As China's slowdown hits demand for metals in traditional sectors such as housing and heavy industry, copper is being offered a lifeline: massive plans to expand solar and wind power in the world's second-biggest economy.

Beijing's push into renewables as it looks to tackle the pollution that has choked its cities is set to be a vital new source of demand for copper, which as the world's most conductive base metal is used in cables for solar panels and parts for wind turbines.

Reuters calculations based on government and industry projections for the growth of cleaner energy in China suggest that demand from the sector could boost global copper consumption by around 2 million tonnes, or about 2 percent, over the rest of the decade.

The extra appetite from China, the world's largest metals consumer, is part of a trend also rippling across other regions as governments target greener technologies to combat pollution and climate change, an issue that is centre stage ahead of U.N. environmental talks in Paris in December.

"The current developments in China in solar and wind are the highest in the world. Since it's policy driven, the plans made by government are generally achieved or exceeded year-on-year," said Mayur Karmarkar, team leader for sustainable energy in Asia at the International Copper Association (ICA).

"The numbers are astonishing," he said, referring to estimates on expansion in China's renewable sector.

Amid growing public disquiet about smog and the environment, China has declared a war on pollution, vowing to abandon a decades-old growth-at-all-costs economic model that has spoilt much of its water, skies and soil.

That is expected to get a shot in the arm with new targets likely to be announced as part of the country's latest five-year plan on economic growth, which will be discussed at a meeting of the ruling Communist Party in October.

"Chinese renewable energy is a potential new source of copper demand that I think is being overlooked by the market at the moment, especially if people are going to take the renewable targets seriously," said a Singapore-based source at a global copper miner. He declined to be identified as he was not authorised to speak with media.

Due to its high conductivity, copper cuts power loss in transmission and is typically used far more heavily in generating so-called green electricity than in traditional thermal plants.

China's installed solar energy capacity is set to soar to 200 gigawatts (GW) by 2020 from around 36 GW in 2015, according to projections from China's Renewable Energy Industry Association. Minerals consultancy CRU estimates 6,000 tonnes of copper is used per GW of capacity.

Wind power is projected to reach 250 GW by 2020, according to industry estimates. About 3,850 tonnes of copper is used per GW of wind capacity, according to an average of industry estimates compiled by Reuters.

These, alongside a steady increase in demand from China's electric vehicle sector of around 200,000 tonnes over the next five years, account for more than 2 million tonnes of copper, compared with current forecasts on total copper consumption over the period of about 105 million tonnes.

The ICA's Karmarkar noted that falling costs for green technology would help accelerate its uptake in China and beyond.

Renewable energy growth will also help stoke the roll out of energy grids connecting power hubs with cities, including transformers that use copper.

Growing appetite from China's renewable energy sector comes as the chief executive of copper and coal at Australian mining giant Rio Tinto last week said that markets for the metal could flip into a structural shortage within two to three years as broad demand from power stations makes it the first commodity to come out of a glut.

http://www.reuters.com/article/2015/09/16/copper-demand-china-renewables-idUSL5N11F0BW20150916 Now this data includes the utility renewables, but may exclude retail renewables.

Now this data includes the utility renewables, but may exclude retail renewables.  Coal falling like a stone.

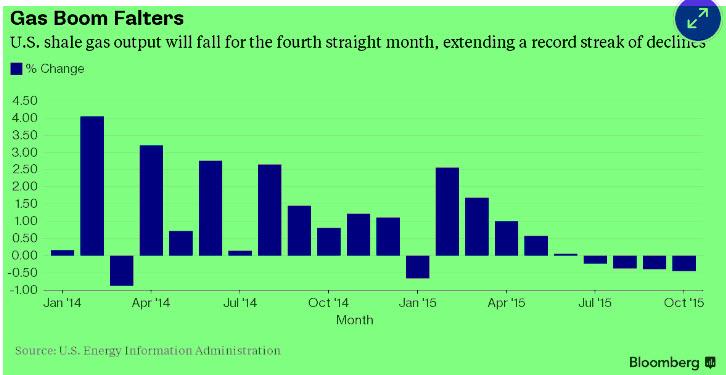

Coal falling like a stone. Gas does not look good either.

Gas does not look good either.