015 include:

• A 10x increase in shipments processed by the TMS solution and corresponding 800% increase in corporate revenue. Likewise, there has been a six-fold increase in the number of shippers participating in the Cloud Logistics network.

The Hyperloop is a futuristic mode of transportation that consists of passenger pods traveling through tubes at speeds of more than 500 miles per hour. And the first one is being built currently in the desert, north of Las Vegas, Nevada.

The Hyperloop is a futuristic mode of transportation that consists of passenger pods traveling through tubes at speeds of more than 500 miles per hour. And the first one is being built currently in the desert, north of Las Vegas, Nevada.The ETF seeks investment results that replicate as closely as possible, before fees and expenses, the price and yield performance of the Thomson Reuters CRB Commodity Producers Index (the "Underlying Index").

The fund, using a low cost "passive" or "indexing" investment approach, seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the Underlying Index. The Fund will normally invest at least 80% of its total assets in the equity securities that comprise the Underlying Index and depositary receipts based on the securities in the Underlying Index.

The Global Commodity Equity ETF (the “ETF” and "CRBQ") is an Exchange Traded Fund (“ETF” and “Fund”) which provides exposure to the equity securities of a global universe of listed companies engaged in the production and distribution of commodities and commodity-related products and services in the agriculture, base/industrial metals, energy and precious metals sectors.

US demand responds to price. (Wish we could say the same of emerging!)

US demand responds to price. (Wish we could say the same of emerging!) EIA expectation on the US shales. Too pessimistic?

EIA expectation on the US shales. Too pessimistic? Crude supply contracting now

Crude supply contracting now Storage cliff.

Storage cliff. https://next.ft.com/content/5e8c1d52-f19f-11e5-aff5-19b4e253664a

https://next.ft.com/content/5e8c1d52-f19f-11e5-aff5-19b4e253664aSeadrill's (NYSE: SDRL) latest contract attracted a lot of attention here on SA. Fellow contributor Fun Trading stated that the new contract or contract extension was a positive and should be celebrated. On the contrary, Henrik Alex called the contract a disaster for the industry.

I recently applied the lower-for-longer day rate scenario for Seadrill and used day rates of $250,000 for semis and drillships. Now, with this new and important piece of information, it's time to reevaluate my previous thoughts.

So, what was the day rate for West Tellus?

There are two ways how you may look at the problem. The first one is to calculate the reduced day rate for the previous contract and the new day rate for the contract extension. You will get a day rate of $300,000.

The second way to evaluate the contract is to divide the net effect on the backlog on the number of added working days, which will leave the previous day rate intact but the new day rate will be roughly $58,000. The numbers are very different and the reaction is also different depending on which method you use.

Naturally, bulls will point to the $300,000-day rate and tell that this was a win for Seadrill. After all, this day rate is above bearish expectations for this part of the industry cycle. Bears will point to the day rate of $58,000 - a number that does not require much commentary. In my view, the correct answer depends on what question you ask.

If you are interested in what exact day rate Seadrill got for an extension of the contract - the day rate is $58,000. The company had a contract in place with a good day rate, but decided to prolong the contract at the expense of the day rate.

Why did Seadrill sign the contract?

At first glance, the contract makes no sense at all. Why go for a blend and extend contract if your additional day rate is $58,000 and you lock your rig for 18 months? If we assume stacking costs of around $35,000 per day and operating costs of $130,000 (I think I'm using rather optimistic numbers), the rig would have been better off waiting for a new job. Under current contract, West Tellus will be losing $72,000 per day instead of losing $35,000 per day if it were warm stacked.

The difference between two options is $37,000 per day, which accrues to $20.3 million over the 18-month period. Even if stack costs are higher for West Tellus, the decision still makes no sense. After all, the rig would have had 18 months to get a new job. The initial contract ended in April 2018, so the rig had time to search for the job up until 2020 before the decision to stack would bring more losses than the decision to extend the contract. Is Seadrill so bearish on the industry that it does not believe that West Tellus will be able to find work until 2020 after it finished working for Petrobras (NYSE: PBR)?

