When forecasting how much oil will be available in future years, a standard approach seems to be the following:

Figure out how much GDP growth the researcher hopes to have in the future.

'Work backward' to see how much oil is needed, based on how much oil was used for a given level of GDP in the past. Adjust this amount for hoped-for efficiency gains and transfers to other fuel uses.

Verify that there is actually enough oil available to support this level of growth in oil consumption.

In fact, this seems to be the approach used by most forecasting agencies, including EIA, IEA and BP. It seems to me that this approach has a fundamental flaw. It doesn't consider the possibility of continued low oil prices and the impact that these low oil prices are likely to have on future oil production. Hoped-for future GDP growth may not be possible if oil prices, as well as other commodity prices, remain low.

It is easy to get the idea that we have a great deal of oil resources in the ground. For example, if we start with BP Statistical Review of World Energy, we see that reported oil reserves at the end of 2013 were 1,687.9 billion barrels. This corresponds to 53.3 years of oil production at 2013 production levels.

If we look at the United States Geological Services 2012 report for one big grouping-undiscovered conventional oil resources for the world excluding the United States, we get a 'mean' estimate of 565 billion barrels. This corresponds to another 17.8 years of production at the 2013 level of oil production. Combining these two estimates gets us to a total of 71.1 years of future production. Furthermore, we haven't even begun to consider oil that may be available by fracking that is not considered in current reserves. We also haven't considered oil that might be available from very heavy oil deposits that is not in current reserves. These would theoretically add additional large amounts.

Given these large amounts of theoretically available oil, it is not surprising that forecasters use the approach they do. There appears to be no need to cut back forecasts to reflect inadequate future oil supply, as long as we can really extract oil that seems to be available.

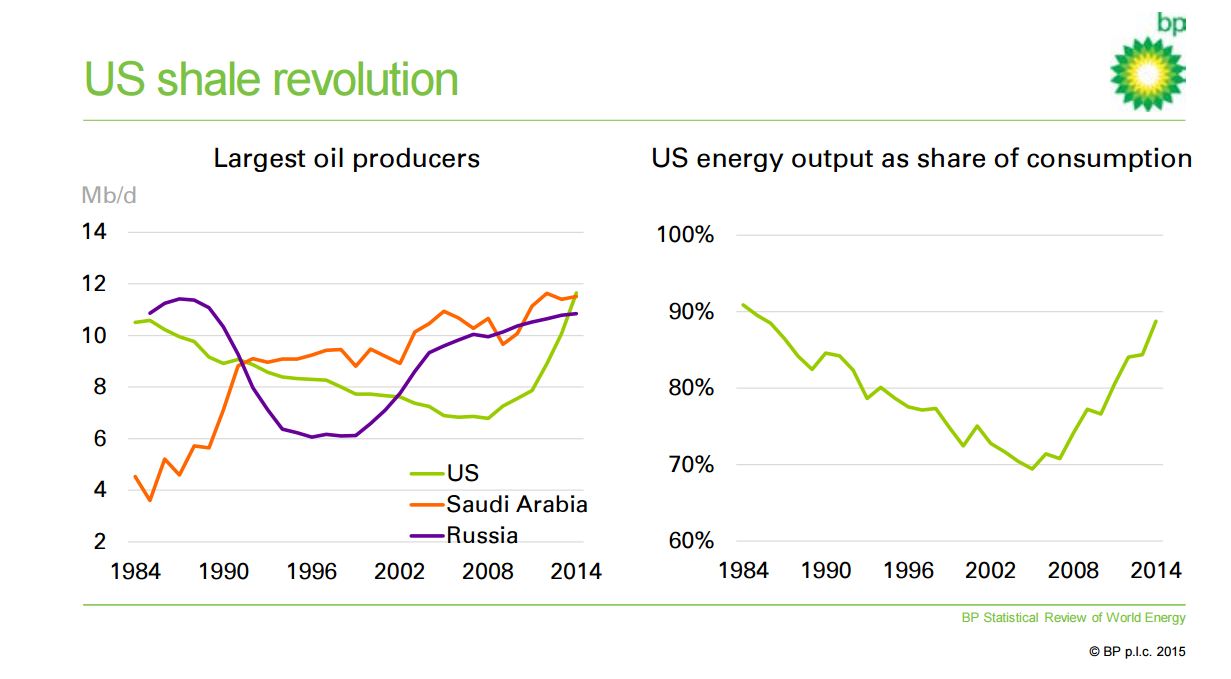

There is clearly a huge amount of oil available with current technology, if high cost is no problem. Without cost constraints, fracking can be used in many more areas of the world than it is used today. If more water is needed for fracking than is available, and price is no object, we can desalinate seawater, or pump water uphill for hundreds of miles.

If high cost is no problem, we can extract very heavy oil in many deposits around the world using energy intensive heating approaches similar to those used in the Canadian oil sands. We can also create gasoline using a coal-to-liquids approach. Here again, we may need to work around water shortages using very high cost methods.

The amount of available future oil is likely to be much lower if real-world price constraints are considered. There are at least two reasons why oil prices can't rise indefinitely:

Any time oil prices rise, economies that use a high proportion of oil in their energy mix experience financial problems. For example, countries that get a lot of their revenue from tourism seem to be vulnerable to high oil prices, because high oil prices raise the cost of airline travel. Also, if any oil is used for making electricity, its high cost makes it expensive to manufacture goods for export.

When oil prices rise, workers find that the cost of food tends to rise, as does the cost of commuting. To offset these rising expenses, workers cut back on discretionary spending, such as going to restaurants, going on long-distance vacations, and buying more expensive homes. These spending cutbacks adversely affect the economy.

The combination of these two effects tends to lead to recession, and recession tends to bring commodity prices in general down. The result is oil prices that cannot rise indefinitely. The oil extraction limit becomes a price limit related to recessionary impacts.

The cost of oil is currently in the $60 per barrel range. It is not even clear that oil prices can rise back to the $100 per barrel level without causing recession in many counties. In fact, the demand for many things is low, including labor and capital. Why should the price of oil rise, if the overall economy is not generating enough demand for goods of all kinds, including oil?

http://www.oilvoice.com/n/Why-EIA-IEA-and-BP-Oil-Forecasts-are-Too-High/30aeae396ac7.aspx?utm_source=dlvr.it&utm_medium=twitter