The Blue Dog Coalition announced their support today for H.R. 702, a bill to repeal the ban on crude oil exports in the United States. The Coalition backs the bill as changing market conditions have proven that the 1970’s-era ban on crude exports is hopelessly outdated. Among countries with the largest energy reserves, the United States is the sole nation that prohibits the export of its own domestically-produced oil.

The bill repeals a section of the Energy Policy and Conservation Act of 1975, which gives the president the authority to restrict oil exports.

"It makes no sense that the U.S. can export refined oil products, but not crude oil," said Blue Dog Co-Chair for Administration Kurt Schrader (OR-05). "Currently, crude oil from the U.S., one of the world’s leading producers, is excluded from determining the global market price of oil. In order to expand our markets and decrease gasoline prices globally, this ban must be lifted. Allowing U.S. oil into foreign markets also has the potential to increase stability in volatile regions of the world by creating competition on the global market and limiting the ability of countries like Russia to use crude oil as a political weapon. Lifting this ban would help improve the U.S.’s trade balance problem and improve the future budget picture for America. It’s high time that Congress moves forward on this commonsense, bipartisan and straightforward solution to a ban which has outlived its usefulness.”

“For the first time in two decades, we are producing more oil than we are buying from foreign countries,” said Blue Dog Co-Chair for Policy Jim Cooper (TN-05). “And our gas production is at an all-time high and growing so fast that we will soon be producing more than we will be able to use at home. The boost to job creation that comes from low energy prices and weaning ourselves from foreign oil is huge, and gives us an international competitive advantage. All of this, including exporting crude, gives us a chance to become an energy leader and we shouldn’t squander this opportunity.”

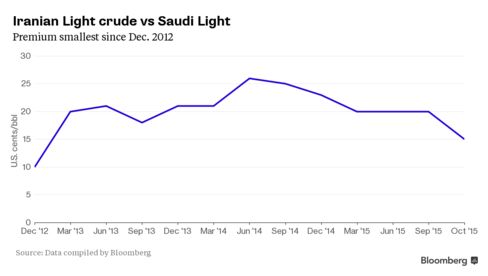

“The ban on crude oil exports is an outdated policy that frankly, no longer makes sense,” said Blue Dog Co-Chair for Communications Jim Costa (CA-16). “New technologies have provided the United States with an abundance of domestic crude oil production and expanding our export opportunities to include crude oil, in addition to gasoline and natural gas products, will further stimulate our economy and create jobs. Additionally, and importantly, providing our domestic producers the ability to sell crude oil to the global market will reduce the geopolitical influence of bad actors like Iran and Russia. This is commonsense, bipartisan legislation that will have a positive impact here in the United States and abroad.”

“As the representative for one of the largest oil-producing regions in the country, I have seen the negative effects of the crude oil export ban on industry in my district,” said Congressman Henry Cuellar (TX-28), lead Democratic whip for the bill. “With jobs being lost and equipment being taken offline, we need to take proactive steps to ensure that the new product being drawn out of the ground with new extraction technologies can be sold. Lifting the ban will benefit the U.S. economy and will likely lead to lower gas prices. It will also jump-start the economy by creating as many as 800,000 new jobs.”

H.R. 702 currently has 123 cosponsors from both parties and will receive a vote in the House Subcommittee on Energy and Power tomorrow. The legislation received a hearing in the Subcommittee in July.

Then there will come a crash -- in asset values and expectations, if not in production and employment. After the crash, China will revert to the standard pattern of an emerging market economy without successful institutions that duplicate or somehow mimic those of the North Atlantic. Its productivity rate will be little more than the 2 percent per year of emerging markets as a whole; catch-up and convergence to the North Atlantic growth-path norm will be slow if at all; and political risks that cause war, revolution or merely economic stagnation rather than unexpected booms will become the most likely surprises.

I was wrong for 25 years straight -- and the jury is still out on the period since 2005. Thus, I'm very hesitant to count out China and its supergrowth miracle. But now "a" crash -- even if, perhaps, not "the" crash I was predicting -- is at hand.

A great deal of China supergrowth always seemed to me to be just catch-up to the norm one would expect, given East Asian societal-organizational capabilities. China had been far depressed below that norm by the misgovernment of the Qing, the civil wars of the first half of the twentieth century, the Japanese conquest and the manifold disasters of rule by the paranoid Mao Zedong. Take convergence to that East Asian societal-capability norm, the wisdom of Deng Xiaoping and then Jiang Zemin in applying the standard Hamiltonian gaining-manufacturing-technological-capability-through-light-manufacturing-exports development strategy (albeit on a world-historical scale) and a modicum of good luck, and China seemed understandable. There thus seemed to me to be no secret Chinese institutional or developmental sauce.

Given that, I focused on how China lacked the good-and-honest government, the societal trust and the societal openness factors that appear to have made for full convergence to the U.S. frontier in countries such as Japan. One of the few historical patterns to repeat itself with regularity over the past three centuries has been that, wherever governments are unable to make the allocation of property and contract rights stick, industrialization never reaches North Atlantic levels of productivity.

China will -- unfortunately -- likely become another corrupt middle-income country in the middle-income relative development trap.

