Following last year’s rush to test the boundaries of the Utica Shale outside Ohio, some producers are reevaluating their prospects in the Appalachian Basin to determine how best to spend capital after consistent success from the formation in West Virginia and Southwest Pennsylvania.

To be sure, for those with established acreage across the basin, the Marcellus Shale remains the low-risk, high-quality asset, while the Utica Shale in Southeast Ohio remains the proven economical sweetspot. But better-than-expected results from the Utica Shale in West Virginia and a series of record-breaking Utica wells in Southwest Pennsylvania now have management at some companies wondering how those blocks could fit into stretched drilling programs amid the current commodity price environment. Infrastructure would need to be built, or repurposed for voluminous dry gas Utica wells, astronomical costs, particularly in the deep, dry gas Utica of Southwest Pennsylvania, would need to come down and more data needs collecting.

For the time being, as oil prices seesaw and natural gas prices show no signs of a rebound, some of the basin's leading producers are at the very least considering their options.

"I think at this point, it's just too early to know how we're going to allocate those rigs to potential Utica wells in 2016 or not," Range Resources Corp. CEO Jeffrey Ventura told financial analysts during the company's second quarter earnings call in July. "I think we'll look at the economics; we'll look at the cost; we'll look at the markets and our new transportation deals and the customers that are coming online. We'll have to look at all of those things to see how that rolls out when we present our budget to the board in December."

Range was the first company to test the Utica in Southwest Pennsylvania's Washington County. In December, the company reported an initial production (IP) rate from its

Claysville Sportsman's Club #1 well of 59 MMcf/d (See Shale Daily, Dec. 15, 2014). That well has a 5,800-foot lateral. Since then, two other wells have bested the Claysville.

EQT Corp. reported that its Utica Scotts Run well in Greene County, PA -- to the south of the Claysville --

had an IP rate of 72.9 MMcf/d (see Shale Daily, July 23). That well was drilled with a 3,221-foot lateral.

To the east, Consol Energy Inc.'s Gaut 4IH, a step-out well in Westmoreland County, PA, IP'd at more than

60 MMcf/d on a 5,840-foot lateral. Both Consol’s and EQT's wells cost about $30 million to drill, complete and turn to sales -- more than double the cost of some Utica wells in Ohio.

The recent success has been underscored by several other prolific dry gas wells in Southeast Ohio and Northern West Virginia over the last year, where operators have tested

Utica wells between 25 MMcf/d and nearly 47 MMcf/d (see Shale Daily, Dec. 9, 2014; Sept. 25, 2014; Sept. 8, 2014; June 2, 2014; Feb. 14, 2014). Terry Engelder, a professor of geosciences at Pennsylvania State University, said those results from a tight, seven-county swath encompassing all three states have essentially proven the Utica's potential in Southwest Pennsylvania. He cautioned, though, that there is not yet enough data to determine decline rates there.

"We have 614,000 acres in the Utica, 530,000 are 100% working interest acres that we really felt needed to be tested," said Consol Vice President of Gas Operations Craig Neal in an interview withNGI's Shale Daily. "Quite frankly, I'm glad we did; the results here have really driven us to look hard at comparing this to our Marcellus opportunities. We believe that we will get the cost down to under $15 million in the deep area and probably work our way down below that. Over in Monroe County, OH, we're already at that level on our 10,000-foot total vertical depths, and we'll be working our way down to much lower than $15 million, possibly even $12 million."

EQT has said the same, aiming to lower Utica costs in Southwest Pennsylvania to between $12.5-14.5 million. EQT plans to drill a second Utica well in Greene County by the end of September, which would be about 13,400 feet deep and have up to a 4,500-foot lateral. Range is finishing up completions at its second Utica well in the region and plans to spud its third by the end of the year ahead of completion in 2016.

Neal said Consol is drilling its second Utica well in the state, the CNX GH9, four miles away from the Smiths Run well. Both EQT and Consol have said it would take a "few" of these wells to ultimately lower costs in the area.

"We think that [laterals] will get longer. We're monitoring our ability to frack at those depths. This thing is in the range of 20,000 feet," Neal said. "So, at those lengths, we are concerned about being able to stimulate it, see what the pressures would be." Neal added that the company would use ceramic proppant on the CNX GH9 as it did on the Gaut well. EQT also used ceramic proppant on its Smiths Run well.

http://www.naturalgasintel.com/articles/103442-appalachian-producers-considering-more-pennsylvania-utica-as-budget-season-nears?utm_source=dlvr.it&utm_medium=twitter

Attached Files

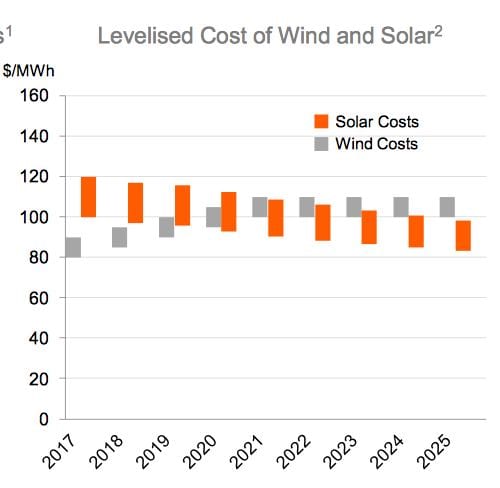

“Wind, which has traditionally supplied renewable energy, is unlikely to come down in cost,” King told a media briefing following the company’s annual results on Thursday.

“Wind, which has traditionally supplied renewable energy, is unlikely to come down in cost,” King told a media briefing following the company’s annual results on Thursday.