MGL CommentBack to Top

In a rare moment of honesty we had this from a Tianjin public official:Clean-up efforts at the site of the Tianjin blast have focused on the risk that sodium cyanide in the area could turn into a hazardous gas with rainfall.

As heavy rain fell briefly on the morning of August 18, white-colored foam streamed onto Huanghai Road in Tianjin's Binhai New Area, 5.5 kilometers away from the site of blasts.

A number of reporters exposed to the rain complained about a burning sensation in their lips and joints, though it is not clear if the foam is linked to chemical spills in the wake of the massive August 12 explosions.

The Tianjin Meteorological Bureau said thunderstorms are expected to stop in the early morning hours of August 19, but a drizzle will follow.

During a news conference on August 18, Bao Jingling, the chief engineer of the Tianjin Environmental Protection Bureau said workers have conducted two rounds of clean-up efforts to collect the toxic chemical sodium cyanide, but sodium cyanide dust from the explosion would remain a large risk.

Bao warned local residents against exposing themselves to rain because if the dust is mixed with water, it triggers the formation of hydrogen cyanide, a colorless and highly poisonous liquid that becomes a vapour at even slightly above room temperature.

He also warned local residents not to touch any dust in their homes if they must return to retrieve personal belongings or necessities.

"In particular, people should avoid spilling water on the dust," he added.

SPECULATION:

Gorbachev admitted in private that the Nuclear accident in the Ukraine made him realise that most of the contents of his intray were lies. He would relate the story of an old Finnish friend who personally brought him the recordings made by Finnish monitoring stations of geiger counter readings from the fallout. Thus started the fall of the Soviet Empire.

China is not the Soviet Empire, and the structure of the Chinese political society is not Russian; but such cataclysmic events often provoke change. Simply because the horror and anger are so widespread, so widely held and so intense that the tissue of lies and fabrications implicit in the structure of the economy becomes visible to all, and the leadership has full authority to act with purpose against deeply entrenched interests responsible for the disaster.

Amongst the revelations we are hearing is that the ownership of that warehouse was vested in some public official hiding behind a 'front' company. So who is now running scared? And have they already left China?

Look at capital ouflows from China:This picture likely understates the true nastiness, as we've been hearing, and relaying to you, stories of Chinese emigre's buying Gold in HK with Yuan, and leaving the country with Gold, or even bitcoin. Last week the Australian gov't launched a crackdown on illegal, mainly Chinese, ownership of ocean front property. Once the Chinese arrive in their chosen destination, they unload the Gold, or bitcoin, and settle down to a quiet life. Last week in Florida, the US Justice dep't was looking into the whereabouts of the brother of a senior Chinese official who they fear had been approached by Chinese agents. There's just too much smoke around this capital flight story for it not to have some 'real', and its not modest, impact on the Yuan, Gold and other portable assets.

MGL CommentBack to Top

Bad number.

Only issue now is the cds market, which did not like these numbers.

7% yield puts it in the company of all the stocks paying 'uncovered' dividends.

Here's our guess: stock goes lower.

MGL CommentBack to Top

Each $10k per day off shipping rates reduces the effective cost of moving LNG to Japan from an export port 4400 miles away by 6c an mmbtu. So the 100k fall in shipping rates over the last two years has likely reduced Japan's spot prices 60c an mmbtu.

At the close of this year we will have spot cargo's appearing in Texas, and the obvious large market, Zeebrugge in Belgium, is thus 65c cheaper than in 2013. EU spot prices seem to have been swooning in the last few months, and they are now down to $6.50 an mmbtu.

This could be economic weakness, but we do know EU buyers are taking spot cargos from Cheniere for december delivery.

The EU spot gas market is the largest spot gas market outside of North America, and it now must surely 'lock' into US henry hub pricing.

This table, from Platts, assumes 66k per day freight rates. Australia-Japan is 10% shorter than Cheniere-Zeebrugge. Belgium-NE US (Boston) is calculated at 70c an MMBTU, Cheniere is 4 days further, but now at half the cost per day, so rough back of the envelope suggests 60c cost Cheniere -Zeebrugge.

