Now this data includes the utility renewables, but may exclude retail renewables.

Now this data includes the utility renewables, but may exclude retail renewables.  Coal falling like a stone.

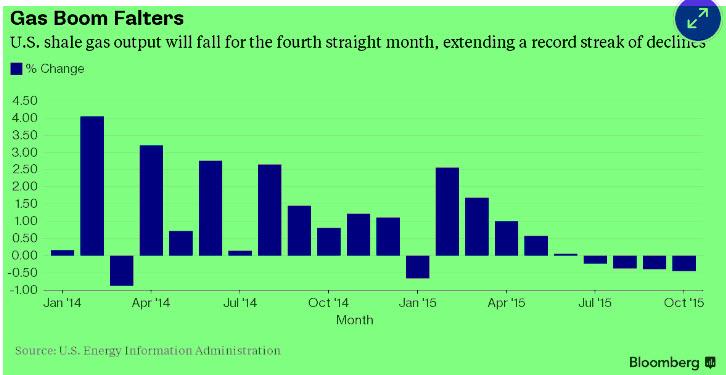

Coal falling like a stone. Gas does not look good either.

Gas does not look good either. China’s diesel exports may surge to a record in the coming months as refinery output increases while domestic demand growth for the fuel slows.

The nation’s diesel shipments might have risen to a record last month, topping the previous high in June of 670,000 tons, and may climb to 1 million tons a month in the fourth quarter, according to ICIS China, a Shanghai-based commodity researcher. China is scheduled to release August diesel export data next week.

Refiners processed 44.34 million metric tons of crude in August, up 6.5 percent from a year earlier, data from the Beijing-based National Bureau of Statistics showed Sunday. That’s about 10.48 million barrels a day and 1.8 percent higher than July as production increased to satisfy growing demand for gasoline.

“Diesel exports will continue to rise amid a supply glut created by high oil processing to meet robust gasoline demand,” Lin Jiaxin, an analyst with ICIS China, said by phone from Guangzhou. “The public holiday breaks early this month and in October will boost traveling and demand for gasoline, while diesel use will remain very weak.”

But now his party has mutinied. Democrats hold near supermajorities in both legislative chambers with 52 of 80 seats in the Assembly. Yet this week 21 Democratic Assembly members representing middle- and low-income communities—including 11 blacks and Latinos—joined Republicans to kill a bill mandating a cut in state greenhouse gas emissions to 80% below 1990 levels by 2050.

Democrats also forced Mr. Brown to scrap a measure that would have given the California Air Resources Board plenary authority to reduce statewide oil consumption in vehicles by half by 2030. Imagine the EPA without the accountability. “One of the implications probably would have been higher gas prices,” noted Democratic Assemblyman Jim Cooper. “Who does it impact the most? The middle class and low-income folks.”

Many Democrats demanded that the legislature get an up-or-down vote on the board’s proposed regulations before they take effect. Yet the Governor and Senate liberals wouldn’t abide constraints on the board’s powers.

The defeat is all the more striking for the failure of appeals to green moral superiority. Liberal groups targeted Catholic Democrats with ads featuring Pope Francis. Mr. Brown demonized oil companies for selling a “highly destructive” product.

The most morally destructive product in California these days is green government. Take the 33% renewable electricity mandate. Since 2011 solar energy has increased more than 10-fold while wind has nearly doubled. But during this period electricity rates have jumped 2.18 cents per kilowatt hour—four times the national average. Inland residents and energy-intensive businesses have been walloped the most.

California’s cap-and-trade program has also hurt manufacturers, power plants and oil refiners, which are required to purchase permits to emit carbon. Between 2011 and 2014, California’s manufacturing employment increased by 2% compared to 6% nationwide, according to the federal Bureau of Labor Statistics.

Cap and trade has also raised fuel costs, though its effect is hard to isolate from other environmental mandates. The Western States Petroleum Association last year projected that cap and trade would add 16 to 76 cents per gallon to the retail price of gas based on data from the Air Resources Board.

... which have since tumbled, and led to the recent surge in not only GLEN CDS but the record drop in its stock price.

http://www.zerohedge.com/news/2015-09-11/glencores-doomsday-plan-insufficient-cds-resumes-rise-questions-emerge-what-happens-

Gross revenue from production sales is in blue and after-tax cash flow in red. The green line is 2015’s estimated cash flow compared to prior years. The figures are not corrected for inflation.

Gross revenue from production sales is in blue and after-tax cash flow in red. The green line is 2015’s estimated cash flow compared to prior years. The figures are not corrected for inflation.