In my view (and this is speculation, of course), Petrobras threatened to cancel the existing contract and the terms of cancellation were not favorable to Seadrill. This is the only possible logical explanation why Seadrill agreed to this losing blend and extend deal. Otherwise, Seadrill's actions make no sense at all.

The previous contract was a disaster, but the new one is a full-blown Armageddon. The worse scenario would be to work for Petrobras for free. The news is bearish for both Seadrill and the industry. I expect that we will see similar renegotiations in the future.It could be the first small tremor of a long-awaited comeback in industry activity, or it could be an early start of another premature ramp-up that, like the failed restart in the summer of 2015, could upset the delicate oil supply correction that's supposed to help lift prices later this year.

After a recent oil price rally, deep cost-cutting and technological breakthroughs, many oil companies can now afford to pump crude from their large backlog of wells. That's one reason some U.S. oil production expected to vanish this year could be "switched back on" if oil prices keep rising, said Neil Atkinson, head of the oil market division at the International Energy Agency in Paris.

"But what's the lag time between companies saying, 'Hey, we're back in business,' and then actually producing oil? Is it six months? Is it nine months?" Atkinson said. "This is uncharted territory."

The speed of the U.S. oil industry's inevitable resurrection after the worst oil bust in decades is at the center of a new debate in the energy world, with some analysts arguing if an oil price recovery arrives before crude stops pouring into storage tanks, domestic drillers could start pumping more oil and cause prices to fall back down. The rally hit a bump this past week, with U.S. crude declining to $39.46 a barrel on Thursday, but it is still well above last month's average of about $30 a barrel.

Others say the downturn has left the industry's finances in tatters, depleted its oil field crews and equipment, and it would take far too long for drillers to stop a sharp decline in U.S. oil production this year. The thinking goes if it's too late to stop the output drop, then the industry can return to the oil patch without fear of interrupting the realignment of supply and demand.

There are early signs U.S. companies are trying to test that theory. Last month, oil companies brought 12 wells into production for every 10 they began to drill, which indicates they are reducing their backlog of so-called drilled-but-uncompleted wells faster than they're drilling new wells for the first time in five months, according to consulting firm Rystad Energy in Norway.

"It's very marginal, but it still is an increase. It could be the early signs of a recovery, but it's too early to say," said Bielenis Villanueva Triana, a senior analyst at Rystad. The industry's forecasts for U.S. oil production are "very sensitive to the drilled-but-uncompleted wells, but there's definitely going to be a decrease" in overall U.S. production this year.

Anadarko Petroleum Corp., EOG Resources and other U.S. companies have said since last year they have drilled hundreds of wells but left the crude underground, and could bring them online within two to three months in an oil price recovery.

Above break-even

Drawing on two data snapshots, one from mid-2015 and the other from earlier this year, energy research firm Wood Mackenzie estimates oil companies have uncorked about 400 of more than 1,400 uncompleted oil wells since September in Texas' Eagle Ford Shale, Wolfcamp and Bone Spring plays and North Dakota's Bakken Shale, though oil companies still added to their backlog of uncompleted wells because many drilling rigs were still on contract.

The firm says climbing oil prices have recently pushed above break-even costs in North Dakota and Texas to complete wells, which could prompt operators to complete another 440 wells in those regions over the next six months, with the oil production from those wells peaking at 250,000 to 300,000 barrels a day in November or December.

Several U.S. producers have told investors they plan to draw down their inventory of dormant wells this year, including Pioneer Natural Resources, Cabot Oil & Gas, Oasis Petroleum, Chesapeake Energy Corp., Hess Corp. and RSP Permian, according to Wood Mackenzie. Whiting Petroleum had said it would pump more crude from its backlog of wells if oil prices landed between $40 and $45 a barrel, and that generally holds true for many of the more aggressive operators, analysts say. The companies could not be reached for comment.