So:

Henry hub $2.70

Toll and port $1.50

Transport 60c

Cheniere buyers can make deliver US gas FOB Zeebrugge at ~$5. This is the second time in 3 days we've arrived at roughly $5 as a back-of-envelope for US gas in the EU. (Our estimates for Nova Scotia yesterday look high on these shipping rates)

This is bad news for the EU majors and Gazprom. We must think on current market that US new LNG build capacity heads into the EU, that implies that EU natural gas prices head towards the $5 mark. Most impacted:

~Shell

~Total

~Statoil (ouch!)

~Gazprom.(big ouch!)

MGL CommentBack to Top

Guanghui Electric is actually quoted, its a $7bn mcap, with $3.5bn of debt (this is post crash, its down 40%).

Engages in real estate investment and development activities, extracts, processes, and distributes granites

Xinjiang Guanghui Industry Co., Ltd. engages in the development, rental, and sale of real estate properties.

It also processes and sells granite and liquefied natural gas. The company was founded in 1994 and is headquartered in Urumqi, China.

Number of employees : 8 374 persons.

Who knows what price the LNG sells at into this JV, but it is unlikely to be 'oil index' as local LNG retails at around the $12 mark. Here's ISIS reporting from Guangdong:

Gas distributors and power generators stand to make significant profits from selling imported LNG to downstream end-users or sending it to their gas-fired power plants. This is even after factoring in the costs of importing, storing, leasing and tolling at a state-owned LNG terminal.

Most of the volume is loaded onto trucks for delivery to the end-users, with only some gas sent into the grid. Chinese distributors typically do not regasify LNG because it takes a chunk out of their margins. They also typically command a large market share in their respective regions, so are almost ensured a steady stream of domestic customers from the residential, industrial and commercial sectors.

The price difference alone is a key factor driving the interest and urgency in buying LNG imports into China this year, market sources told ICIS. Even if the Asian spot price were to rise to $10.00-12.00/MMBtu, Chinese buyers can still earn a slight margin.

So it sounds like spot LNG.

MGL CommentBack to Top

Last month we had near closure of Asian spot markets, as utilities retreated to their contractual commitments and simply did not require additional cargos. So there was almost no activity, and spot cargos head for the EU.

This month, we have spot buyers appearing around the $8.20 mark from a spattering of smaller buyers, all of whom are price sensitive.

Some wry amusement here that the traders for the big LNG players are short, when senior managements are telling investors in the EU that the LNG market is 'fine'.

MGL CommentBack to Top

The first accounting item we look at today in a big oil or gas company is their contingent liabilities. $100bn of contracted capex incurred prior to last August represents a future loss on the P&L of $25bn, that being the approximate cost of contracting that capex today in a much softer service market.

Woodside, like BP, is nearly unique in that it entered the downturn with a very liquid balance sheet that contained few capex commitments. This was simply because management could not make the substantial Browse development work at economic rates, even the gungho, and former partner Shell, turned its nose up at Browse preferring the ill fated and disastrous Gorgon development in the same space.Woodside capex collapsed well before the crash.

As a result, Woodside entered the downturn uncommitted, and can now enjoy the bounty of cheap service and engineering offered by starving service companies. Which, conveniently, brings us back to Browse. Clearly Woodside is running the numbers again on Browse with 25-30% lobbed off capex costs. The problem: they can't find buyers of LNG.

Woodside has a near 5% dividend yield approximately covered by free cashflow next year. That's pretty rare, and might be of interest to some investors.

MGL CommentBack to Top

This shale gas in the UK story is somewhat like one of those endless epic old english saga's. Think Beowulf, at 3182 lines, one of the most famous. So we've been sitting listening to this saga now for 7 years.

Everyone is bored. Even Shakespeare wasn't this cruel!

MGL CommentBack to Top

Vaca Muerta is big, but it's in Argentina. In a perfect world it could be the size of the Eagle Ford.

Any rise in Oil prices would convert YPF into a great stock, with volume growth for a decade or more.

