Enter the NYT which overnight reported that "China Arrests at Least 3 Workers’ Rights Leaders Amid Rising Unrest" in which it says that "police in southern China have arrested at least three workers’ rights leaders in recent days, labor groups and activists said on Saturday. The detentions come amid rising labor unrest in southern China, one of the world’s most important manufacturing centers, and are prompting concern that the Communist Party is extending its latest crackdown on civil society to a new arena."

Precisely as we said would happen, the rising labor discontent is forcing the government to retaliate. Only this time the Chinese government is hopeless: if and when the angry workers, several hundred million of them, decide to take their anger out on their communist rulers, not all the arrests in the world, not even the full mobilization of the PLA, will do anything to stem this unprecedented tide of bodies which, simply due to its vast numbers, is practically unstoppable.

The rest of the story is self-explanatory: during the good times, everyone was happy. But now that wages are sliding, and jobs are suddenly hard to come by, workers (many of whom recently fired), do what they do everywhere around the world: they get angry, go on strike, protest, and break or burn things down.

When the economy in Guangdong, China’s richest and most populous province, was booming, the authorities apparently did not see labor activism as a threat. After strikes by workers at Honda auto parts plants in the province in 2010, for example, many workers won higher wages and benefits.

But now, with many factories moving to regions where lower wages prevail — or to other countries, like Vietnam — labor unrest is rising, said Geoffrey Crothall, a spokesman for the China Labor Bulletin, which promotes independent labor unions in China and tracks strikes and other labor protests nationwide. Local governments in Guangdong are often the focus of workers’ demands after factory bosses leave town, sometimes with wages and pension benefits in arrears, he said.

Not surprisingly, the NYT used precisely the same source as we did a month ago, to reach the same conclusion:

According to figures from the group, the number of strikes and protests in Guangdong has more than doubled in recent months, rising to 56 in November from 23 in July.

“Clearly the rise in the number of protests and increase in labor activism has got the authorities worried,” Mr. Crothall said in a telephone interview. “They don’t know how to respond. And the only solution they can come up with is by cracking down on the people who are actually trying to help.”

Which, as we warned a month ago, is a huge problem for not only China's government but its economy.

One Chinese researcher on labor issues, who asked not to be identified in order to speak freely about the arrests, said that at least 16 activists had been detained or questioned and released in the crackdown on the Panyu Workers’ Center, or had disappeared with no information about their whereabouts. He said the detention of Mr. Zeng might have been a signal to workers not to get involved in labor movements outside the Communist Party-controlled All-China Federation of Trade Unions.

“They want to make an example of them for worker rights’ defense in the future — don’t get involved with these labor organizations,” the researcher said. “They realize that the economic slowdown and decline of industry is creating widespread bankruptcies and unemployment, and labor incidents will increase.”

Did we say the "biggest, most underreproted risk facing China"? Why yes we did. At least it is now being reported.

“There have been arrests and crackdowns before on grass-roots labor organizations here,” one activist, He Shan, said in a telephone interview from Shenzhen, a mainland city that abuts Hong Kong. “But this is the most concentrated, the most serious. For us, this is unprecedented.”

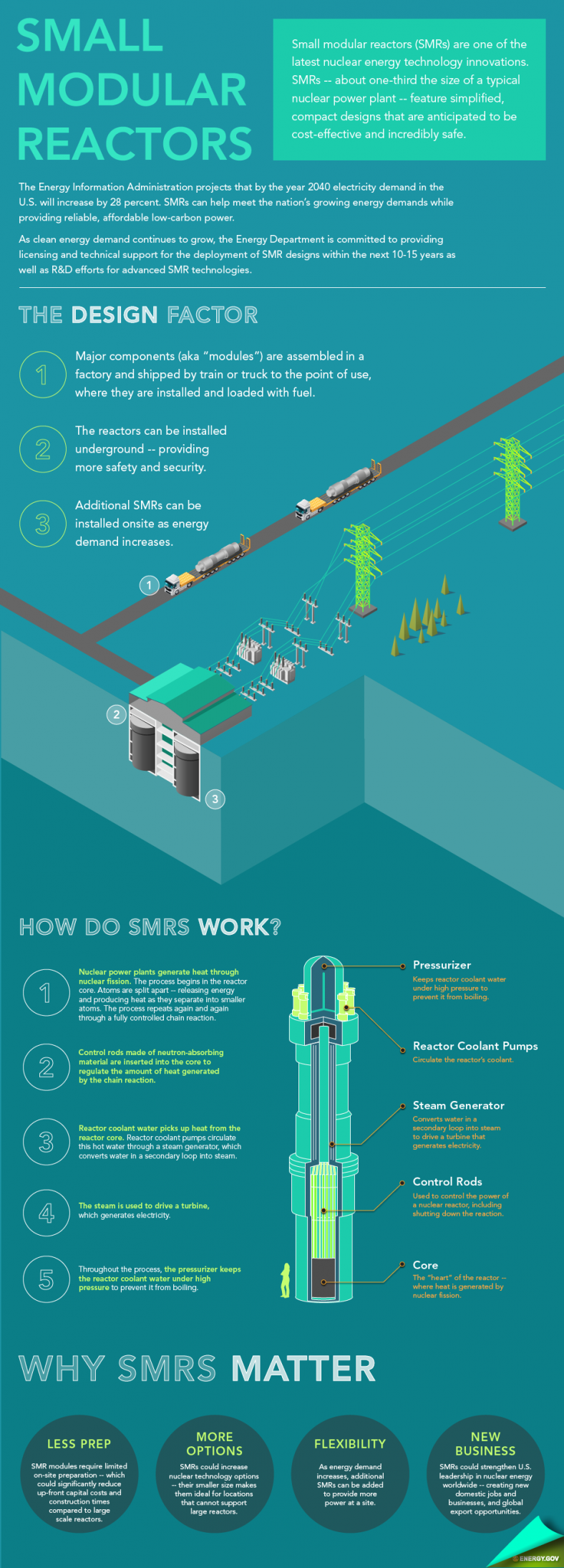

Sarah Gerrity, Energy Department. " title="The basics of small modular reactor technology explained. | Infographic by Sarah Gerrity, Energy Department. " width="153" height="425" >

Sarah Gerrity, Energy Department. " title="The basics of small modular reactor technology explained. | Infographic by Sarah Gerrity, Energy Department. " width="153" height="425" >