Sometimes the benefits of entrepreneurship are skimmed off by roving thieves. Sometimes economic growth stalls. Sometimes profits are skimmed by local notables, who abuse what ought to be the state's powers for their own ends. China -- in spite of all its societal and cultural advantages -- had failed to make its allocation of property rights stick in any meaningful sense through the rule of law. Businesses could flourish only when they found party protectors, and powerful networks of durable groups of party protectors at that.

Brad DeLongProfessor of economics, U.C. Berkeley

At a cabinet meeting in Beijing to draft a new water pollution prevention law, China’s minister of industry and information technology, Miao Wei, said that since the Tianjin explosion local governments throughout the country have provided his ministry with plans to relocate about 1,000 chemical plants away from population centers.

According to the official People’s Daily newspaper, the relocation proposals involve plants that are either hazardous or heavily polluting. The project, if it goes forward, would cost a total of about $63 billion. Miao did not provide details on who would pay for the moves.

WASHINGTON — Another Senate Democrat has signaled his support for exporting U.S. oil — as long as it is part of a broader clean energy plan.

The declaration from Sen. Michael Bennet came during the Rocky Mountain Energy Summit, when the Coloradan was asked if he backed oil exports.

“In the context of being able to move us to a more secure energy environment in the United States (and) a cleaner energy environment in the United States, yes,” Bennet said.

A spokesman for Bennet said the senator believes a move to lift the 40-year-old ban on crude exports “would have to be part of a more comprehensive plan that includes steps to address climate change and give the country and the world a more sustainable energy future.”

Bennet’s comments make him the latest Senate Democrat to suggest he is open to oil exports — even if the support is predicated on other changes.

Senate Democratic Leader Harry Reid recently said there was room for a “compromise” on the issue. “We should sit down and try to work something out with the people who are so focused on exporting it and those people who are so focused on not exporting it and come up with a deal,” Reid told Politico.

And Sen. Robert Menendez, D-N.J., a longtime oil export critic, highlighted the possibility of strategically selling U.S. crude abroad to bolster a new round of nuclear negotiations with Iran.

To some oil export advocates, the declarations are a sign of building momentum — that a change in policy is viewed as practically inevitable by some lawmakers who want to extract some concessions in exchange for a yes vote.

Two-hundred billion dollars of investment that’s poured into six natural gas plants currently under construction in Australia will struggle to generate a return due to falling energy prices, according to the International Energy Agency.

The Australian Financial Review reports that IEA senior gas expert, Constanza Jacazio, also says the three projects currently in planning stage are unlikely to go ahead.

"In a $US60 oil environment the Australian projects will continue, but you are probably not breaking even," Ms Jacazio said in an interview from Paris, the AFRreports. "Will anything else in Australia proceed beyond this next portion of projects? I think in this environment it is very unlikely."

Australia’s six LNG projects across Western Australia, Queensland and the Northern Territory were all planned when energy prices were high courtesy of strong Asian demand.

Major energy investors from the US, Japan and China pumped tens of billions of dollars into the industry based on projections that energy prices would remain higher for longer.

But strong supply from the US shale and Saudi Arabia, coupled with a larger than expected slowdown in demand from China has seen oil prices plunge to six-and-a-half year lows.

“With the LNG market facing a wall of new supply just as China’s gas demand growth has faltered, it is surprising how few new projects chasing a final investment decision have been postponed,” said Noel Tomnay, VP Global Gas & LNG Research.

Global LNG supply is presently around 250 million tonnes per annum (mmtpa) and there is a further 140mmtpa under construction, says Tomnay.

Noel Tomnay, VP Global Gas & LNG Research, Wood Mackenzie.

“Recognising that the global market will struggle to absorb such a large supply uptick, for some time now we’ve been forecasting a soft global market,” he said. “However that bearish prognosis is now being exacerbated by a demand downturn.”

LNG prices are stuck in the US$7-US$8 per million British thermal unit range, compared to the US$11-US$12 needed long-term to make the economics feasible, according to Tomnay.

Wood Mackenzie points to Asia and China, in particular, as being key to its revised outlook. China’s LNG import commitments are set to rise by 17 per cent year-on-year between 2015 and 2020, from 20 to 41 mmtpa but China will struggle to take all this LNG so quickly.

.

Glencore Plc, the commodity producer and trader, plans to sell assets and shares to cut its $30 billion net debt by about a third following the rout in global markets.

Baar, Switzerland-based Glencore, which last week posted its biggest weekly decline in London since going public in 2011, plans to sell about $2.5 billion in new shares and assets worth as much as $2 billion. It also will suspend dividend payments until further notice as it aims to reduce its net debt by about $10.2 billion, the company said Monday in a statement.

Glencore has lost more than half its market value this year, and along with BHP Billiton Ltd. and Rio Tinto Group has seen profits slump as commodity prices plunged to touch a 16-year low last month. Standard & Poor’s cut Glencore’s outlook to negative from stable last week, saying weaker growth in China will weigh on copper and aluminum prices.

| Data Point | Sep-15 | Change from August (points) |

| CSSI (Total New Orders) | 55.64 | 0.45 |

| New Domestic Orders | 58.33 | 1.35 |

| New Export Orders | 24.48 | -10.09 |

| Steel Production | 37.14 | 2.14 |

| Steel Prices (flat products) | 41.43 | -3.57 |

| Stocks held by traders | 61.34 | 13.64 |

| | ||