There's tremendous desire by investors in emerging and the resource space for Oil prices to rise. We think the critical decision path on Oil is now in the Permian basin in Texas. If Oil output rise there, it could overwhelm the decline in Eagle Ford and Bakken, and keenly upset investors.

I want to be bullish Oil here, but Oxy in the Permian is frightening me with those wells that are 4.5x more productive than Concho's.

MGL CommentBack to Top

Here's a map of the world with Supergiant gas fields marked in red:

I've marked the Marcellus, which is simply absent from the 'official' literature in Red.

Here's Wiki on the 'official' supergiants.

Here's our edit:

Marcellus: 2360 tcf breakeven $1.

South Pars: 1235tcf breakeven $7.5

Urengoy: 222tcf breakeven $3-5 (complete guess, but it has 4000 miles of pipe to move through to arrive in western EU)

Hassi R'Mei 123tcf breakeven $2-$3.

So the Marcellus (EXCLUDING Utica and Upper Marcellus, which could double the numbers) is 2x the size of the the biggest known field, and considerably lower in cost.

Marcellus gas has already displaced all other North American gas from: NY, Chicago, St Louis. It is competing head on head with western basin gas in: Florida, Ontario (!!), Atlanta, the midwest.

The issue becomes how far Marcellus gas can travel before it hits competition from a field of equivalent size and cost. The battleground is moving from the US into the Atlantic. The next field of combat will be western europe. In a perfect world it would move to Nova Scotia and into LNG export terminals there, and reach Zeebrugge well under $5 an mmbtu breakeven. In fact, it will be displaced Texan/Louisiana gas that moves into Europe via LNG STARTING THIS FALL!

As per usual the companies impacted are maintaining as stony silence, and or denying its very existence.

Perception on the Marcellus has fought reality for 7 brutal years:

2009: "Shale gas is expensive and high cost"

2011 "The US will NEVER export gas"

2015: " Our gas is contracted at good prices"

Denial, denial, and more denial.

Reality will be brutal, and I strongly suspect many EU investors are in for a shock next year as US LNG exports pour into the EU.

Figure 1. Tight oil horizontal rig counts since January 1, 2015. Source: Baker Hughes & Labyrinth Consulting Services, Inc.

Figure 1. Tight oil horizontal rig counts since January 1, 2015. Source: Baker Hughes & Labyrinth Consulting Services, Inc. Figure 2. Tight oil and shale gas rig counts as of August 14,2015. Source: Baker Hughes & Labyrinth Consulting Services, Inc.

Figure 2. Tight oil and shale gas rig counts as of August 14,2015. Source: Baker Hughes & Labyrinth Consulting Services, Inc.MGL CommentBack to Top

Here's the world's supergiant oil fields:Here's the latest estimate of STOIIP in the Permian Basin:

"Original oil in place (OOIP) in the Permian Basin has been estimated to be 106 billion barrels "

Now lets apply some recovery factors:

At 2% shale recovery= 2bn boe. (This is the approx number in most E&P accounts today)

At 5% shale recovery=5bn boe. (This is current 'best practise' of Shale 1.0 companies: CXO, PXD, Brigham etc.)

At 15% shale recvery=15bn boe. (This is implied by Oxy well results, it's the number acheived in the Marcellus, and it's the number in the Petroleum acedemic literature)

So at 15bn boe, the number implied by the Oxy Permian numbers the Permian is #3 in the world.

The biggest question facing investors today is the Oil price. The Oil price depends on shale economics. Shale economics in the Bakken, and the Eagle Ford are marginal at todays spot prices, and we should reasonable now expect, with hedges, and capex contracts gone from the system, those basins to show declining production.

But the Permian remains a complete wild card. The rig count is rising, that implies that the companies THINK they have a viable economic solution at $60 Oil, now I am saying $60, because that's pretty much the number in Permian based E&P company presentations today. The critical player in this latest chapter is Oxy, and Oxy, with 2.3m acres of land held by production showed Permian volumes up 78% yoy in q2. Oxy has not disclosed economics, but they look substantially better than either Concho's, EOG's, or Pioneer's.

MGL CommentBack to Top

I shall try and keep the invective in check.