"At $40 oil, you'll definitely see an acceleration of wells being completed and more activity coming back," said Maria Cortez, an analyst at Wood Mackenzie. "It's the more financially attractive option for (some of) these operators."

Hess Corp. expects to drill and complete 50 wells and finish another 30 that have been waiting to be completed this year.

"We are in a really good position in the Bakken," said John Roper, a spokesman for Hess. "Because we have such prime leases, we're able to focus on those."

Tapping that inventory of wells is one of three major levers that U.S. oil companies can pull to restart activity. One other lever is hedging, which allows companies to lock in higher prices for the oil they produce, and it has already been pulled. Earlier this month, net short positions among producers - oil hedging - reached the highest point ever recorded by the U.S. Commodity Futures Trading Commission, which has tracked those numbers for about a decade.

The bulk of producer hedges are done between oil companies and banks and aren't recorded by the CFTC, but those trades typically track closely with the public data, and there has been a substantial increase in recent weeks, said John Saucer, vice president of research and analysis at Mobius Risk Group in Houston. Drillers are hedging at current prices because they can lock in mid-$40 oil prices for production in coming months or more than a year out, he said.

A federal judge could hold a Pennsylvania family that runs a maple syrup business in contempt of court on Feb. 19 if it persists in blocking crews from felling a grove of trees to make way for a new shale gas pipeline that would cross its property.

The defendants and their supporters, who first confronted chainsaw crews on Feb. 10, face arrest if they again interfere, U.S. District Court Judge Malachy Mannion in Scranton warned earlier this week.

The $875 million Continental Pipeline, due to be operational this autumn, would run 124 miles (200 km) from Montrose, Pa., to Albany, N.Y., and bring gas from Pennsylvania fracking wells to the New York and New England markets.

"We're trying to keep them from cutting trees before they have all the permits they need to build in New York state," said Megan Holleran, spokeswoman for North Harford Maple, a family-run syrup business in New Milford, Pa.

Christopher Stockton, a Constitution spokesman, acknowledged the company does not have all the permits needed to finish the New York portion of the pipeline but said it expected to receive them.

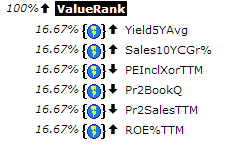

The "ValueRank" ranking system is quite complex, and it is taking into account many factors like 5-year average yield, sales growth, trailing P/E, price to book, price to sales and return on equity, as shown in Portfolio123's chart below.

Back-testing over sixteen years has proved that this ranking system is very useful. The reader can find the back-testing results of this ranking system in this article.

MINING.com: How can risk assessment reduce the probability of tailings failure?

Harvey McLeod: Well as I mentioned before, if you don't know you have a problem you are not going to manage it. The process of risk assessment is really getting everybody to think about what could go wrong, because if you have some ideas of what could go wrong, then you can start implementing both management practices to manage the risk but also engineer or design other procedures which will reduce the likelihood or the consequence of something happening. It's important to illustrate that risk is a combination of two things: it's the likelihood that something will happen and the consequence.

MINING.com: What role does risk assessment play in mine financing?

Harvey McLeod: Well I will think you will see with these recent failures that there’s been a large drop in the equity of the companies. Moving forward you will see financiers and shareholders saying: "Wait a minute, if I am going to invest my money in this company, what are the risks?" Insurers will be asking the same questions. Traditionally insurance companies haven't focused on tailings dam failure. It's been more of a global insurance policy. And certainly after the Omai and Los Frailes in the late '90s insurers started asking, "Should we have different systems for insuring mining companies?"

MATTHEW BROWN | Associated Press

BILLINGS, Mont. (AP) -- Royalty rates on coal extracted from massive strip mines on public lands could increase 50 percent under a pending overhaul of a U.S. government program that critics say contributes to climate change, documents released Thursday show.

The royalty hike was contained in an Interior Department notice providing the first outlines of a planned three-year evaluation of the government's sale of coal from public lands, primarily in the West.