The EPA set out to measure methane from oil and gas wells after an academic accused the industry of being a leading methane polluter. Devon Energy, which has a myriad of shale, and conventional wells all over the USA, was one of the chosen partners. After some period of time, Devon withdrew its support for EPA measurements, and noted that that process was not being conducted on an accepted scientific basis.

Devon Energy, we would note, is one of the most technically able Oil and Gas E&P's in the field. They've made some bad strategic decisions in the last ten years, but their commitment to clean, environmentally friendly sound practice should not be doubted. Senior management at this company started their careers persuading the Navajo tribes in the 4 corners area (NM-CO-AZ-UT) to accept and allow gas drilling on pristine wilderness areas.

Now the polemic:

This is 100% politics, and lacks any scientific basis.

MGL CommentBack to Top

Obviously bullish the refiners in the midwest. Marathon?

Also seriously nasty news for Canadian Oil producers, this unit was specifically designed to run WCS crude.

This is the second time there have been problems at this big BP refinery.

MGL CommentBack to Top

Warren is a $32m mcap with $229m of debt.

Not convinced on the economics of this well at <$2 gas, but it does strongly imply that we have to start factoring in yet another large resource of gas in the Marcellus. Cabot has also been drilling these upper Marcellus wells nearby, and with what appear to be better results, but Cabot is coy!

MGL CommentBack to Top

This bloggers invective is worse than mine!

MGL CommentBack to Top

Google does something intelligent in the renewable arena! For years the company has been backing 'moonshots' which the stock market holds in mild amusement or outright derision.

On another subject: have you noticed that all the 'internet generals' in this stockmarket have CEO's playing in the space flight sand pit?

MGL CommentBack to Top

I hate stories like this. They are plausible, disruptive and dangerous to my wealth.

Biotech tranforms solar economics? Be scared, be very scared.

UNSUBSIDISED solar, without this development, which could plausibly half solar electric costs over a ten year time frame, is already hitting the market at $4c a kwh.

MGL CommentBack to Top

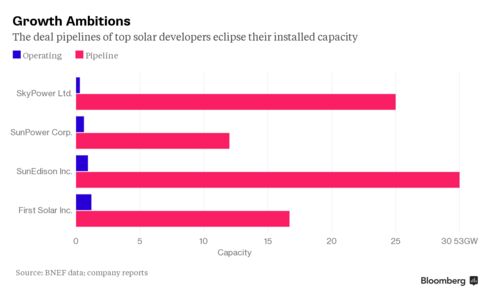

That Solar is competitive is clear. Whether Solar can be financed in this scale is unclear.

Just to be clear, that chart above is about 210m mt of coal.

MGL CommentBack to Top

First reaction here is that a big contract like this, with an opportunist buyer like Koch, is sort of like a poison pill. Potash wants to crimp volumes into the market, and 'taking out' Legacy was clearly part of the plan. But if Legacy is contracted, the Potash cartel is once again, broken.

Putting Humpty Dumpty together again is never easy is it?

MGL CommentBack to Top

We pointed out that Silver was holding the lows yesterday.

Almost the nanosecond we went to press, it crashed out.Here's the Silver 50 year chart, it's by far the clearest 'supercycle' indicator: 1980 peak: $50, 2011 peak $50. Long yawning bear market in between.

We thought yesterday that Silver might hold the line, and stop being woeful and sad.

No luck. Supercycle bear thought MUST be your assumption. That means we're value trap, and not value.

MGL CommentBack to Top

Treading water here. We can't enthuse until China's property market recovers, or, more likely now, we have a boom in property somewhere else big enough to match Chinese capacity.

Sort of:

~EU

~US

~Rest of emerging combined.

MGL CommentBack to Top

Ugly.

MGL CommentBack to Top

Indian iron ore now likely being marketed in China.

Best case: puts lid on price, and many analysts seem to have forgotten about this source of iron ore, so some negative surprise around the houses.

MGL CommentBack to Top

Impairments wiped out equity, leave debt intact, enfeeble balance sheets, and drive the killing zone dynamic.